- United States

- /

- Banks

- /

- NasdaqGS:PWOD

We Think Shareholders May Want To Consider A Review Of Penns Woods Bancorp, Inc.'s (NASDAQ:PWOD) CEO Compensation Package

Key Insights

- Penns Woods Bancorp will host its Annual General Meeting on 7th of May

- Total pay for CEO Dick Grafmyre includes US$1.00m salary

- The total compensation is 147% higher than the average for the industry

- Penns Woods Bancorp's EPS declined by 1.7% over the past three years while total shareholder loss over the past three years was 12%

Shareholders will probably not be too impressed with the underwhelming results at Penns Woods Bancorp, Inc. (NASDAQ:PWOD) recently. At the upcoming AGM on 7th of May, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Penns Woods Bancorp

How Does Total Compensation For Dick Grafmyre Compare With Other Companies In The Industry?

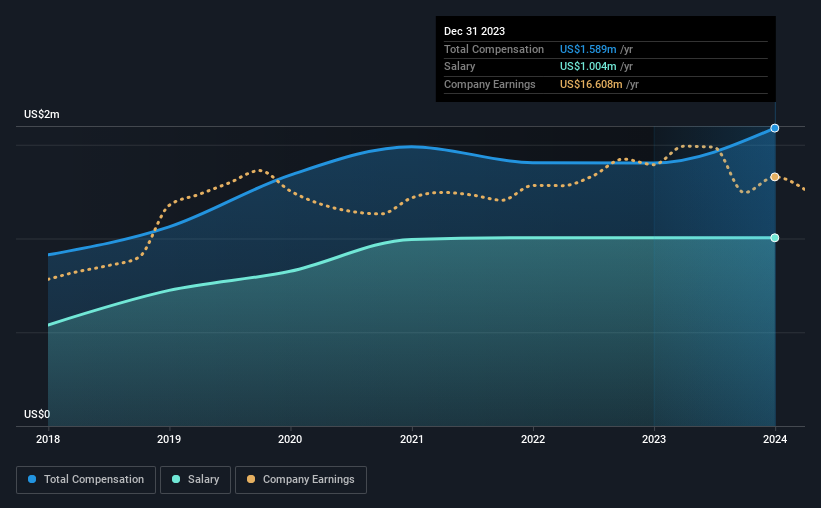

Our data indicates that Penns Woods Bancorp, Inc. has a market capitalization of US$131m, and total annual CEO compensation was reported as US$1.6m for the year to December 2023. That's a notable increase of 13% on last year. We note that the salary portion, which stands at US$1.00m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the American Banks industry with market capitalizations under US$200m, the reported median total CEO compensation was US$643k. This suggests that Dick Grafmyre is paid more than the median for the industry. Moreover, Dick Grafmyre also holds US$341k worth of Penns Woods Bancorp stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.0m | US$1.0m | 63% |

| Other | US$585k | US$399k | 37% |

| Total Compensation | US$1.6m | US$1.4m | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. It's interesting to note that Penns Woods Bancorp pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Penns Woods Bancorp, Inc.'s Growth

Over the last three years, Penns Woods Bancorp, Inc. has shrunk its earnings per share by 1.7% per year. It saw its revenue drop 2.9% over the last year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Penns Woods Bancorp, Inc. Been A Good Investment?

Since shareholders would have lost about 12% over three years, some Penns Woods Bancorp, Inc. investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Penns Woods Bancorp that investors should look into moving forward.

Important note: Penns Woods Bancorp is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking to trade Penns Woods Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PWOD

Penns Woods Bancorp

Operates as the bank holding company for Jersey Shore State Bank, which provides commercial and retail banking services to individuals, partnerships, non-profit organizations, and corporations in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives