AdTech Stocks Thrive As Digital Advertising Expands

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: It’s hard to find things that won’t sell online.”

– Jeff Bezos

This earnings season has been another reminder of the astonishing profitability of online advertising. Three out of the six most valuable companies in the world earn a big chunk — if not all — of their revenue from ads.

Antitrust legislation and the emergence of LLMs mean there could be some changes ahead for the industry.

This week, we are taking a closer look at digital advertising and adtech, and why many companies are getting into the space.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🧑⚖️ DOJ to push Google to sell Chrome ( Bloomberg )

- What’s our take?

- If the DoJ gets its way, Chrome could be up for grabs.

- Should a sale occur, some estimate it could sell for at least $15-20bn, given the browser doesn’t generate revenue, but is more of a key data provider to its ads business. Current antitrust scrutiny on other big tech players means finding an interested buyer who has big enough pockets and would be approved by the FTC might be tricky.

- The judge can decide at a later date if a sale is necessary. That decision will be based on whether previous recommendations around data licensing, Android and AI are effective at creating a more competitive market.

- What’s our take?

-

💰 USD rally continues as jobless claims fall to seven-month low ( Reuters )

- What’s our take?

- Continued USD strength could mask the impact of tariffs.

- The outlook for the USD, interest rates, inflation and trade is getting complicated. Global investors believe Donald Trump’s election win will be good for the US economy and stock market. That’s one reason for money to flow into the USD. The other reason is that Trump’s campaign promises are generally regarded as inflationary, which would result in higher interest rates and make the USD more attractive than other currencies.

- If the USD continues to rise, it would make imports cheaper for US consumers — and that could offset the effect of a 10% tariff — though not a 60% tariff. If the oil price remains under pressure, that could also offset the impact of tariffs. Trump wants to ‘drill, baby, drill’, which would pressure the price - eventually. It’s not quite as simple as turning the tap on or off.

- To complicate matters more, Trump actually wants a weaker dollar to make US exports more competitive. He might struggle to get everything he wants.

- What’s our take?

-

🗄️ Ray Dalio’s Bridgewater team files for retail ETF ( Yahoo )

- What’s our take?

- Now you don’t need millions to invest in Ray Dalio’s “ All-weather ” strategy.

- Bridgewater believes that while traditional asset allocations have worked over the past few decades, there is a wide range of possible economic environments coming. Their approach aims to generate returns no matter what happens.

- They’re partnering with State Street to host the ETF, but there are no details on a ticker symbol or expense ratios just yet. If you like the Bridgewater philosophy and approach, soon you’ll be able to get simple ETF exposure to it, without needing to be a billionaire.

- What’s our take?

-

💸 Nvidia flat despite another record quarter ( Forbes )

- What’s our take?

- It’s hard to grow at a breakneck pace for a long time, and the market seems to know that.

- Despite beating estimates in both revenue and earnings and improving its outlook, the market wasn’t too impressed. It’s probably because the guidance of 7% QoQ sales growth for Q4 would imply the slowest quarterly growth since January 2023.

- While Nvidia’s reports are an important leading indicator for other companies' AI capex spending, the fact that the market is so obsessed with one company’s earnings is still somewhat concerning.

- What’s our take?

-

🧱 Many industries will be hit hard by Trump's immigration crackdown ( Axios )

- What’s our take?

- The human and economic tolls from mass deportation would be significant.

- Some estimates believe that the deportation operation could cost up to $315bn, and reduce GDP by 4-6%, similar to the GFC period. As for the worker side, industries like hospitality, construction, agriculture, and health care would likely face large labor shortages.

- If that’s the case, expect delays, higher costs, and you guessed it, inflation.

- What’s our take?

-

📉 Target shares fall as slow rebound frustrates investors ( Bloomberg )

- What’s our take?

- The issues for Target are both a weaker consumer and internal challenges.

- The market wants more evidence of the turnaround plan working. The likes of Walmart and Costco are doing well and raising their guidance, but Target is struggling to do the same.

- A few errors around inventory management and product assortment are weighing on the company’s ability to improve sales. Despite it being a competitive market, Target’s challenges are internal with operations as much as they are external with market forces.

- What’s our take?

💨 The Tailwinds Driving Digital Advertising

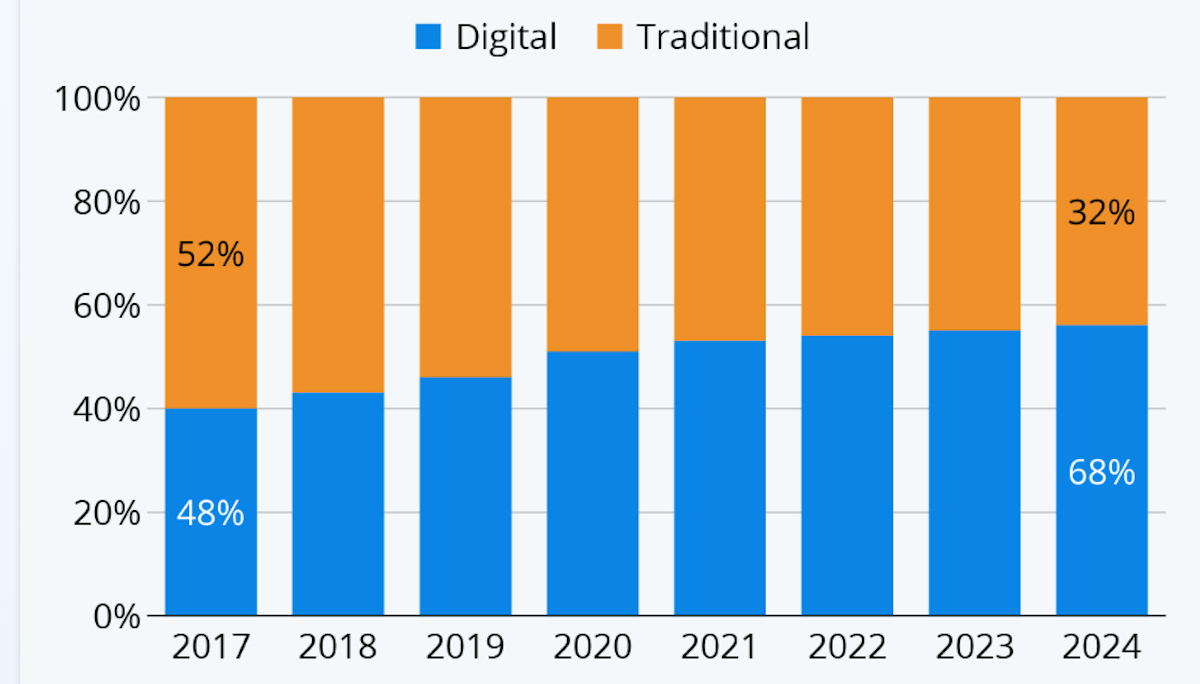

According to a recent study, global ad revenue is on the verge of crossing the $1 trillion mark, with about two-thirds of that now being spent on digital platforms. Digital ad spent continues to increase at around 10% annually, while spend on traditional channels remains flat.

🌬️ The Three Big Tailwinds Behind Digital Ad Spend

Digital advertising includes any advertising that reaches its audience via a connected device. That typically means mobile phone, tablet, PC or smart TV.

Traditional advertising includes satellite and cable television, radio, print advertising and billboards.

The first advantage digital channels have is that advertisers need to go to where the audience is.

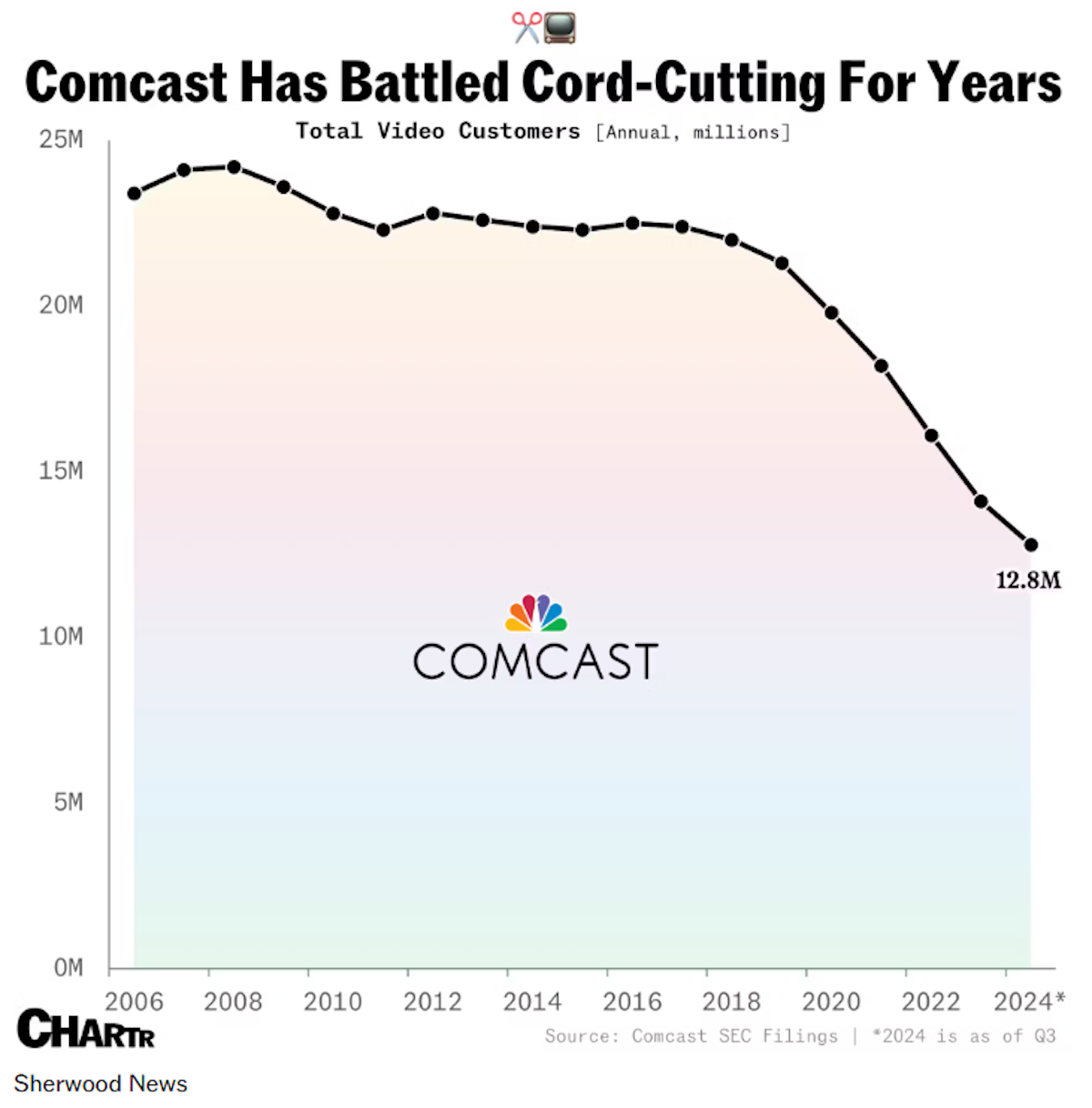

For at least 20 years, consumers have been moving away from traditional channels like cable TV and print media, and consuming content online. Many of the consumers who used to watch cable TV have ‘ cut the cord ’ and moved to streaming services like Netflix. Meanwhile, younger consumers have gone straight to digital. The chart below from Chartr shows just how clear the trend is for Comcast.

Some traditional channels are still quite profitable. But audiences are shrinking, and those ad dollars need to move to new channels.

The second tailwind is the way digital media has become fragmented.

30 years ago, advertisers could only reach consumers via a handful of newspapers and TV networks. Radio ads could target slightly narrower audiences, but advertisers generally had to use the same channel whether they were selling washing powder or luxury vehicles. They had to pay to put ads in front of millions of people who were never part of their target market.

Today, there’s a multitude of new channels, including websites, social media apps, podcasts, long and short-form video, and streaming video services. Some of those platforms have millions of individual channels, each catering to a very specific target market.

✨ The more precise an advertiser can be when targeting their audience, the higher their return on investment will be. The higher the ROI, the more they will spend on advertising.

The third tailwind is technology and data.

Digital ads can be targeted to specific audiences using data about a channel's audience. The effectiveness of ads can also be measured, and in many cases advertisers only pay when consumers respond to an ad.

Being able to measure the response to a campaign means advertisers know exactly what their ROI is and how much they are prepared to spend. With traditional channels, it’s always a guessing game, and advertisers need to build in a margin of safety.

Measurable ROIs also allow for testing and optimization. Again, this increases the ROI, which leads to higher ad spend.

Long before everyone was talking about generative AI, Google and Facebook were using machine learning to optimize their platforms and deliver value to advertisers. Now, with the help of generative AI, they are able to deliver even more value. AI brings down the cost of creating content - which further increases the return for advertisers and for those platforms.

3️⃣ The Big Three

Digital advertising is dominated by just three companies: Amazon was late to the party, but is now the third-largest ad platform in the world behind Alphabet and Meta.

In 2023 those three companies earned over 60% of global digital ad revenue. By some estimates, they earn more than 70% of each year’s growth in global ad revenue.

The dominance of those three companies might be the best example of the power of network effects in the world.

As more users join each platform, it becomes more valuable to other consumers and to users. And then, growing ad revenue allows the companies to invest in more AI development and hardware, and maintain their edge over competitors.

It’s unlikely that the big three will lose their position anytime soon, even with antitrust action from regulators. But there is a new frontier for advertisers (and for investors) in the form of streaming services.

Netflix, Disney, Spotify and other video and music streaming services are building advertising businesses. With ad-supported subscription plans, these platforms can expand their addressable markets.

✨ The ad businesses are still small, but growth could accelerate quickly when they have big enough audiences to really attract advertisers.

🚀 AdTech’s Potential

While the big online platforms control most of the value in the digital ad ecosystem, adtech platforms offer the potential for more upside - simply because they are so small.

We recently mentioned AppLovin, which has been an even bigger winner from AI in 2024 than Nvidia, with revenue up 38%, and operating income up 187% in 12 months. One of the advantages of the ad business is that revenue can increase much faster than costs when a company gains traction.

AppLovin is part of the ad tech ecosystem that matches advertisers and digital media platforms. Digital ad impressions (ad space) are traded in real-time via a network of exchanges and platforms. These include:

- Demand Side Platforms (DSPs) that help advertisers buy impressions or ad space. Examples include AppLovin, The Trade Desk and Adobe’s Advertising Cloud. A DSP’s role is to help advertisers buy impressions that offer the highest ROI.

- Supply Side Platforms (SSPs) help publishers sell impressions at the highest possible rate. SSPs connect publishers with DSPs and ad exchanges. They allow media companies to offer impressions to the largest possible pool of buyers and to set a minimum price for impressions. Examples of SSPs include PubMatic, Magnite and Criteo (based in France).

- Ad Exchanges facilitate programmatic advertising between SSPs and DSPs, or directly between buyers and sellers of impressions.

- Data Management Platforms help advertisers collect, manage, and analyze data to optimize their ad campaigns. Salesforce, Oracle, and Cloudera (private), are leading DMPs.

Some companies like ROKU, Xandr (owned by Microsoft), and OpenX (private) operate across the entire ecosystem. In addition, all the big platforms, including Meta and Google, have their own DSPs and SSPs.

✨ Small platforms still play an important role because advertisers want access to more than one platform.

From an advertiser's point of view, Facebook may offer the greatest reach, but other platforms like Pinterest or Snap may offer higher ROI from time to time.

Media analysts reckon the digital ad market will continue to grow at about 9 to 10% annually - but expect the ad tech market to grow at 14% a year through 2030.

However, the industry is continuously evolving and changing - and even more so with generative AI. Growing competition (on both sides of the market) means any company that can build tools to improve ROI can have a place in the ecosystem.

🔎 Screener Of The Week - Advertising Opportunities

Top Global Advertising Stocks shifts focus to the world of advertising. Find opportunities from around the globe to invest in companies at the forefront of AdTech and Digital Advertising.

❗ Reminder : When you’re researching companies on the Simply Wall St platform, make sure you have a look at sections

- 1.3 - Price to Earnings Ratio vs Peers, and

- 1.5 -Price to Earnings Ratio vs Industry

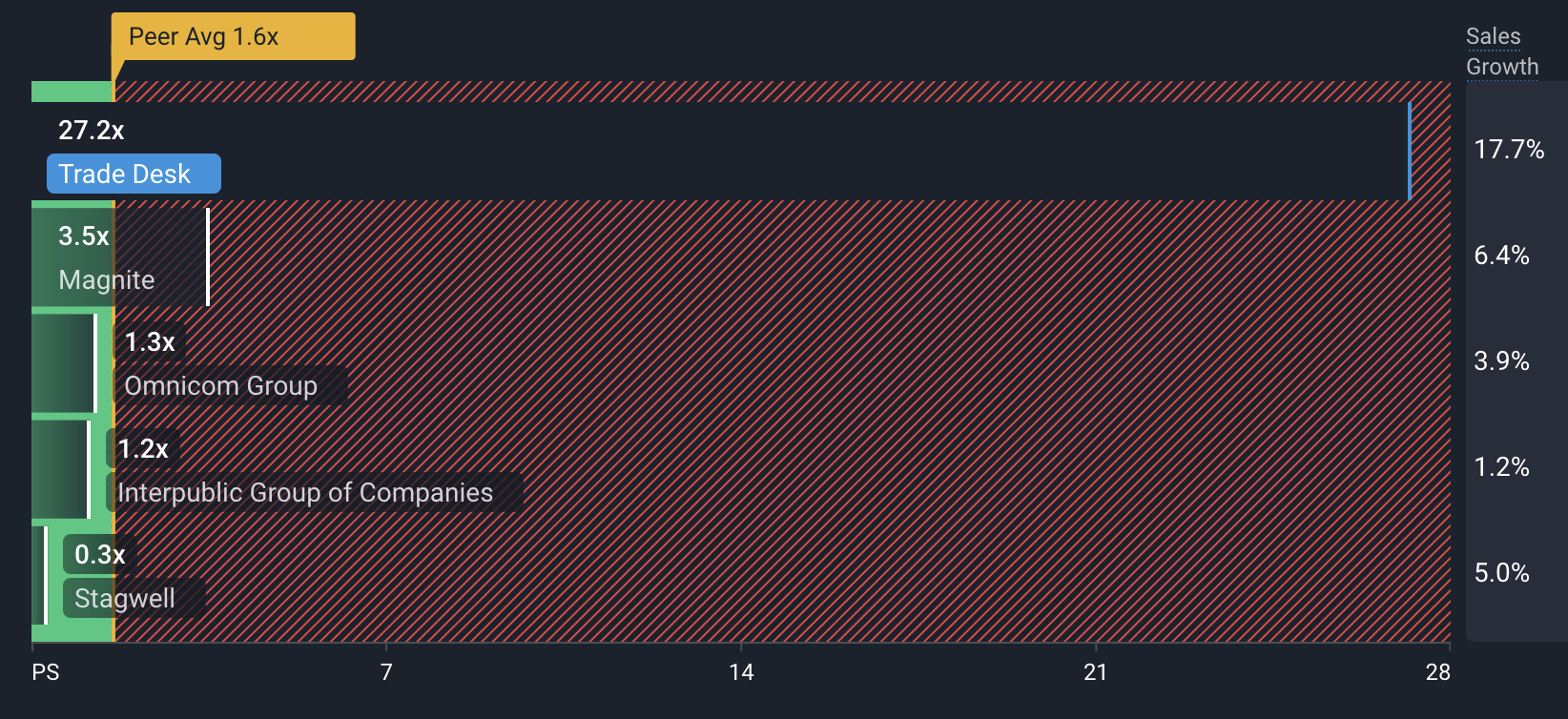

If you are looking at a popular company or one that’s shooting the lights out, chances are it’s going to be looking pricey. Those two sections might alert you to s imilar, and possibly overlooked companies. Below is a good example of The Trade Desk’s peers.

⚠️ The Risks and Drawbacks

If a media company has a large audience, it’s almost like having a license to print money - but not quite. Ad spend is cyclical, and consumers can’t spend indefinitely. When consumers stop buying and ad campaigns stop generating sales, ad spend slows down. The silver lining is that a slowdown in consumer spending creates opportunities for long term investors.

When it comes to ad tech, and even smaller social media platforms, it’s important to consider how sustainable an edge they have.

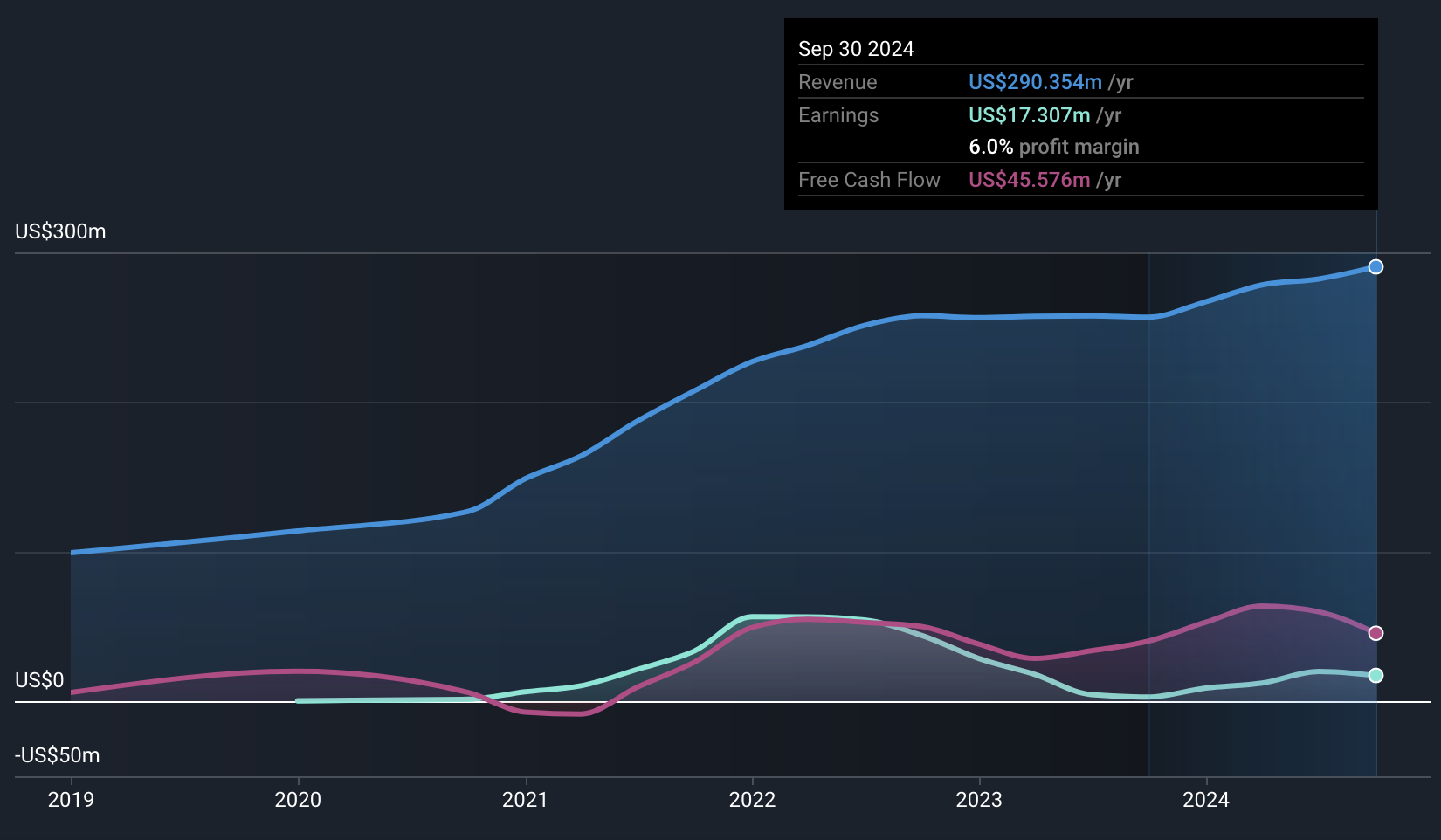

Sometimes a platform happens to have the right tech at the right time, but over time their edge gets eroded, or their expenses increase faster than revenue. PubMatic (below) is one example, while Pinterest and Snapchat have also struggled to maintain their margins.

PubMatic Revenue, Earnings and Cash Flow - Simply Wall St

💡 The Insight: Advertising is no Longer the Exclusive Domain of Media Companies

Selling ad space used to be something media companies did. Then Amazon built the world’s third-biggest ad business, and now everyone’s getting in on the act.

Most major retailers, including Walmart and Home Depot, now have substantial ad businesses. By selling ads (mostly on their websites) to their suppliers, they can boost their own revenue and sales for their suppliers. The ad campaigns also provide valuable data to both parties.

Since then more companies, including Uber, and PayPal have joined in. We can probably expect to see more of this - any company with an audience can potentially create a new source of revenue.

Having a substantial audience is essential, but having a lot of data about consumer buying behavior is even better.

Key Events During the Next Week

Tuesday

- 🇺🇸 The US Fed will release the minutes from the recent FOMC meeting.

Wednesday

- 🇦🇺 Australia’s consumer inflation report will be published. The previous print was 2.1%.

- 🇺🇸 The US GDP 2nd estimate will be published. Economists are expecting 2.8% YoY, down from 3% in Q2.

- 🇺🇸 US personal income and spending data will also be published.

Thursday

- 🇩🇪 Germany’s inflation rate will be published, and is expected to remain at 2%.

Friday

- 🇫🇷 France's inflation rate is forecast to remain at just 1.2%.

- 🇪🇺 Eurozone inflation is expected to tick up to 2.3% from the current rate of 2%.

- 🇨🇦 Canada GDP growth rate is forecast to be 2%, down a touch from 2.1% in Q2.

As earnings seasons winds down, there are still a few cloud software companies due to report:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.