- United States

- /

- Banks

- /

- NYSE:CBAN

Discovering Undiscovered Gems in the US Market November 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by slight declines in major indices and heightened attention on tech and retail earnings, investors are keenly observing how these factors impact small-cap stocks. With economic indicators and broader market sentiment influencing investment strategies, identifying promising opportunities requires a focus on companies that demonstrate resilience and potential for growth amidst volatility. In this environment, undiscovered gems can often be found in companies that exhibit strong fundamentals, innovative approaches, or niche market positions that set them apart from their peers.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

We'll examine a selection from our screener results.

John Marshall Bancorp (JMSB)

Simply Wall St Value Rating: ★★★★★★

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services in the United States, with a market capitalization of $280.79 million.

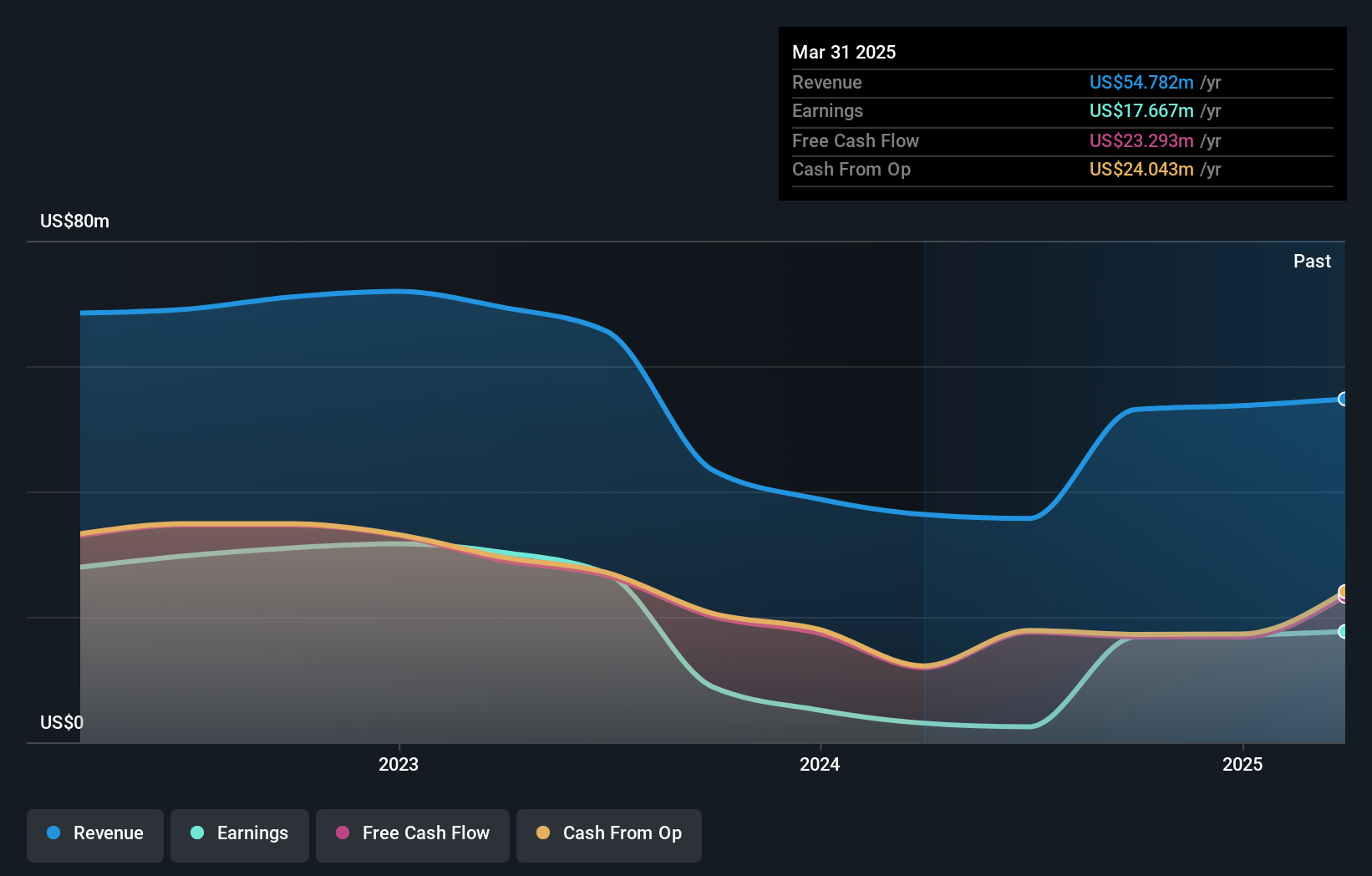

Operations: John Marshall Bancorp generates revenue primarily from its banking segment, which amounts to $59.27 million.

John Marshall Bancorp, with assets totaling US$2.3 billion and equity of US$259.7 million, stands out for its robust financial health. Total deposits are at US$2 billion, while loans amount to US$1.9 billion, supported by a net interest margin of 2.3%. The company maintains a sufficient allowance for bad loans at 0.5% of total loans and has seen earnings grow by 19% over the past year, outpacing the industry average of 18%. Its price-to-earnings ratio is a favorable 14x compared to the broader market's 18x, suggesting potential value for investors seeking growth opportunities in smaller financial institutions.

Northfield Bancorp (Staten Island NY) (NFBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Northfield Bancorp, Inc. (Staten Island, NY) is the bank holding company for Northfield Bank, offering a variety of banking services to individual and corporate clients with a market cap of $442.68 million.

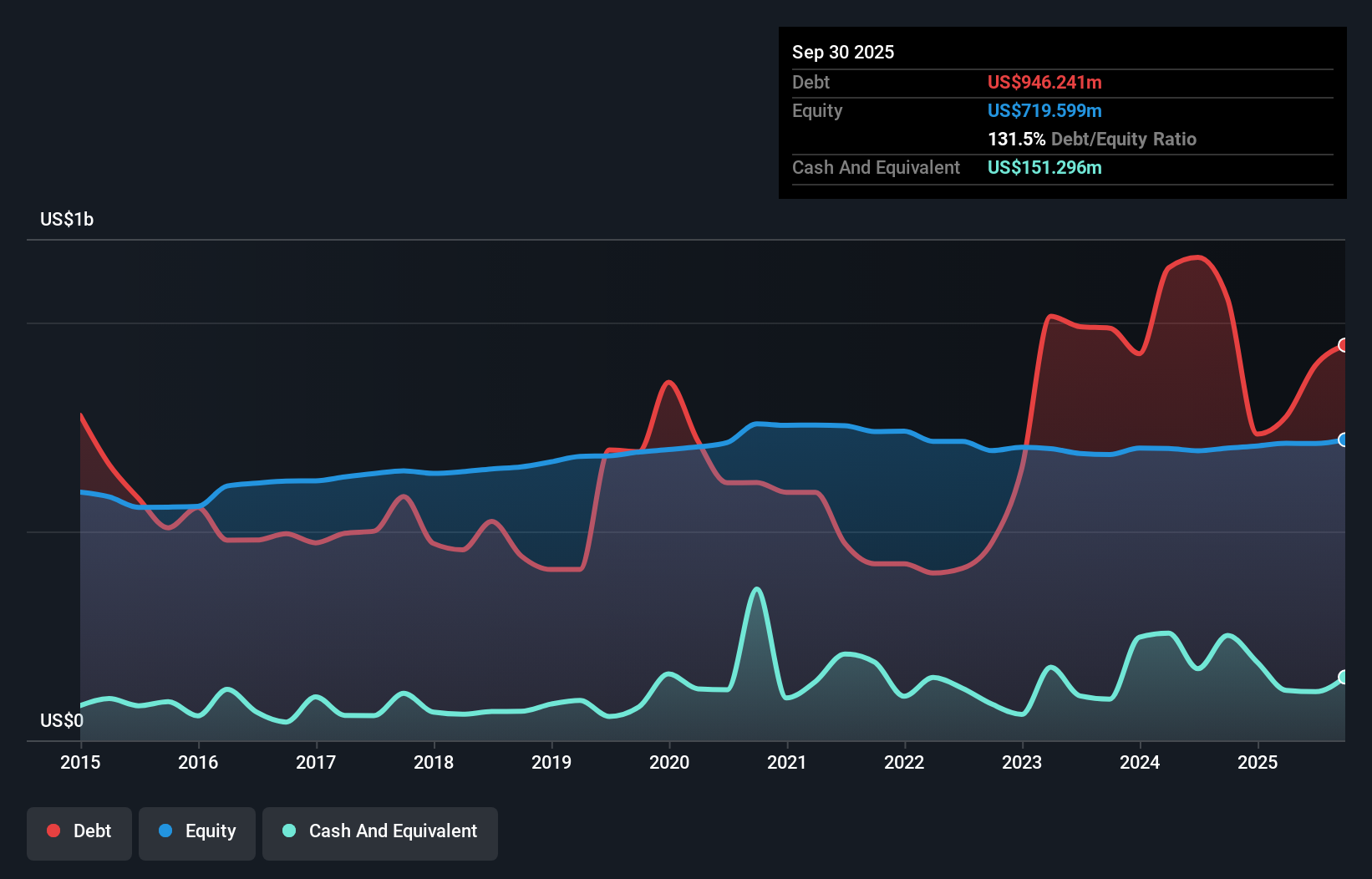

Operations: Northfield Bancorp generates revenue primarily from its banking segment, totaling $141.98 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Northfield Bancorp, with total assets of US$5.7 billion and equity of US$719.6 million, stands out for its robust financial health. The company boasts a solid allowance for bad loans at 0.5%, well within acceptable limits, and primarily relies on low-risk funding sources, accounting for 79% of liabilities. Its price-to-earnings ratio is an attractive 11.2x compared to the broader market's 18.2x, suggesting potential value upside. Recent earnings growth has been impressive at 46.6%, surpassing industry averages significantly, while net charge-offs have notably decreased from US$2.1 million to just US$299,000 year-over-year in Q3 2025.

Colony Bankcorp (CBAN)

Simply Wall St Value Rating: ★★★★★★

Overview: Colony Bankcorp, Inc. is a bank holding company for Colony Bank, offering a range of banking products and services to retail and commercial clients in the United States, with a market cap of approximately $287.85 million.

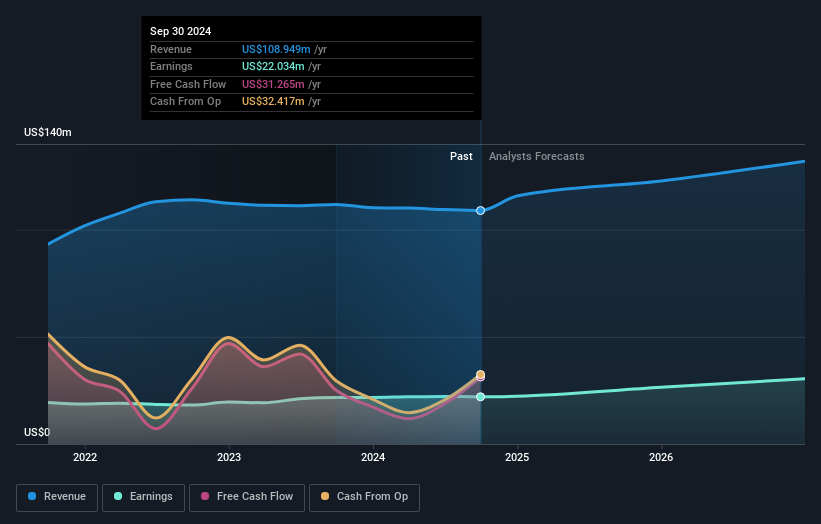

Operations: Colony Bankcorp generates revenue primarily from its Banking Division, which contributes $104.64 million, followed by the Small Business Specialty Lending Division at $10.74 million and the Mortgage Banking Division at $7.17 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability relative to its total revenue streams.

Colony Bankcorp, a regional banking entity with total assets of $3.2 billion and equity of $302.3 million, is making strategic moves to bolster its presence in the Southeast through a merger with TC Bancshares. This initiative is likely to boost earnings per share while expanding its market reach. With deposits totaling $2.6 billion and loans at $2 billion, the bank maintains a sufficient allowance for bad loans at 0.7% of total loans, indicating prudent risk management practices. Despite trading below estimated fair value by 18.6%, challenges like rising noninterest expenses and regulatory pressures could affect future profitability projections amidst anticipated growth strategies.

Summing It All Up

- Click this link to deep-dive into the 294 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBAN

Colony Bankcorp

Operates as the bank holding company for Colony Bank that provides various banking products and services to retail and commercial customers in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives