- United States

- /

- Luxury

- /

- NYSE:CRI

April 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, driven by robust earnings reports and optimism surrounding potential tariff reductions, investors are keenly observing the performance of major indices like the Dow Jones, S&P 500, and Nasdaq Composite. In this dynamic environment, dividend stocks stand out as attractive options for their ability to provide steady income streams while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.12% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.50% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.01% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.99% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.78% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.76% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.04% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.00% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.55% | ★★★★★★ |

Click here to see the full list of 151 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Fidelity D & D Bancorp (NasdaqGM:FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc., with a market cap of $230.68 million, operates as the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individuals, small businesses, and corporate clients.

Operations: Fidelity D & D Bancorp, Inc. generates revenue through its provision of diverse banking, trust, and financial services tailored for individuals, small enterprises, and corporate entities.

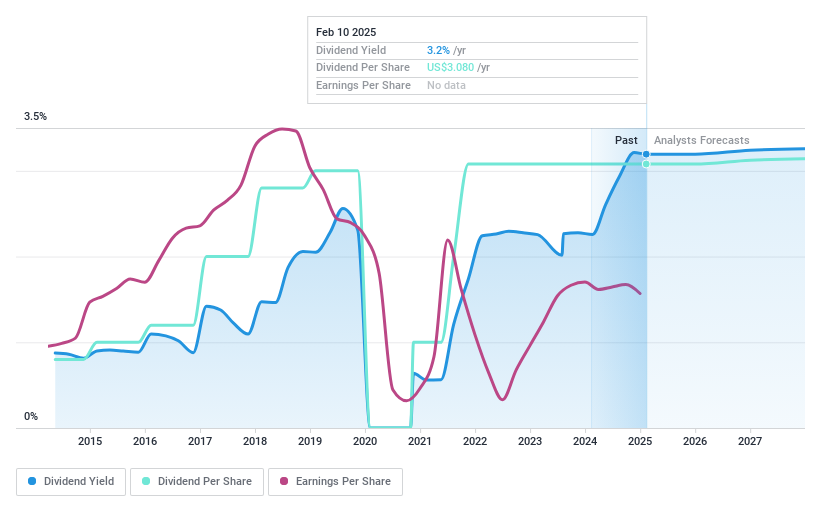

Dividend Yield: 4.1%

Fidelity D & D Bancorp offers a stable dividend yield of 4.06%, supported by a low payout ratio of 42.5%. Despite trading at 61.1% below its estimated fair value, the company's dividends have been reliable and growing over the past decade. Recent earnings results show significant growth with net income rising to US$5.84 million in Q4 2024 from US$0.468 million a year earlier, reinforcing its capacity for continued dividend payments.

- Take a closer look at Fidelity D & D Bancorp's potential here in our dividend report.

- Our valuation report here indicates Fidelity D & D Bancorp may be undervalued.

Carter's (NYSE:CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets branded childrenswear and related products under various brands both in the United States and internationally, with a market cap of approximately $1.34 billion.

Operations: Carter's, Inc. generates revenue through three main segments: U.S. Retail ($1.42 billion), International ($405.60 million), and U.S. Wholesale ($1.02 billion).

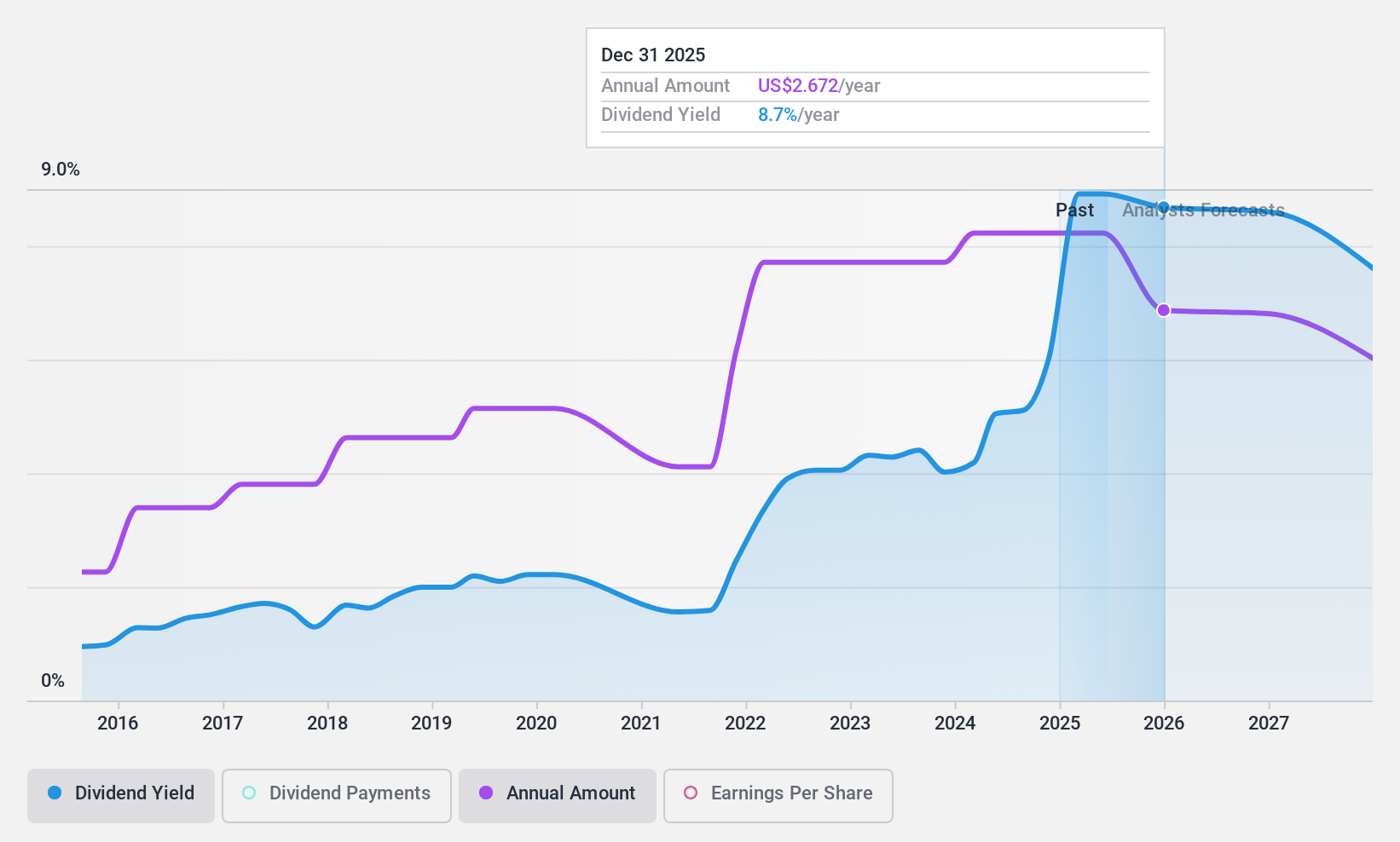

Dividend Yield: 8.6%

Carter's offers an attractive dividend yield, placing it in the top 25% of US dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 62.5% and 47.8%, respectively. However, its dividend history has been volatile over the past decade, raising concerns about reliability despite recent increases. Executive changes with Douglas C. Palladini as CEO may influence future strategies to enhance profitability and shareholder returns amidst a forecasted decline in earnings growth.

- Delve into the full analysis dividend report here for a deeper understanding of Carter's.

- Our valuation report unveils the possibility Carter's shares may be trading at a discount.

Lear (NYSE:LEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lear Corporation operates as a global supplier of automotive seating and electrical distribution systems, serving original equipment manufacturers across multiple continents, with a market capitalization of approximately $4.33 billion.

Operations: Lear Corporation generates revenue through its Seating segment, which accounts for $17.22 billion, and its e-Systems segment, contributing $6.08 billion.

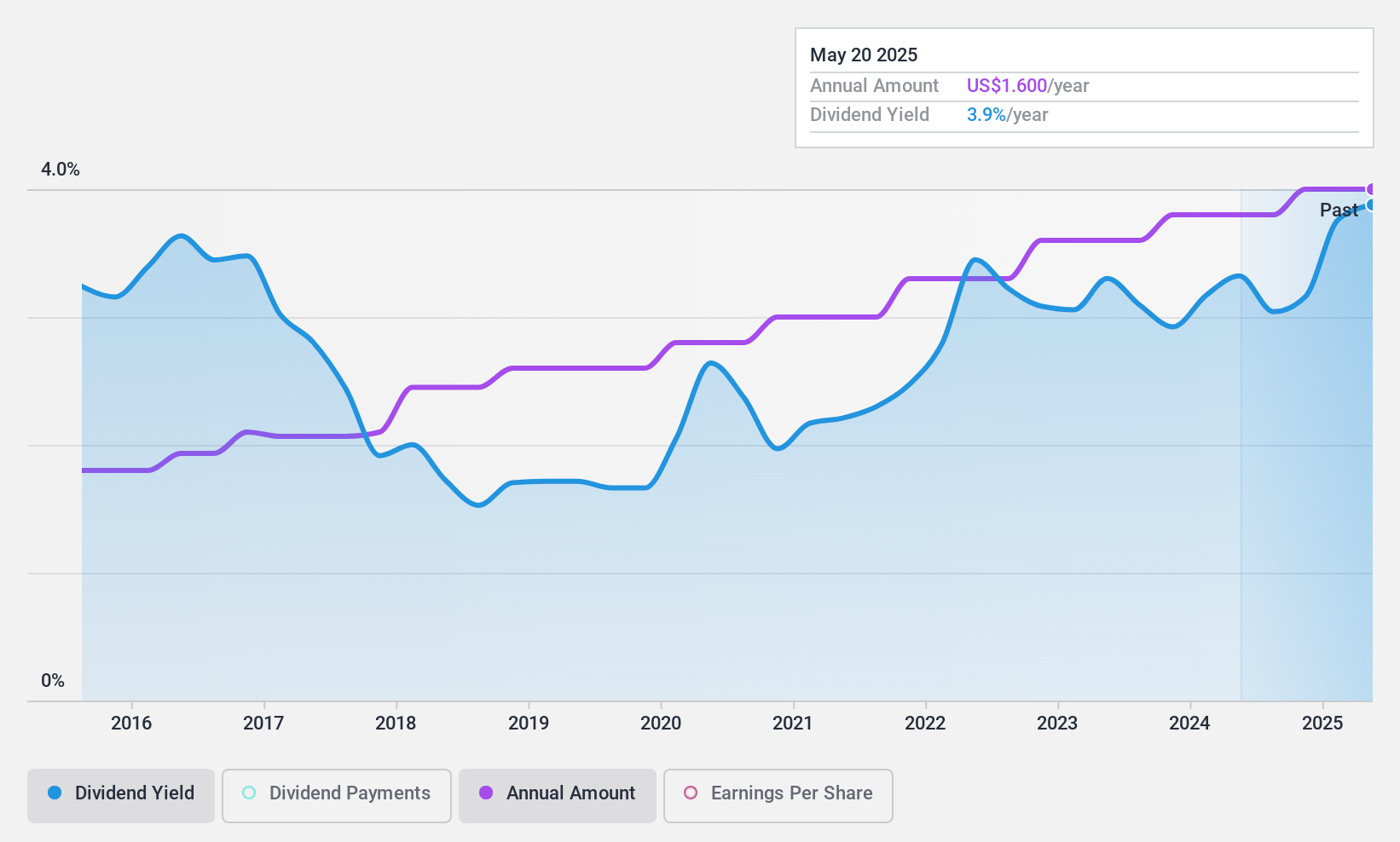

Dividend Yield: 3.8%

Lear Corporation's dividend yield of 3.76% is below the top 25% of US dividend payers, yet dividends are well-covered by earnings and cash flows, with payout ratios of 34.1% and 29.4%, respectively. Despite a volatile dividend history over the past decade, recent increases suggest potential stability improvements. Lear's strategic partnership with General Motors on ComfortMax Seat technology highlights its commitment to innovation and may support future financial performance amidst evolving market demands.

- Click here and access our complete dividend analysis report to understand the dynamics of Lear.

- The analysis detailed in our Lear valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click this link to deep-dive into the 151 companies within our Top US Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives