- United States

- /

- Banks

- /

- NasdaqGM:NWFL

Do Norwood Financial's (NASDAQ:NWFL) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Norwood Financial (NASDAQ:NWFL), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Norwood Financial

Norwood Financial's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Norwood Financial has grown EPS by 15% per year. That's a good rate of growth, if it can be sustained.

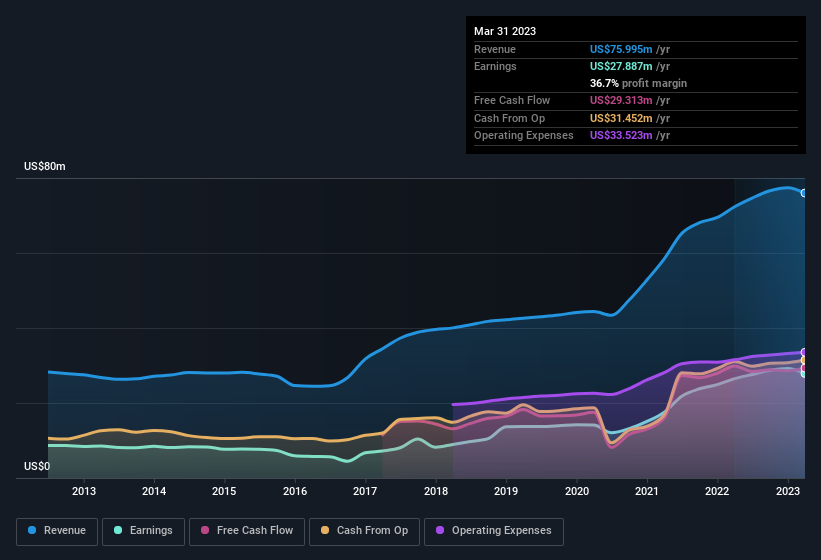

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Norwood Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Norwood Financial maintained stable EBIT margins over the last year, all while growing revenue 5.0% to US$76m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Norwood Financial isn't a huge company, given its market capitalisation of US$223m. That makes it extra important to check on its balance sheet strength.

Are Norwood Financial Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Norwood Financial insiders spent US$163k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Independent Director Jeffrey Gifford who made the biggest single purchase, worth US$48k, paying US$23.88 per share.

On top of the insider buying, it's good to see that Norwood Financial insiders have a valuable investment in the business. As a matter of fact, their holding is valued at US$21m. That's a lot of money, and no small incentive to work hard. That amounts to 9.5% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Jim Donnelly is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Norwood Financial with market caps between US$100m and US$400m is about US$1.7m.

The Norwood Financial CEO received total compensation of just US$706k in the year to December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Norwood Financial Worth Keeping An Eye On?

As previously touched on, Norwood Financial is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Norwood Financial is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Norwood Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Norwood Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NWFL

Norwood Financial

Operates as the bank holding company for Wayne Bank that provides various banking products and services.

Flawless balance sheet with high growth potential and pays a dividend.