Quote of the Week: “Diversification is a safety factor that is essential because we should be humble enough to admit we can be wrong.” — John Templeton

Last week, we explored the idea of the US Exceptionalism premium and tried to cover whether or not there was justification for US stocks trading at traditionally higher valuations compared to stocks in other markets.

This week, we’re going to look at the flip side of the coin and discuss global diversification, its impact on portfolio performance and whether it's worth implementing in your own portfolio.

Traditionally, investors’ portfolios are heavily biased towards stocks from their home country, but we’ll look at ways that investors can gain exposures to new industries and trends that may not be represented in their domestic market.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or Youtube!

What Happened in Markets this Week?

-

✂️ Fed Delivers Oversized Rate Cut As It Gains 'Greater Confidence' On Inflation ( Reuters )

- What’s our take?

- Borrowers will be happy, while savers, not so much.

- You could say these rate cuts were priced in already because long-term mortgages, corporate borrowing rates, and term deposits had all already fallen in anticipation of this September cut. Fed policymakers see another 50bps worth of cuts in 2024, which would take the official cash rate down to 4.25% to 4.50%.

- Rate futures traders are expecting even more than that, and are pricing in 4% - 4.25% by the end of the year, probably because they think the Fed has acted too late. Some large central banks like the European Central Bank (ECB), Bank of England, Reserve Bank of New Zealand, and Bank of Canada have already started cutting rates, with more likely still to come.

- While historically speaking, we have never achieved a “soft landing” after a bout of inflation, that isn’t stopping the Fed from trying. Analysts anticipate greater allocation to risk-on assets due to these cuts, meaning equities could continue to receive inflows over the coming months if more cuts occur.

-

🧑⚖️ TikTok Argued Against Its U.S. Ban In Court ( NPR )

- What’s our take?

- There are 170m users at stake, and it’s a matter of free speech versus national security.

- So far, the judges seem dubious about TikTok’s pleas that the former is more important than the latter.

- If TikTok US isn’t sold to a non-Chinese company or group of investors by January 19th, the app will be banned in the US (unless of course an extension is granted).

- Many companies will be impacted if TikTok is banned in the US, some positively, and some negatively . The likes of Meta, Snap and Alphabet would all probably gain some of the 170m users looking for a platform to consume or create short-form content on. While beauty companies (like Ulta, Coty, L'Oréal, Clinique - owned by Estée Lauder ), retailers (like Resolve , Crocs and Walgreens ) and music companies (like UMG and Warner Music ) are likely to be impacted given their reliance on the platform.

-

⛏️ China and UK Expand Mining Presence In Africa While US, Canada, Australia Lose Ground ( S&P Global )

- What’s our take?

- Resource nationalism is on the rise, and certain countries need access to key commodities, regardless of geopolitical issues.

- While the US, Canada, and Australia are still the largest non-African countries owning mines in Africa, with roughly 400 mines each, these numbers have declined by about 5-8% since 2019. They’ve lost ground to the UK and China, who have increased their number of mines by 11% and 21% to reach around 325 and 300 mines, respectively.

- UK-owned companies are buying into junior exploration companies in gold and lithium mines, while Chinese state-owned entities are buying into projects that have pre-feasibility or feasibility studies and have been de-risked, rather than greenfield explorations.

- Africa is a resource-rich region, and those countries that need access to these key commodities will likely continue to invest and establish their presence.

-

🧑💻 US and Japan Near Deal To Curb Chip Technology Exports To China ( FT )

- What’s our take?

- Talks of export controls are creating a possible tit-for-tat situation amongst the countries involved.

- The US has been in talks with Japan and the Netherlands for months about establishing export control regimes that would exempt them from the US’s “foreign direct product rule”.

- The US wants to limit China’s access to advanced chips and servicing (like software updates) and exempt its allies like Japan and the Netherlands from these strict export rules. However, limiting exports to China would impact the likes of ASML and Tokyo Electron , so they’re trying to find solutions.

- Meanwhile, Japan wants to reach mutually beneficial agreements with the US, but it’s concerned that China may then restrict the export of critical minerals to Japan if they side with the US too much.

- The current US government has incentives leading up to the election to continue strong-arming arrangements, but it needs to be careful because the Dutch and Japanese counterparts could walk away from their trilateral mechanism created years ago if they’re too aggressive.

-

🚗 Electric Cars Now Outnumber Petrol Vehicles in Norway ( BBC )

- What’s our take?

- It goes to show that the EU EV targets that people saw as “too optimistic” were actually quite achievable with the right incentive structure.

- It’s been hotly debated whether or not the EU’s ban on petrol vehicle sales from 2035 was too aggressive and threatened to destabilise transport infrastructure.

- Norway has seemingly proved doubters wrong when it set a target for all new cars being sold to be zero emission vehicles by 2025, 10 years ahead of the EU’s goal.

- It looks like Norway is well on the way to achieving this too, with all-electric vehicles made up a record 94.3% of new car registrations.

- Norway is quite unique, however, with the Norwegian government offering hefty subsidies for those buying EVs paid mostly through royalties from Norway’s oil and gas industry. The high price of petrol vehicles also contributes to increased uptake of electric vehicles.

- While the subsidies were previously quite extensive, a lot of them have actually been phased out already, a sign of a more permanent shift in consumer behaviour.

-

🙅 Most CFOs say now is not a good time to take risks ( Axios )

- What’s our take?

- Less investment and risk-taking could be the canary in the coal mine for an economic slowdown.

- Only 12% of CFOs said that now is a good time to take greater risks.

- This survey was done in July, around the same time as the political turmoil and assassination attempt on presidential candidate, Donald Trump.

- Since we’ve now received a 50bps cut from the Fed and there is less uncertainty around the candidates running in the US election, these figures may be very different.

- While it can be volatile due to unforeseen circumstances, keeping your finger on the pulse of how eager or reluctant big companies are to invest is a good proxy for guidance on economic activity.

⚖️ The Pros And Cons Of Home Country Bias

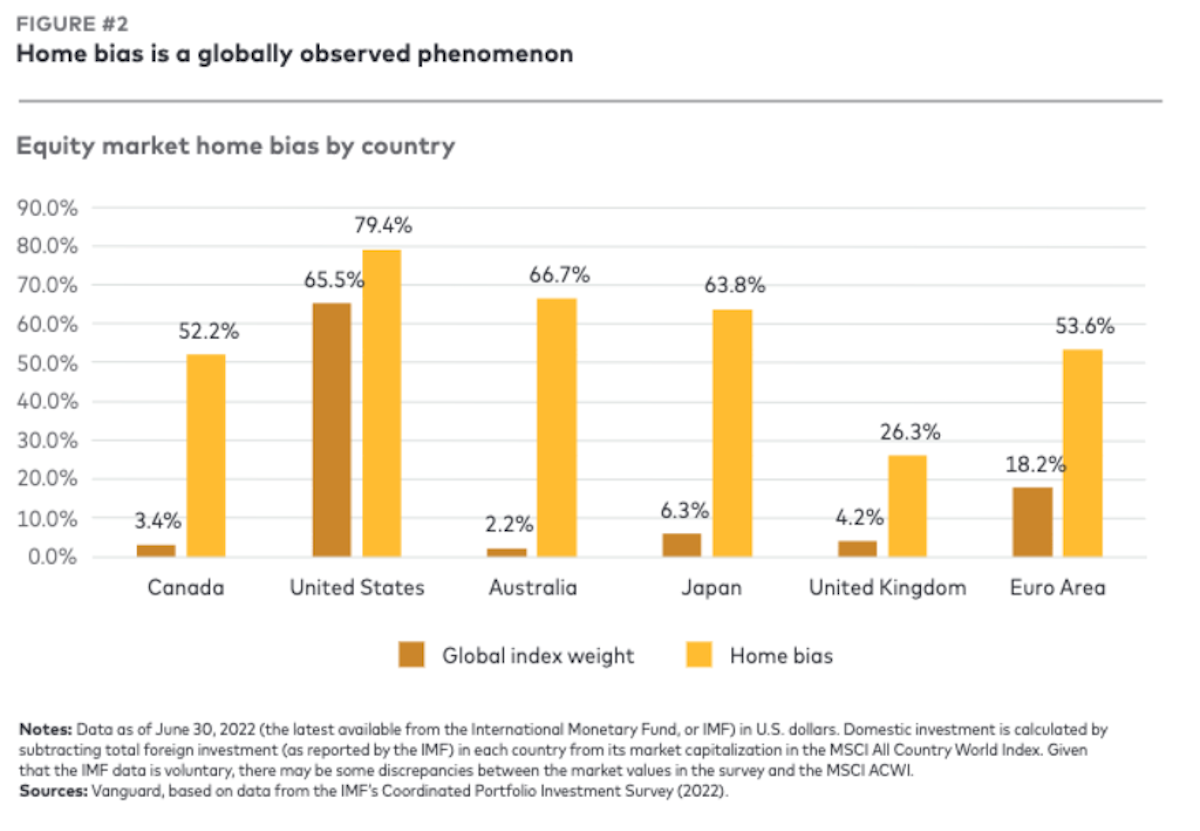

Home country bias is a recognized tendency for an investor’s portfolio to be extremely overweight in the country where they live. This chart from Vanguard compares the average portfolio of investors in each country with that country’s weight in a global index.

As we can see, for most investors, portfolios are extremely overweight in investments from the country in which they live. Now, being overweight isn’t necessarily a bad thing, in fact there are several good reasons why a bias towards investments from your home country may benefit you as an investor:

-

✅ Practicality

- For the majority of investors, it's a lot easier to invest locally, rather than setting up investment and bank accounts offshore. Keeping track of investments in different countries would also be a challenge, but your Simply Wall St account makes it a breeze.

-

🧓 Retirement funds

- In many cases, retirement funds and legislation dictate what types of investments can be held. In particular, you may not be able to invest directly in shares offshore.

-

💱 Matching assets with expenses

- There is a good reason to ensure a good chunk of your assets are in the same currency, and invested in the same economy, as your future expenses. This helps you stay on the right side of currency movements and inflation.

-

💸 Fees and costs

- Although it’s largely dependent on which broker you use, there may be additional brokerage fees for investing in companies listed on foreign exchanges that aren’t also listed on your local exchange. It’s rare that these costs will be prohibitive, but you’ve got to assess the opportunity cost of investing in that foreign company with higher transaction fees to a similar domestic company with comparatively lower transaction fees.

-

🕜 Timezones

- For investors with longer investment timeframes, this may be less of a concern, but there are times when being in sync with the market open hours for an exchange is beneficial. Perhaps prior to market open, there’s a price sensitive announcement that materially impacts your narrative on a given company. For domestic stocks, you're afforded the opportunity to assess this new information and arrive at a new investment decision that can be actioned while the market is open. For companies listed on exchanges that may be open while you’re asleep, you may be a day behind the market with respect to the new information on the company.

As with most things in life, there are both pros and cons to having a significant bias to domestic investments. So, what are the risks of being overweight in investments in your own country?

- 🔎 Missed opportunities :

- If you want to invest in the best companies in the world, you’ll probably need to go to them. Investors with no US exposure would have missed a lot of great opportunities over the last 20 years.

- 🌍 Sector diversification:

- Some countries have very few listed companies in certain sectors. Even more typical is that there might be very few quality companies in certain sectors. If that’s the case, diversifying across several sectors in your local market could leave you owning a few very mediocre companies.

- 📉 Downside risk:

- Every country comes with certain country specific risks. Emerging economies carry more risk - Turkey and Argentina being good examples. But things can go wrong in any country, as UK investors have realized over the last few years.

✨ Reminder: When currencies lose value, stock prices usually appreciate, offsetting that loss. That helps your savings (stocks) keep up with inflation, but it can give you a false sense of confidence. As shares that are underperforming in ‘real’ terms appear to be doing well. If the currency loses value, it’s worth keeping track of the value of your portfolio in hard currency terms.

🤔 To Diversify, Or Not To Diversify, That Is The Question

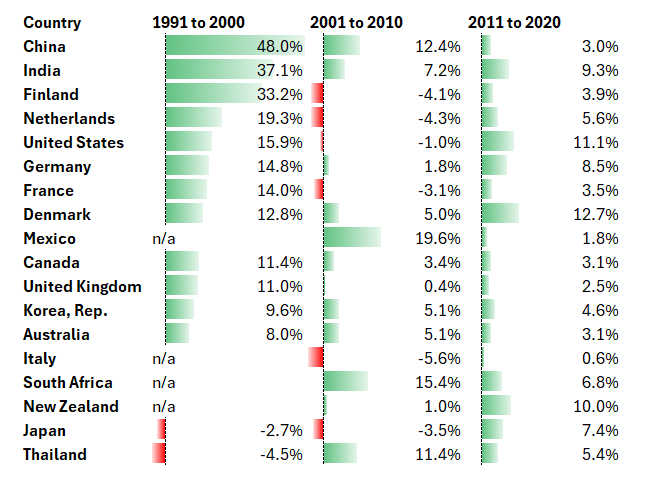

So this begs the question: To diversify or not to diversify? One of the best arguments in favor of diversification is average annual returns by decade for the major stock markets:

As we can see in the above chart, there’s little correlation between average annual returns from one decade to the next.

This makes sense, if you can remember back to our deep dive on the Australian market , you’ll remember that Australia’s economy is heavily resource based and their trade relationship with China is one of the key factors influencing overall market returns.

The cyclicality of the resource sector and the peaks and troughs in China’s demands for those resources meant that the Australian market’s average return was inconsistent from one decade to the next.

Australia is one such example, but it’s relevant to almost every country in that list. It’s incredibly rare to string together several decades of strong results due to factors outside our control. Think back over the last two decades alone. The world grappled with a global financial crisis in one decade and was shaken up by a global pandemic in the next, and that’s just on a global scale.

On a country level there have been drastic changes in economic policy, changes in government policy, new industries emerging and changes in consumer behavior over the years that have all influenced whether a market is in a period of boom or bust.

Ultimately, diversifying your portfolio across a range of markets can help prevent these factors weighing too heavily on your return. A globally diversified portfolio may not experience the full uplift of a domestic boom, but it will weather the periods where market returns are less than stellar better than a portfolio overweight in domestic assets, effectively smoothing out the ride.

✨ Remember, returns come from a combination of both earnings growth AND changes in valuation. Valuations vary most when a country goes from cold to hot to cold - and that happens when investors chase returns.

🔍 Understanding The Difference Between A Local And Global Focus

Diversification isn’t as simple as picking a company that trades on a foreign exchange and adding it to your portfolio. It’s important to understand that irrespective of which market you look at, some companies are locally focussed and some have a global presence and these companies will enrich your portfolio in different ways.

🌍 Globally Focussed Companies

The most profitable companies in the world today are global. These are large multinationals that have a presence across many different markets. These companies are less impacted by factors on a local scale and are more impacted by global economics and policy changes.

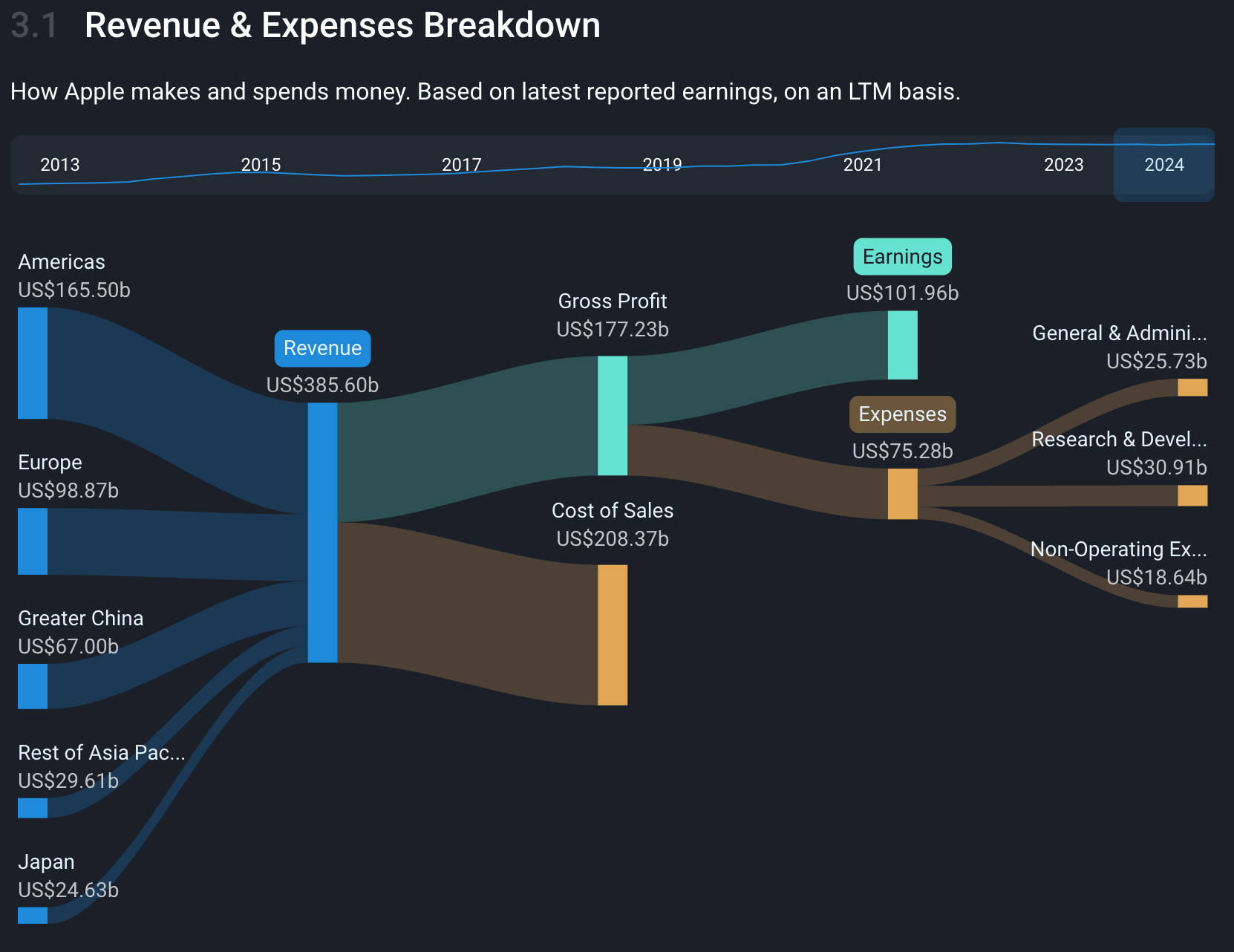

Take Apple for example, although Apple is based in the US and is listed on US exchanges, there are factors like intervention from EU regulators and expansion into emerging markets in Latin America and Asia that are just as likely to influence valuations as anything local.

If your goal is to reduce volatility in your portfolio, then gaining exposure to globally focussed companies can be an effective way to do that. Their large operations and geographically diversified nature should mean that their returns are less prone to large fluctuations.

Here are some ideas for some globally focussed companies

- 💻 The digital economy is a global phenomenon, and a lot of the software and tech companies that contribute to it have a global reach. Your first thought when it comes to these types of companies will be Silicon Valley, and who can blame you, with it being home to many of the largest global tech companies, but let’s shine a light on some other tech giants from around the world!

- 🇩🇪 SAP SE

- 🇰🇷 Samsung Electronics

- 🇮🇳 Infosys

- 🇨🇦 Constellation Software

- 🇨🇳 Xiaomi

- 🇦🇺 Atlassian

- 🛍️ Global consumer goods companies are generally well-diversified and have compounded returns for decades. These companies may not have the excitement of a high-growth tech company, but steady single-digit sales growth and a wide moat can produce better long-term returns than sporadic periods of rapid growth.

- 🇨🇭 Nestle

- 🇫🇷 LVMH Moët Hennessy - Louis Vuitton

- 🇯🇵 Sony Group

- 🇨🇳 Midea Group

- 🇩🇪 Adidas

- 🇬🇧 Tesco

🏙️ Locally Focussed Companies

While these locally focussed companies are also listed on foreign exchanges, their businesses are much more isolated from global factors.

Banks, insurers, retail stores and food producers often operate in a way that solely serves the local market in which they’re listed and are unique to each country. They can offer exposure to market-specific factors like increasing consumer spending in particular countries, new economic policies or to capitalize on new emerging industries - but this can be cyclical.

If your goal is to lower the correlation between the returns in your portfolio and look for stocks that may zig while your domestic investments zag, then searching for locally focussed foreign investments could be effective.

Simply Wall St’s Stock Screener is a great way to discover some great locally-focussed companies from around the globe that will give your portfolio an extra kick of regional diversity. You’re able to filter results by industry and - most importantly - by market to find some great opportunities that you would otherwise miss if you focussed solely on your home country.

💹 Emerging markets

Some of the most interesting locally-focussed companies can be found within emerging markets. Emerging markets present investors with unique opportunities to gain exposure to trends that you may not see in developed markets.

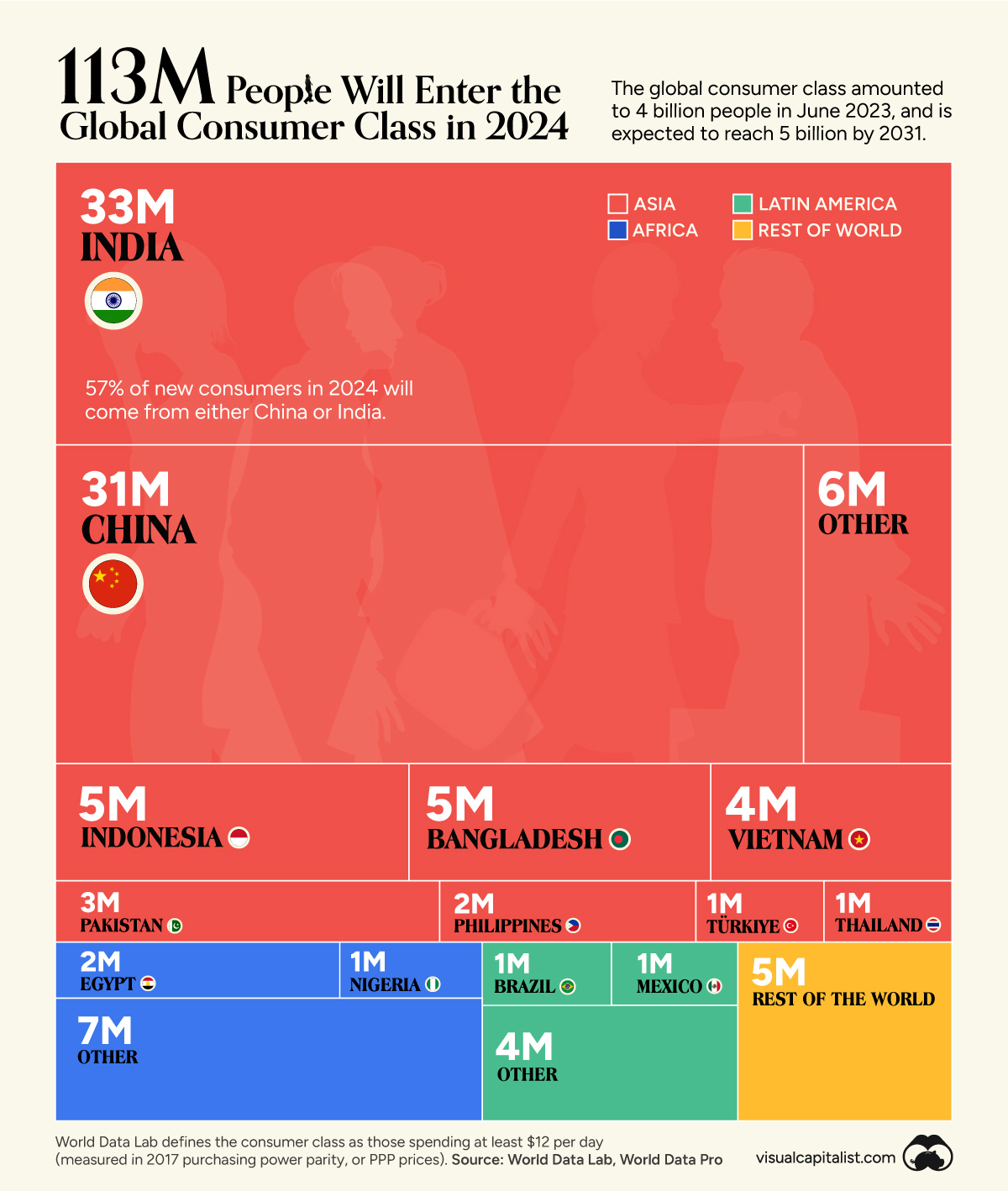

For example, emerging markets are often characterized by the emergence of a middle class. This middle class generally has greater levels of disposable income. Higher disposable income leads to changes in purchasing behavior and consumer products, and retailers begin to grow their presence and thrive as the retail model shifts from local markets and vendors to larger retailers.

We’ve previously dived deeper into some really interesting emerging markets like Mexico , which is undergoing a period of growth from the benefits of ‘near-shoring’ and India, which is in the midst of an economic modernization that is seeing many new industries flourish and millions of the population entering the global consumer class.

These economies aren’t alone, with 4.3 Billion of the world’s population living in emerging markets there are opportunities around the globe to explore in the search of diversifying your domestically over-concentrated portfolio.

While emerging markets offer some great opportunities and investors can be rewarded with monumental returns, they aren’t a golden ticket to a successful portfolio. As with all things, there are important risks to note when considering investing in emerging markets:

- 🙅 Growth opportunities don’t guarantee success

- When it occurs, growth can be phenomenal, as you can see with India’s HDFC Bank’s earnings, which increased by nearly 800% in the last 10 years. While some emerging markets will have short periods of great returns, on the whole, things haven’t been smooth sailing and the MSCI Emerging Market Index has actually underperformed both the S&P 500 and the MSCI World Index on a year-to-date basis, 1-year basis and a 5-year basis.

- 📉 High interest rates have been brutal to emerging markets

- Emerging markets often have a high dependence on d ebt that is priced in the US Dollar, which becomes more expensive as the interest rises. That’s not the only issue either, as hawkish monetary policy is a tool to slow economic growth. Higher interest rates can further negatively impact emerging markets that heavily rely on exports if imports into developed countries slow in response.

🌏 Getting International Exposure Through ETFs

Most exchanges now offer investors the chance to diversify globally with ETFs. As we’ve mentioned before, ETFs are a great place to start when it comes to diversifying, particularly in a global fashion. There’s a few pros and cons that should always be considered:

- Purchasing an ETF is a lot more convenient than opening trading accounts on the other side of the world, and the brokerage costs of purchasing will likely be lower if the ETF is listed on your local exchange.

- These ETFs do offer diversification - but may include a lot of mediocre companies.

- ETFs are a good start, but finding a handful of really great companies around the world could offer diversification and return, all without paying a management fee.

💡 The Insight: Understanding How To Diversify Is Just As Important As Diversifying Itself

When seeking to globally diversify your portfolio, there are some key considerations.

1. 📅 Firstly, think long-term rather than the immediate outlook:

- There is more to it than just considering the individual company catalysts. Consider the catalysts that contribute to a great business environment where companies thrive. Last week, we discussed a few factors that are indicative of a market that is more friendly to investors, which tends to make things easier for foreign investors. Check them out in last week’s market insights if you’re interested.

- Consider each market’s exposure to long term secular trends too. The way a narrative can play out in your home country can be completely different to how it plays out in other markets. Each market has its own unique economic traits, age demographics and laws that can see secular trends play out in wildly different ways. This can be both an advantage and a disadvantage.

2. 🌍 Secondly, balance out home country bias:

- Pick markets with strong sectors that are underrepresented in your local portfolio.

- Exploring the exchanges of global financial centers is a great place to start, as they offer access to regional and global companies. Examples include the US, UK, Switzerland, Singapore and South Africa.

- Ideally, offshore investments should help you spread the risk AND offer the chance for exceptional returns over the long term.

3. 💸 Thirdly, GDP matters less than you might think:

- Countries with higher per capita GDP do have higher stock market value-to-GDP ratios.

- However, several studies have shown little correlation between GDP growth and stock market returns.

- Higher GDP leads to more companies becoming publicly listed, hence the higher market-to-GDP ratio.

- The highest ratios occur in markets that become financial centers and attract dual-listed global companies and regional companies.

Key Events During The Next Week

Tuesday

- 🇦🇺 The Reserve Bank of Australia’s interest rate decision is due. Unfortunately for mortgage holders (and fortunately for savers), the ASX Interest Rate Tracker indicates a 90% probability rates go unchanged and remain at 4.35%

Wednesday

- 🇦🇺 Australia’s CPI indicator for the month of August is due. The last few months have seen inflation cooling again after it spiked again in May. July’s inflation rate came in at 3.5%.

Thursday

- 🇺🇸 The final US GDP growth figure for Q2 is due on Thursday. The forecast of 3.0% is up from an earlier estimate of 2.8% due to increased consumer spending.

Friday

- 🇫🇷 France’s preliminary year-on-year inflation rate for September is due on Friday. Inflation had slowed to 1.8% in August, but a slight increase to 2.0% is forecast for this month.

- 🇺🇸 United States Core PCE Price Index for August is due. This index is the Fed’s preferred gauge for underlying inflation. July saw 0.2% growth reported, and the same is expected for August, with further 0.2% growth forecast.

- 🇺🇸 US personal income growth is due for the month of August. Growth is set to be similar to last month, with 0.3% growth forecast, the same as July’s result.

- 🇺🇸 US personal spending growth is also due. July’s results were marginally hotter, at 0.5%, but this is set to slow to 0.3% growth for this month.

There are still some companies that are yet to report earnings, some to note are:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.