- United States

- /

- Banks

- /

- NasdaqGS:SASR

3 US Dividend Stocks With Yields Up To 7.6%

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause in its post-election rally, with technology shares leading a recent decline, investors are closely monitoring economic indicators for insights into future interest rate decisions. In this environment of fluctuating indices and cautious optimism, dividend stocks can offer stability and income potential, making them an attractive option for those seeking to balance growth with reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.33% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.55% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.50% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.32% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

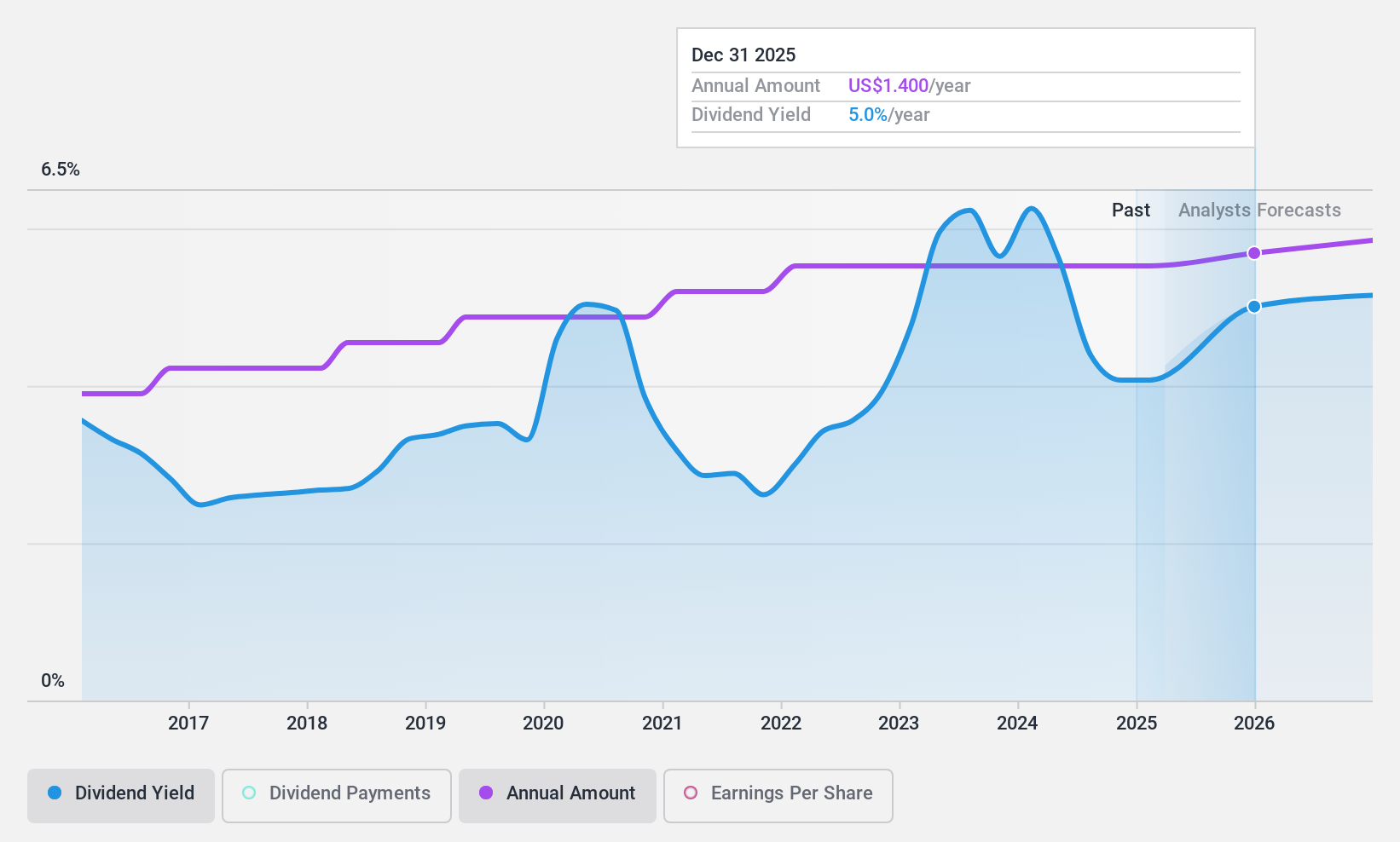

Midland States Bancorp (NasdaqGS:MSBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Midland States Bancorp, Inc. is a financial holding company for Midland States Bank, offering a range of banking products and services to individuals, businesses, municipalities, and other entities with a market cap of $581.69 million.

Operations: Midland States Bancorp, Inc. generates revenue through its segments including Banking ($241.67 million) and Wealth Management ($27.60 million).

Dividend Yield: 4.6%

Midland States Bancorp offers a competitive dividend yield, ranking in the top 25% of US dividend payers. Despite trading below its estimated fair value, it maintains a sustainable payout ratio with dividends covered by earnings both currently and in forecasts. However, significant insider selling was noted recently. The company declared a quarterly cash dividend of $0.31 per share and reported strong third-quarter earnings growth despite declining net interest income year-over-year.

- Unlock comprehensive insights into our analysis of Midland States Bancorp stock in this dividend report.

- Our expertly prepared valuation report Midland States Bancorp implies its share price may be lower than expected.

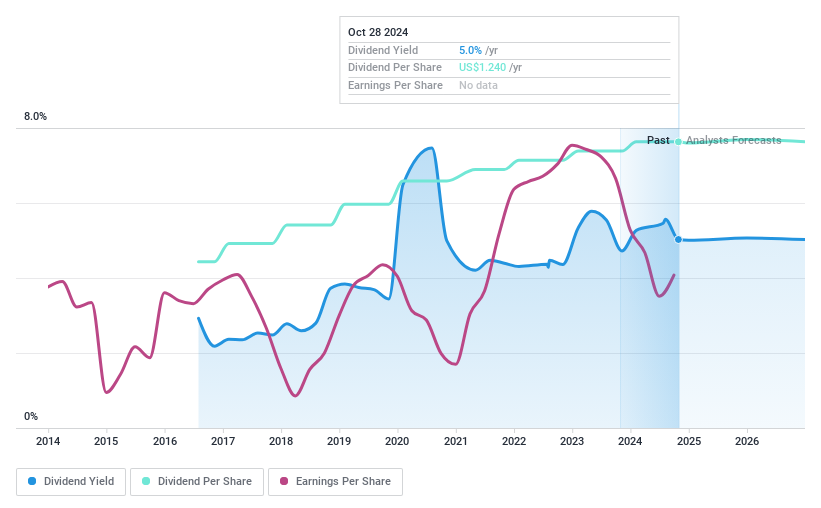

Sandy Spring Bancorp (NasdaqGS:SASR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sandy Spring Bancorp, Inc. is the bank holding company for Sandy Spring Bank, offering commercial and retail banking, mortgage services, private banking, and trust services to individuals and businesses in the United States with a market cap of approximately $1.71 billion.

Operations: Sandy Spring Bancorp, Inc. generates its revenue through a diverse range of financial services, including commercial and retail banking, mortgage services, private banking, and trust offerings to both individuals and businesses in the United States.

Dividend Yield: 3.6%

Sandy Spring Bancorp provides a stable dividend yield of 3.63%, though it is below the top 25% in the US market. Its dividends have grown consistently over the past decade, supported by a reasonable payout ratio of 71.7%, forecasted to improve to 48.3%. Recent earnings showed declines, with net income dropping year-over-year. The company is set to merge with Atlantic Union Bankshares for $1.6 billion, potentially impacting future dividend policies and shareholder returns.

- Take a closer look at Sandy Spring Bancorp's potential here in our dividend report.

- Upon reviewing our latest valuation report, Sandy Spring Bancorp's share price might be too pessimistic.

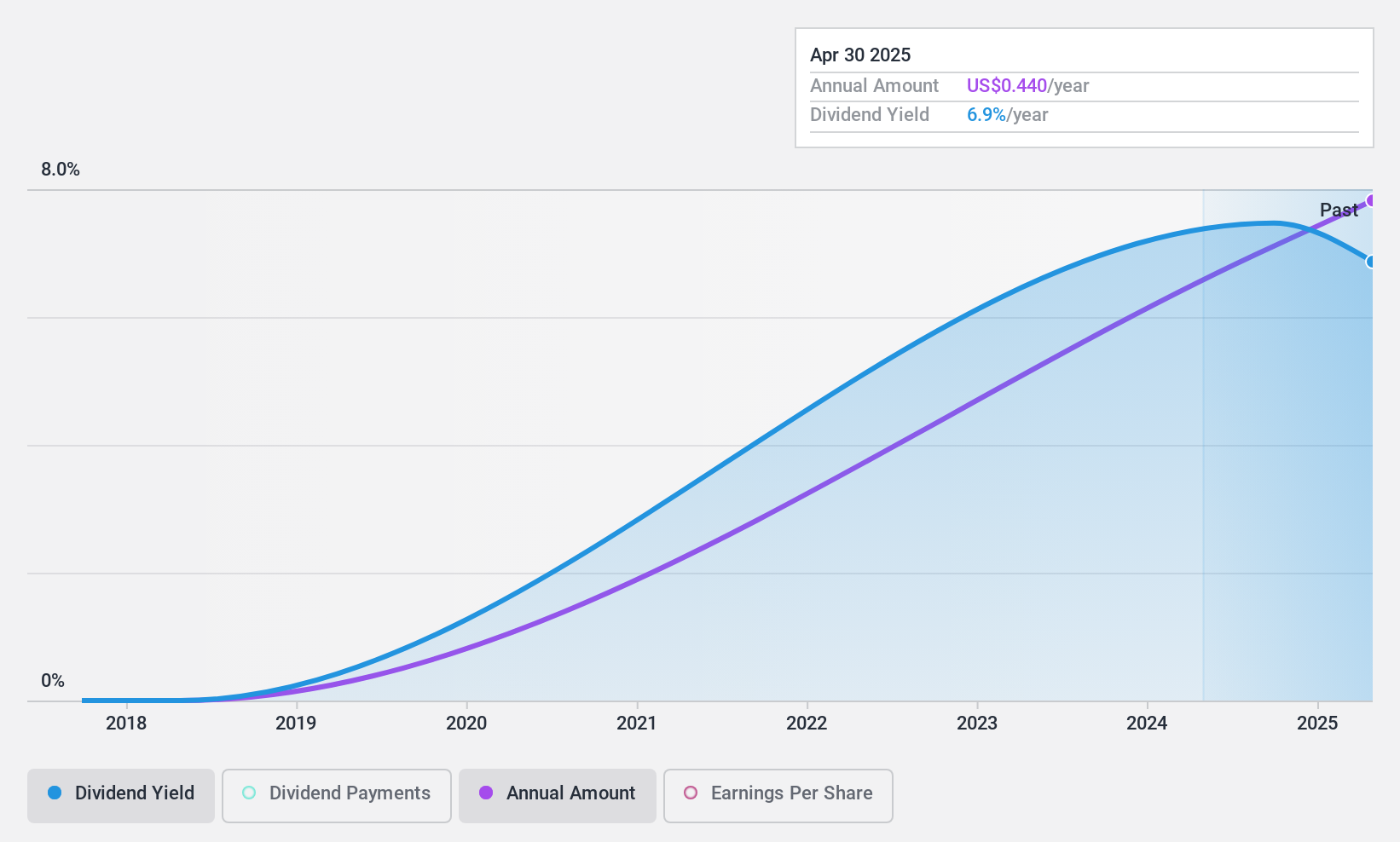

Yiren Digital (NYSE:YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China and has a market cap of approximately $395.55 million.

Operations: Yiren Digital Ltd. generates revenue primarily from its Financial Services Business, which accounts for CN¥3.21 billion, and its Insurance Brokerage Business, contributing CN¥400.14 million.

Dividend Yield: 7.6%

Yiren Digital's dividend yield of 7.62% places it in the top 25% of US dividend payers, supported by a low payout ratio of 6.7%, indicating strong earnings coverage. However, dividends have only recently commenced, making growth and reliability uncertain. Despite recent earnings declines—net income fell to CNY 355.44 million from CNY 554.42 million year-over-year—dividends remain well-covered by cash flows with a cash payout ratio of just 12.2%.

- Dive into the specifics of Yiren Digital here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Yiren Digital is priced lower than what may be justified by its financials.

Where To Now?

- Investigate our full lineup of 135 Top US Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SASR

Sandy Spring Bancorp

Operates as the bank holding company for Sandy Spring Bank that provides commercial and retail banking, mortgage, private banking, and trust services to individuals and businesses in the United States.

Flawless balance sheet established dividend payer.