- United States

- /

- Banks

- /

- NasdaqGS:HTBK

Top US Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the U.S. stock market continues to ride record highs, with major indices like the Dow Jones and Nasdaq hitting all-time peaks, investors are keenly observing the economic landscape shaped by recent policy shifts and technological advancements. In this environment of optimism and strategic growth, dividend stocks present a compelling option for those looking to balance potential returns with income stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.77% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.51% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.51% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.31% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

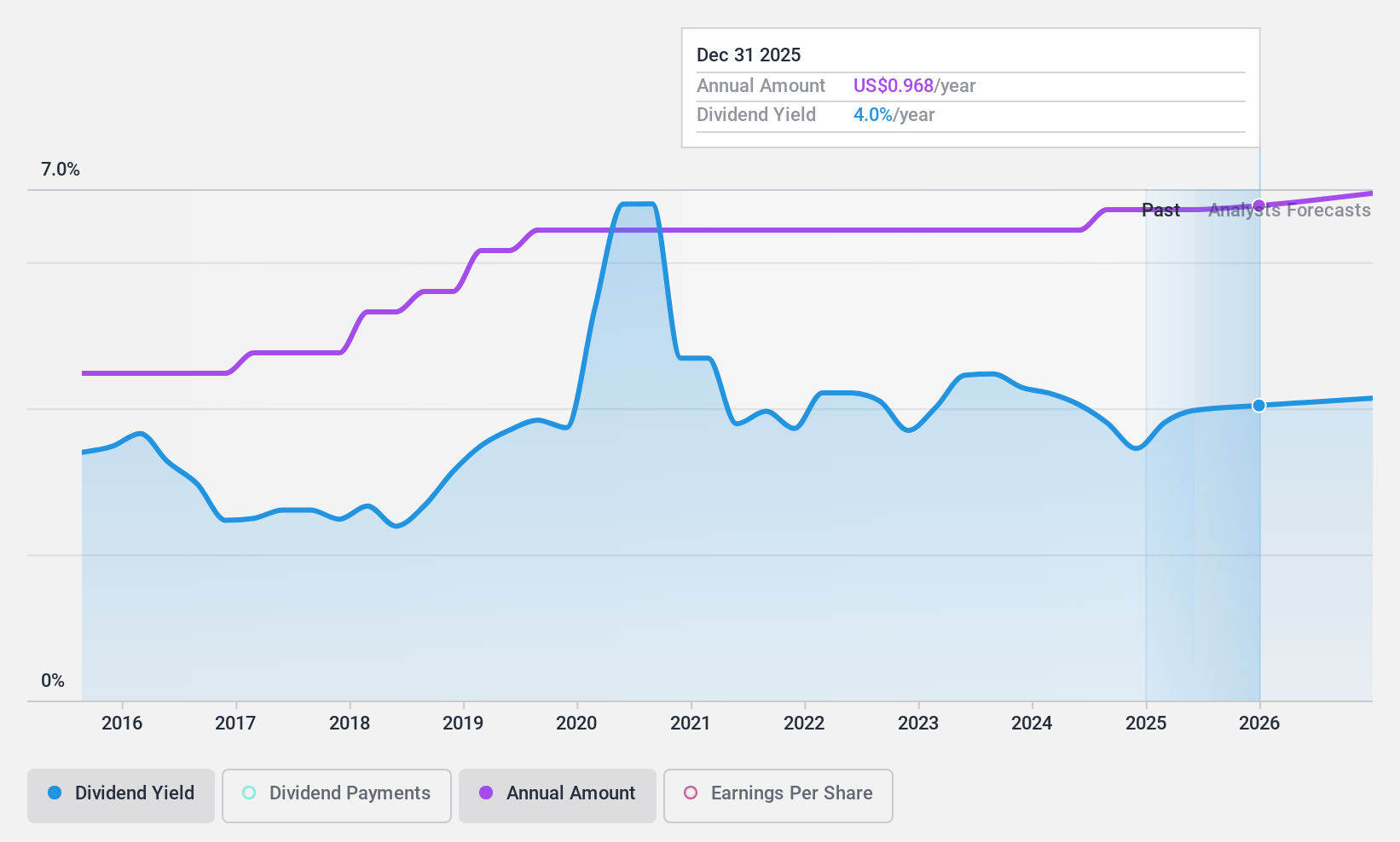

First Financial Bancorp (NasdaqGS:FFBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Financial Bancorp is a bank holding company for First Financial Bank, offering commercial banking and related services to individuals and businesses across Ohio, Indiana, Kentucky, and Illinois, with a market cap of approximately $2.75 billion.

Operations: First Financial Bancorp generates revenue primarily through its Community Banking segment, which accounted for $763.43 million.

Dividend Yield: 3.3%

First Financial Bancorp. recently affirmed a quarterly dividend of US$0.24 per share, payable on December 16, 2024. Despite a volatile dividend history over the past decade, current dividends are well-covered by earnings with a payout ratio of 39.7%. The company reported decreased net income for Q3 and the first nine months of 2024 compared to last year but maintained stable net interest income. Trading at significant value below estimated fair value, it offers potential appeal despite not engaging in recent share buybacks.

- Click here and access our complete dividend analysis report to understand the dynamics of First Financial Bancorp.

- Our comprehensive valuation report raises the possibility that First Financial Bancorp is priced lower than what may be justified by its financials.

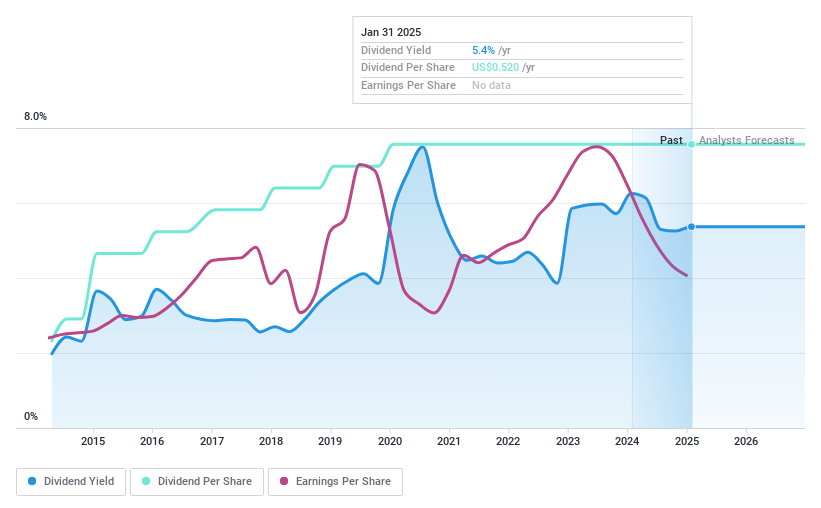

Heritage Commerce (NasdaqGS:HTBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Heritage Commerce Corp, with a market cap of $641.85 million, operates as the bank holding company for Heritage Bank of Commerce, offering diverse commercial and personal banking services to individuals and businesses in California.

Operations: Heritage Commerce Corp generates revenue through its primary segments of Banking, accounting for $159.94 million, and Factoring, contributing $9.23 million.

Dividend Yield: 4.9%

Heritage Commerce Corp. declared a quarterly dividend of US$0.13 per share, maintaining a stable and reliable dividend history over the past decade with a current yield in the top 25% of U.S. dividend payers. The payout ratio is 73.6%, indicating dividends are well-covered by earnings, though recent financials show decreased net income and interest income compared to last year. Executive changes include CFO transition, which may impact future operations stability.

- Click here to discover the nuances of Heritage Commerce with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Heritage Commerce shares in the market.

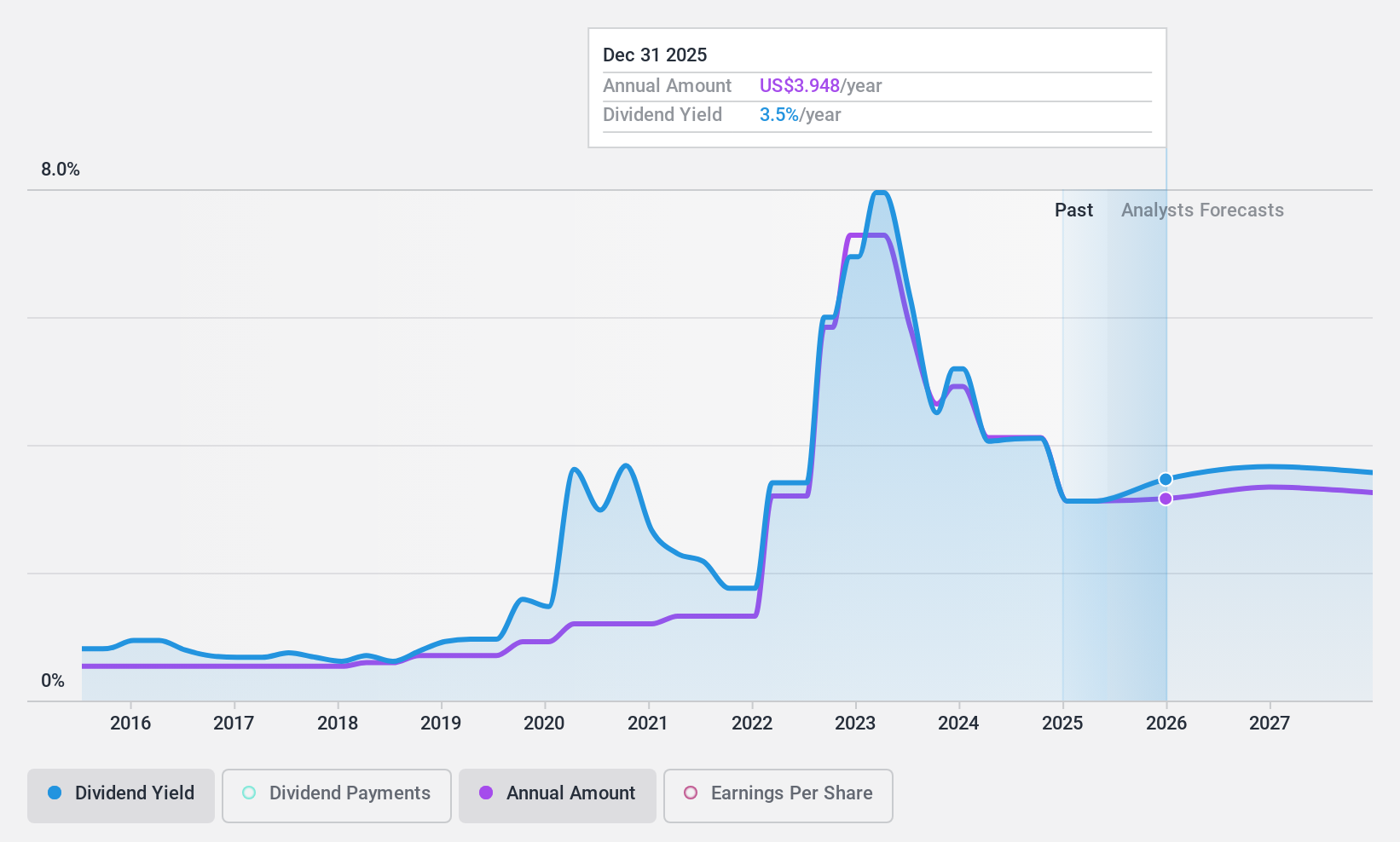

EOG Resources (NYSE:EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas in the United States and internationally, with a market cap of approximately $74.13 billion.

Operations: EOG Resources generates its revenue primarily from crude oil and natural gas exploration and production, amounting to $23.86 billion.

Dividend Yield: 3%

EOG Resources has a low payout ratio of 29.2% and a cash payout ratio of 36.8%, indicating dividends are well-covered by earnings and cash flows, despite a volatile dividend history over the past decade. Recent financials show decreased revenue and net income for Q3 2024 compared to last year. The company completed a $994 million fixed-income offering, potentially impacting future financial flexibility, while also executing significant share buybacks totaling $3.21 billion since 2021.

- Click to explore a detailed breakdown of our findings in EOG Resources' dividend report.

- Our valuation report unveils the possibility EOG Resources' shares may be trading at a discount.

Summing It All Up

- Gain an insight into the universe of 135 Top US Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heritage Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTBK

Heritage Commerce

Operates as the bank holding company for Heritage Bank of Commerce that provides various commercial and personal banking services to residents and the business/professional community in California.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives