- United States

- /

- Banks

- /

- NasdaqGS:INDB

Independent Bank (INDB): Revisiting Valuation After a Steady Share Price Climb

Reviewed by Simply Wall St

Independent Bank (INDB) has been quietly rewarding patient shareholders, with the stock climbing about 12% over the past month and roughly 16% over the past year, outpacing many regional banking peers.

See our latest analysis for Independent Bank.

That steady climb in the share price, including a 4.4% 7 day share price return and a solid year to date gain, suggests momentum is building as investors reassess Independent Bank’s growth prospects and risk profile.

If Independent Bank’s recent run has you thinking about what else might be gaining traction, it could be worth exploring fast growing stocks with high insider ownership for more ideas.

With earnings still growing faster than the share price and a modest discount to analysts’ targets, the big question is whether Independent Bank is still undervalued or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 6.2% Undervalued

With Independent Bank last closing at $77.58 against a narrative fair value of $82.75, the story frames today’s price as a modest opportunity, not a stretch.

Analysts are assuming Independent Bank's revenue will grow by 32.9% annually over the next 3 years.

Analysts assume that profit margins will increase from 28.4% today to 38.9% in 3 years time.

Curious how a regional bank earns a premium tag usually reserved for growth darlings? The secret mix blends aggressive expansion with richer margins and a surprisingly restrained future earnings multiple. Want to see exactly how those moving parts stack up to justify that fair value?

Result: Fair Value of $82.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated commercial real estate exposure and potential integration hiccups from recent acquisitions could quickly challenge the upbeat growth and valuation story around Independent Bank.

Find out about the key risks to this Independent Bank narrative.

Another Lens on Valuation

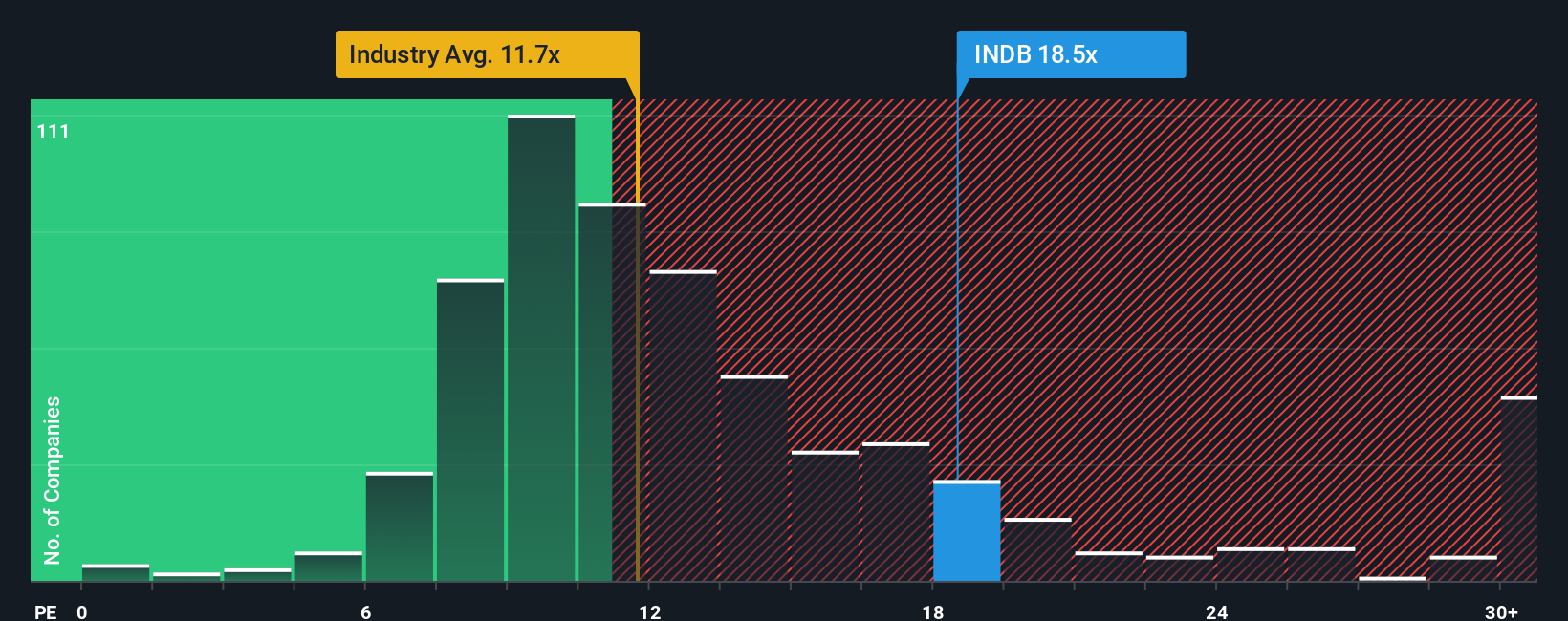

On earnings, the picture looks far less forgiving. Independent Bank trades on a 21.4x price to earnings ratio, well above the US banks industry at 12x, its peers at 19.9x, and even its own 18.9x fair ratio, which hints at meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independent Bank Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Independent Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart opportunity by using the Simply Wall St Screener, where focused, data driven shortlists surface what most investors overlook.

- Capture potential income streams by targeting businesses with reliable payouts and rising earnings through these 13 dividend stocks with yields > 3%.

- Ride the next wave of innovation by pinpointing companies building real world solutions with these 26 AI penny stocks.

- Position yourself early in sectors the market still underestimates by scanning these 906 undervalued stocks based on cash flows based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)