Stock Analysis

- United States

- /

- Media

- /

- NasdaqGM:PUBM

Unveiling Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in the U.S. stock market, where tech giants like Nvidia and Alphabet have shown resilience, there exists a keen interest in growth companies with high insider ownership. Such companies often signal strong confidence from those closest to the business, an appealing trait especially in today's volatile market environment.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Let's explore several standout options from the results in the screener.

PubMatic (NasdaqGM:PUBM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PubMatic, Inc. is a technology firm that operates a cloud infrastructure platform facilitating real-time programmatic advertising transactions globally, with a market capitalization of approximately $993.13 million.

Operations: The company generates its revenue primarily from the Internet Information Providers segment, totaling $278.31 million.

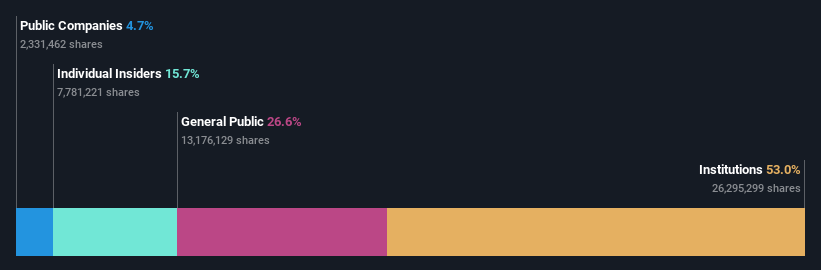

Insider Ownership: 16.8%

PubMatic, a company with high insider ownership, is expected to see its earnings grow by 34.1% annually, outpacing the US market's growth. Despite this promising outlook, its return on equity is forecasted to be low at 7.5% in three years. Recent strategic partnerships and share buybacks indicate proactive management; however, profit margins have declined from last year, and revenue growth projections are moderate at 10.8% annually. Analysts predict a potential stock price increase of 42%.

- Click here and access our complete growth analysis report to understand the dynamics of PubMatic.

- Our valuation report unveils the possibility PubMatic's shares may be trading at a premium.

Amazon.com (NasdaqGS:AMZN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amazon.com, Inc. operates as a global online retailer and provides advertising and subscription services through both digital and physical store formats, with a market capitalization of approximately $1.97 trillion.

Operations: The company's revenue is divided into three main segments: North America which generates $362.29 billion, International at $134.01 billion, and Amazon Web Services (AWS) contributing $94.44 billion.

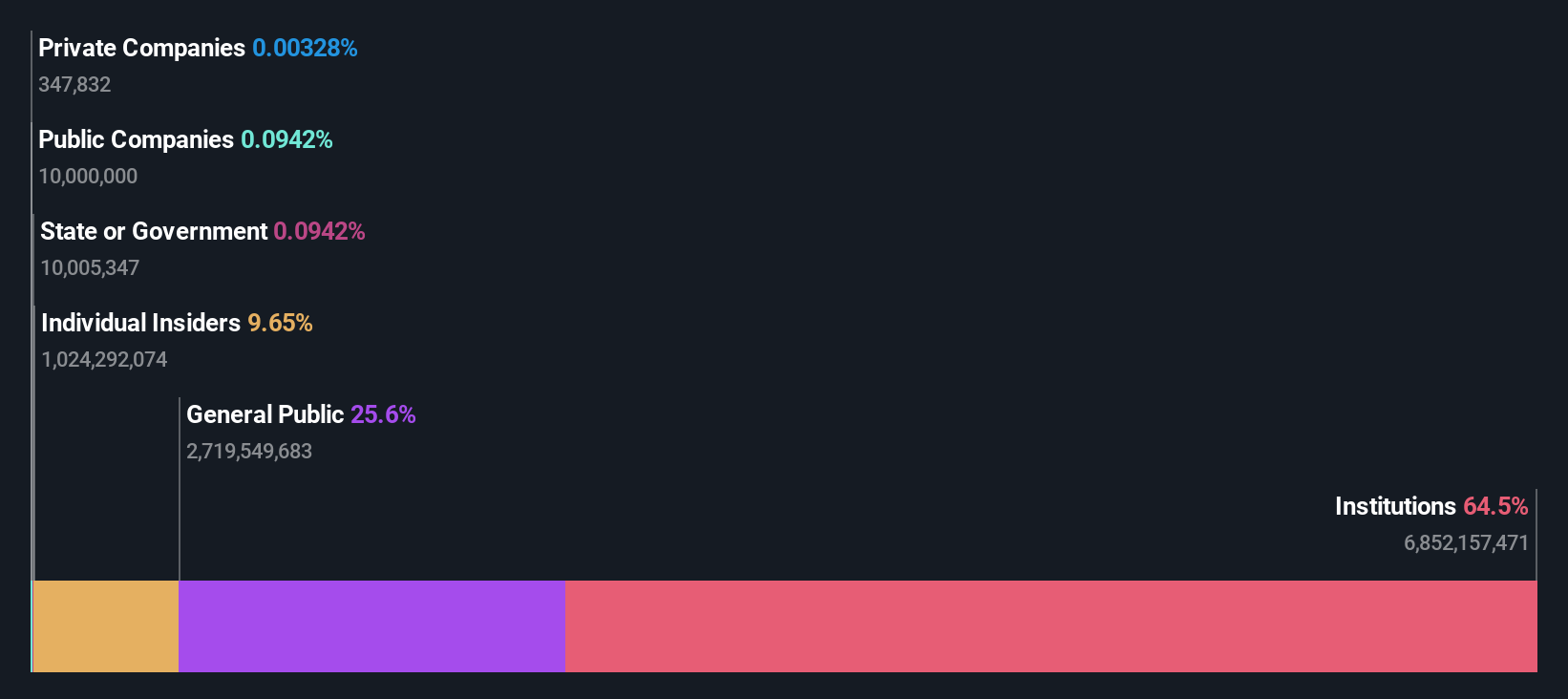

Insider Ownership: 10.8%

Amazon, a significant player in growth companies with high insider ownership, is trading at a 40.6% discount to its estimated fair value. While its return on equity is expected to be low at 18.1% in three years, earnings are projected to grow by 21.38% annually over the same period, outpacing the US market's average of 14.8%. Recent innovations in Amazon Business aim to streamline procurement processes for large organizations through new technology features and system integrations, enhancing efficiency and user experience across multiple countries.

- Click here to discover the nuances of Amazon.com with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Amazon.com shares in the market.

Paymentus Holdings (NYSE:PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. operates globally, offering cloud-based bill payment technology and solutions, with a market capitalization of approximately $2.32 billion.

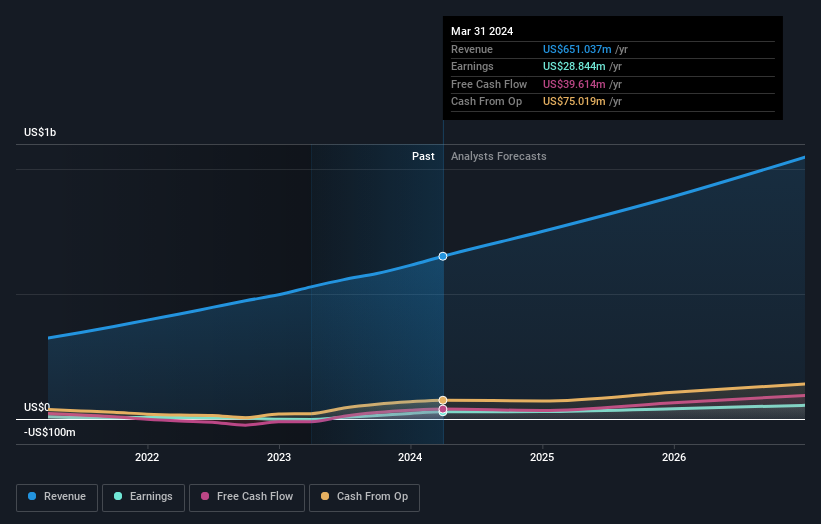

Operations: The company generates revenue primarily through services to financial companies, amounting to $651.04 million.

Insider Ownership: 17.6%

Paymentus Holdings, a contender in the growth companies with high insider ownership sector, has shown promising financial performance. Recently, the company projected its Q2 revenue to be between US$178 million and US$183 million and full-year revenue forecasts suggest figures between US$737 million and US$755 million. Despite a modest return on equity forecast of 13.5% in three years, Paymentus is experiencing robust earnings growth at 21.61% annually, surpassing the U.S market average of 14.8%. Moreover, insider transactions have not been substantial over the past three months.

- Take a closer look at Paymentus Holdings' potential here in our earnings growth report.

- Our valuation report here indicates Paymentus Holdings may be overvalued.

Make It Happen

- Discover the full array of 185 Fast Growing US Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether PubMatic is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PUBM

PubMatic

A technology company, engages in the provision of a cloud infrastructure platform that enables real-time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide.

Flawless balance sheet with reasonable growth potential.