- United States

- /

- Banks

- /

- NasdaqCM:GCBC

Uncovering US Market's Undiscovered Gems With 3 Promising Stocks

Reviewed by Simply Wall St

As the United States market navigates a period of volatility marked by tech sector slumps and tariff uncertainties, investors are keeping a close eye on economic indicators and potential Federal Reserve rate cuts. In this climate, identifying promising stocks requires a keen understanding of market dynamics and an ability to spot companies with solid fundamentals and growth potential amidst broader challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Greene County Bancorp (GCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Greene County Bancorp, Inc. operates as a holding company for The Bank of Greene County, offering a range of financial services in the United States with a market cap of $408.47 million.

Operations: The primary revenue stream for Greene County Bancorp comes from its thrift and savings and loan institutions, generating $74.04 million.

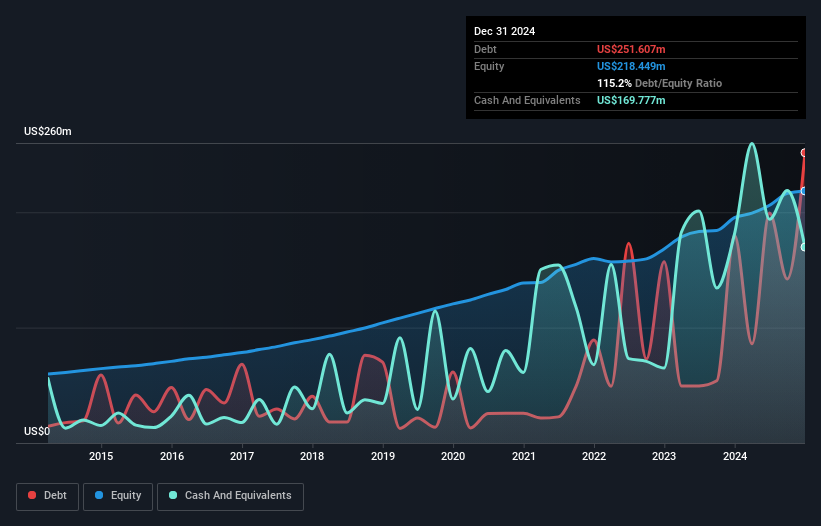

Greene County Bancorp, a financial entity with total assets of US$3.0 billion and equity of US$238.8 million, stands out with its robust earnings growth of 25.7%, surpassing the industry average of 12.8%. The bank's liabilities are primarily low-risk, backed by customer deposits comprising 94% of the total, minimizing external borrowing risks. It maintains an appropriate bad loan ratio at 0.2% and has a substantial allowance for these loans at 650%. Recently added to multiple Russell indices, GCBC is trading at a notable discount to its estimated fair value by about 32%, reflecting potential undervaluation in the market.

ASA Gold and Precious Metals (ASA)

Simply Wall St Value Rating: ★★★★★★

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market capitalization of $710.17 million.

Operations: Revenue for ASA Gold and Precious Metals Limited primarily stems from its financial services segment, specifically closed-end funds, generating approximately $3.92 million.

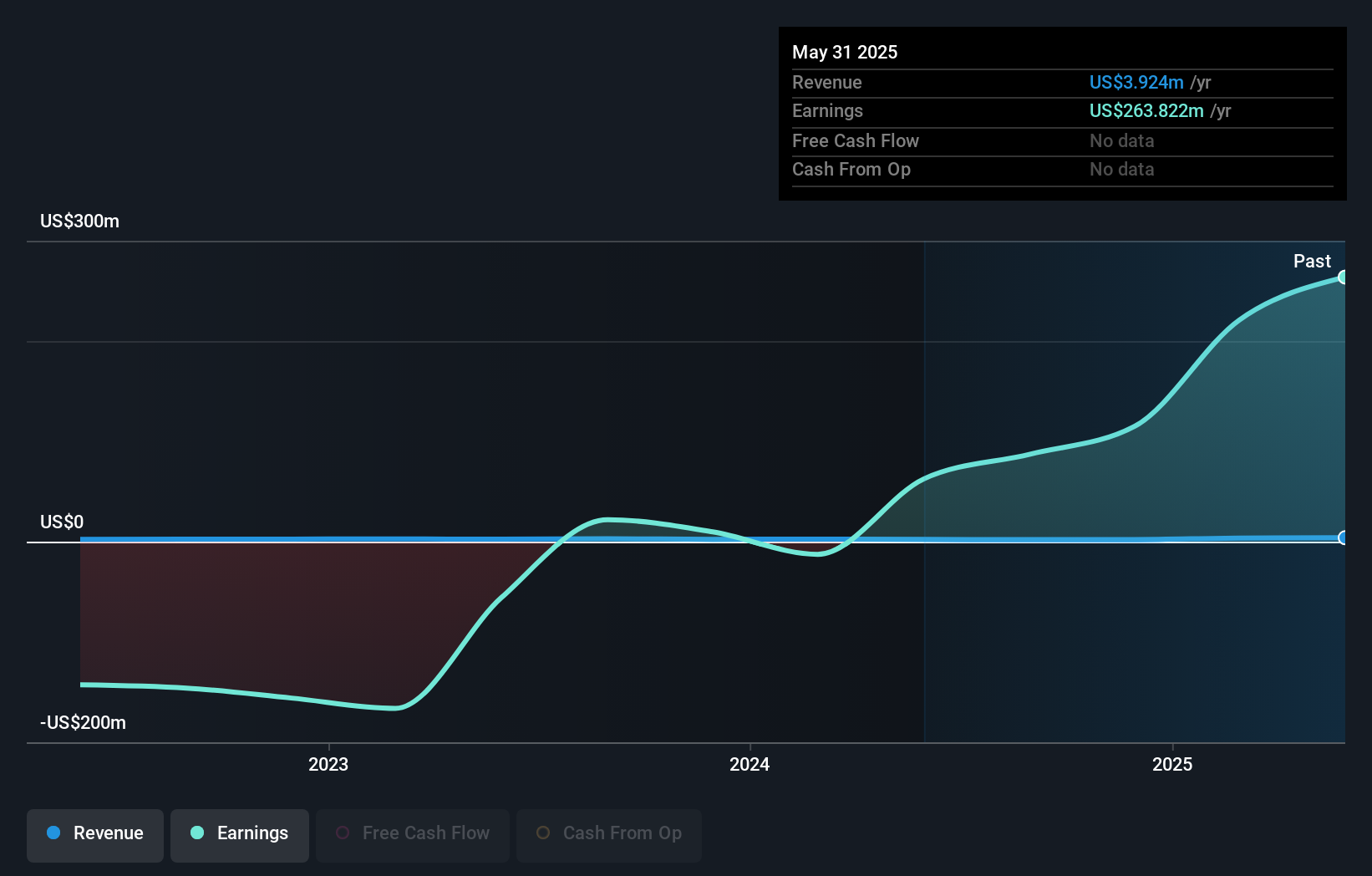

ASA Gold and Precious Metals, a debt-free entity, has recently experienced significant changes in its board composition. The company reported an impressive 321% earnings growth over the past year, surpassing the Capital Markets industry average of 15.8%. However, this growth is largely attributed to a one-off gain of US$266 million impacting its financial results for the year ending May 2025. Despite these gains, ASA's revenue remains modest at US$4 million with earnings declining by 0.6% annually over five years. The company's price-to-earnings ratio stands at a low 2.8x compared to the broader US market's 19.3x, suggesting potential undervaluation amidst ongoing governance restructuring efforts led by new director appointments like Karen Caldwell and Maryann Bruce following shareholder activism initiatives aimed at enhancing board independence and accountability.

- Navigate through the intricacies of ASA Gold and Precious Metals with our comprehensive health report here.

Understand ASA Gold and Precious Metals' track record by examining our Past report.

TETRA Technologies (TTI)

Simply Wall St Value Rating: ★★★★★★

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market cap of $626.41 million.

Operations: TETRA Technologies generates revenue primarily from two segments: Water & Flowback Services, contributing $270.75 million, and Completion Fluids & Products, accounting for $336.46 million.

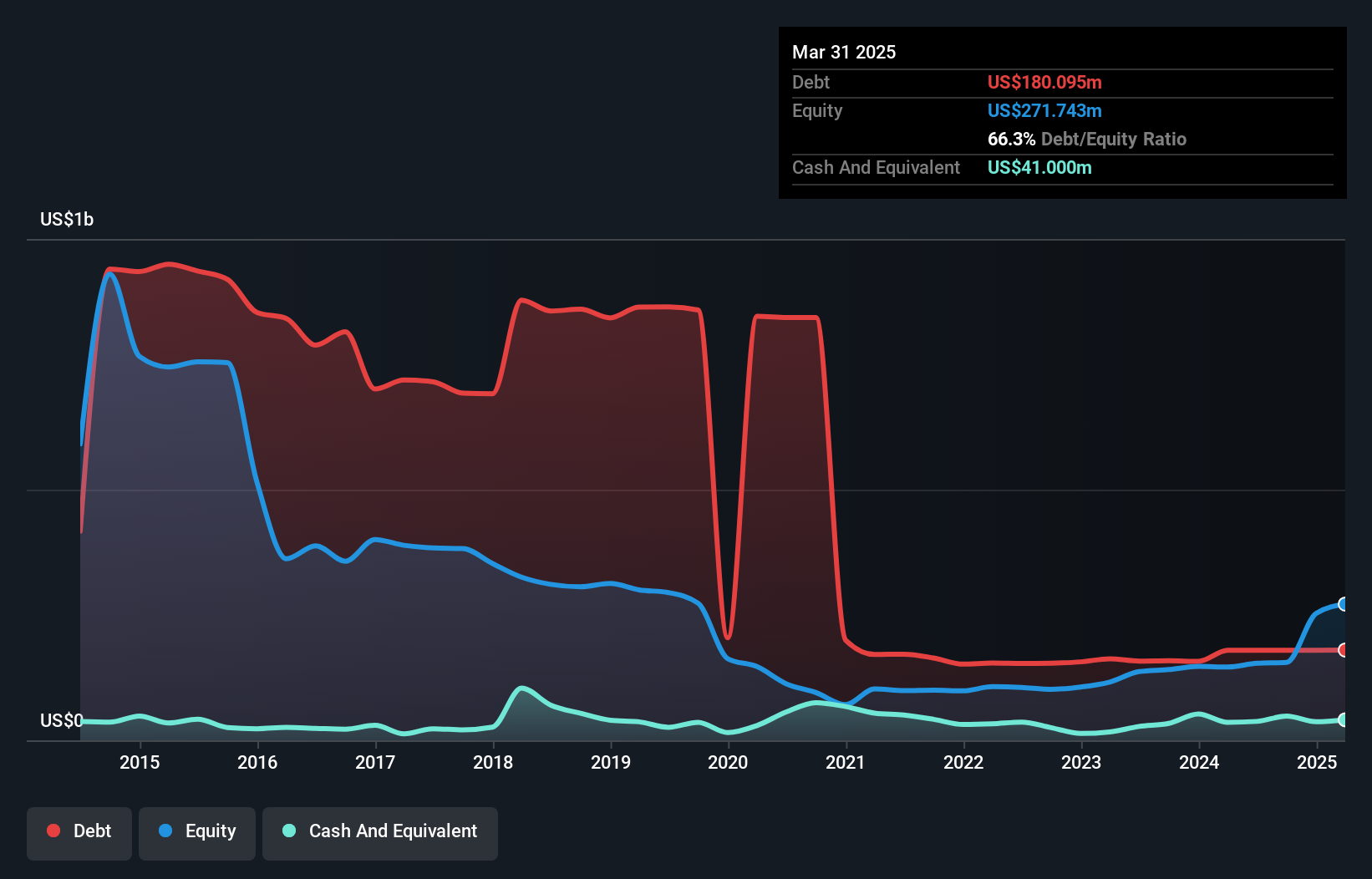

TETRA Technologies is carving a niche in energy storage and water desalination, aiming to capitalize on growing demand for grid stability and sustainable resources. With earnings surging by 1130% last year, the company outpaced its industry peers significantly. Despite trading at 53% below estimated fair value, TETRA's future looks challenging with anticipated profit margin shrinkage from 19.8% to 0.4%. The debt-to-equity ratio has impressively reduced from 748% to a more manageable 62%, reflecting improved financial health. However, heavy capital expenditures and reliance on volatile deepwater projects pose risks to consistent profitability.

Key Takeaways

- Embark on your investment journey to our 286 US Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GCBC

Greene County Bancorp

Operates as a holding company for The Bank of Greene County that provides various financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives