- United States

- /

- Banks

- /

- NasdaqCM:GCBC

Undiscovered Gems in US Market for October 2025

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights with the S&P 500 and Nasdaq setting record highs, investors are navigating an environment marked by a government shutdown and recent Federal Reserve interest rate cuts. In this climate, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that may not yet be reflected in their valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Greene County Bancorp (GCBC)

Simply Wall St Value Rating: ★★★★★★

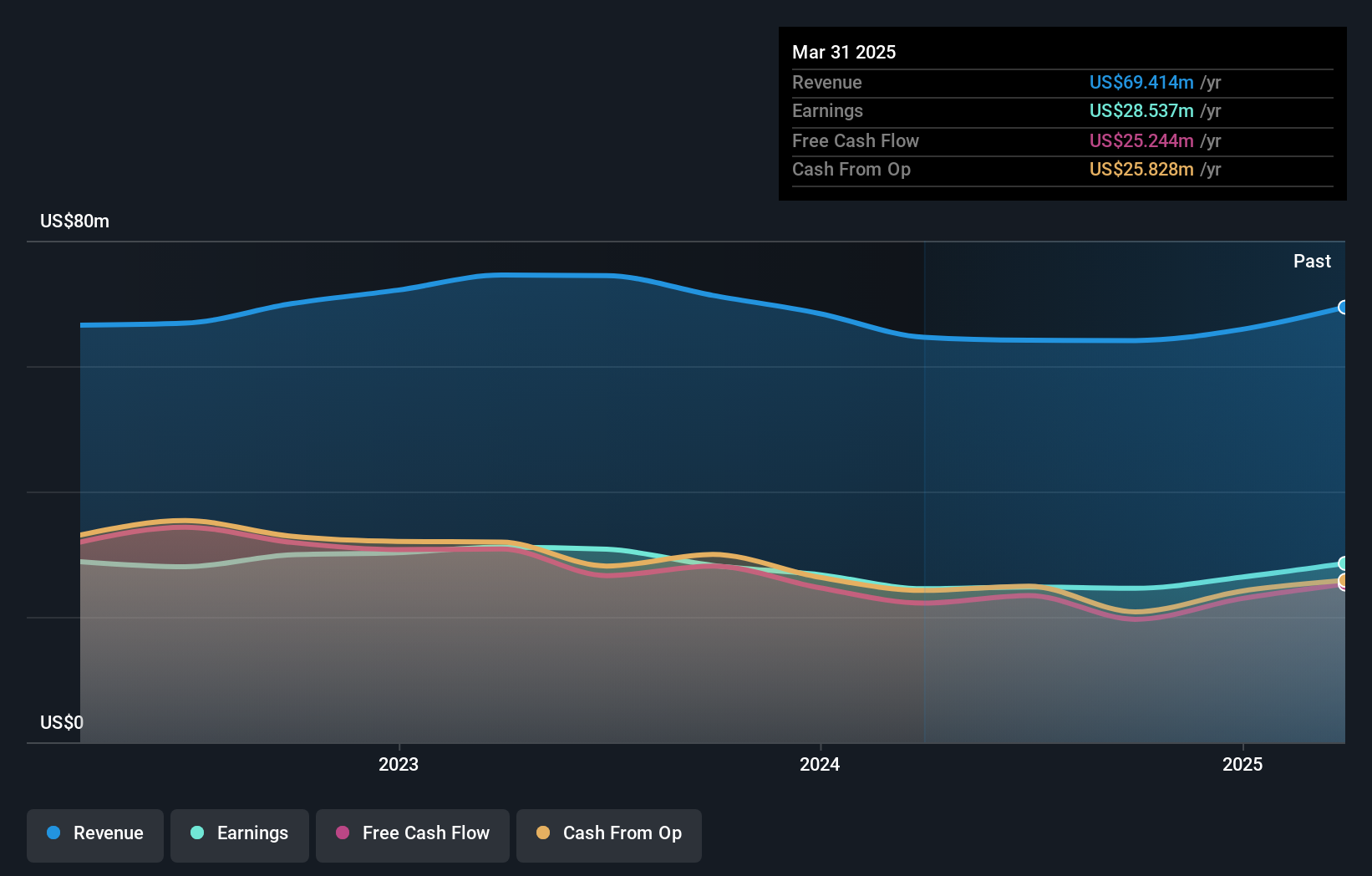

Overview: Greene County Bancorp, Inc. operates as a holding company for The Bank of Greene County, offering a range of financial services in the United States with a market capitalization of $377.83 million.

Operations: The primary revenue stream for Greene County Bancorp comes from its banking operations, generating $74.04 million.

Greene County Bancorp, a notable player with total assets of US$3 billion and equity of US$238.8 million, boasts a solid financial position. The bank's deposits stand at US$2.6 billion, while loans amount to US$1.6 billion, reflecting its robust lending operations. It maintains an allowance for bad loans at 658%, ensuring coverage well above industry norms and keeping non-performing loans low at 0.2%. With earnings growth outpacing the industry average by hitting 25.7% this past year and trading 35.8% below estimated fair value, GCBC presents an intriguing opportunity for investors seeking value in the banking sector.

- Get an in-depth perspective on Greene County Bancorp's performance by reading our health report here.

Gain insights into Greene County Bancorp's past trends and performance with our Past report.

Amalgamated Financial (AMAL)

Simply Wall St Value Rating: ★★★★★★

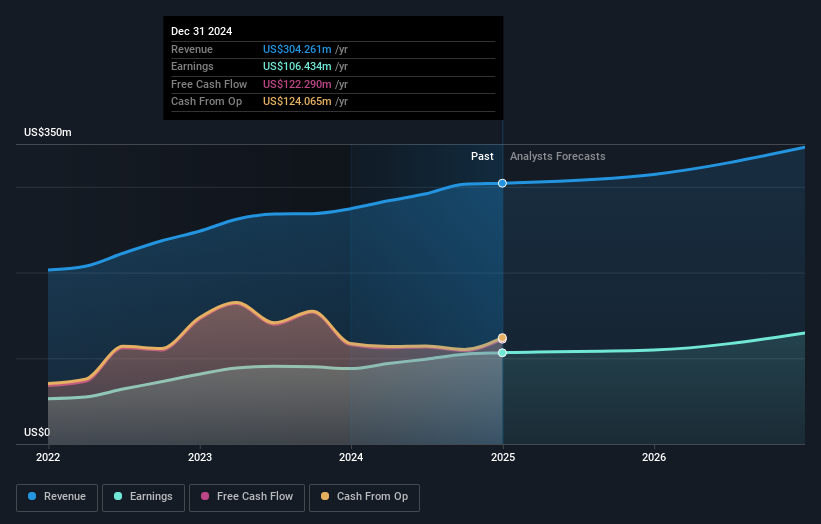

Overview: Amalgamated Financial Corp. is a bank holding company for Amalgamated Bank, offering commercial and retail banking, investment management, and trust and custody services in the United States with a market cap of $822.88 million.

Operations: The company generates revenue primarily from its banking segment, totaling $304.72 million.

Amalgamated Financial, a bank holding company, is navigating its growth strategy through ESG-driven initiatives and digital modernization. With total assets of US$8.6 billion and equity of US$754 million, it primarily relies on customer deposits for funding, which makes up 98% of liabilities—considered low-risk. The company has an appropriate bad loans ratio at 0.7%, reflecting sound credit management. Over the past five years, earnings have grown by 19.5% annually despite recent challenges in renewable energy loan portfolios. Trading at a significant discount to estimated fair value by 71%, Amalgamated repurchased 401,000 shares worth US$12 million recently, indicating confidence in its valuation amidst industry consolidation efforts and rising costs from digital transformation projects.

Yuanbao (YB)

Simply Wall St Value Rating: ★★★★★★

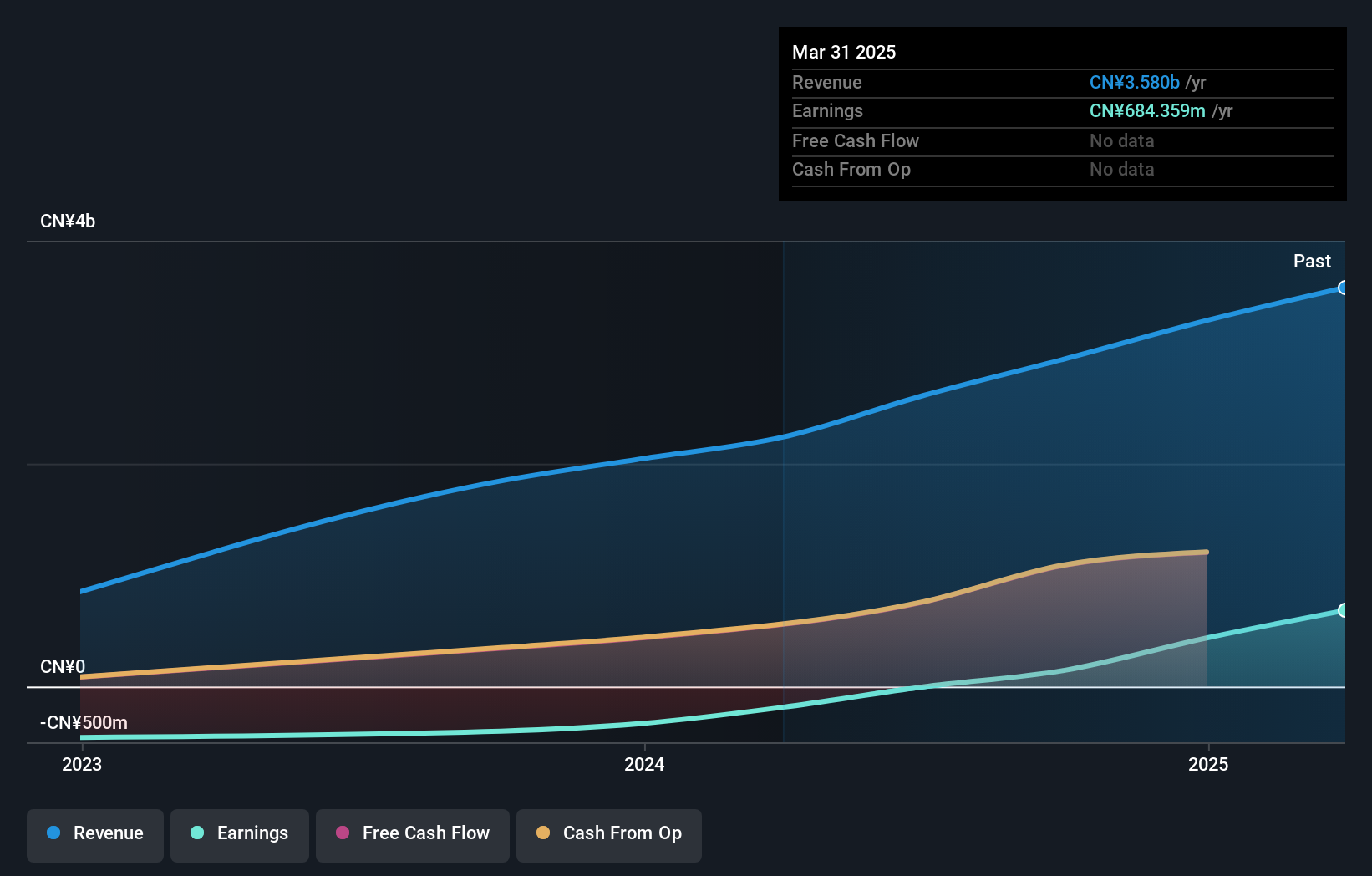

Overview: Yuanbao Inc. operates as an online insurance distribution and services provider in China, with a market cap of approximately $897.18 million.

Operations: Yuanbao generates revenue primarily through its insurance brokerage services, amounting to CN¥3.80 billion. The company's financial performance is highlighted by a notable net profit margin trend, reflecting its operational efficiency in the online insurance sector.

Yuanbao's recent performance showcases its potential, with net income for Q2 2025 reaching CNY 304.69 million, up from CNY 195.86 million the previous year. The company's earnings per share jumped significantly to CNY 27.36 from CNY 6 a year ago, highlighting robust growth. Despite high volatility in its share price over the past three months, Yuanbao trades at an attractive valuation—79% below estimated fair value—indicating room for appreciation. With no debt and high-quality earnings, this small company has positioned itself well in the market while navigating industry challenges effectively.

- Delve into the full analysis health report here for a deeper understanding of Yuanbao.

Explore historical data to track Yuanbao's performance over time in our Past section.

Summing It All Up

- Explore the 287 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GCBC

Greene County Bancorp

Operates as a holding company for The Bank of Greene County that provides various financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives