- United States

- /

- Personal Products

- /

- NYSE:EL

Growth Companies With High Insider Ownership On US Exchanges November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause in its recent rally, with technology shares leading the decline, investors are closely monitoring economic indicators and Federal Reserve decisions that could influence future interest rates. In this environment of fluctuating indices, companies with strong growth potential and significant insider ownership can offer a unique appeal, suggesting confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 23.7% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 43.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

We'll examine a selection from our screener results.

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of $15.55 billion.

Operations: The company's revenue is primarily derived from its educational software segment, which generated $689.46 million.

Insider Ownership: 14.6%

Earnings Growth Forecast: 41.6% p.a.

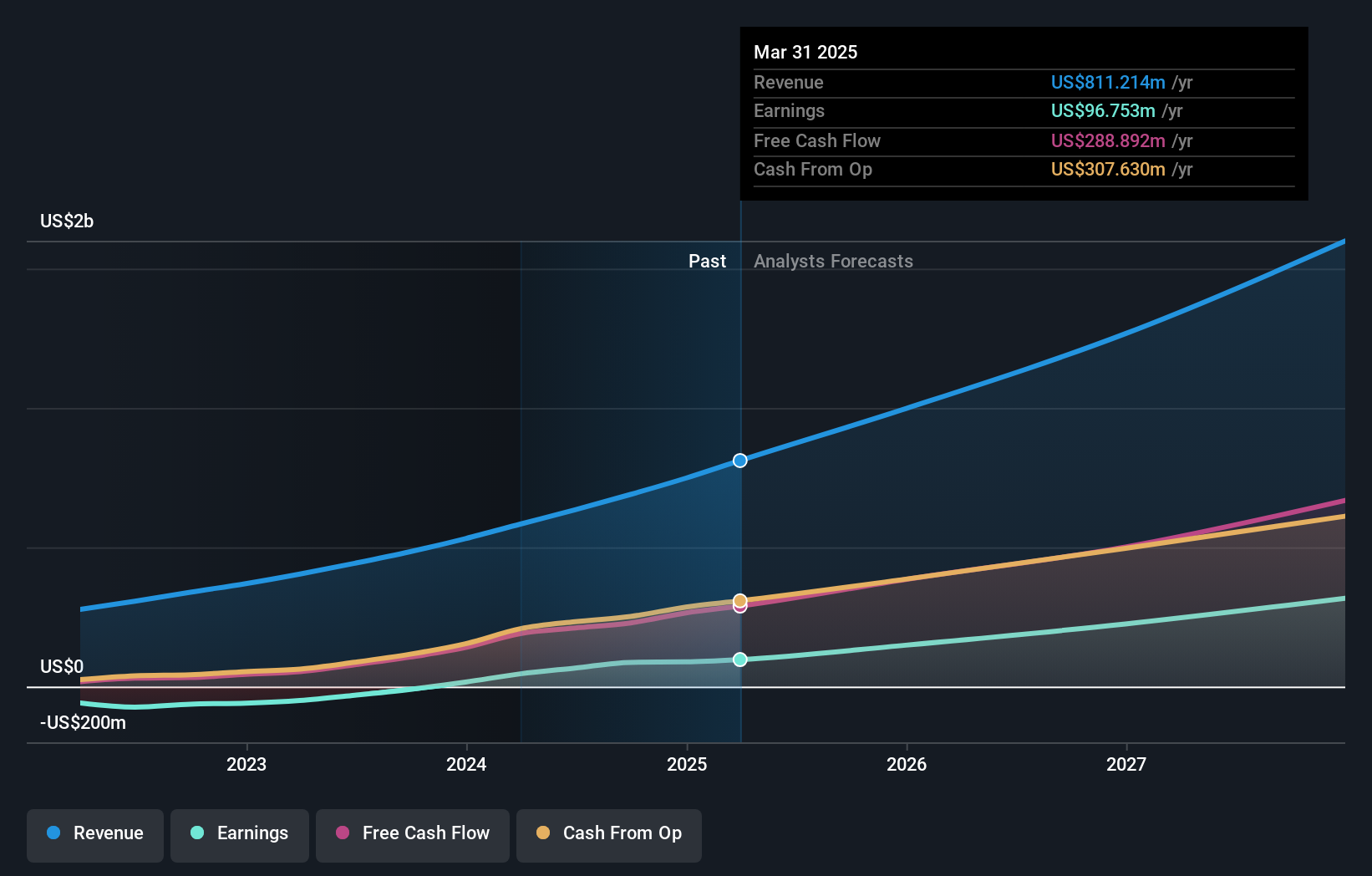

Duolingo, a growth company with significant insider ownership, has shown impressive financial performance and future potential. In Q3 2024, revenues reached US$192.59 million, up from US$137.62 million the previous year, with net income increasing to US$23.36 million. Revenue is forecast to grow at 22.4% annually, outpacing the broader market's 8.9%. Despite recent insider selling and past shareholder dilution, Duolingo remains below its estimated fair value by 6.8%.

- Click to explore a detailed breakdown of our findings in Duolingo's earnings growth report.

- Our comprehensive valuation report raises the possibility that Duolingo is priced higher than what may be justified by its financials.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China with a market cap of approximately $21.78 billion.

Operations: The company's revenue primarily comes from its Auto Manufacturers segment, which generated CN¥141.92 billion.

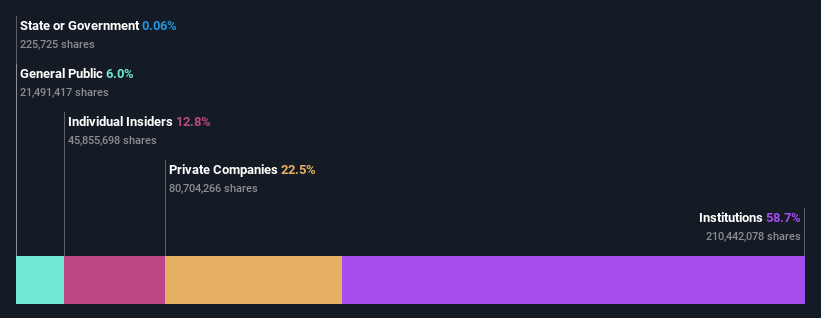

Insider Ownership: 30.4%

Earnings Growth Forecast: 24.7% p.a.

Li Auto's earnings are projected to grow significantly at 24.7% annually, surpassing the US market average. Despite a volatile share price, it's trading 26.3% below its estimated fair value. Recent reports show robust vehicle deliveries and revenue growth, with October deliveries up 27.3% year-over-year and Q4 revenue expected between US$6.2 billion and US$6.5 billion, reflecting up to a 10% increase from last year, highlighting its growth trajectory amidst high insider ownership.

- Take a closer look at Li Auto's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Li Auto's current price could be quite moderate.

Estée Lauder Companies (NYSE:EL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Estée Lauder Companies Inc. is a global manufacturer, marketer, and seller of skincare, makeup, fragrance, and hair care products with a market cap of approximately $26.27 billion.

Operations: The company's revenue is primarily derived from skin care at $7.80 billion, followed by makeup at $4.45 billion, fragrance at $2.48 billion, and hair care at $620 million.

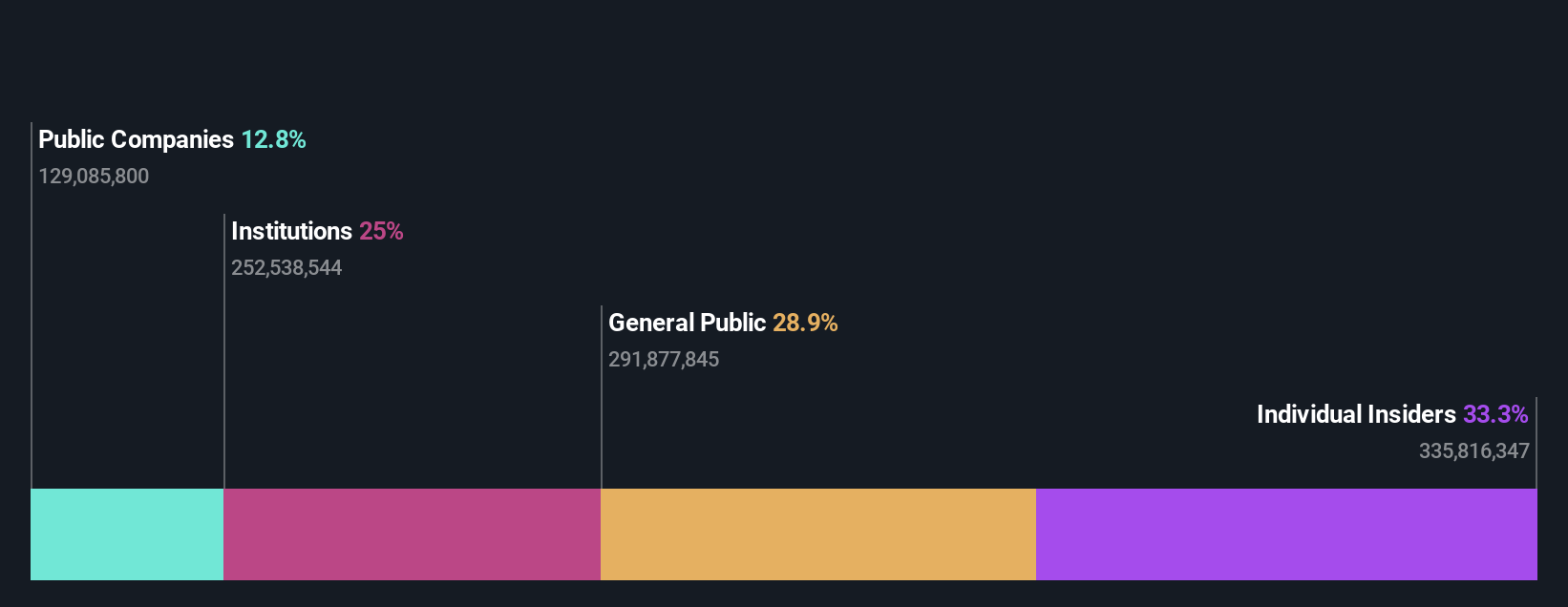

Insider Ownership: 12.8%

Earnings Growth Forecast: 36% p.a.

Estée Lauder Companies faces challenges with reduced sales and profitability, reporting a US$156 million net loss in Q1 2024. Despite this, earnings are projected to grow significantly at 36% annually, outpacing the US market. Recent leadership changes aim to drive strategic recovery and growth. Insider ownership remains high with no substantial selling recently. However, revenue growth is forecasted at a modest 3.2% annually, lagging behind market expectations amidst complex industry dynamics.

- Delve into the full analysis future growth report here for a deeper understanding of Estée Lauder Companies.

- Upon reviewing our latest valuation report, Estée Lauder Companies' share price might be too optimistic.

Turning Ideas Into Actions

- Click here to access our complete index of 210 Fast Growing US Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential slight.