- United States

- /

- Food

- /

- NasdaqGS:JBSS

3 Dividend Stocks In The US Yielding Up To 3.4%

Reviewed by Simply Wall St

As the U.S. stock market grapples with a tech selloff and economic concerns following a disappointing jobs report, investors are increasingly seeking stability in their portfolios. In such volatile times, dividend stocks can offer a reliable income stream and potential for long-term growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.09% | ★★★★★★ |

| WesBanco (NasdaqGS:WSBC) | 4.67% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.05% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.12% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.68% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.72% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.71% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.51% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.57% | ★★★★★★ |

Click here to see the full list of 180 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

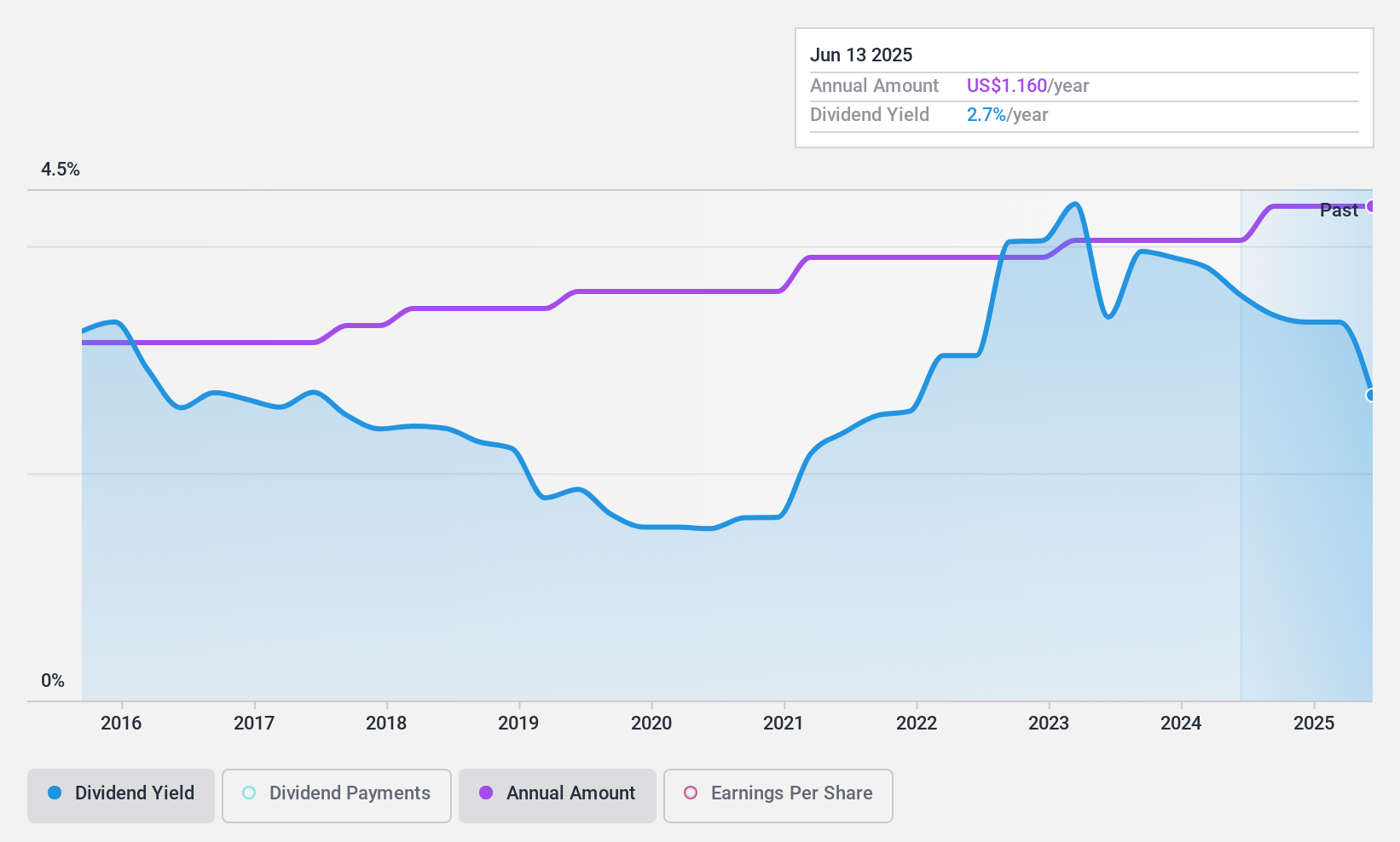

First Capital (NasdaqCM:FCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc. (NasdaqCM:FCAP) operates as the bank holding company for First Harrison Bank, offering a range of banking services to individuals and businesses, with a market cap of $111.39 million.

Operations: First Capital, Inc. generates its revenue primarily from its banking segment, totaling $40.80 million.

Dividend Yield: 3.5%

First Capital's dividends have grown steadily over the past decade, with a recent 7.4% increase to US$0.29 per share, payable on September 27, 2024. Despite a relatively low yield of 3.49%, its payout ratio is a sustainable 30%. The stock trades at 61.1% below estimated fair value and has consistently reliable dividend payments, though there is insufficient data to predict future coverage or sustainability beyond three years.

- Click here and access our complete dividend analysis report to understand the dynamics of First Capital.

- The analysis detailed in our First Capital valuation report hints at an deflated share price compared to its estimated value.

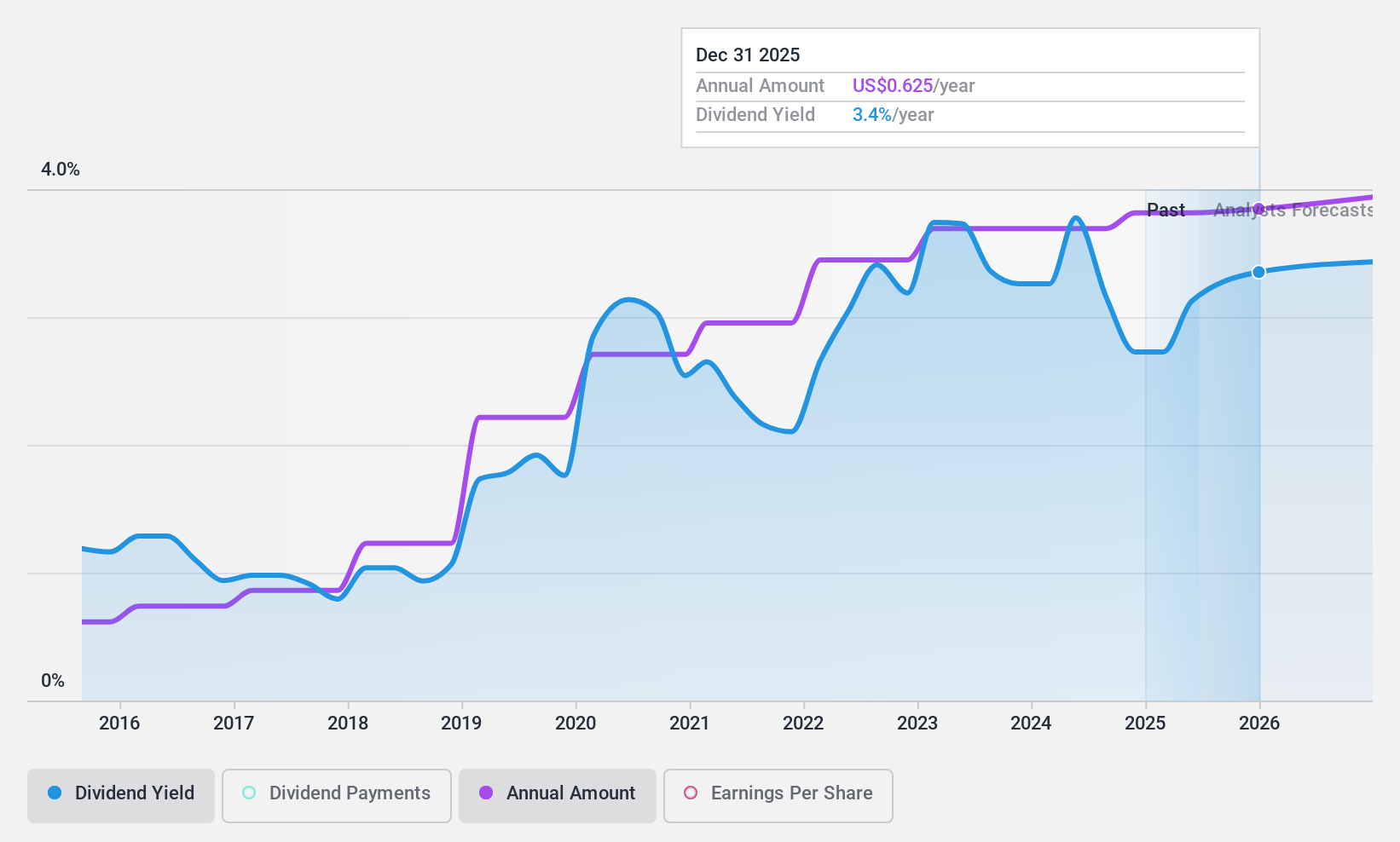

First National (NasdaqCM:FXNC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First National Corporation, with a market cap of $109.28 million, operates as the bank holding company for First Bank, offering a range of commercial banking services to small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations in Virginia.

Operations: First National Corporation generates $49.19 million in revenue from its banking services segment.

Dividend Yield: 3.4%

First National Corporation declared a quarterly dividend of $0.15 per share, payable on September 13, 2024. Despite a lower yield of 3.45%, the company has maintained stable and growing dividends over the past decade with a reasonable payout ratio of 47.5%. However, recent earnings reports show declining net income and increased net charge-offs, which may impact future dividend sustainability. The stock trades at 58.2% below estimated fair value and is considering a merger with Touchstone Bank.

- Dive into the specifics of First National here with our thorough dividend report.

- Our valuation report here indicates First National may be undervalued.

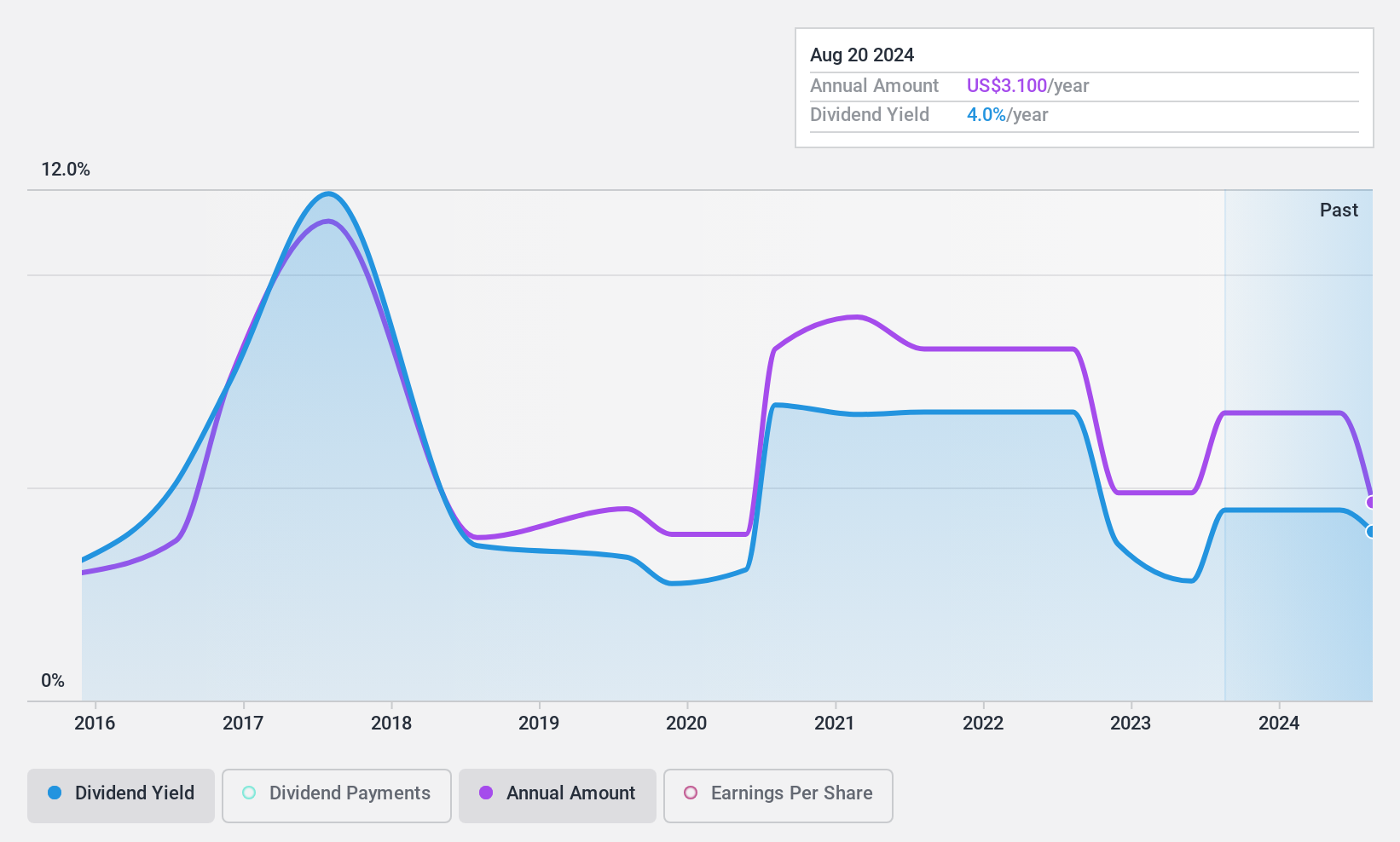

John B. Sanfilippo & Son (NasdaqGS:JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., with a market cap of $1.11 billion, processes and distributes tree nuts and peanuts in the United States through its subsidiary JBSS Ventures, LLC.

Operations: John B. Sanfilippo & Son, Inc. generates $1.07 billion in revenue from selling various nut and nut-related products in the United States through its subsidiary JBSS Ventures, LLC.

Dividend Yield: 3.3%

John B. Sanfilippo & Son declared an annual dividend of $0.85 per share and a special dividend of $1.25 per share, totaling approximately US$24.6 million to be paid on September 11, 2024. Despite a low payout ratio of 16.4% and adequate cash flow coverage (49%), the company's dividends have been volatile over the past decade, with significant drops exceeding 20%. The stock trades at a discount of 17.7% below estimated fair value.

- Navigate through the intricacies of John B. Sanfilippo & Son with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of John B. Sanfilippo & Son shares in the market.

Key Takeaways

- Gain an insight into the universe of 180 Top US Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBSS

John B. Sanfilippo & Son

Through its subsidiary, JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States.

Flawless balance sheet average dividend payer.