- United States

- /

- Banks

- /

- NasdaqGS:HWC

3 US Dividend Stocks Offering Yields Up To 8.9%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations due to recent tariff implementations on steel and aluminum, investors are closely monitoring indices like the Dow Jones Industrial Average and S&P 500 for signs of stability. In such a volatile environment, dividend stocks can offer a measure of reliability by providing consistent income streams, making them an attractive consideration for those looking to navigate uncertain times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.26% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.86% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.61% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.92% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.16% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.85% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Silvercrest Asset Management Group (NasdaqGM:SAMG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Silvercrest Asset Management Group Inc. is a wealth management firm offering financial advisory and family office services in the United States, with a market cap of approximately $254.56 million.

Operations: Silvercrest Asset Management Group Inc. generates revenue primarily from its investment management industry segment, totaling $120.23 million.

Dividend Yield: 4.3%

Silvercrest Asset Management Group recently declared a quarterly dividend of US$0.20 per share, maintaining its stable dividend history over the past decade. Although the payout ratio is high at 98.5%, indicating dividends are not well covered by earnings, they are supported by cash flows with a reasonable cash payout ratio of 61.5%. The dividend yield stands at 4.34%, slightly below the top quartile in the U.S., but it has shown consistent growth over ten years despite lower profit margins this year.

- Click to explore a detailed breakdown of our findings in Silvercrest Asset Management Group's dividend report.

- The analysis detailed in our Silvercrest Asset Management Group valuation report hints at an deflated share price compared to its estimated value.

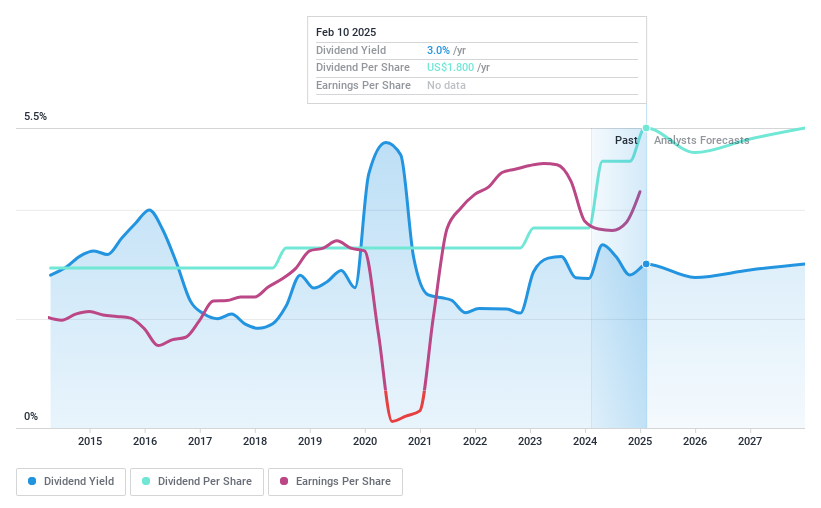

Chord Energy (NasdaqGS:CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company operating in the United States, with a market cap of approximately $6.69 billion.

Operations: Chord Energy Corporation generates revenue primarily from the exploration and production of crude oil, NGLs, and natural gas, amounting to $4.45 billion.

Dividend Yield: 9%

Chord Energy's dividend yield of 8.97% places it among the top 25% of U.S. dividend payers, although its four-year history reveals volatility with significant annual drops. Despite this instability, dividends are covered by earnings and cash flows, with payout ratios at 52.1% and 66.5%, respectively. The stock is trading significantly below fair value estimates, suggesting potential upside; however, shareholder dilution last year and expected earnings decline may impact future payouts.

- Click here to discover the nuances of Chord Energy with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Chord Energy is trading behind its estimated value.

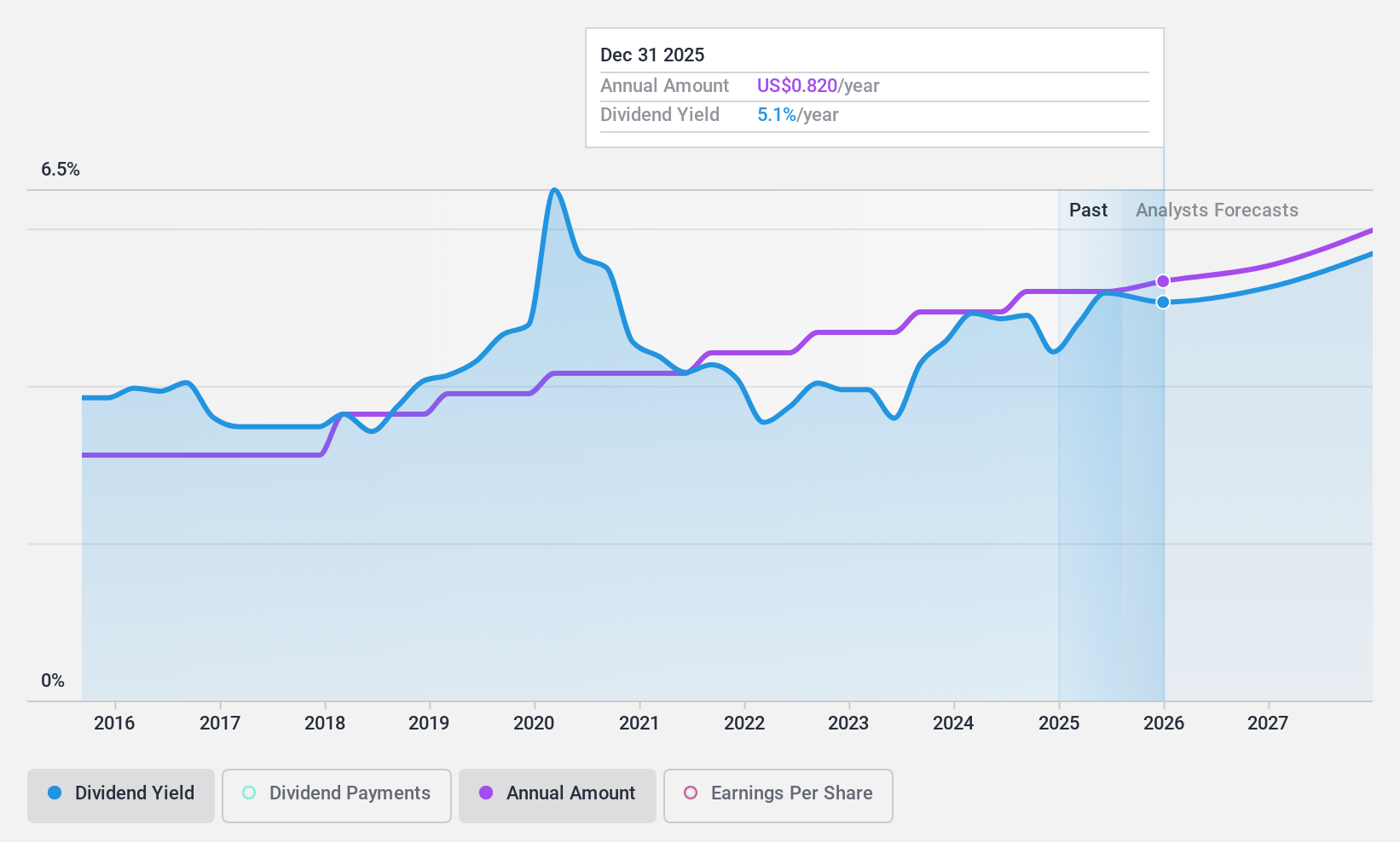

Hancock Whitney (NasdaqGS:HWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hancock Whitney Corporation, with a market cap of $5.19 billion, operates as the financial holding company for Hancock Whitney Bank, offering traditional and online banking services to commercial, small business, and retail customers.

Operations: Hancock Whitney Corporation generates revenue of $1.39 billion from its banking operations segment, which includes a range of financial services for various customer groups.

Dividend Yield: 3%

Hancock Whitney recently increased its quarterly dividend by $0.05 to $0.45 per share, reflecting a stable and growing dividend history over the past decade. Despite a relatively low yield of 3.01% compared to top-tier U.S. dividend stocks, the dividends are well-covered by earnings with a payout ratio of 28.3%. The stock trades at a significant discount to its estimated fair value, offering potential value for investors seeking reliable income amidst ongoing inorganic growth pursuits and recent earnings improvements.

- Take a closer look at Hancock Whitney's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hancock Whitney shares in the market.

Key Takeaways

- Investigate our full lineup of 133 Top US Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hancock Whitney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HWC

Hancock Whitney

Operates as the financial holding company for Hancock Whitney Bank that provides traditional and online banking services to commercial, small business, and retail customers.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives