- United States

- /

- Communications

- /

- NasdaqGS:ITRN

Top US Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with the S&P 500 extending its winning streak and major indices nearing record highs, investors are increasingly looking for stable income sources amidst this bullish environment. In such times, dividend stocks can provide a reliable stream of income while potentially benefiting from capital appreciation, making them an attractive option for investors seeking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.53% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.70% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.51% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.84% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.40% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.56% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

Click here to see the full list of 134 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

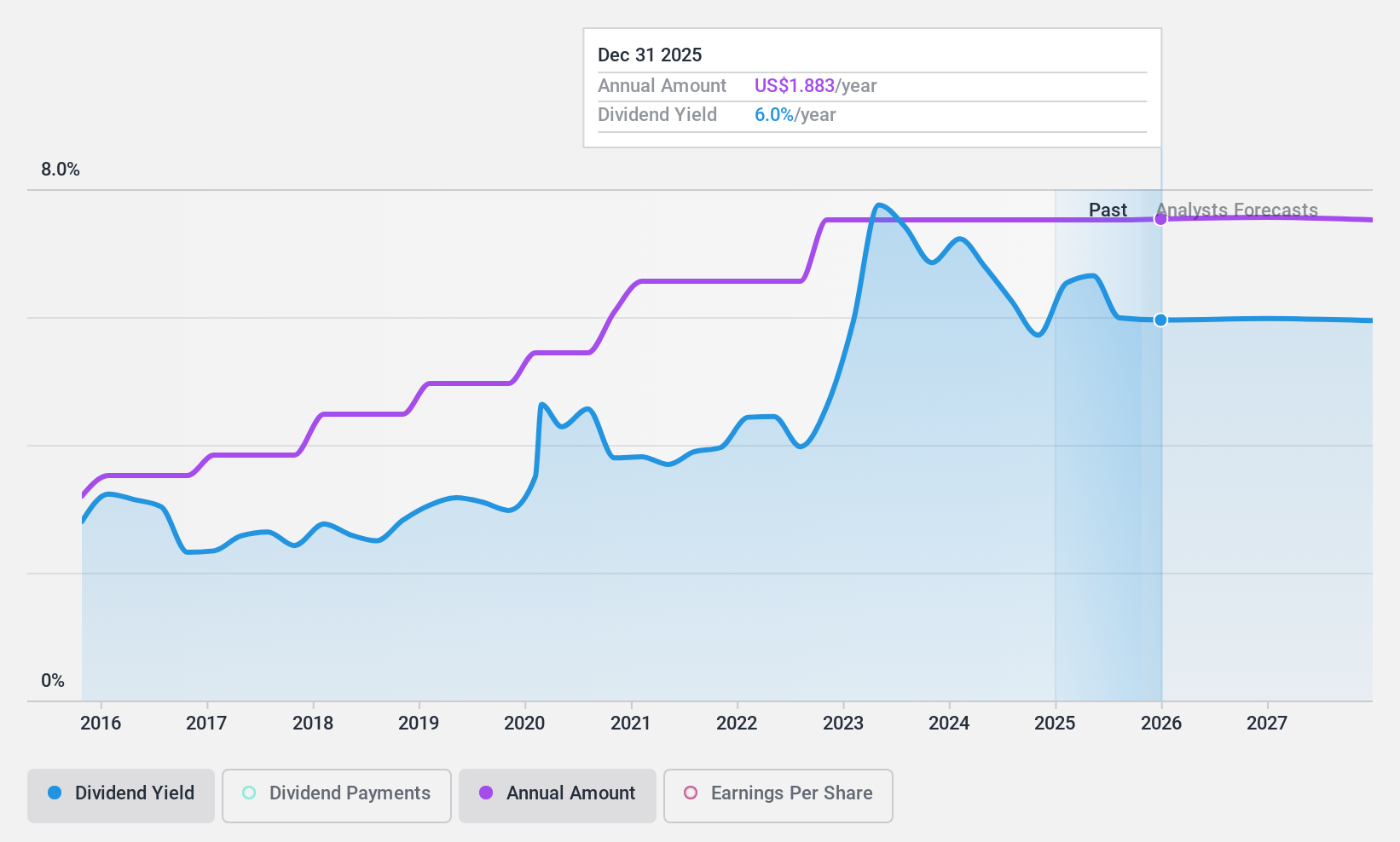

First Interstate BancSystem (NasdaqGS:FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering a variety of banking products and services across the United States with a market cap of approximately $3.49 billion.

Operations: First Interstate BancSystem, Inc.'s revenue from Community Banking is $951.20 million.

Dividend Yield: 5.6%

First Interstate BancSystem offers a stable dividend, recently affirming a $0.47 per share payout, despite facing reduced net income of US$55.5 million in Q3 2024. The dividend yield is attractive at 5.56%, placing it among the top 25% of U.S. market payers, though insider selling raises concerns. With dividends historically reliable and covered by current earnings at an 82.3% payout ratio, future coverage is projected to improve to 71.6%.

- Navigate through the intricacies of First Interstate BancSystem with our comprehensive dividend report here.

- Our expertly prepared valuation report First Interstate BancSystem implies its share price may be too high.

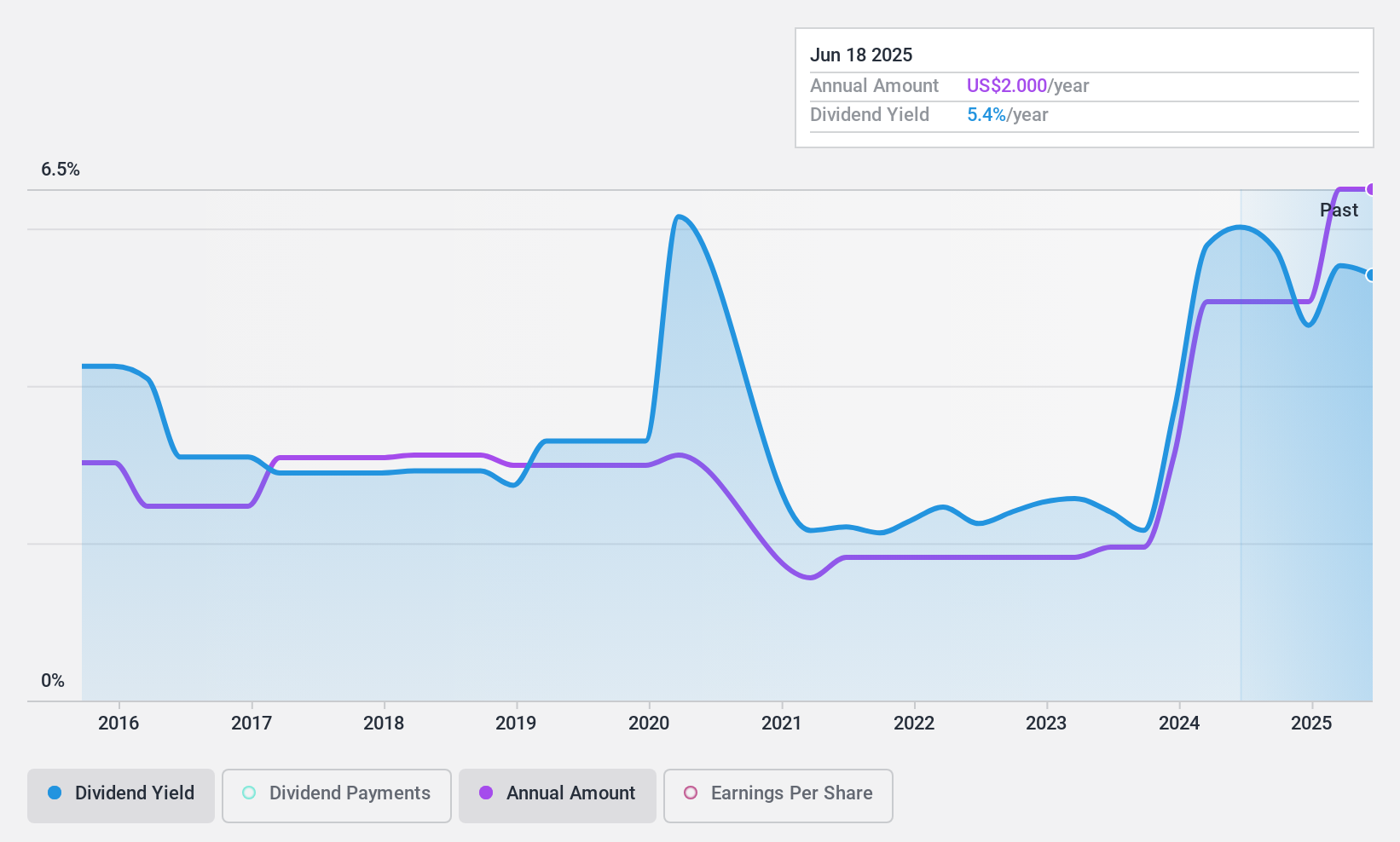

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products, with a market cap of $542.30 million.

Operations: Ituran Location and Control Ltd.'s revenue is derived from two main segments: Telematics Products, contributing $87.83 million, and Telematics Services, generating $240.93 million.

Dividend Yield: 5.5%

Ituran Location and Control recently affirmed a $0.39 per share dividend, totaling approximately US$8 million, with payments scheduled for January 2025. The dividend yield ranks in the top 25% of U.S. payers, supported by a sustainable payout ratio of 55.3%. Despite historical volatility in dividends, earnings have grown by 17.2% over the past year and are expected to continue growing, enhancing dividend sustainability alongside strong cash flow coverage at a 49.7% cash payout ratio.

- Click here to discover the nuances of Ituran Location and Control with our detailed analytical dividend report.

- The analysis detailed in our Ituran Location and Control valuation report hints at an deflated share price compared to its estimated value.

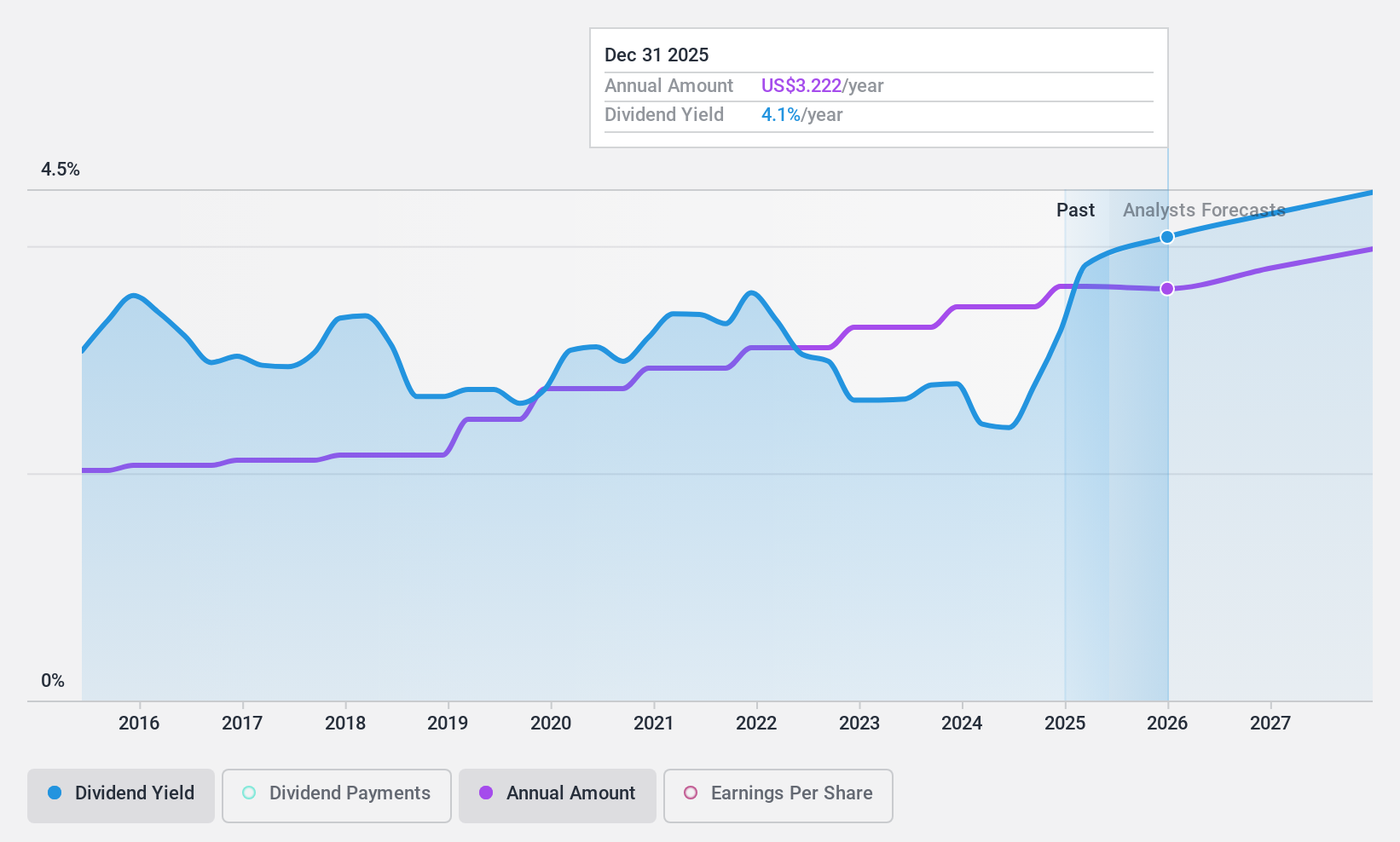

Merck (NYSE:MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations worldwide and a market cap of approximately $246.49 billion.

Operations: Merck & Co., Inc.'s revenue is primarily derived from its Pharmaceutical segment, which generates $56.50 billion, and its Animal Health segment, contributing $5.76 billion.

Dividend Yield: 3.1%

Merck announced a quarterly dividend of US$0.81 per share, demonstrating consistent dividend growth over the past decade. Despite a lower yield of 3.08% compared to top U.S. payers, the dividend is well-covered by earnings and cash flow, with payout ratios at 63.4% and 52.5%, respectively. Recent earnings growth supports future payments, although high debt levels pose potential risks to financial flexibility in maintaining dividends amid market fluctuations or operational challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Merck.

- Our valuation report here indicates Merck may be undervalued.

Summing It All Up

- Access the full spectrum of 134 Top US Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRN

Ituran Location and Control

Provides location based telematics services and machine-to-machine telematics products.

Flawless balance sheet established dividend payer.