- United States

- /

- Banks

- /

- NasdaqGS:FFIN

How Recent Volatility Impacts First Financial Bankshares Valuation in 2025

Reviewed by Bailey Pemberton

If you’ve kept an eye on regional banks lately, you might be wondering what is really going on with First Financial Bankshares. Deciding whether to buy, hold, or move on isn’t always easy, especially when a chart looks like a rollercoaster. Over the past year, the stock has dropped about 5.0%, and the three-year view shows a steeper decline of 17.1%. Yet, step back further and things look up: over five years the stock is still in positive territory, growing 17.9% overall. The most recent month has seen a dip of 8.8% and, with the last close at $33.5, investors are weighing whether this is a temporary setback or a longer trend.

Some of these moves track broader shifts in market sentiment. Rising interest rates and competition for deposits have been shaking up the entire sector, nudging risk perceptions higher for regional banks like this one. However, while headwinds are real, they often open the door for potential value if you know where to look.

So, how does First Financial Bankshares stack up from a valuation perspective? Using six standard checks for undervaluation, the company scores a 2, signaling that it meets two out of six undervalued benchmarks. That is not an overwhelming bargain, but it might hint at hidden potential depending on what matters most to you as an investor.

Let’s break down these valuation measures and see what they can reveal about opportunity here. More importantly, this approach introduces a smarter, more holistic way to gauge value that could change how you view First Financial Bankshares altogether.

First Financial Bankshares scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: First Financial Bankshares Excess Returns Analysis

The Excess Returns valuation model measures how efficiently a company generates profit above its cost of capital, using factors like book value, earnings, and return on equity instead of future cash flows. This makes it particularly useful for banks, where traditional valuation methods may not capture the full picture of profitability and growth potential.

For First Financial Bankshares, analysts estimate a current book value of $12.22 per share, with a stable book value projected to reach $13.48 per share. The stable earnings per share (EPS) is calculated at $1.98, serving as a reliable signal of future profitability based on weighted forecasts from five analysts. The average return on equity is strong at 14.67%, comfortably above the cost of equity, which stands at $0.91 per share. This results in an excess return of $1.06 per share, showing the company is effectively generating value for its shareholders.

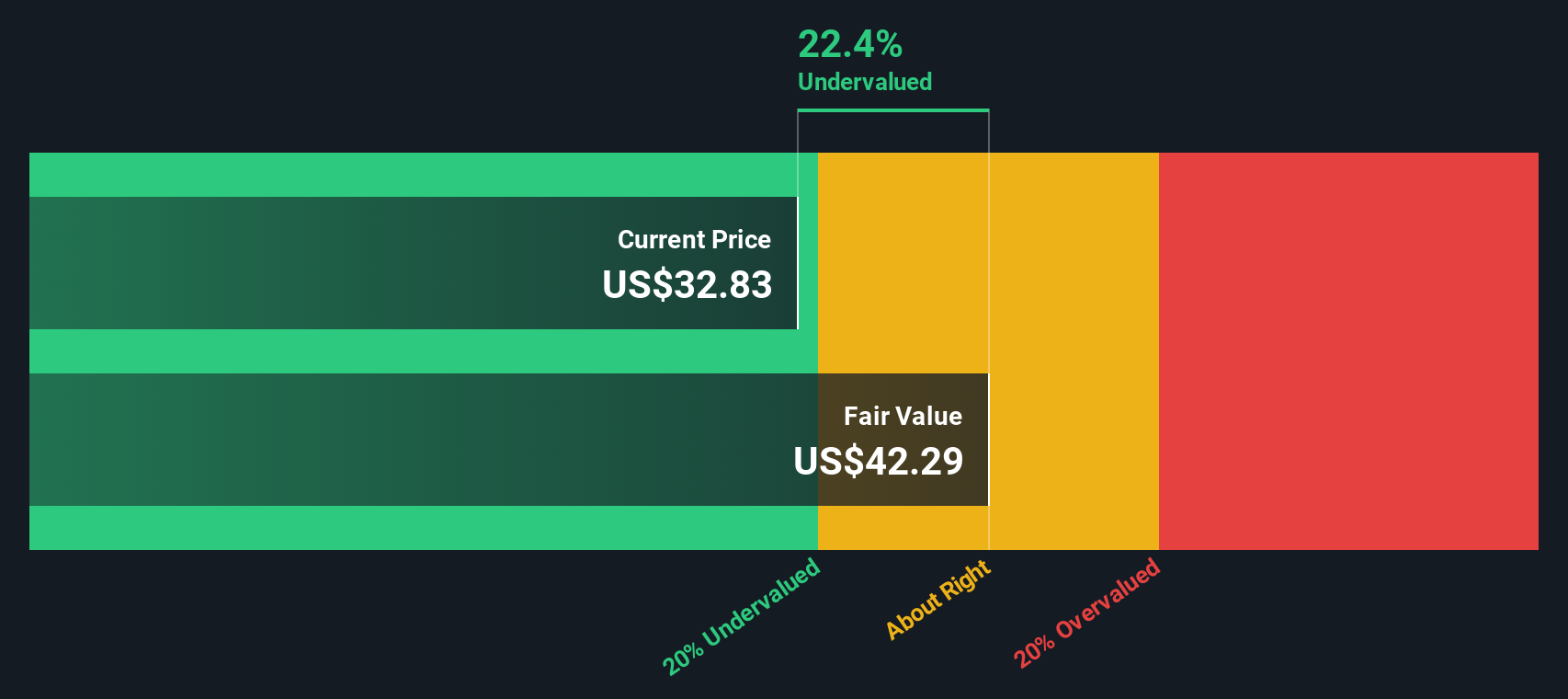

Taken together, the model yields an intrinsic value of $42.25 per share. With the latest market price at $33.50, this points to a 20.7% intrinsic discount, indicating the stock is notably undervalued based on excess returns.

Result: UNDERVALUED

Our Excess Returns analysis suggests First Financial Bankshares is undervalued by 20.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: First Financial Bankshares Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies, as it provides a straightforward way to compare the market price of a stock to the company’s earnings. A reasonable PE ratio gives investors a sense of what the market is willing to pay today for a dollar of future earnings, taking into account growth prospects and risk. If investors expect robust growth and see low risk, a higher PE is usually justified. Greater uncertainty or slower growth often leads to a lower "fair" PE multiple.

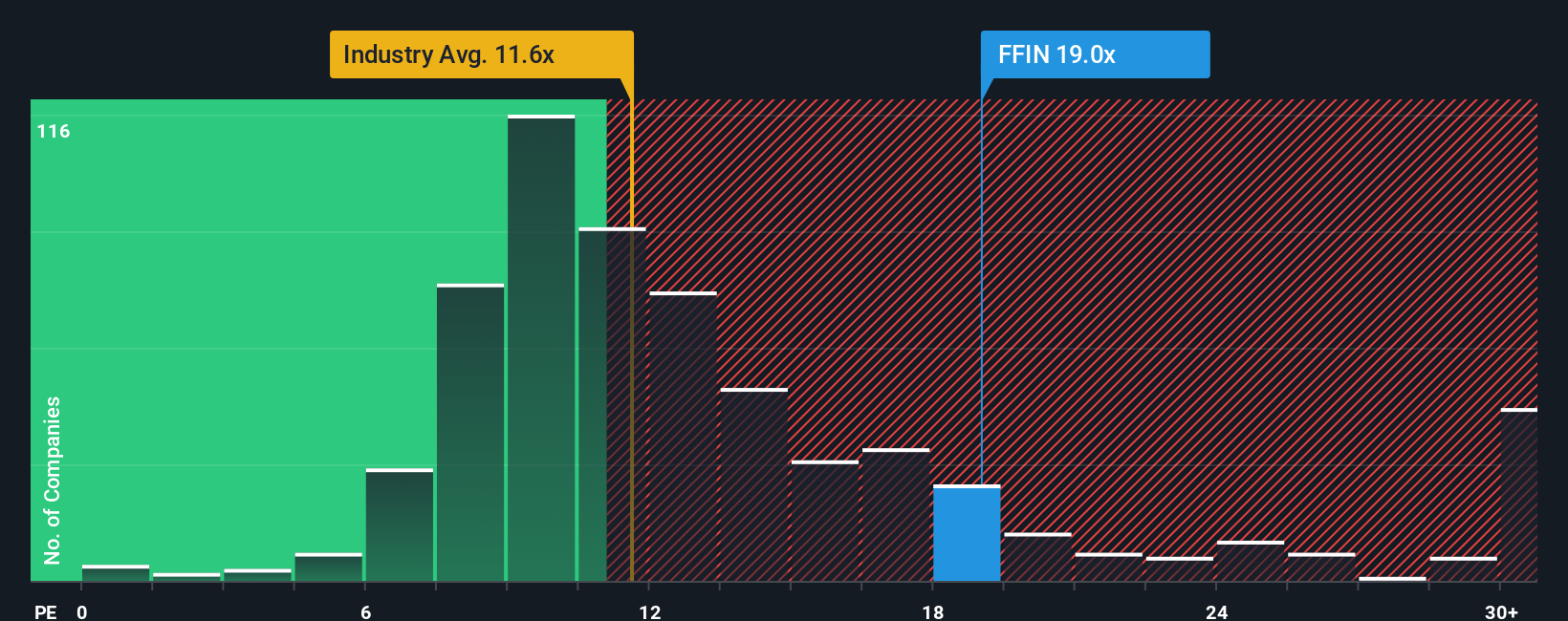

First Financial Bankshares is currently trading at a PE ratio of 19.39x. For context, this is well above the average PE of its peer group (14.53x) and also considerably higher than the broader banking industry average of 11.80x. At first glance, the premium suggests that the market is pricing in higher quality, growth, or stability relative to peers. However, a more nuanced view comes from Simply Wall St’s proprietary "Fair Ratio," which factors in not just industry norms but also the company’s own growth outlook, profit margins, size, and risk profile. For First Financial Bankshares, this Fair Ratio is 12.66x.

The benefit of the Fair Ratio is that it provides a deeper analysis, adjusting for elements that peers or industry averages might miss. By incorporating company-specific strengths and risks, it gives a more tailored sense of what a "normal" valuation should be.

Currently, First Financial Bankshares’ PE ratio of 19.39x sits noticeably above its Fair Ratio of 12.66x. This suggests the stock is trading at a premium to what would typically be expected based on its fundamentals and market backdrop.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Financial Bankshares Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you tell about a company, connecting your perspective and insights with the numbers that drive its future, such as your estimates for fair value, earnings, revenue, and margins.

Narratives link a company’s background and outlook to a concrete investment case, resulting in a projected fair value that’s easy to compare with the current share price. On Simply Wall St's platform, Narratives are an accessible tool found on the Community page, used by millions of investors to clarify when the gap between fair value and price presents a buy or sell opportunity.

As news, earnings, or other updates emerge, Narratives are automatically refreshed, empowering investors to stay current and confident in fast-moving markets. For example, one investor’s Narrative for First Financial Bankshares might be highly optimistic, valuing it at $45 per share, while another’s more cautious outlook sets fair value at just $30 per share. This demonstrates how perspectives and investment decisions can differ.

Do you think there's more to the story for First Financial Bankshares? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives