- United States

- /

- Banks

- /

- NasdaqGS:NBTB

3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility with major indices like the S&P 500 and Dow Jones experiencing consecutive losses, investors are increasingly seeking stable returns amidst concerns over tech sector declines and AI bubble fears. In such an environment, dividend stocks can offer a reliable income stream, providing investors with potential stability and growth opportunities even when market conditions are challenging.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.61% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.19% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.34% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.86% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.29% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.72% | ★★★★★★ |

| Ennis (EBF) | 5.47% | ★★★★★★ |

| Dillard's (DDS) | 4.78% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.98% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.10% | ★★★★★★ |

Click here to see the full list of 113 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

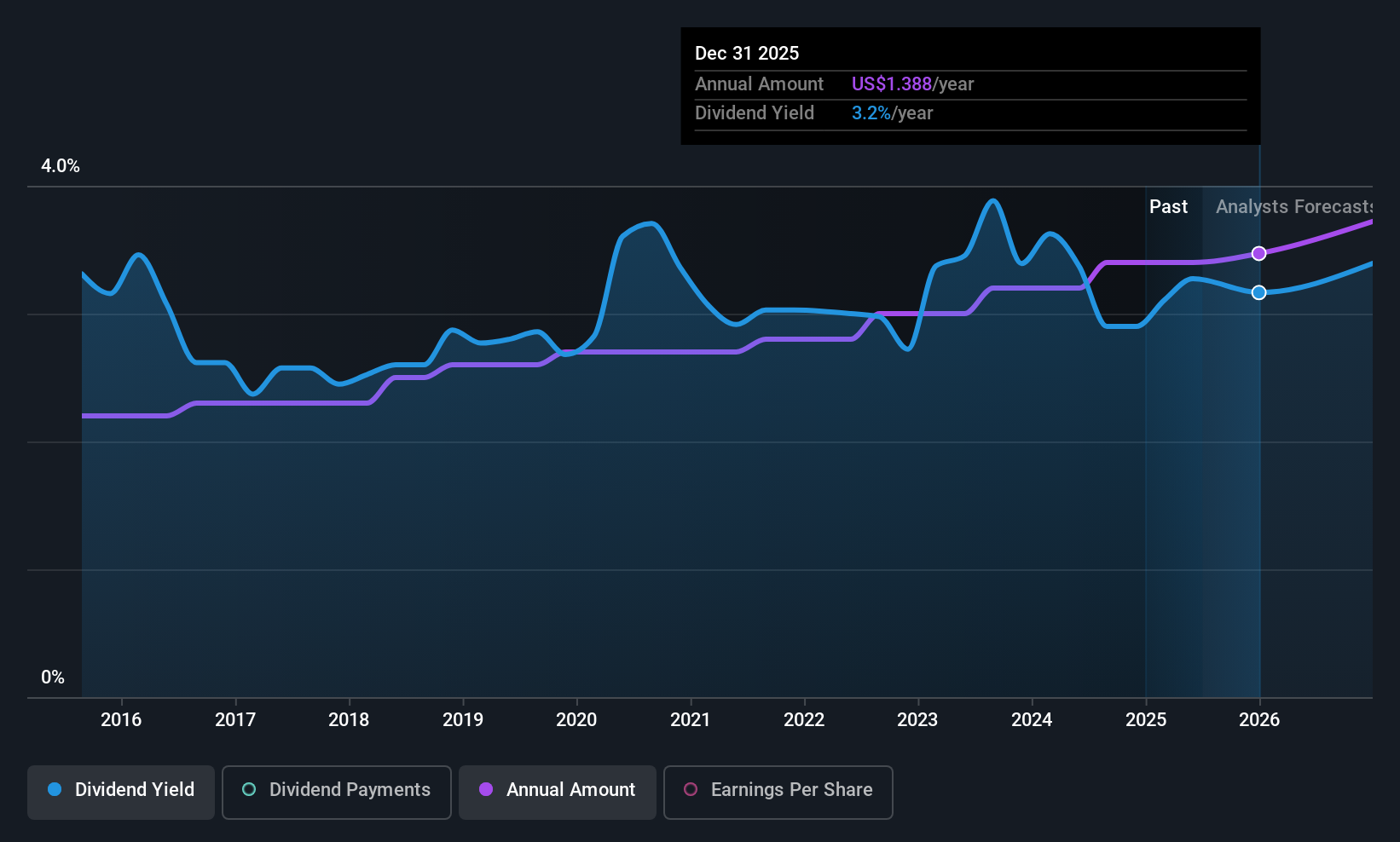

NBT Bancorp (NBTB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NBT Bancorp Inc. is a financial holding company offering commercial banking, retail banking, and wealth management services with a market cap of $2.33 billion.

Operations: NBT Bancorp Inc. generates revenue through its commercial banking, retail banking, and wealth management services.

Dividend Yield: 3.4%

NBT Bancorp recently increased its quarterly dividend by $0.03 to $0.37 per share, marking the thirteenth consecutive year of annual increases. Despite a low dividend yield of 3.37% compared to top-tier payers, the payout is well-covered with a 45.8% earnings payout ratio and forecasted coverage at 34.5%. Recent earnings showed growth in net interest income and net income, though loan charge-offs have slightly increased, which may warrant investor attention.

- Delve into the full analysis dividend report here for a deeper understanding of NBT Bancorp.

- Insights from our recent valuation report point to the potential undervaluation of NBT Bancorp shares in the market.

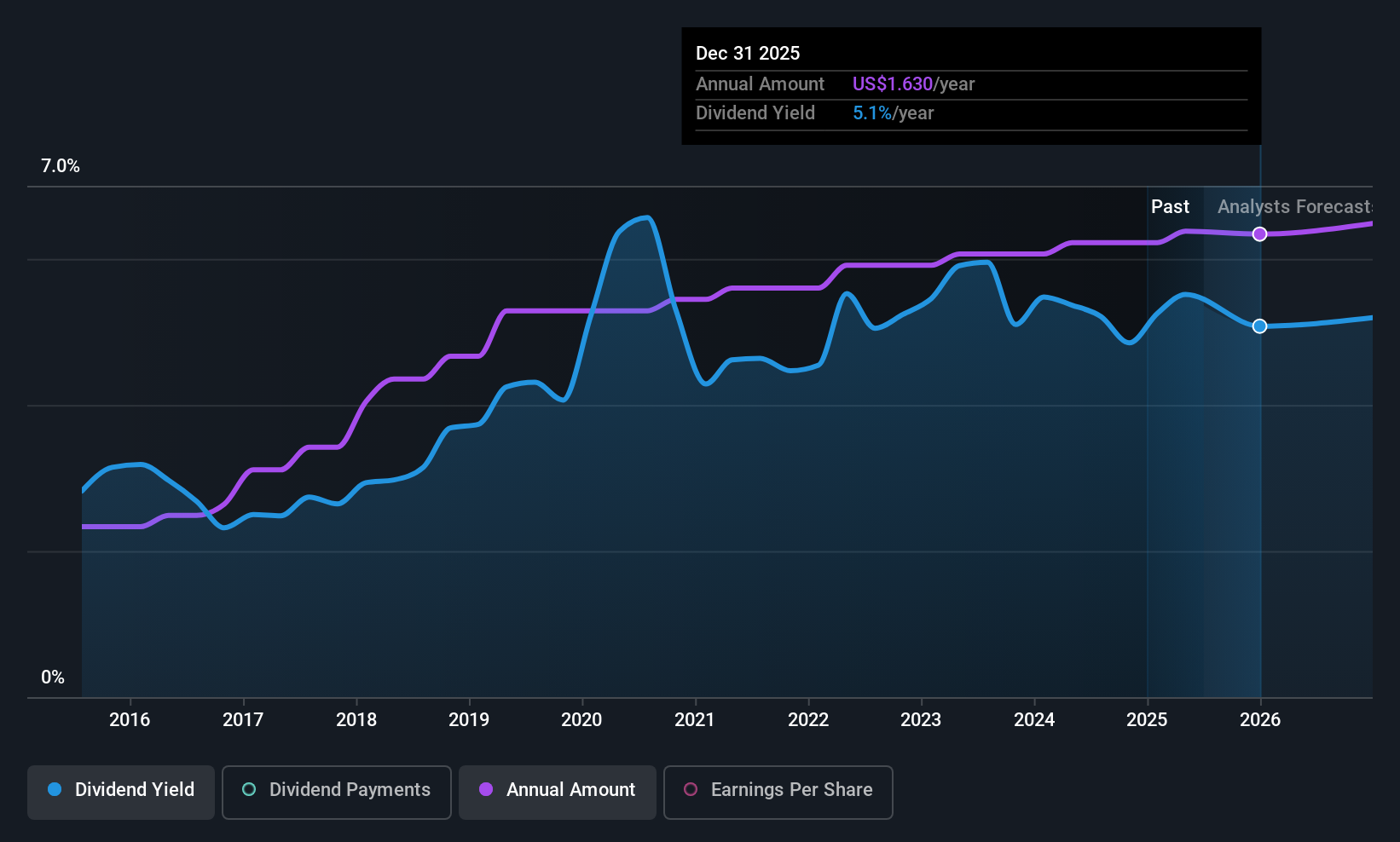

Peoples Bancorp (PEBO)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Peoples Bancorp Inc. is the financial holding company for Peoples Bank, offering commercial and consumer banking products and services, with a market cap of approximately $1.10 billion.

Operations: Peoples Bancorp Inc. generates its revenue primarily through its Community Banking segment, which accounted for $555.35 million.

Dividend Yield: 5.2%

Peoples Bancorp offers a compelling dividend yield of 5.19%, placing it in the top 25% among US dividend payers. The dividends are well-supported by earnings, with a current payout ratio of 56.4% and a forecasted ratio of 48.3% in three years, ensuring sustainability. Despite stable dividends over the past decade, recent earnings showed a slight decline in net income to US$29.48 million for Q3 2025, alongside increased net charge-offs at US$6.83 million.

- Get an in-depth perspective on Peoples Bancorp's performance by reading our dividend report here.

- The analysis detailed in our Peoples Bancorp valuation report hints at an deflated share price compared to its estimated value.

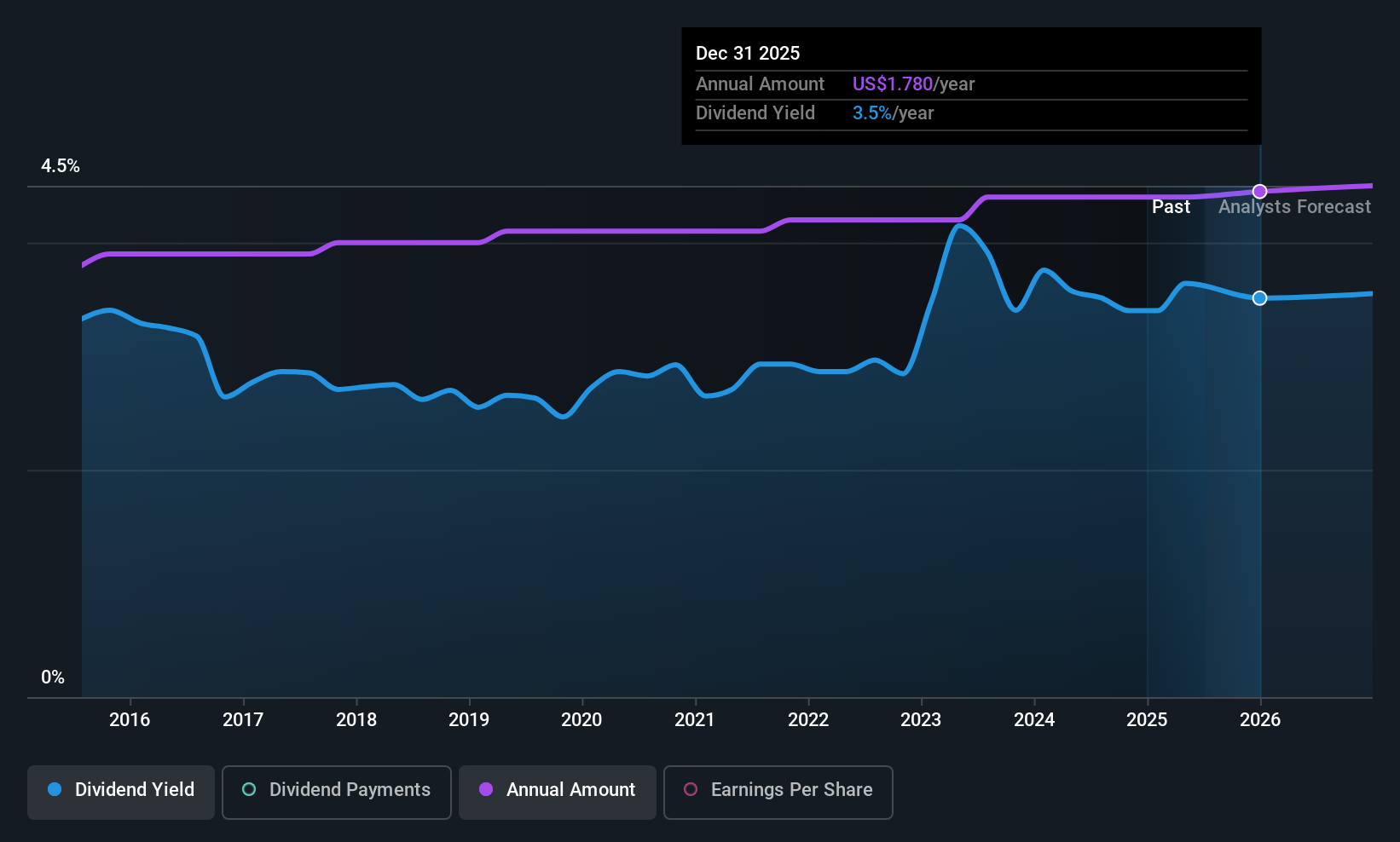

Westamerica Bancorporation (WABC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Westamerica Bancorporation is a bank holding company for Westamerica Bank, offering a range of banking products and services to individual and commercial customers in the United States, with a market cap of approximately $1.23 billion.

Operations: Westamerica Bancorporation generates its revenue primarily through its banking segment, which accounted for $264.66 million.

Dividend Yield: 3.7%

Westamerica Bancorporation's dividend yield of 3.74% is reliable and has grown steadily over the past decade, though it falls short of the top US dividend payers. The dividends are well-covered by a low payout ratio of 39.2%, with future coverage projected at 46.8%. Despite recent earnings declines—net income for Q3 2025 was US$28.26 million, down from US$35.06 million—a quarterly dividend of $0.46 per share was affirmed in October 2025.

- Dive into the specifics of Westamerica Bancorporation here with our thorough dividend report.

- Our expertly prepared valuation report Westamerica Bancorporation implies its share price may be lower than expected.

Where To Now?

- Delve into our full catalog of 113 Top US Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion