- United States

- /

- Banks

- /

- NasdaqGS:FIBK

Top Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 8.4%, contributing to a 5.9% increase over the past year, with earnings forecasted to grow by 13% annually. In this promising environment, identifying dividend stocks that offer reliable payouts and potential for growth can be a prudent strategy for investors seeking both income and stability.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.57% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.25% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.62% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.29% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 7.33% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.82% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.27% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.22% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.08% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Chord Energy (NasdaqGS:CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company in the United States with a market cap of approximately $5.27 billion.

Operations: Chord Energy Corporation generates its revenue primarily from the exploration and production of crude oil, NGLs, and natural gas, amounting to $4.92 billion.

Dividend Yield: 9.4%

Chord Energy's dividend yield is among the top 25% in the US, but its dividends have been unstable and volatile over its short four-year history. The company maintains a reasonable payout ratio, with dividends covered by earnings and cash flows. Despite trading below estimated fair value, earnings are projected to decline slightly over the next three years. Recent financial maneuvers include a $750 million senior notes offering to manage existing debt and improve liquidity.

- Navigate through the intricacies of Chord Energy with our comprehensive dividend report here.

- Our expertly prepared valuation report Chord Energy implies its share price may be lower than expected.

First Interstate BancSystem (NasdaqGS:FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering a variety of banking products and services across the United States with a market cap of $2.59 billion.

Operations: First Interstate BancSystem, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $931.90 million.

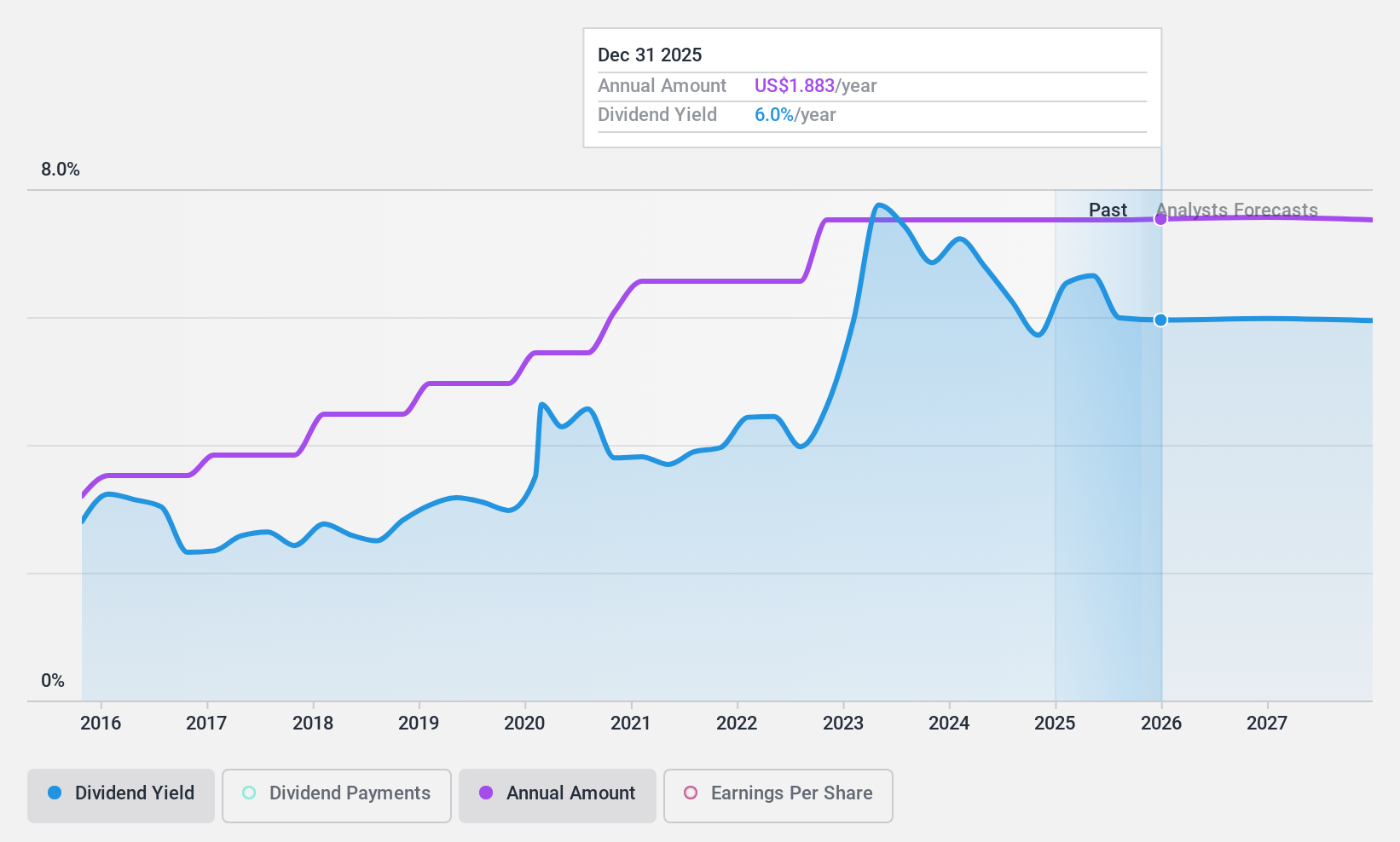

Dividend Yield: 7.3%

First Interstate BancSystem offers a high dividend yield of 7.29%, placing it in the top 25% of US dividend payers, with stable and reliable payments over the past decade. Its payout ratio is currently 85.7%, expected to decrease to 61.7% in three years, indicating sustainable dividends covered by earnings. Despite recent executive changes and a decline in net income to US$226 million for 2024, the stock trades at a significant discount to fair value estimates.

- Unlock comprehensive insights into our analysis of First Interstate BancSystem stock in this dividend report.

- According our valuation report, there's an indication that First Interstate BancSystem's share price might be on the cheaper side.

GeoPark (NYSE:GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company operating mainly in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries with a market cap of $328.38 million.

Operations: GeoPark Limited generates its revenue primarily from its oil and gas exploration and production segment, which reported $660.84 million.

Dividend Yield: 9.3%

GeoPark Limited's dividend yield of 9.3% ranks it among the top US dividend payers, although its track record is unstable with volatile payments over the past five years. Despite a low payout ratio of 32% and cash payout ratio of 10.8%, indicating dividends are well-covered by earnings and cash flows, recent financial results show declining revenue and net income for 2024. The company’s strategic asset acquisitions in Vaca Muerta aim to enhance reserves, yet high debt levels may impact financial flexibility.

- Delve into the full analysis dividend report here for a deeper understanding of GeoPark.

- Our valuation report here indicates GeoPark may be undervalued.

Make It Happen

- Reveal the 170 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives