- United States

- /

- Banks

- /

- NasdaqGS:HBAN

Huntington Bancshares (HBAN): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Huntington Bancshares (HBAN) has quietly outperformed many regional peers recently, with the stock up about 13% over the past month and roughly 8% over the past year on improving growth metrics.

See our latest analysis for Huntington Bancshares.

With the latest share price at $17.91 and a strong 1 month share price return, the move higher looks more like momentum building than a one off bounce, especially when set against Huntington Bancshares’ hefty multi year total shareholder returns.

If this kind of steady financials driven rerating interests you, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar opportunities.

Yet with earnings growing faster than revenue and the shares still trading at a notable discount to both intrinsic value estimates and analyst targets, is Huntington Bancshares a genuine buying opportunity, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 9.3% Undervalued

With Huntington Bancshares closing at $17.91 versus a most popular narrative fair value of $19.75, the story leans toward upside if the growth plays out.

The expansion into Texas via the Veritex acquisition, combined with ongoing organic growth in high population growth markets (Texas, North Carolina, South Carolina), is set to substantially increase Huntington's addressable market and fee generating opportunities, likely driving higher revenue and earnings growth as these regions mature.

Curious how this regional land grab supposedly turns into faster growing earnings, richer margins, and a higher future multiple than many peers? The key levers are all quantified, but the full playbook sits inside the narrative. Want to see what assumptions really have to come true to reach that fair value?

Result: Fair Value of $19.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on successful Cadence integration and on Huntington keeping pace in digital banking, where fintech rivals and larger peers are aggressively competing.

Find out about the key risks to this Huntington Bancshares narrative.

Another Lens On Value

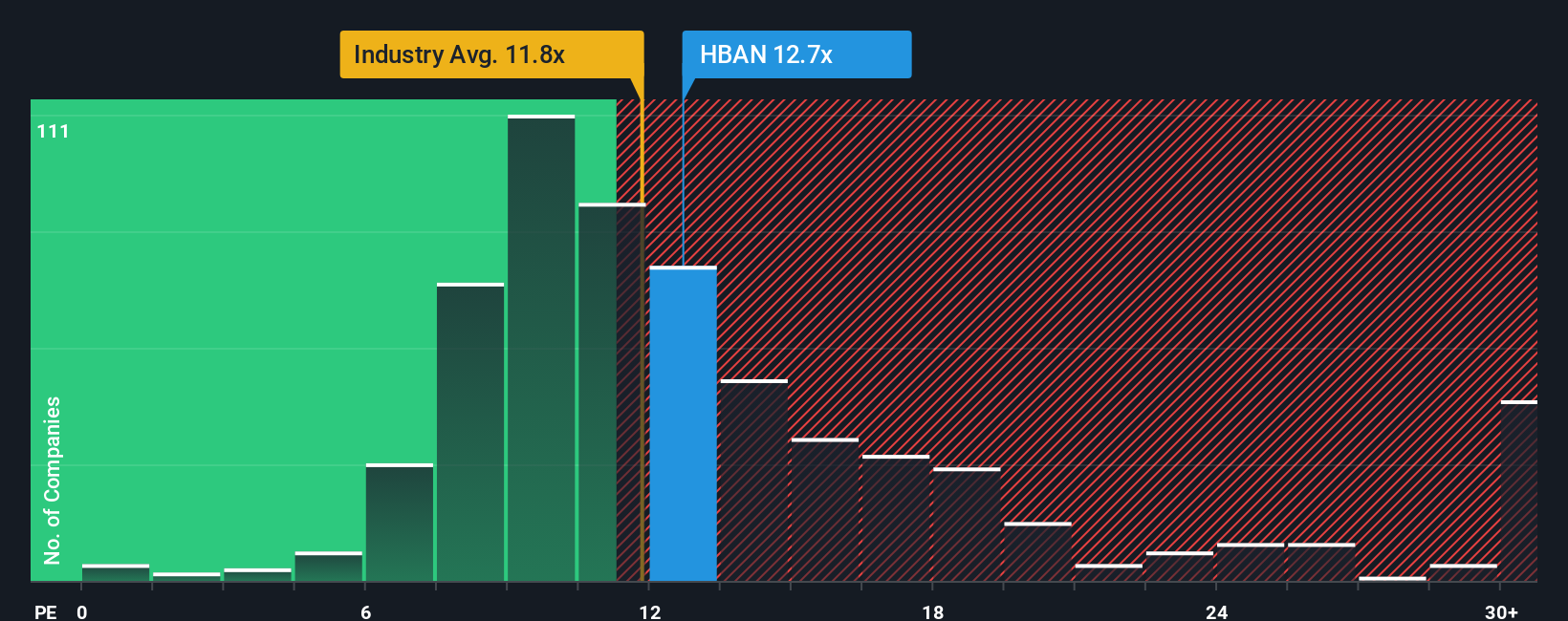

On traditional earnings multiples, Huntington looks less obviously cheap. The stock trades on 13.3 times earnings, slightly richer than both peers at 13.1 times and the wider US banks group at 12 times, even though our fair ratio points to 19.8 times as a level the market could eventually move toward. Is that a margin of safety, or a sign expectations are already high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Huntington Bancshares Narrative

If you see the setup differently or want to stress test your own assumptions directly against the numbers, build a custom view in minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Huntington Bancshares.

Looking for more investment ideas?

Before the market’s next big move leaves you watching from the sidelines, use the Simply Wall St Screener to uncover practical, data backed opportunities tailored to your style.

- Lock in potential income streams by reviewing quality payers through these 12 dividend stocks with yields > 3%, built to highlight sustainable cash returns rather than just headline yields.

- Position ahead of structural growth by targeting innovation leaders using these 25 AI penny stocks, where earnings potential and technological edge go hand in hand.

- Sharpen your value hunting by scanning these 904 undervalued stocks based on cash flows, which may still trade below their cash flow potential while sentiment catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion