Quote of the Week: “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” - John Templeton

Tesla's much anticipated Robotaxi is scheduled for 10th October. The event has already been pushed out from August, and the fact that it’s now taking place at a film studio in Hollywood only adds to the intrigue and anticipation.

The hype around robotaxis is likely to reach fever pitch over the next few weeks, so we thought it would be a good time to look at the opportunity, as well as the potential hurdles and risks facing the companies trying to claim their slice of the market.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🛢️ OPEC+ to delay production increase by two months ( CNBC )

- What’s our take?

- OPEC is steadily losing influence over the oil price.

- The price of crude oil is back below $70 as demand has fallen short of forecasts, while production continues to rise. OPEC was planning to increase production by 180,000 barrels per day in October, as part of a longer term plan to unwind the production cuts of the last two years.

- In the past, OPEC had considerable influence over the oil price, as its members accounted for the bulk of global supply. With non-OPEC members (mostly the US) increasing supply, that’s no longer the case. At the same time, most of the members of OPEC+ are heavily reliant on oil revenue and can’t afford indefinite cuts.

- The International Energy Agency predicts that supply will outstrip demand by 8 million barrels a day by 2030. If they are correct, OPEC’s influence is unlikely to bounce back.

- Looking further out, Exxon recently published its forecast for oil demand out to 2050 -the key takeaway being that it sees demand remaining above 100 million barrels per day through 2050.

- What’s our take?

-

Nvidia Denies It Was Subpoenaed In DOJ Antitrust Probe ( Forbes )

- What’s our take?

- Subpoena or not, Nvidia is going to be facing intense scrutiny from several different regulatory authorities.

- Reports had come out on Tuesday that Nvidia had been subpoenaed as a part of growing antitrust investigations into some of the largest tech giants on the market.

- The report, which cited several unnamed people, claimed that Nvidia had received a formal request to lift the curtains on their $700 million deal to acquire the AI management firm, Run:ai.

- While a spokesperson from Nvidia denied the DOJ has sent any subpoena, you know how the saying goes, “where there’s smoke, there’s fire”. There’s almost no doubt the company is on the DOJ’s radar.

- As part of the DOJ’s antitrust investigation into the biggest tech players, it’s only natural that Nvidia might be involved, given their meteoric rise to a multi-trillion dollar behemoth and their relative advantage they hold over their peers.

- It’s not just the US authorities that are interested in Nvidia, either, with French competition regulators expressing concerns over the market’s reliance on Nvidia’s CUDA software.

- It’s too early to predict what kind of outcome we may see, but don’t be surprised if you see Nvidia strike fewer acquisition deals in the near future.

-

✂️ Bond Rally Turns ‘Dangerous to Chase’ With Bets on Big Rate Cuts ( Bloomberg )

- What’s our take?

- Investors chasing bonds now might be a bit too late.

- According to Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investments, “The debate for the rest of the year will be whether the job market stabilises, or deteriorates fast.”

- The Fed mentioned at Jackson Hole that their focus has slightly shifted from fighting inflation to protecting jobs. Bonds have rallied (and yields fell) on the prospects of the Fed cutting rates by 1% by the end of the year, and by 2% over the next 12 months.

- The risk here is that investors may be underestimating the strength of the US economy. If the labour market is stronger than expected, the Fed might cut rates slower, meaning bonds rallied too hard. If the labour market is weaker than expected and rates are cut by 1-2% over the next 12 months, then the current rally is justified.

-

🪙 Biden to block Nippon's acquisition of U.S. Steel, reports say ( Axios )

- What’s our take?

- While there is bipartisan opposition against the deal, there may be unintended consequences if the deal is blocked.

- While both sides of the aisle want to keep the company “American-owned and operated”, workers and shareholders may be worse off if it remains so. US Steel has said it will close plants and move headquarters if the deal doesn’t go ahead which would put thousands of jobs at risk. Meanwhile, Nippon has said if the deal goes ahead, it will invest billions into the company on top of the deal terms and pledge that US citizens will make up the majority of the newly formed board.

- US Steel shares dropped nearly 17% at the prospect of the deal being blocked. From our POV, while it may be a union-friendly move to block the deal from the political side of things, that may be to the detriment of workers, the people they’re trying to protect.

-

🧑⚖️ Johnson & Johnson adds $1.1bn to talc settlement ( Reuters )

- What’s our take?

- $8bn in damages has become $9bn, and J&J is going to use a “Texas two-step” bankruptcy to do it.

- In order to pay damages to claimants from its talc powder lawsuit, J&J is going to pay out the $9bn over 25 years by offloading the talc liability onto a newly created subsidiary, with the goal being J&J doesn’t have to file for bankruptcy itself.

- There is a lot of controversy around the maneuver, considering what it means for the claimants and why it would benefit J&J. The company legally needs 75% of the claimants to agree for the move to be approved by a judge, which it looks like it will reach. Considering the company has $25bn in cash and earned $19bn in free cash flow, the payout should not impact the company’s financials too much.

-

🤝 Verizon Nearing Deal for Frontier Communications ( WSJ )

- What’s our take?

- Shareholders of Frontier Communications are happy and AT&T might have more competition on its hands.

- Shares of FYBR were up 38% on Thursday after the WSJ published its article. The deal would strengthen Verizon’s Fibre network and consequently increase its competitiveness against rivals like AT&T.

- If the deal doesn’t hit any last-minute hurdles, an announcement could be made this week, which may be after the time we publish this.

🤖 🚕 The Robotaxi Revolution

The idea of ride-hailing networks operating autonomous vehicles - aka robataxis - has always been less about if and more about when . The first robotaxis were already being tested in Singapore in 2016, and Elon Musk famously promised that by 2020 Tesla would have a fleet of a million robotaxis , competing with the likes of Uber.

Progress has been slower than many anticipated, but the concept is starting to look a lot more real. A couple of recent developments suggest confidence is growing:

- Pilot fleets that initially consisted of a handful of vehicles now typically number in the hundreds.

- Waymo was recently authorized to do all-day, curbside pickups and drop-offs at Phoenix Sky Harbor International Airport.

- And lastly, Tesla is finally ready to unveil its robotaxi.

🌅 The Opportunity

For investors, the opportunity is a lot more tangible than many prior innovations. The unit economics are also fairly straightforward:

- Uber charges $2 to $4 per mile in the US. Elsewhere, the cost is lower but generally above $1 a mile.

- Robotaxis should be able to charge $1 per mile and be competitive.

- If a vehicle completes 50,000 miles a year in paid trips (136 miles per day), it would generate $50,000.

- Operating costs, including charging, cleaning, maintenance and insurance, are estimated to be less than $0.5 per mile. If that’s the case, one vehicle could generate $25,000 per year to be split between the vehicle owner and the network operator.

- The first robotaxis that were tested cost over $150,000 to build - but that figure is now getting closer to $30,000.

✨ However you slice and dice those numbers, the ROE looks incredible. Over time, fares would come down due to competition, but lower fares would presumably result in more mileage.

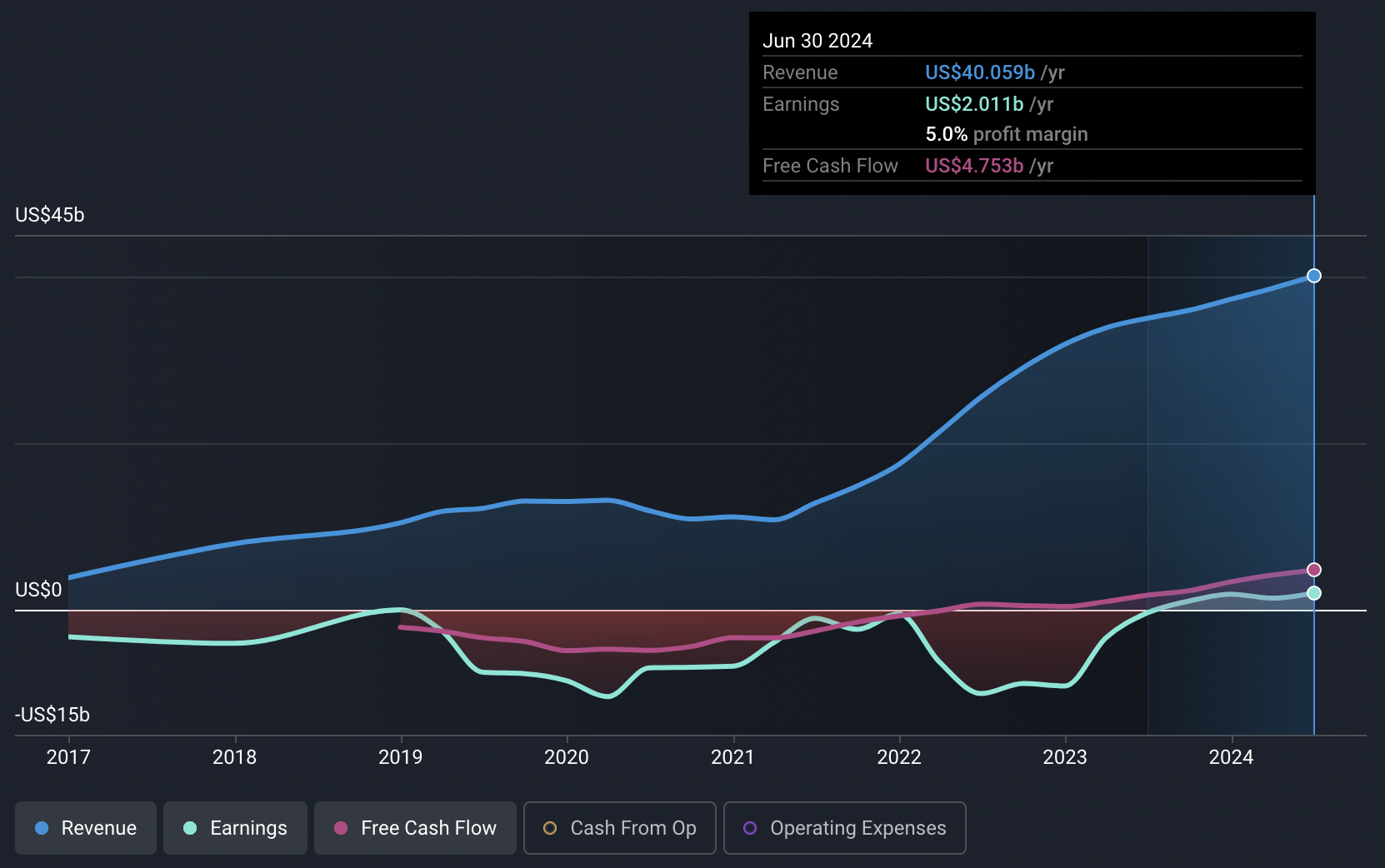

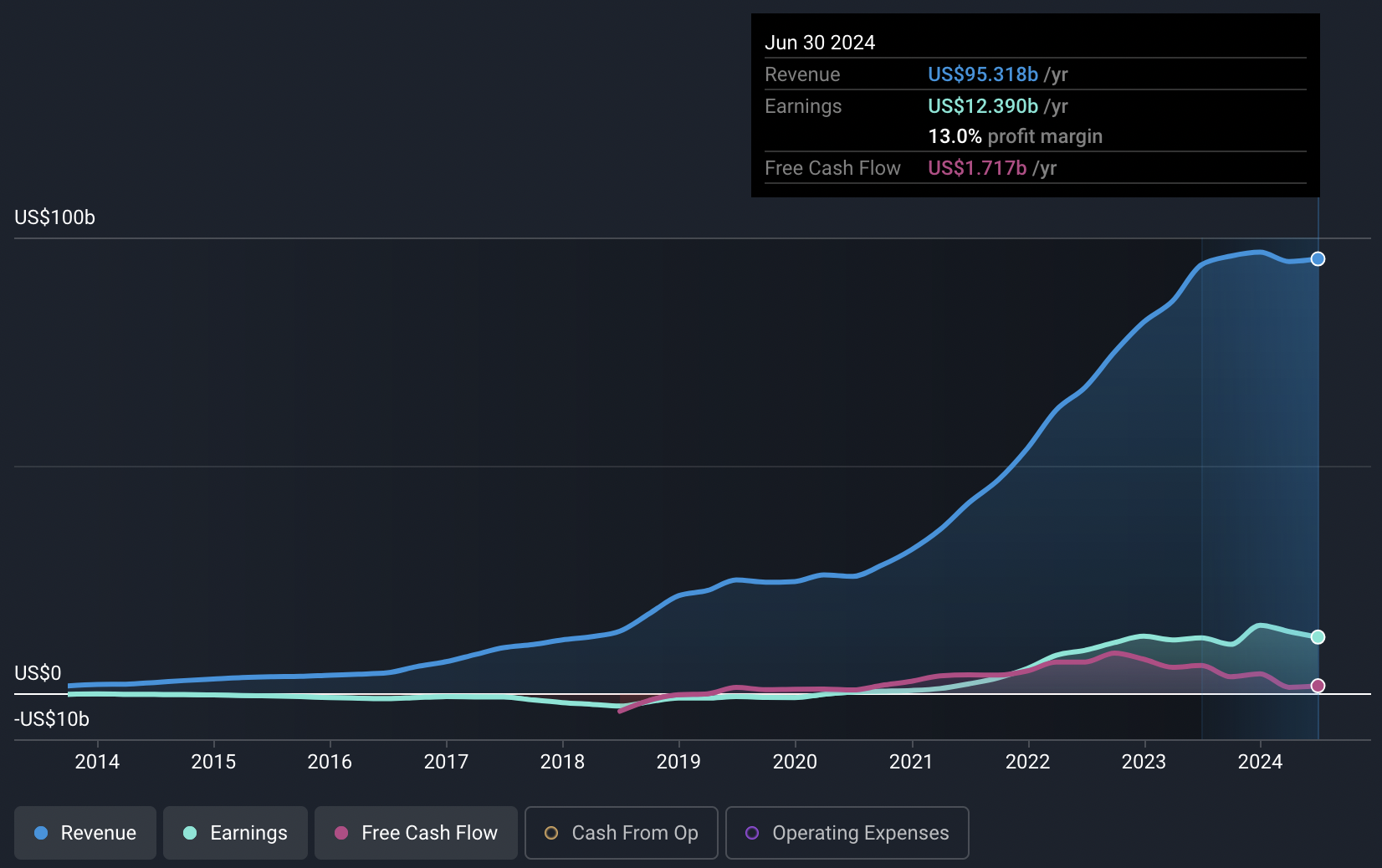

When the time comes, robotaxi services could scale very quickly too. Uber’s revenue growth over the last 10 years (below) is a good example of the potential for autonomous ridesharing services to scale. This could even occur if they are limited to high-density urban centres for the first five to ten years, as residents in these areas are less likely to own their own vehicle.

⛑️ The Safety Factor

The most obvious limiting factor is safety. Theoretically, autonomous vehicles are, or will be, safer than those driven by people.

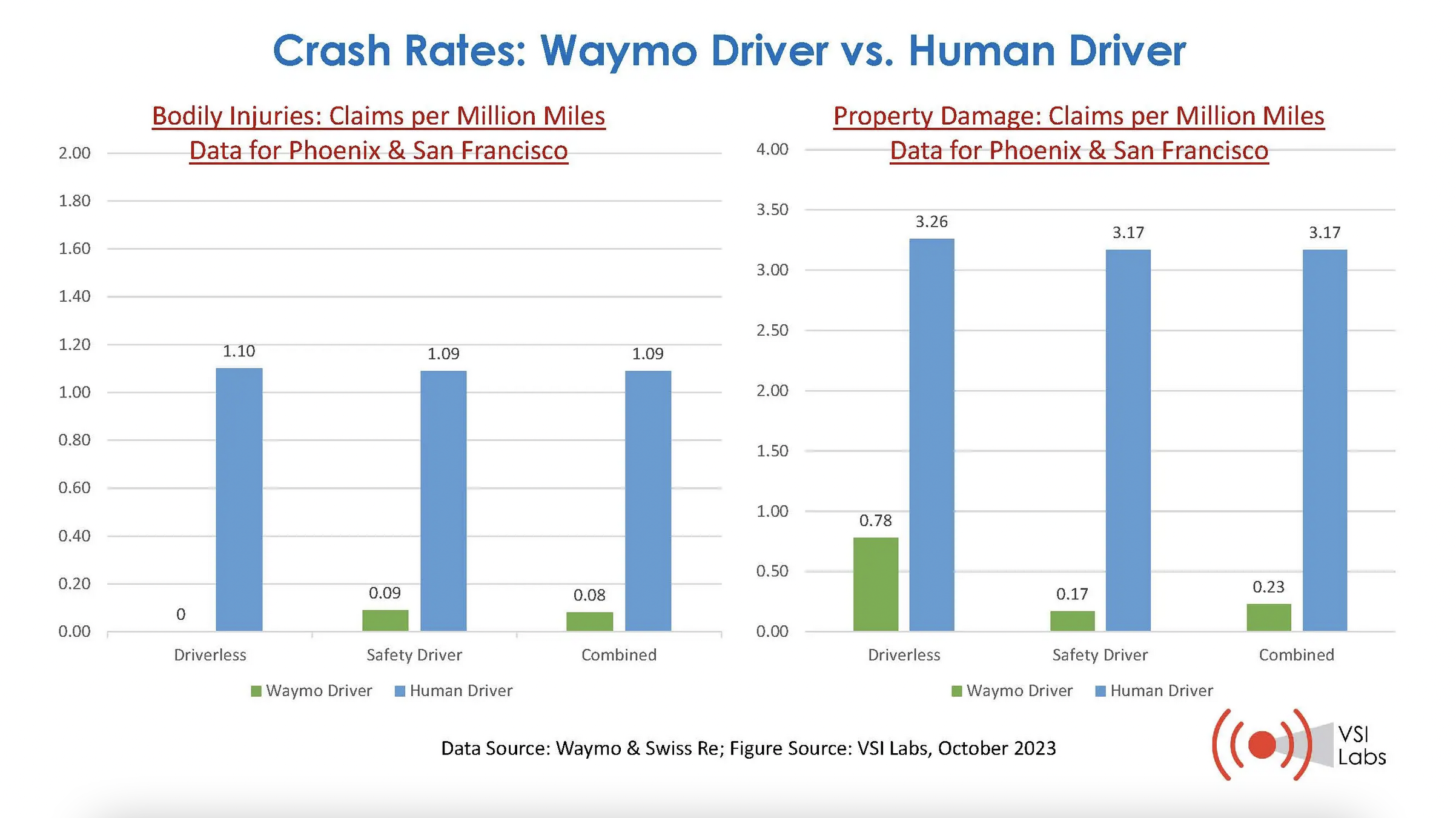

Convincing regulators, consumers, and insurers may take some work though. Sample sizes are still quite small, but early studies have shown promising results. The chart below shows the results from a study conducted by Waymo and Swiss Re.

📅 Where Things Stand Now

Pilot programs are now running in numerous cities around the world - mostly in the US, China, Singapore and South Korea. The major players include:

🇺🇸 US

-

Waymo , which is owned by Alphabet, is operating in four US cities. Waymo’s weekly rides have doubled since May to 100,000 a week. The company currently uses Jaguar I-PACE vehicles fitted with over 30 cameras and sensors. Geely Automobile Holding’s Zeekr is due to begin manufacturing Waymo’s sixth generation vehicle in 2025.

-

Cruise , which is owned by GM, got off to a bad start and suspended its service in October 2023. The company is now in the process of returning its vehicles to service. Cruise is also forming a strategic partnership with Uber

-

Zoox , which is a subsidiary of Amazon, recently expanded its service and now operates in four cities. Zoox vehicles are possibly the most futuristic with no apparent front and rear, or driver's seat.

🇨🇳 China

- Apollo Go , owned by Baidu, operates around 75k rides per week in Wuhan with a fleet of around 500 vehicles. The company has racked up the most miles in the country

- BYD is still developing its robotaxi technology, but is also partnering with Uber.

- Pilot projects are also being run by AutoX (backed by Alibaba ) and Didi Global which is partnering with automaker GAC Aion.

- Pony.ai and WeRide , are startups that are running pilot programs in several cities.

🇰🇷 South Korea

- South Korea’s government is actively encouraging the development of robotaxis, which include autonomous buses.

- Hyundai’s RoboRide and startup RideFlux are both running pilot programs. Rideflux recently launched the world's longest autonomous bus services, a 116 kilometer round trip.

- In addition, many of Korea’s largest tech companies including Samsung , LG Electronics , SK Telecom are developing technology and forming partnerships.

- One thing worth noting is that these robotaxi operations are all pilot programs. It seems that most, if not all of these vehicles are set up to receive remote assistance from operators back at HQ . Supposedly, a human only steps in when there’s a problem, but just how often that happens isn’t quite clear. Let’s face it, if it turns out many are ‘faking it till they make it’ it wouldn't be the first time.

🤖 Tesla: A Very Different Approach

Unlike all the companies listed above, Tesla hasn’t even shown the world its robotaxi - and isn’t even testing unmanned vehicles on public roads. Tesla is taking a completely different approach to the opportunity.

The services listed above all use a variety of cameras and sensors, and most notably LiDAR (Light Detection and Ranging) to measure the distance to other vehicles and objects. They are also confined to a geofenced area. In other words, these vehicles operate on a predefined network of roads using a variety of sensors to navigate those roads.

Tesla’s FSD (full self-driving) technology relies on camera-based vision, its own AI models and its immense compute power. Elon Musk has rejected LiDAR which is expensive, and he believes it is unnecessary.

Interestingly, in Q1, Tesla became Luminar’s biggest customer for LiDAR sensors . That order was only for $2 million, so the sensors may just be for testing, or verifying Tesla’s own systems.

Tesla’s FSD technology has perpetually been on the verge of full autonomy but is still only rated at level 2 , where full autonomy is level 5 . The existing services are rated at level 4 , but are confined to geo-fenced zones. Tesla’s approach means that it can reach level 5, and can then be used anywhere without needing to be trained on a specific network of roads.

Of course, Tesla has a few other key factors in its favor:

- 🛣️ Tesla has now logged well over a billion miles of travel using various levels of autonomy, while competing platforms only recently crossed the 10 million mile mark.

- 🧑💻 Tesla’s Dojo which is being used to train the FSD model is arguably the most powerful supercomputer in the world.

- 🏗️ The company has the capacity to manufacture over 2 million (and growing) vehicles a year.

- 🚘 Many of the Tesla vehicles currently on the road can be upgraded to the latest FSD version.

- 🏰 All of the above means Tesla has a huge moat that can’t be replicated easily.

The business model for Tesla’s robotaxi business could take several forms. Some analysts believe it will initially operate its own vehicles, and then allow third-party companies to own and operate fleets. Other possibilities include allowing individual vehicle owners to make vehicles available to the network or licensing its technology to other automakers.

⚠️ There are still a few Hurdles and Risks

Both Tesla and its rivals could face quite a few hurdles, both in the short term, and as their services scale.

-

🚧 Regulatory challenges: The immediate focus is on safety, but the next challenge is likely to be the inevitable job losses that will be faced by drivers. Just as services like Uber faced pushback from taxi drivers in certain cities, autonomous taxi services are very likely to face similar hurdles.

-

💰 Costs: The economics make sense at scale, but robotaxi networks are likely to be very expensive to operate in the early years, particularly while remote drivers need to be on standby. This could give companies like Uber an advantage if they can offer a hybrid model with both autonomous and manually driven vehicles.

-

⚡ Electricity consumption : Charging costs for EVs are low compared to the fares being charged. However, if these services scale as quickly as they hope to, power grids might not be able to keep up. That could lead to higher costs just as competition begins to bring prices down.

-

🌧️ Adverse weather: Ford’s CEO raised a few other issues . One of these was the fact that the technology isn’t ready to deal with severe weather, and until it is, cities can’t be reliant on autonomous services.

In time, these hurdles can be overcome, but they could mean scaling takes a little longer than the more optimistic projections.

💡 The Insight: Tesla’s Business Strategy Is Getting Complicated

Most of the companies in the robotaxi space are either owned by US and China’s technology giants, or are unlisted start-ups. For investors, this makes Tesla the most obvious stock with direct exposure. But Tesla’s business and strategy is getting complicated.

There are currently four investment narratives on the Simply Wall St platform with fair value estimates ranging from $170 to $355 (fair value estimates in brackets):

- Tesla's Supercomputer And Battery Technology Will Deliver Outstanding Growth And Transform The Automaker Into A Tech Powerhouse ($355)

- Navigating the Future: Analysis of Tesla's Growth and Challenges ($333)

- Decent Revenue Growth Won't Stop Valuation Multiple Re-rating Lower ($170)

- Electric Vehicles, AI, And New Markets Propel Growth ($204 - this narrative is generated by Gen AI using estimates from analysts and earning call transcripts)

Furthermore, the 43 analysts covering the company have 12-month price targets ranging from $85 to $310, with an average slightly lower than the current price.

On the other end of the spectrum, Ark Invest has a 2029 price target of $2,600 for Tesla. To be clear, that’s the middle of their range which is $2,000 to $3,100. If we use a discount rate of 9%, that range works out to $1,300 to $2,014 in today’s money!

Clearly, the market is very divided on Tesla’s outlook - but that’s been the case for the last 10 years.

One of the big issues is Tesla’s strategy and which parts of the business it’s going to prioritize. Tesla has a lot of opportunities for growth, including:

- The EVs it's currently manufacturing

- Robotaxis

- A low-cost EV

- The Optimus robot

- Energy storage solutions

The narratives listed above see varying combinations of the above opportunities contributing to earnings growth. One of the major considerations is Tesla’s cash flow, now that its margins have been squeezed:

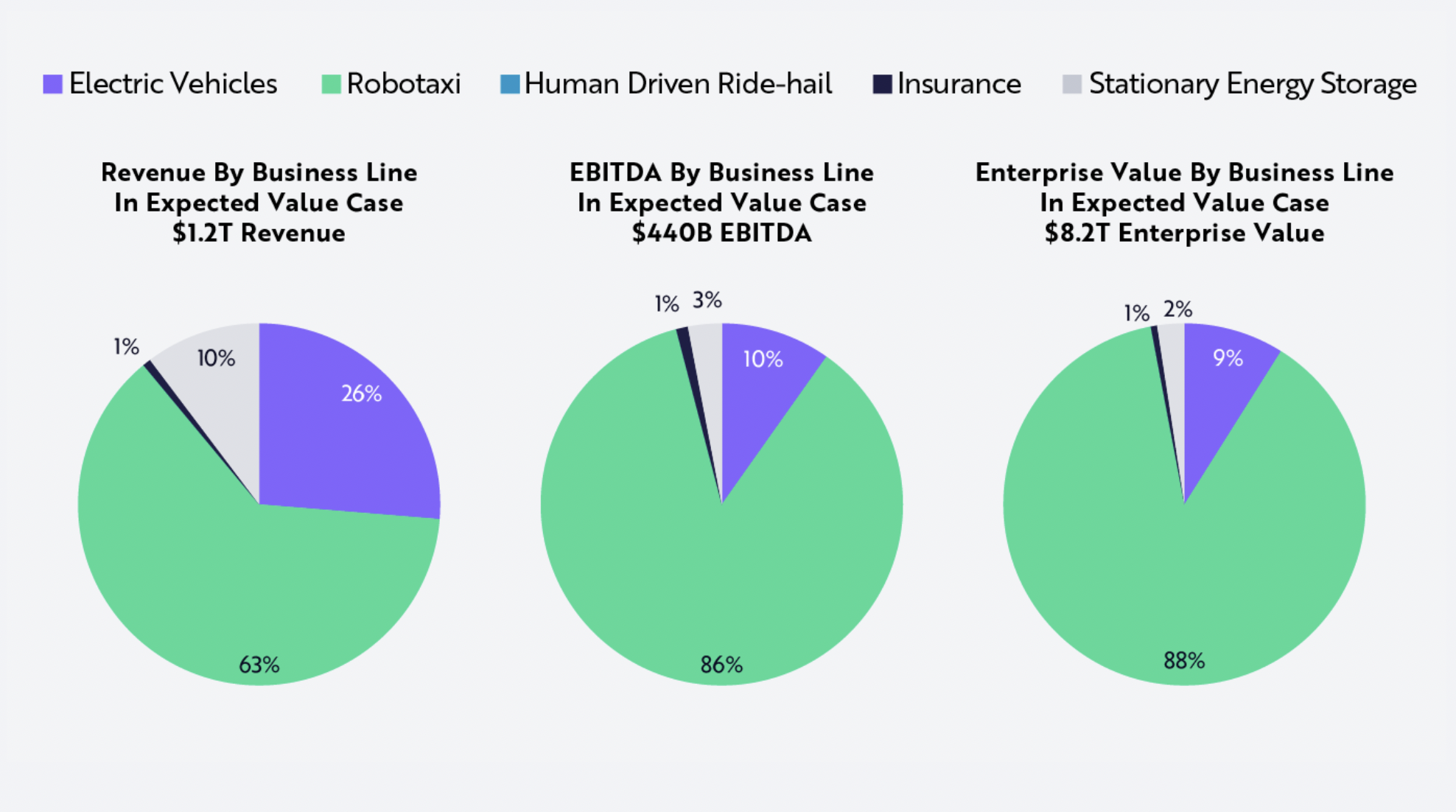

ARK Invest’s wildly optimistic valuation assumes the company will go all-in on robotaxis, because that’s where the highest margin is. Their base case assumes 63% of revenue and 86% of EBITDA would come from robotaxis in 2029. But then, even ARK’s bear case assumes robotaxis will generate $600 billion in revenue in 2029. A lot has to go right for a business to go from $0 to $600 billion in five years.

Whatever Tesla decides to prioritize, it will need to decide how to fund that growth, and how to allocate resources without losing focus.

✨ For investors, the key takeaway from the robotaxi event might not be the vehicle itself, but the business strategy.

Key Events During the Next Week

Monday

- 🇨🇳 China’s inflation data is due to be published. Consumer prices are forecast to be just 0.5% higher over the last year, while producer prices are expected to be 0.5% lower!

Tuesday

- 🇬🇧 The UK Unemployment rate for July will be published, and is expected to remain at 4.2%

Wednesday

-

🇬🇧 UK GDP data is due. The economy is forecast to have grown by 0.5% in the three months to July, down from 0.6% in the quarter to June. Manufacturing production is also expected to show an improvement, but still show activity falling 0.7% over the last 12 months.

-

🇺🇸 US Consumer Inflation data will be published. Consumer prices are forecast to be 2.6% higher over 12 months, down from 2.9% in July. The core inflation rate is expected to be flat at 3.2%.

Thursday

- 🇪🇺 The ECB is expected to announce a 0.25% rate cut, taking the interest rate to 4%. It’s expected to make similar cuts to the deposit facility and marginal lending rates.

- 🇺🇸 US producer price data will be published. PPI is forecast to be 2%, down from 2.2% in July.

- 🇺🇸 US initial jobless claims are also due to be published.

Friday

- 🇺🇸 The US Michigan Consumer Sentiment Index will be updated. Economists expected to see a slight decline in sentiment from 67.9 to 67.4

Earnings season is just about over, but there are still a handful of companies dude to report, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.