Stock Analysis

- United States

- /

- Banks

- /

- NasdaqCM:CIVB

Top Dividend Stocks To Consider In May 2024

Reviewed by Simply Wall St

Over the past year, the United States stock market has seen a robust increase of 28%, with earnings projected to grow by 15% annually. In this dynamic environment, dividend stocks can be particularly appealing for investors looking for potential steady income combined with opportunities for capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.32% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.00% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.88% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.93% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.81% | ★★★★★★ |

| Citizens Financial Group (NYSE:CFG) | 4.68% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.81% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.75% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.73% | ★★★★★☆ |

| Franklin Financial Services (NasdaqCM:FRAF) | 4.83% | ★★★★★☆ |

Click here to see the full list of 204 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

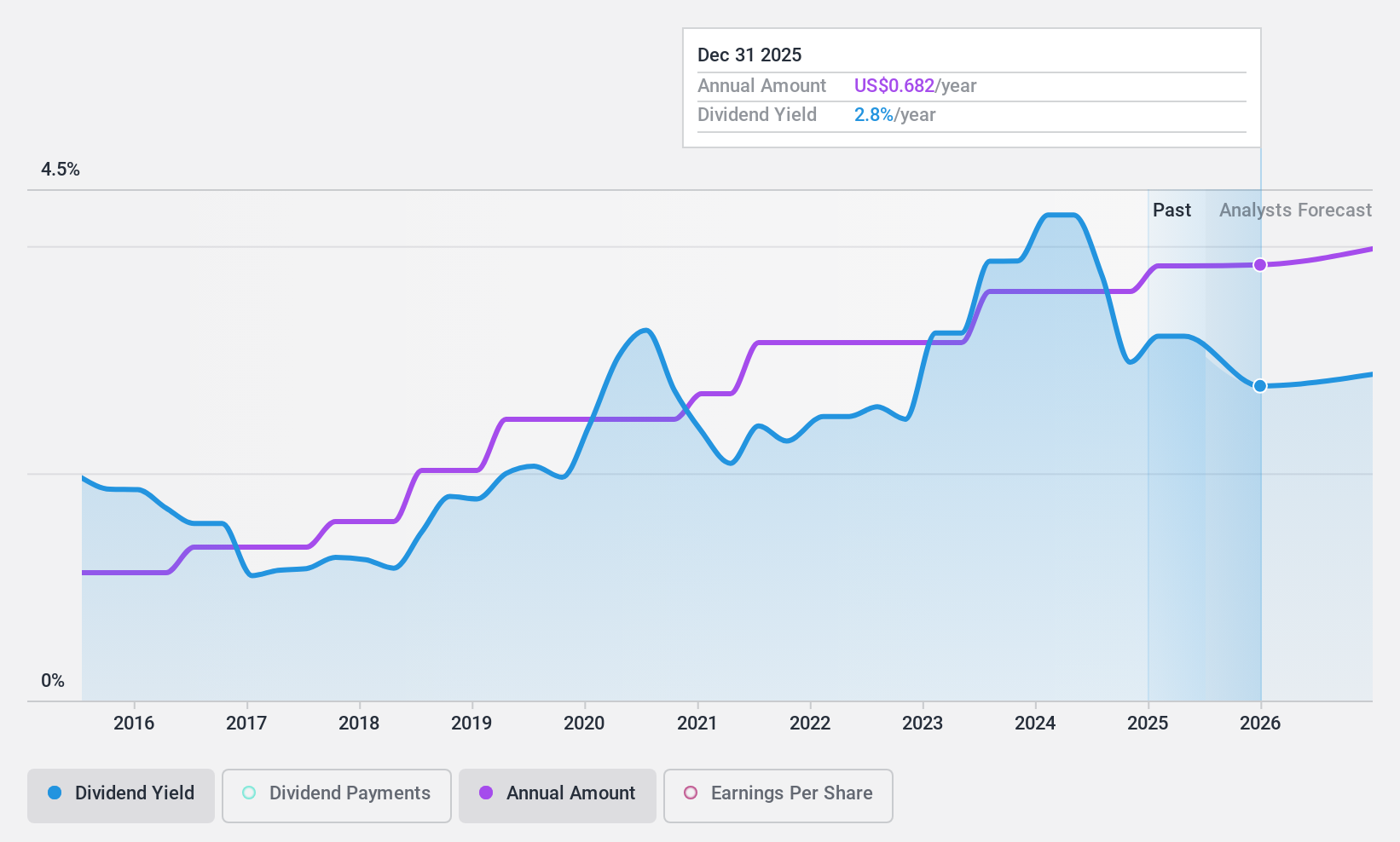

Civista Bancshares (NasdaqCM:CIVB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Civista Bancshares, Inc., serving as the financial holding company for Civista Bank, offers community banking services with a market capitalization of approximately $231.50 million.

Operations: Civista Bancshares, Inc. generates its revenue primarily through banking services, totaling $150.26 million.

Dividend Yield: 4.1%

Civista Bancshares offers a dividend yield of 4.12%, which, while stable over the past decade and well-covered by a low payout ratio of 27.2%, is not among the top tier in the U.S. market. The company's dividends have shown growth over this period, suggesting reliability in its distribution policy. Despite trading at 27.6% below estimated fair value and being valued favorably against peers, earnings are expected to decline annually by 10% over the next three years, posing potential challenges for future dividend sustainability without further data on long-term coverage.

- Get an in-depth perspective on Civista Bancshares' performance by reading our dividend report here.

- Our valuation report unveils the possibility Civista Bancshares' shares may be trading at a discount.

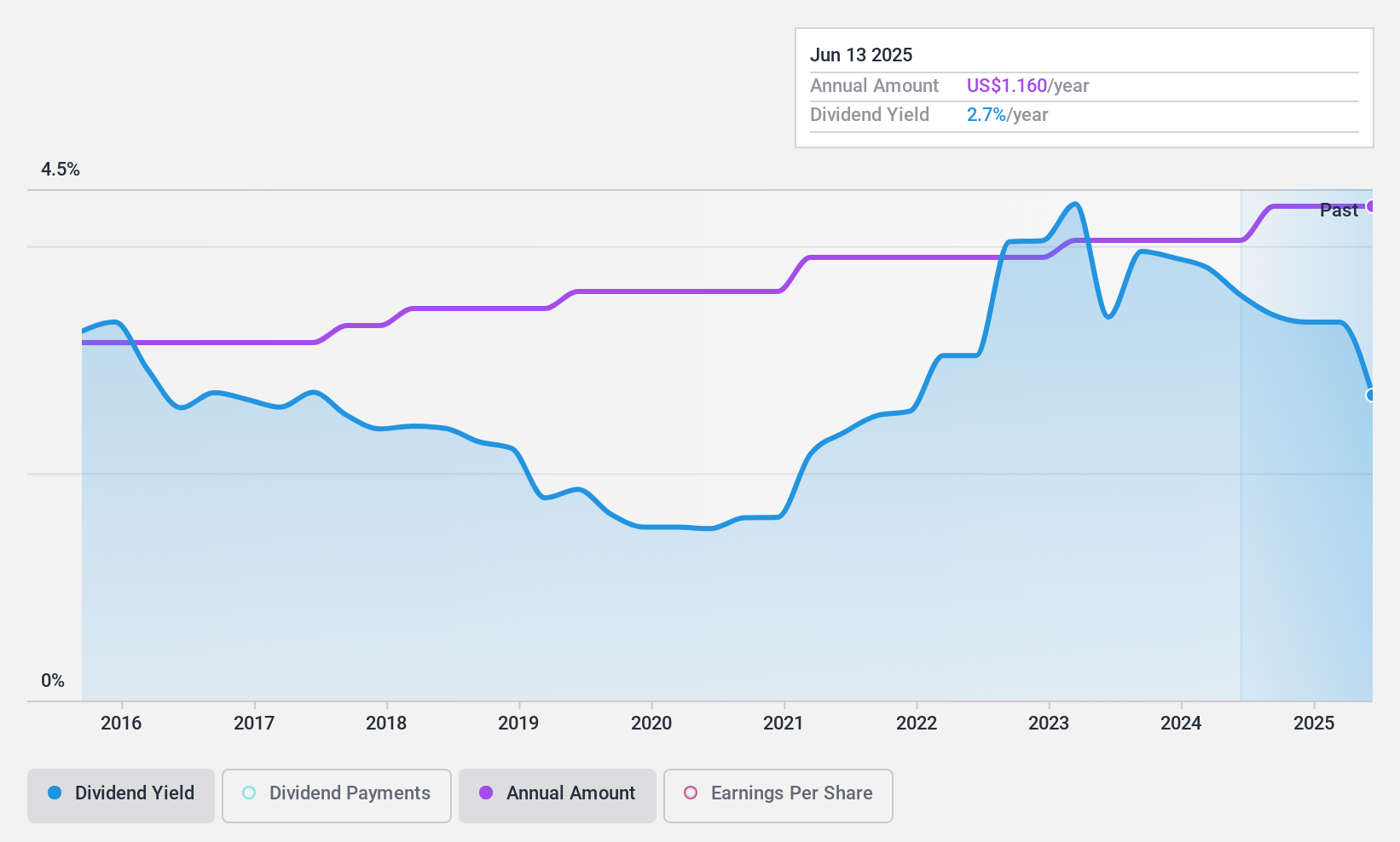

First Capital (NasdaqCM:FCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc., serving as the bank holding company for First Harrison Bank, offers a range of banking services to individual and business customers with a market capitalization of approximately $100.60 million.

Operations: First Capital, Inc. generates its revenue primarily through banking services, amounting to $40.31 million.

Dividend Yield: 3.4%

First Capital maintains a consistent dividend yield of 3.44%, underpinned by a stable decade-long payout history and a low payout ratio of 30.3%, ensuring dividends are well-covered by earnings. Despite its reliability and growth in dividend payments over the years, its yield remains modest compared to the top quartile of U.S. dividend stocks at 4.6%. Recent financials show a dip in net income and interest income, which could impact future payouts, although the company's stock is currently undervalued by 57.5%.

- Take a closer look at First Capital's potential here in our dividend report.

- The analysis detailed in our First Capital valuation report hints at an deflated share price compared to its estimated value.

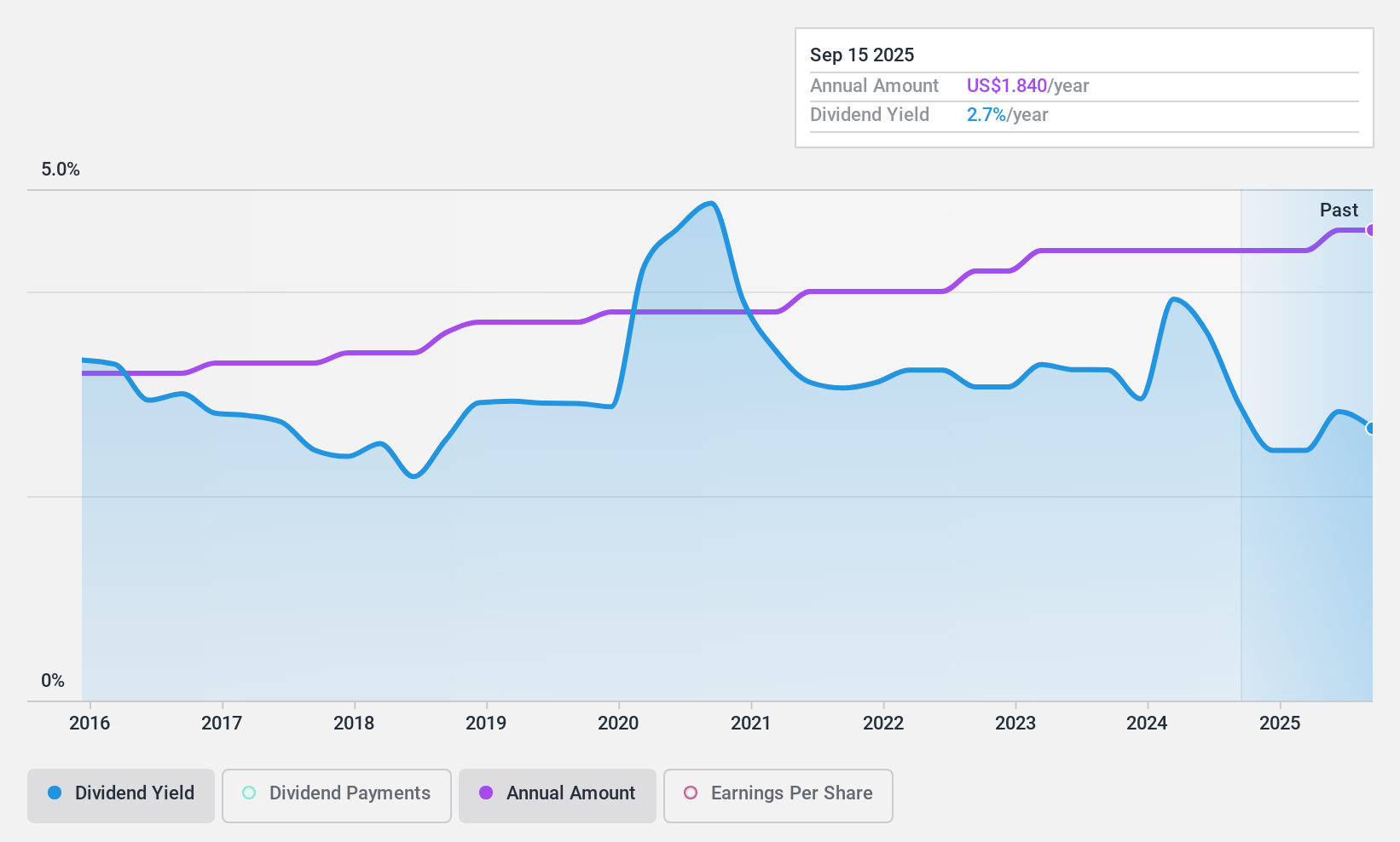

C&F Financial (NasdaqGS:CFFI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&F Financial Corporation serves as the bank holding company for Citizens and Farmers Bank, offering banking services to individuals and businesses, with a market capitalization of approximately $152.45 million.

Operations: C&F Financial Corporation generates revenue through three primary segments: Community Banking at $86.97 million, Consumer Finance at $17.69 million, and Mortgage Banking at $10.96 million.

Dividend Yield: 3.9%

C&F Financial has demonstrated a stable dividend history, with payments growing over the last decade and a current yield of 3.88%. The dividends are well-supported by earnings, given a low payout ratio of 29%. However, its yield lags behind the top quartile in the U.S. market at 4.64%. Recent financials indicate a decrease in net income and interest income from US$24.96 million to US$23.16 million and net income from US$6.5 million to US$3.44 million respectively, which could pose challenges for future dividend sustainability despite its stock trading at 72.6% below estimated fair value.

- Click here to discover the nuances of C&F Financial with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of C&F Financial shares in the market.

Turning Ideas Into Actions

- Embark on your investment journey to our 204 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Civista Bancshares is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CIVB

Civista Bancshares

Operates as the financial holding company for Civista Bank that provides community banking services.

Flawless balance sheet, undervalued and pays a dividend.