- United States

- /

- Mortgage REITs

- /

- NYSE:EFC

Exploring 3 Undervalued Small Caps With Insider Action In Global Markets

Reviewed by Simply Wall St

As the U.S. market experiences mixed results with major indices like the S&P 500 and Dow Jones Industrial Average setting new records, small-cap stocks continue to garner attention amid economic uncertainties such as the ongoing government shutdown. In this dynamic environment, identifying promising small-cap opportunities often involves looking at companies with strong fundamentals and notable insider activity, which can signal confidence in their potential despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 29.4x | 1.9x | 42.79% | ★★★★★★ |

| PCB Bancorp | 9.6x | 2.9x | 35.19% | ★★★★★☆ |

| Peoples Bancorp | 10.2x | 1.9x | 43.58% | ★★★★★☆ |

| Tandem Diabetes Care | NA | 1.0x | 43.62% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 41.28% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.50% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 32.68% | ★★★★☆☆ |

| Shore Bancshares | 10.1x | 2.6x | -81.01% | ★★★☆☆☆ |

| Farmland Partners | 7.0x | 8.5x | -45.02% | ★★★☆☆☆ |

| Tilray Brands | NA | 2.2x | -37.47% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Civista Bancshares (CIVB)

Simply Wall St Value Rating: ★★★★★★

Overview: Civista Bancshares operates as a financial holding company providing community banking services, with a market capitalization of approximately $0.34 billion.

Operations: CIVB generates revenue primarily from its banking operations, with recent figures showing $157.43 million in revenue. The company has consistently achieved a gross profit margin of 100%, reflecting no cost of goods sold. Operating expenses, including general and administrative costs, significantly impact net income margins, which have fluctuated over time but reached 24.89% in the latest period.

PE: 10.1x

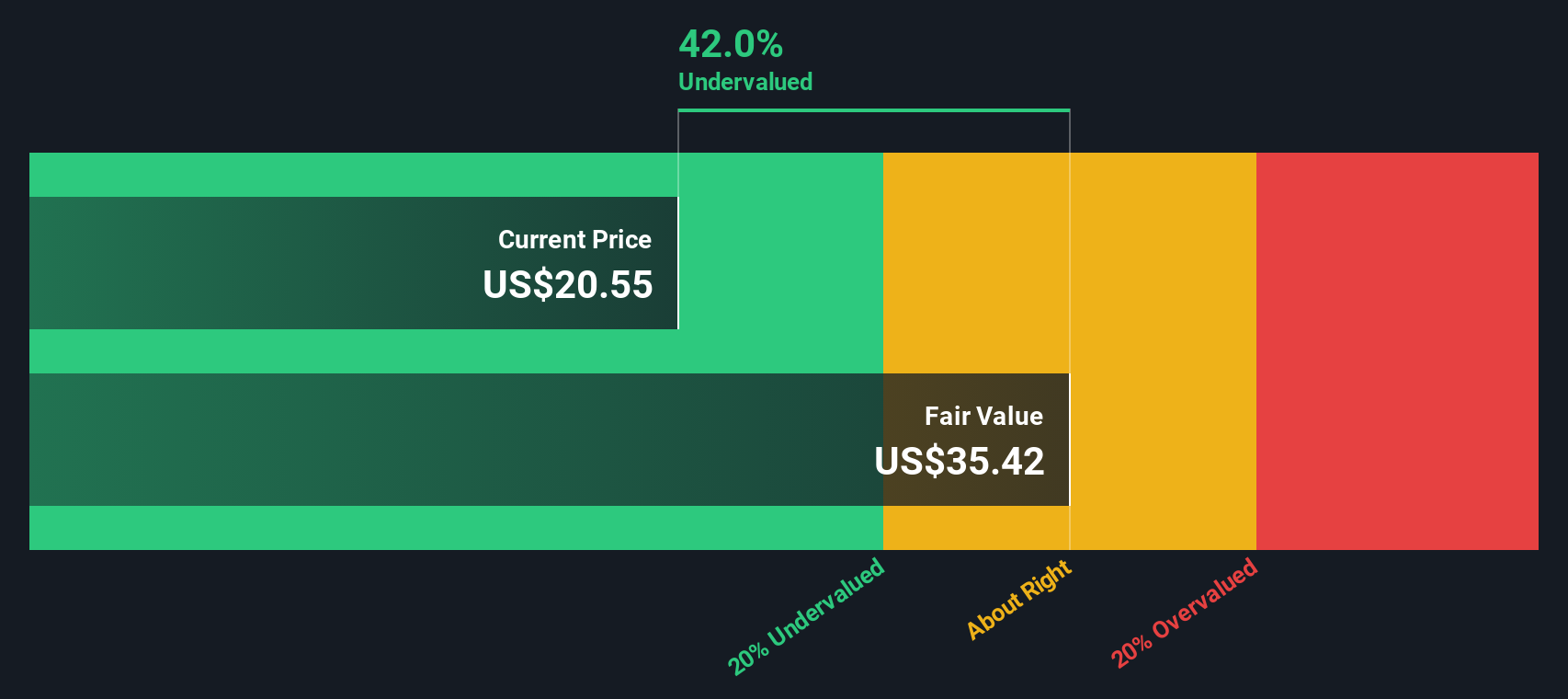

Civista Bancshares, a U.S. financial institution with a market capitalization indicative of smaller companies, has shown signs of being undervalued. Recent insider confidence is evident as Dennis Murray purchased 6,143 shares for US$137,837 between July and October 2025. The company reported an increase in net income to US$11 million for Q2 2025 from US$7 million the previous year. Despite recent dilution due to equity offerings, earnings are projected to grow annually by over 21%.

- Unlock comprehensive insights into our analysis of Civista Bancshares stock in this valuation report.

Explore historical data to track Civista Bancshares' performance over time in our Past section.

Mid Penn Bancorp (MPB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mid Penn Bancorp operates as a full-service commercial banking and trust business with a market capitalization of approximately $0.44 billion.

Operations: The company generates revenue primarily from its full-service commercial banking and trust business, with recent figures showing $191.45 million in revenue. Operating expenses are significant, with general and administrative expenses consistently being the largest component, reaching $98.55 million in the latest period. The net income margin has varied over time, recently recorded at 23.00%.

PE: 15.1x

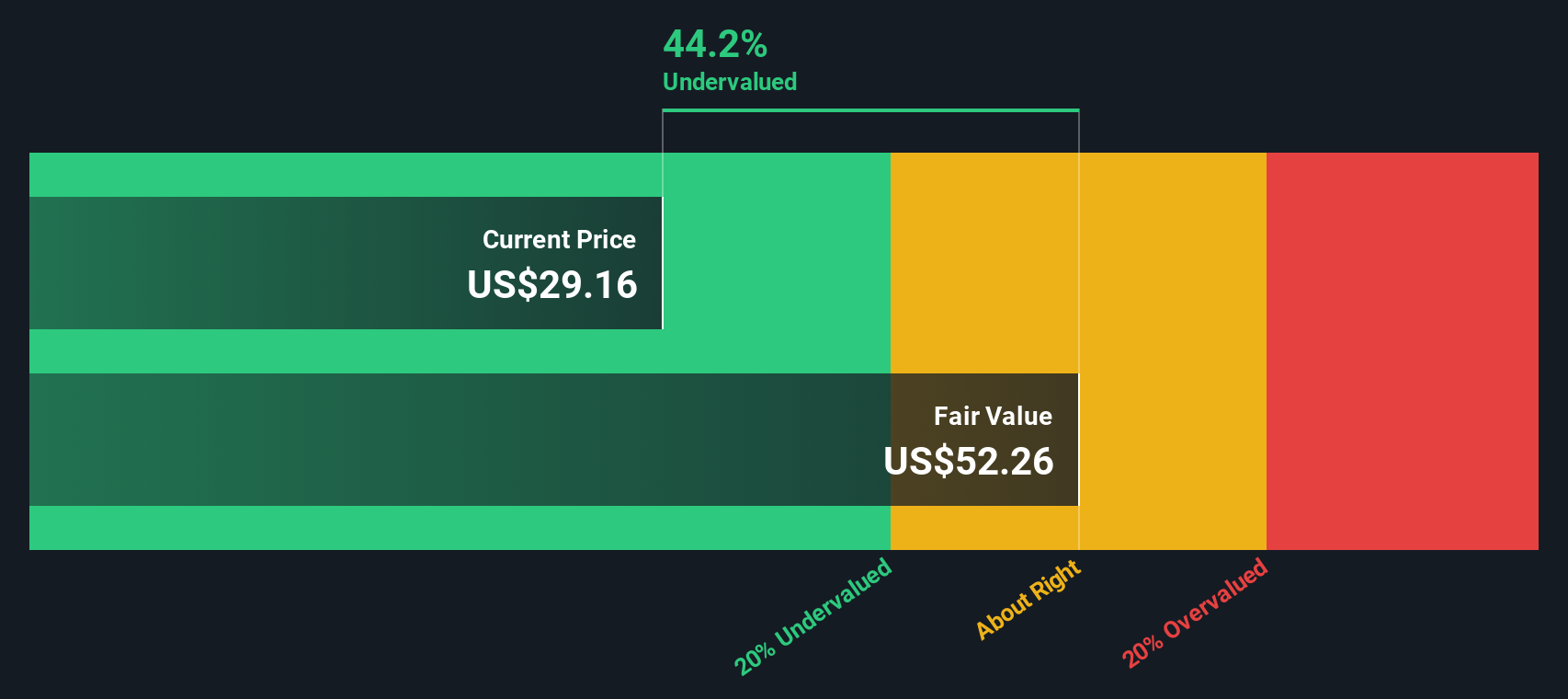

Mid Penn Bancorp, a player in the banking industry, has shown insider confidence through recent share purchases. The company was added to the S&P Regional Banks Select Industry Index in September 2025, reflecting its growing recognition. Despite a dip in net income to US$4.76 million for Q2 2025 from US$11.77 million a year prior, net interest income rose to US$48.21 million from US$38.77 million. A dividend of $0.20 per share underscores its commitment to shareholder returns amidst these dynamics.

- Get an in-depth perspective on Mid Penn Bancorp's performance by reading our valuation report here.

Gain insights into Mid Penn Bancorp's past trends and performance with our Past report.

Ellington Financial (EFC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ellington Financial operates as an investment firm specializing in acquiring and managing mortgage-related assets, with a market capitalization of approximately $0.88 billion.

Operations: Ellington Financial generates revenue primarily from its Longbridge segment and Investment Portfolio, with a notable contribution of $172.53 million and $165.96 million, respectively. The company consistently achieves a gross profit margin of 100%, indicating that it incurs minimal to no cost of goods sold relative to its revenue. Operating expenses are significant, with general and administrative expenses being a major component, impacting net income margins over various periods.

PE: 11.8x

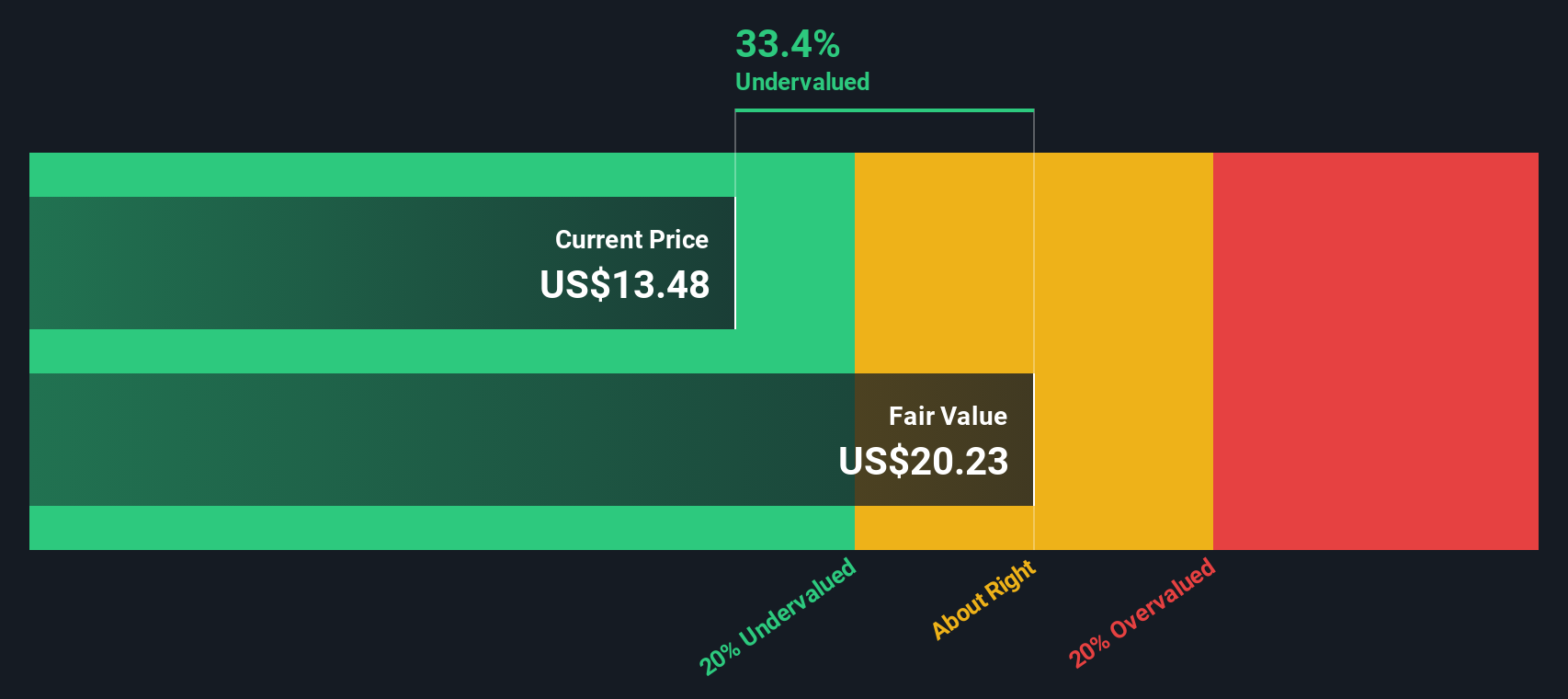

Ellington Financial, a smaller player in the financial sector, recently completed a $400 million fixed-income offering with 7.375% senior unsecured notes due 2030. This move aims to manage debt and fund new asset purchases, aligning with their strategic goals. Despite challenges like high-risk funding sources and shareholder dilution over the past year, insider confidence is evident through ongoing dividends of $0.13 per share monthly. Earnings growth is projected at 17.84% annually, reflecting potential for future expansion amidst its current undervalued status in the market.

Make It Happen

- Click this link to deep-dive into the 68 companies within our Undervalued US Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Ellington Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFC

Ellington Financial

Through its subsidiary, Ellington Financial Operating Partnership LLC, acquires and manages mortgage-related, consumer-related, corporate-related, and other financial assets in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)