- United States

- /

- Food and Staples Retail

- /

- NYSE:DDL

3 US Growth Companies With Up To 28% Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a stall in its recent rally, with major indexes like the Dow Jones and S&P 500 slipping from record highs, investors are increasingly cautious about their next moves. In such an environment, growth companies with high insider ownership can offer a compelling investment case due to the confidence these insiders have in their own firms' prospects. When evaluating stocks under current market conditions, companies where insiders hold significant stakes often signal strong alignment between management and shareholder interests. Here are three U.S. growth companies with up to 28% insider ownership that stand out amid today's economic landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Let's uncover some gems from our specialized screener.

Coastal Financial (NasdaqGS:CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $693.81 million, operates as the bank holding company for Coastal Community Bank, offering various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: Coastal Financial Corporation generates revenue through three main segments: CCBX ($184.17 million), Community Bank ($76.75 million), and Treasury & Administration ($10.76 million).

Insider Ownership: 18.7%

Coastal Financial Corporation has seen substantial insider buying over the past three months, indicating strong internal confidence. Despite recent impairments with net charge-offs rising to US$53.2 million for Q2 2024, the company's revenue and earnings are forecasted to grow significantly faster than the US market, with annual revenue growth expected at 59.4% and earnings at 52.4%. Coastal Financial's inclusion in multiple Russell indices highlights its growing market presence.

- Delve into the full analysis future growth report here for a deeper understanding of Coastal Financial.

- The valuation report we've compiled suggests that Coastal Financial's current price could be quite moderate.

Hesai Group (NasdaqGS:HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions in Mainland China, Europe, North America, and internationally with a market cap of $517.56 million.

Operations: Hesai Group's revenue segments include the development, manufacture, and sale of three-dimensional light detection and ranging (LiDAR) solutions across Mainland China, Europe, North America, and other international markets.

Insider Ownership: 24.4%

Hesai Group, a leader in the lidar market, has demonstrated strong growth potential with significant insider ownership. Its recent launch of the OT128 lidar solution is expected to drive advancements in autonomous vehicle technology. Despite reporting a net loss for Q2 2024, Hesai's revenue and earnings are forecasted to grow significantly faster than the US market. The company’s strategic partnerships, including its exclusive deal with Baidu for robotaxi platforms, further bolster its growth outlook.

- Click to explore a detailed breakdown of our findings in Hesai Group's earnings growth report.

- Upon reviewing our latest valuation report, Hesai Group's share price might be too pessimistic.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited operates an e-commerce company in China with a market cap of $578.07 million.

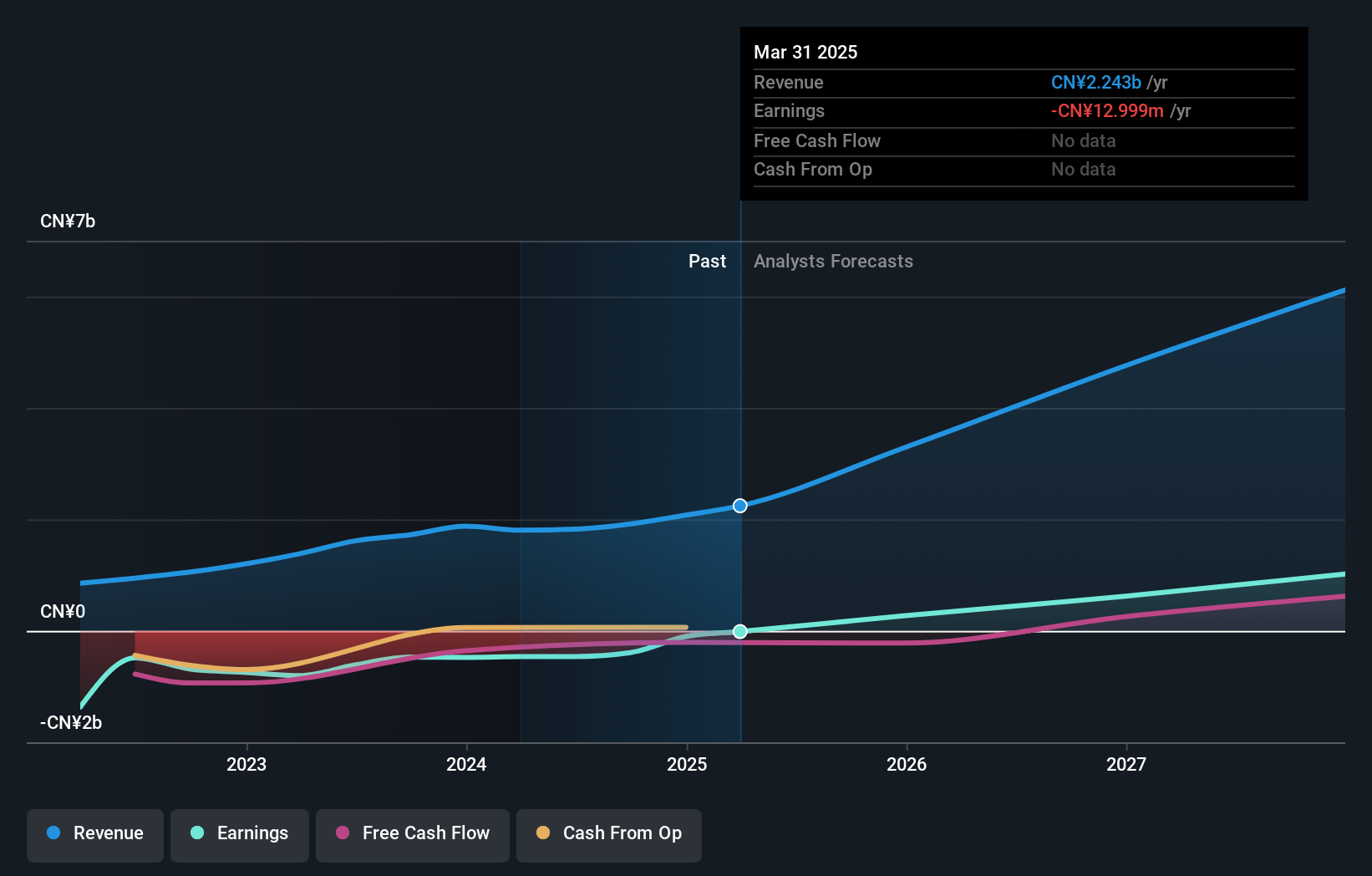

Operations: Dingdong (Cayman) Limited generates revenue primarily through its online retail segment, which reported CN¥20.76 billion.

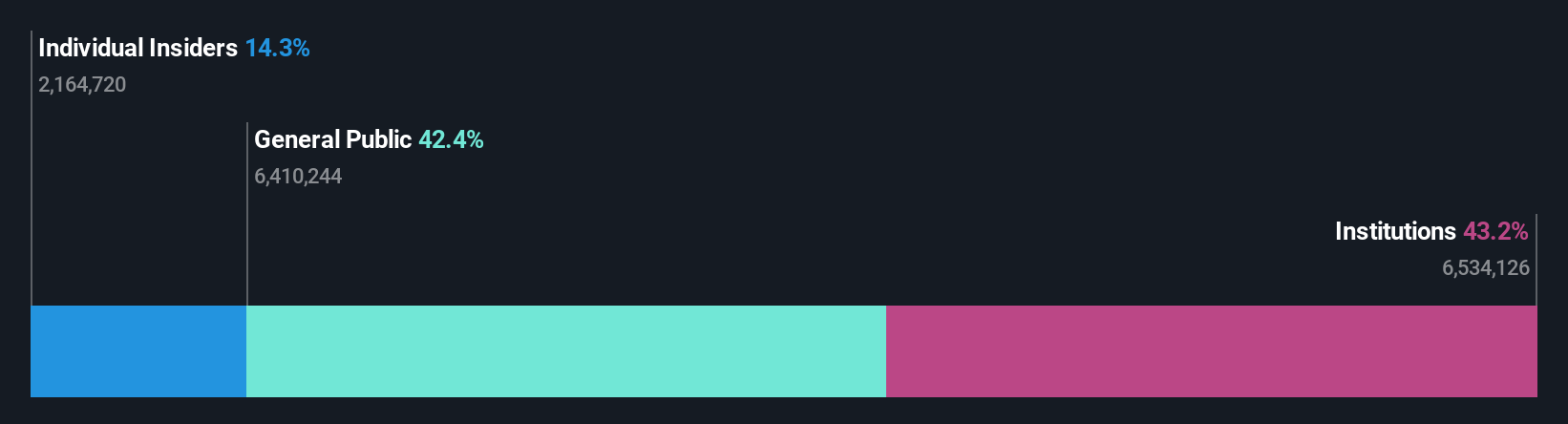

Insider Ownership: 28.7%

Dingdong (Cayman) Limited has shown promising growth, becoming profitable this year with earnings forecasted to grow 49.4% annually, outpacing the US market. Despite revenue growing slower than the market at 5.9% per year, its stock trades at 55.2% below estimated fair value. Recent executive changes include appointing Ed Chan as a director and chair of key committees following Weili Hong's resignation. The company reported Q2 revenue of CNY 5.60 billion and net income of CNY 67.13 million, raising its profit expectations for the full year 2024.

- Dive into the specifics of Dingdong (Cayman) here with our thorough growth forecast report.

- According our valuation report, there's an indication that Dingdong (Cayman)'s share price might be on the expensive side.

Next Steps

- Access the full spectrum of 179 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDL

Reasonable growth potential with adequate balance sheet.