- United States

- /

- Banks

- /

- NasdaqGS:FFIN

First Financial Bankshares (FFIN) Valuation: Assessing Market Reaction to Global Trade Tensions and Recent Share Declines

Reviewed by Kshitija Bhandaru

Shares of First Financial Bankshares (FFIN) dropped alongside other regional banks after China imposed tighter export controls on key minerals, which amplified trade tensions with the US. The sector's reaction reflects broader sensitivity to global macroeconomic shifts.

See our latest analysis for First Financial Bankshares.

FFIN’s share price has come under pressure recently, sliding 4.83% in the past day and 10.86% over the past month, as investors responded to escalating global trade tensions and sector-wide jitters. While these headlines have sparked near-term volatility, the one-year total shareholder return of -11.87% and a three-year total return of -21.74% highlight a longer stretch of fading momentum, even though the five-year track record remains positive.

If the shifting landscape in banking has you looking for different opportunities, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

But after recent declines and ongoing volatility, is First Financial Bankshares now undervalued due to market fears, or is the market already factoring in the company’s future trajectory? Could this be an entry point, or has growth been fully priced in?

Price-to-Earnings of 18.6x: Is it justified?

First Financial Bankshares currently trades at a price-to-earnings (P/E) multiple of 18.6x, making it notably pricier than other banks, considering its last close was $32.11. This figure stands out in an industry where most peers command far lower multiples.

The price-to-earnings ratio measures how much investors are paying today for a dollar of the company’s earnings. For banks, this metric is widely used because it reflects market expectations for growth, profitability, and risk specific to the sector.

Despite solid earnings quality and a reliable dividend, FFIN’s P/E of 18.6x eclipses the US Banks industry average of 11.3x and the peer average of 17x. In addition, it sits well above the estimated Fair Price-to-Earnings Ratio of 12.7x. This may imply the market is assigning a premium that could come under scrutiny if future growth expectations are not met.

Explore the SWS fair ratio for First Financial Bankshares

Result: Price-to-Earnings of 18.6x (OVERVALUED)

However, persistent macroeconomic uncertainty and slower earnings growth could challenge the market’s current optimism, which may put further pressure on FFIN shares.

Find out about the key risks to this First Financial Bankshares narrative.

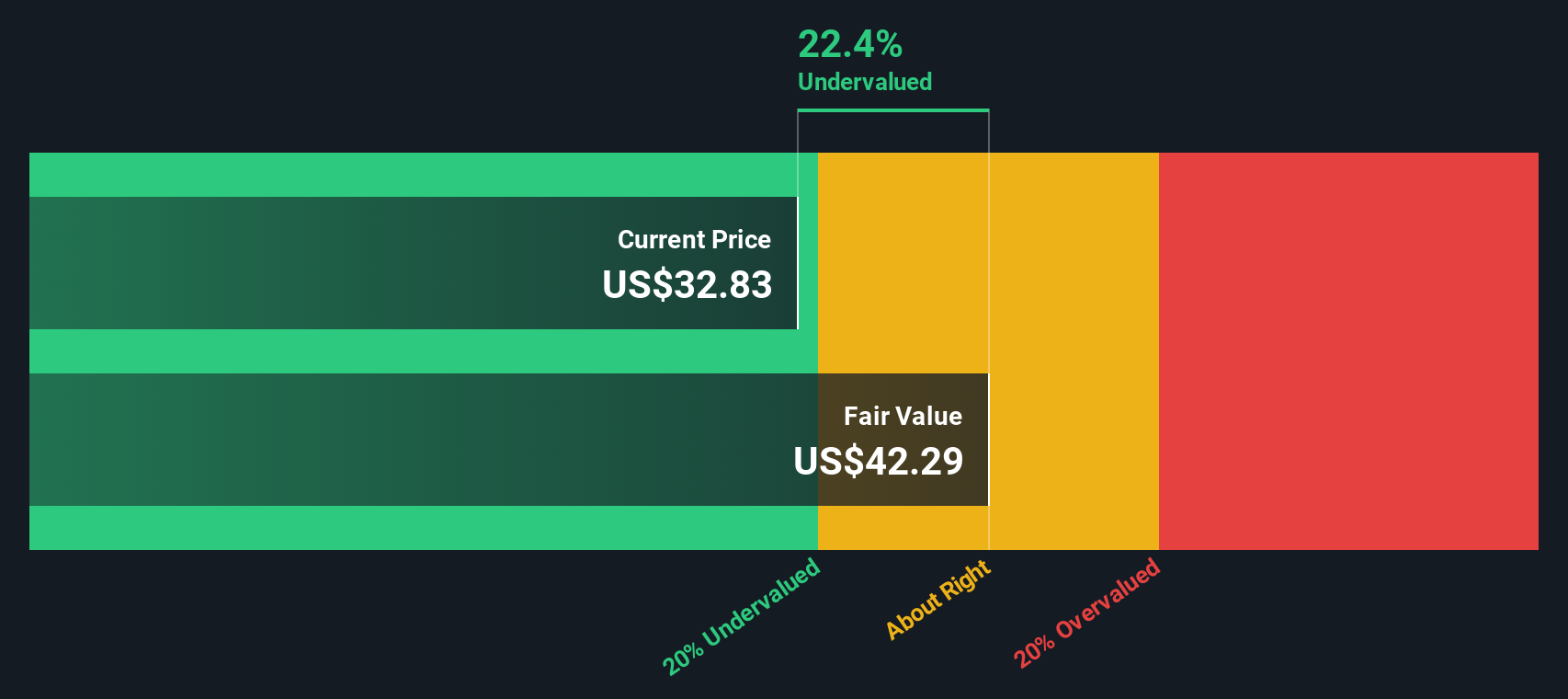

Another View: SWS DCF Model Suggests Undervaluation

Looking from a different angle, our DCF model estimates First Financial Bankshares is trading about 24% below its fair value. The calculated fair value is $42.26 compared to the current price of $32.11. This suggests the market may be underestimating the company's potential, despite concerns raised by other indicators. Could this disconnect signal a hidden opportunity or just reflect ongoing uncertainty?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Financial Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Financial Bankshares Narrative

If you see the numbers differently or want to dig deeper, you can quickly create your own narrative and analysis, tailored to your perspective, before the next shift in sentiment. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding First Financial Bankshares.

Looking for More Smart Investment Ideas?

Open the door to fresh investing opportunities. Take charge of your next move and don’t let tomorrow’s success stories slip past your radar.

- Unlock high potential by targeting companies with cash flows that suggest they’re undervalued using these 894 undervalued stocks based on cash flows.

- Tap into rapid sector growth by evaluating standout candidates among these 33 healthcare AI stocks transforming medicine with artificial intelligence.

- Boost your income strategy by screening for reliable businesses topping the list for consistent yields over 3% thanks to these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives