- United States

- /

- Banks

- /

- NasdaqGS:FBNC

How Strong Net Interest Income Growth Will Impact First Bancorp (FBNC) Investors

Reviewed by Simply Wall St

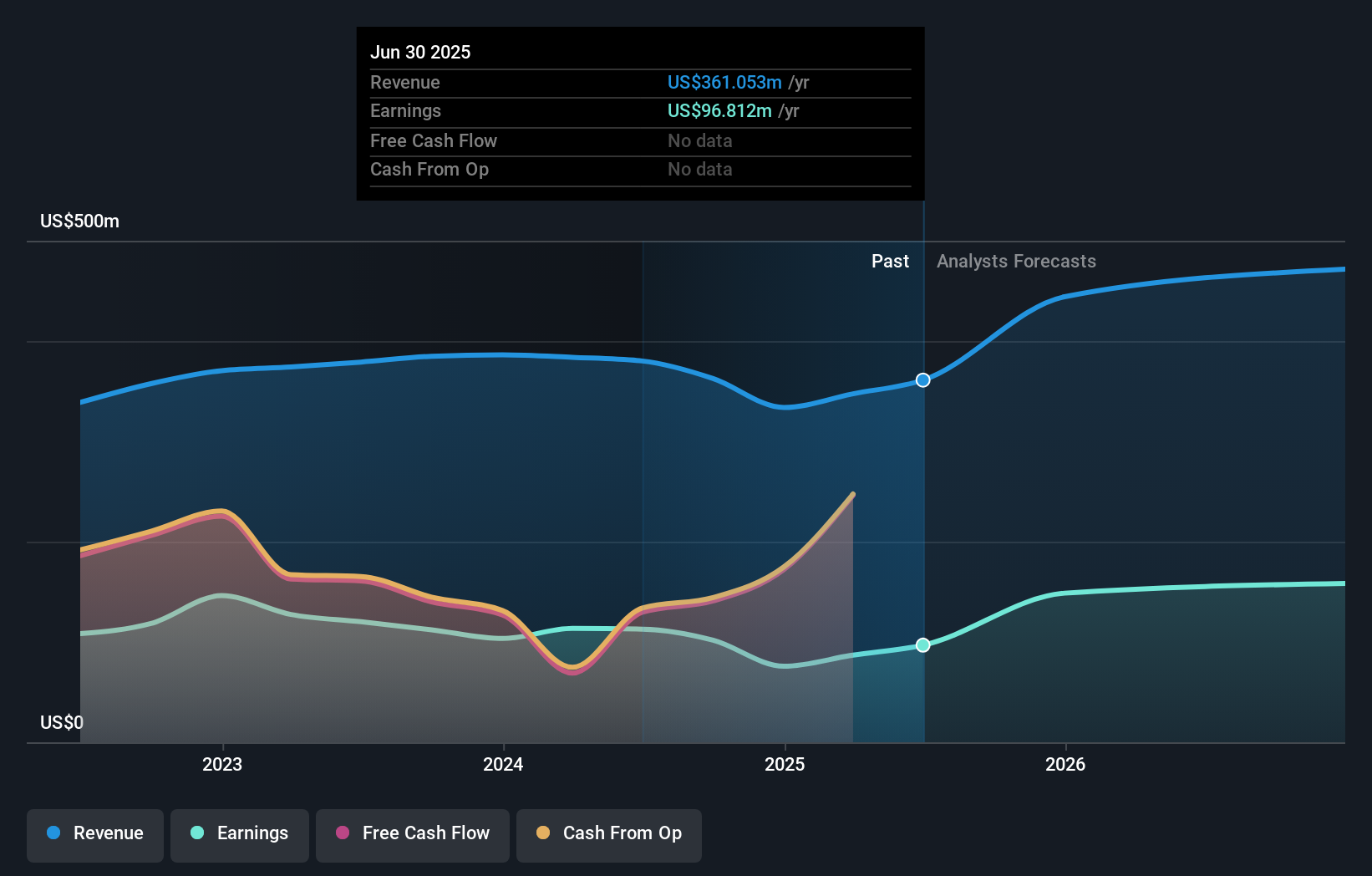

- First Bancorp recently announced its earnings for the second quarter and first half of 2025, reporting net interest income of US$96.68 million for the quarter and net income of US$38.57 million, both higher than the same period last year.

- This performance also resulted in basic and diluted earnings per share from continuing operations rising to US$0.93 for the quarter and US$1.81 for the first six months, reflecting significant growth year-over-year.

- We'll look at how the strong increases in net interest income may shape First Bancorp's investment narrative going forward.

What Is First Bancorp's Investment Narrative?

For someone considering First Bancorp, the overarching question is whether the company can sustain its current momentum amid shifting banking sector pressures. The most recent earnings release signals a shift in the short-term outlook: with net interest income and net income both meaningfully higher year-over-year, the company is signaling operational resilience just as analysts had earlier flagged slowing revenue growth and expense headwinds. The strong results, coupled with a 5% single-day share price jump, could boost sentiment and recalibrate near-term catalysts, including further attention on loan growth and credit quality. However, while the increased dividend payout and steady buybacks may appeal to income-focused investors, drivers like board refreshment and recently expanded executive leadership still bring execution risks. The latest set of results alters the immediate risk-reward balance, but questions around the cost of credit and whether higher earnings can be maintained remain crucial for investors to consider.

By contrast, the impact of net charge-offs is a key area investors should watch going forward.

Exploring Other Perspectives

Explore 3 other fair value estimates on First Bancorp - why the stock might be worth just $49.94!

Build Your Own First Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Bancorp's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives