- United States

- /

- Banks

- /

- NasdaqGS:FIBK

First Interstate BancSystem (FIBK): Valuation Check After Its Addition to the S&P 1000 Index

Reviewed by Simply Wall St

First Interstate BancSystem (FIBK) just earned a spot in the S&P 1000, putting this regional bank on the radar of more index funds and passive investors, which could provide potential tailwinds for liquidity and sentiment.

See our latest analysis for First Interstate BancSystem.

The backdrop to this index inclusion is a steadily improving trend, with a 30 day share price return of 9.09 percent and a year to date share price return of 10.76 percent suggesting momentum is quietly building, while a 1 year total shareholder return of 10.6 percent points to solid, if unspectacular, long term compounding.

If this kind of quietly improving story appeals to you, it could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

Yet with shares now hovering almost exactly at Wall Street’s price target, but still trading at a notable discount to some intrinsic value estimates, investors have to ask: Is FIBK a quiet bargain, or is future growth already priced in?

Most Popular Narrative: 30% Undervalued

With First Interstate BancSystem last closing at 35.40 dollars and the narrative fair value anchored at 35.50 dollars, the story hinges less on a headline gap and more on what drives that valuation beneath the surface.

Strong capital and liquidity levels, further enhanced by the Arizona and Kansas branch transaction, give the company multiple options for value creation (e.g., share repurchases, organic investment, or future M&A), increasing flexibility to support shareholder returns and earnings growth through 2026 and beyond.

Curious how steady branch pruning, ambitious margin expansion, and brisk earnings growth all fit into one valuation playbook? The narrative connects these moving parts into a single, aggressive profit trajectory that most regional banks are not even attempting. Want to see the exact growth path and margin lift this fair value assumes, and how low the future earnings multiple has to fall to make it all add up?

Result: Fair Value of $35.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated criticized loans and ongoing loan balance declines could pressure asset quality and revenue growth, which may challenge the optimistic margin and earnings trajectory.

Find out about the key risks to this First Interstate BancSystem narrative.

Another View on Valuation

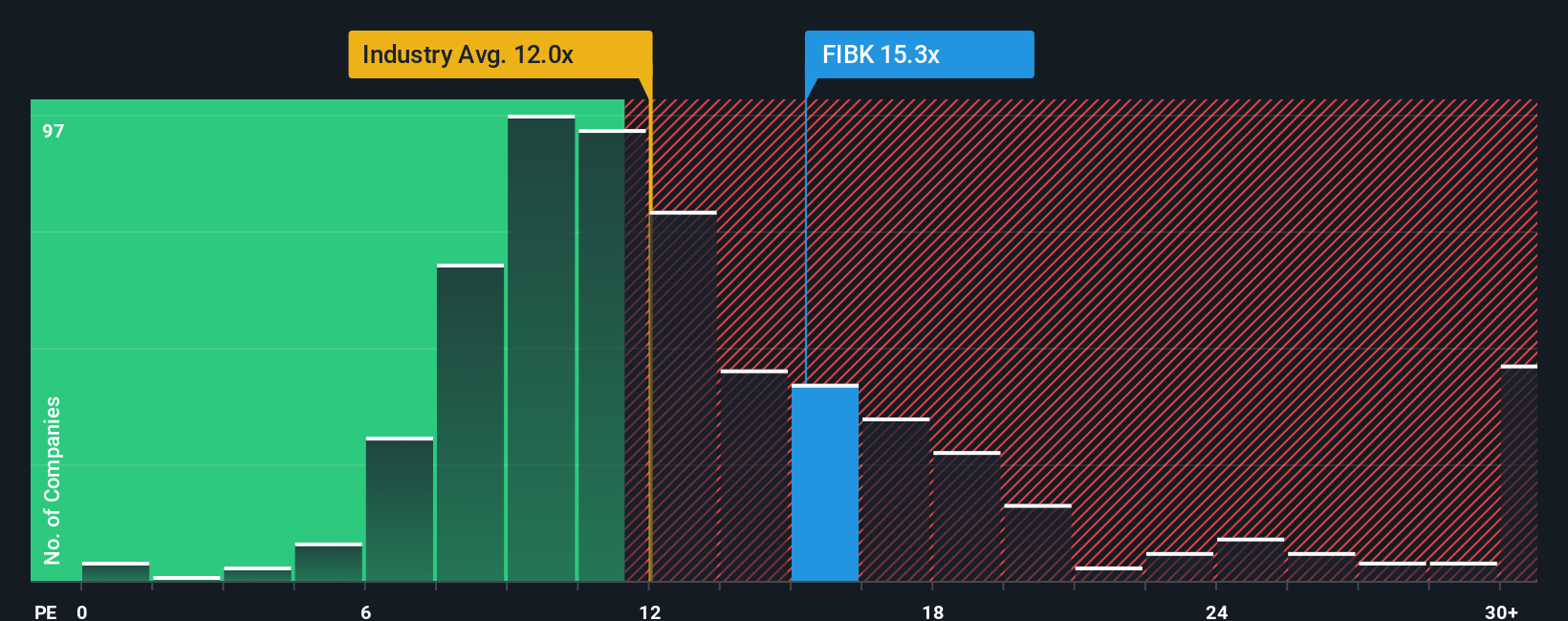

On earnings, the picture is less generous. FIBK trades on a 14.8 times price to earnings ratio, richer than both the US banks sector at 11.9 times and peer average at 11.5 times, and only slightly below its 15.9 times fair ratio, so is the upside really that large?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Interstate BancSystem Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a full narrative yourself in just a few minutes, Do it your way.

A great starting point for your First Interstate BancSystem research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next smart move by using the Simply Wall Street Screener to uncover fresh, data driven opportunities beyond First Interstate BancSystem.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value with these 903 undervalued stocks based on cash flows.

- Ride powerful secular trends by focusing on innovation leaders shaping tomorrow through these 26 AI penny stocks.

- Strengthen your income stream by pinpointing resilient businesses offering attractive yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)