- United States

- /

- Energy Services

- /

- NYSE:HP

Virginia National Bankshares And Two More Top Dividend Stocks To Consider

Reviewed by Simply Wall St

The U.S. stock market has recently displayed significant volatility, with individual stocks like Nvidia influencing major indices while others, such as Pool Corporation and SolarEdge Technologies, navigate challenging economic conditions. In this environment, dividend stocks like Virginia National Bankshares can offer investors potential stability and regular income, qualities that are particularly appealing amid the current market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.76% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.16% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.41% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.09% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.05% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.84% | ★★★★★★ |

| Citizens Financial Group (NYSE:CFG) | 4.80% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.86% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 6.48% | ★★★★★☆ |

Click here to see the full list of 207 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

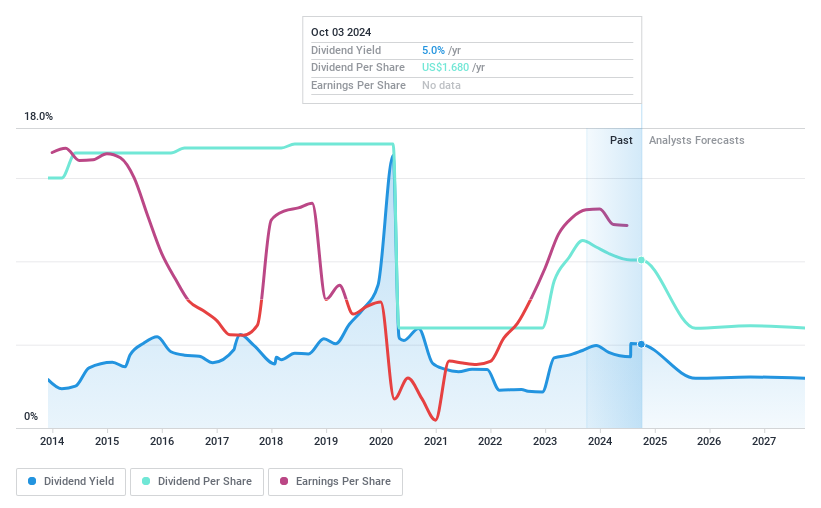

Virginia National Bankshares (NasdaqCM:VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of approximately $171.33 million, serves as the holding company for Virginia National Bank, offering various commercial and retail banking services.

Operations: Virginia National Bankshares Corporation generates revenue through its banking operations at $52.43 million, Masonry Capital at $1.04 million, and VNB Trust & Estate Services at $1.07 million.

Dividend Yield: 4.1%

Virginia National Bankshares recently declared a quarterly dividend of US$0.33, maintaining a consistent payout amidst a backdrop of declining earnings, with Q1 net income dropping to US$3.65 million from US$5.79 million year-over-year. Despite the lower yield of 4.14% relative to top U.S. dividend payers, the company's dividends have shown stability and growth over the past decade, supported by a manageable payout ratio of 41.4%. Trading at 61% below estimated fair value suggests potential undervaluation.

- Navigate through the intricacies of Virginia National Bankshares with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Virginia National Bankshares' share price might be too optimistic.

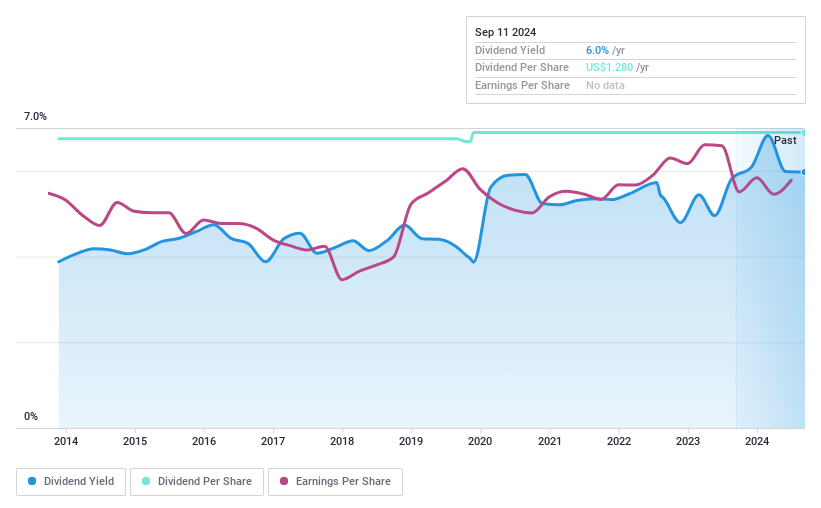

Penns Woods Bancorp (NasdaqGS:PWOD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Penns Woods Bancorp, Inc., serving as the bank holding company for Jersey Shore State Bank, offers commercial and retail banking services to a diverse clientele including individuals and corporations, with a market capitalization of approximately $156.46 million.

Operations: Penns Woods Bancorp, Inc. generates its revenue primarily through community banking activities, amounting to $63.69 million.

Dividend Yield: 6.1%

Penns Woods Bancorp recently affirmed a quarterly dividend of US$0.32, reflecting its commitment to shareholder returns amid a backdrop of repurchasing 5% of its outstanding shares. Despite a slight decline in net interest income and net income in Q1 2024, the company maintains a high dividend yield at 6.13%, ranking it among the top 25% of US dividend payers. The dividends are well-covered with a payout ratio of 58.7%, indicating sustainability despite past shareholder dilution and economic fluctuations.

- Click to explore a detailed breakdown of our findings in Penns Woods Bancorp's dividend report.

- According our valuation report, there's an indication that Penns Woods Bancorp's share price might be on the expensive side.

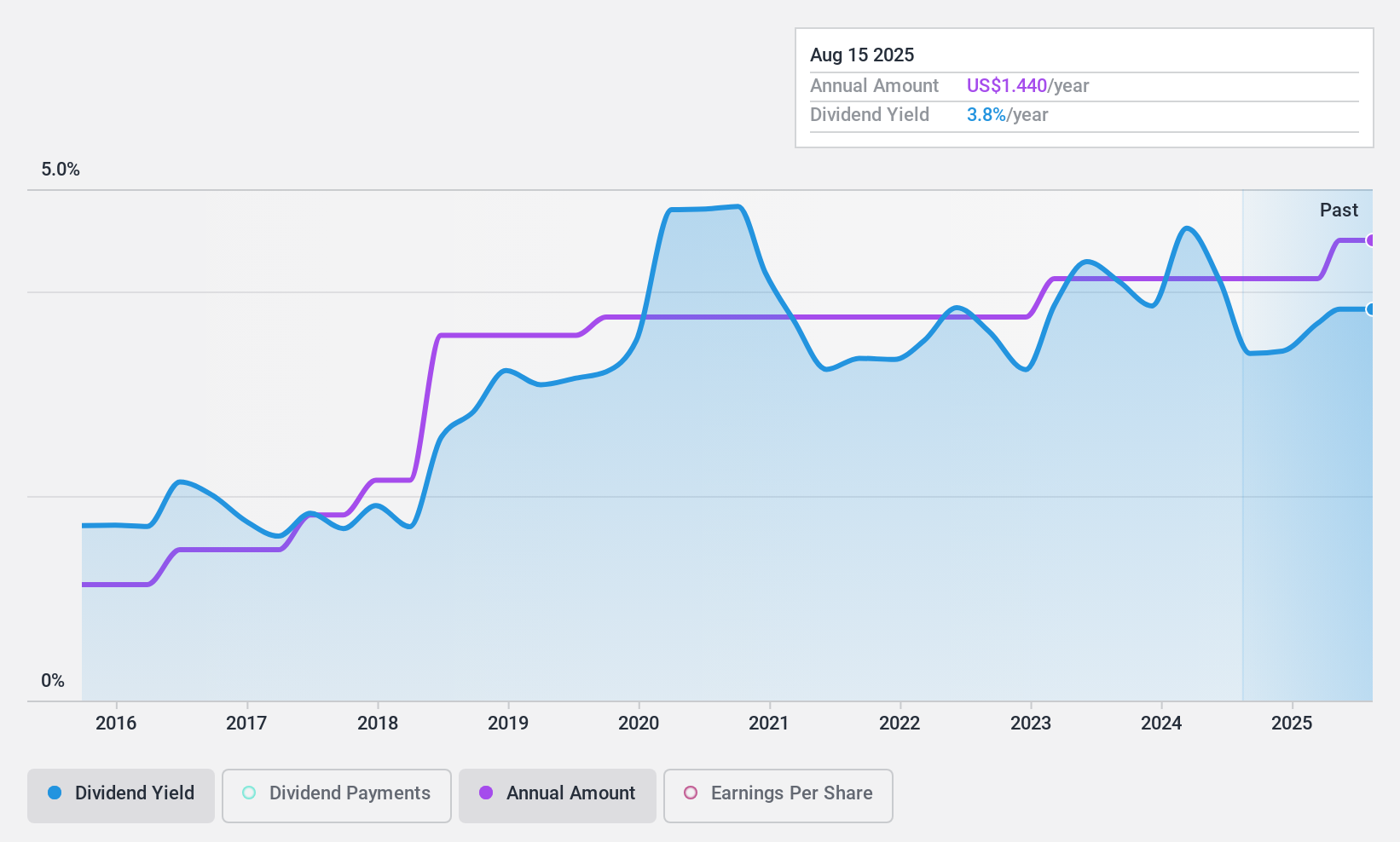

Helmerich & Payne (NYSE:HP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helmerich & Payne, Inc. offers drilling services and solutions to exploration and production companies, with a market capitalization of approximately $3.43 billion.

Operations: Helmerich & Payne, Inc. generates revenue primarily through its North America Solutions segment, which brought in $2.42 billion, accompanied by International Solutions at $202.51 million and Offshore Gulf of Mexico operations contributing $111.55 million.

Dividend Yield: 5%

Helmerich & Payne recently declared a quarterly base dividend of US$0.25 and a supplemental dividend of US$0.17 per share, payable on August 30, 2024. Despite a revenue decline to US$687.94 million in Q2 2024 from the previous year and lower net income at US$84.83 million, the company maintains dividends with a sustainable payout ratio of 28.6% and cash payout ratio of 48.2%. Analysts suggest its stock is undervalued by 48.1%, indicating potential for price appreciation.

- Delve into the full analysis dividend report here for a deeper understanding of Helmerich & Payne.

- Insights from our recent valuation report point to the potential undervaluation of Helmerich & Payne shares in the market.

Taking Advantage

- Explore the 207 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helmerich & Payne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HP

Helmerich & Payne

Provides drilling services and solutions for exploration and production companies.

Undervalued average dividend payer.