- United States

- /

- Banks

- /

- NasdaqGS:PEBO

If EPS Growth Is Important To You, Peoples Bancorp (NASDAQ:PEBO) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Peoples Bancorp (NASDAQ:PEBO). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Peoples Bancorp

How Fast Is Peoples Bancorp Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Peoples Bancorp has managed to grow EPS by 20% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Peoples Bancorp's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Peoples Bancorp remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 23% to US$361m. That's a real positive.

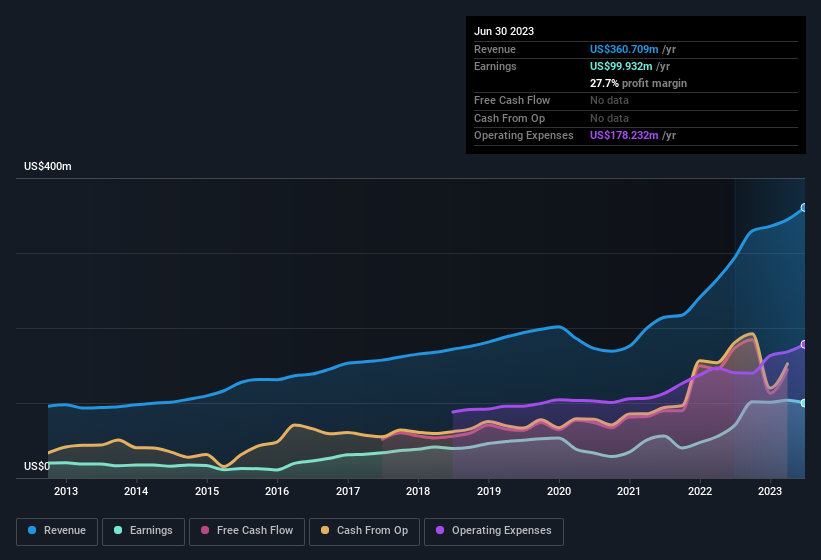

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Peoples Bancorp's forecast profits?

Are Peoples Bancorp Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite US$32k worth of sales, Peoples Bancorp insiders have overwhelmingly been buying the stock, spending US$285k on purchases in the last twelve months. This overall confidence in the company at current the valuation signals their optimism. Zooming in, we can see that the biggest insider purchase was by Independent Non-Employee Director Kevin Reeves for US$89k worth of shares, at about US$29.80 per share.

On top of the insider buying, it's good to see that Peoples Bancorp insiders have a valuable investment in the business. Indeed, they hold US$41m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Chuck Sulerzyski, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Peoples Bancorp with market caps between US$400m and US$1.6b is about US$3.4m.

The Peoples Bancorp CEO received US$1.9m in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Peoples Bancorp To Your Watchlist?

For growth investors, Peoples Bancorp's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Still, you should learn about the 1 warning sign we've spotted with Peoples Bancorp.

The good news is that Peoples Bancorp is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PEBO

Peoples Bancorp

Operates as the financial holding company for Peoples Bank that provides commercial and consumer banking products and services.

Very undervalued with flawless balance sheet and pays a dividend.