- United States

- /

- Oil and Gas

- /

- NasdaqCM:PNRG

Undiscovered Gems in the US Market for July 2025

Reviewed by Simply Wall St

The United States market has shown a robust performance, climbing by 1.7% over the past week and achieving an impressive 18% increase in the last year, with earnings anticipated to grow by 15% per annum in the coming years. In this dynamic environment, identifying stocks that are undervalued yet poised for growth can offer unique opportunities for investors seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Esquire Financial Holdings (ESQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services primarily to legal and small businesses as well as commercial and retail customers in the United States, with a market cap of approximately $827.20 million.

Operations: Esquire Financial Holdings generates revenue primarily through its community banking segment, which reported $124.13 million. The company has a market cap of approximately $827.20 million.

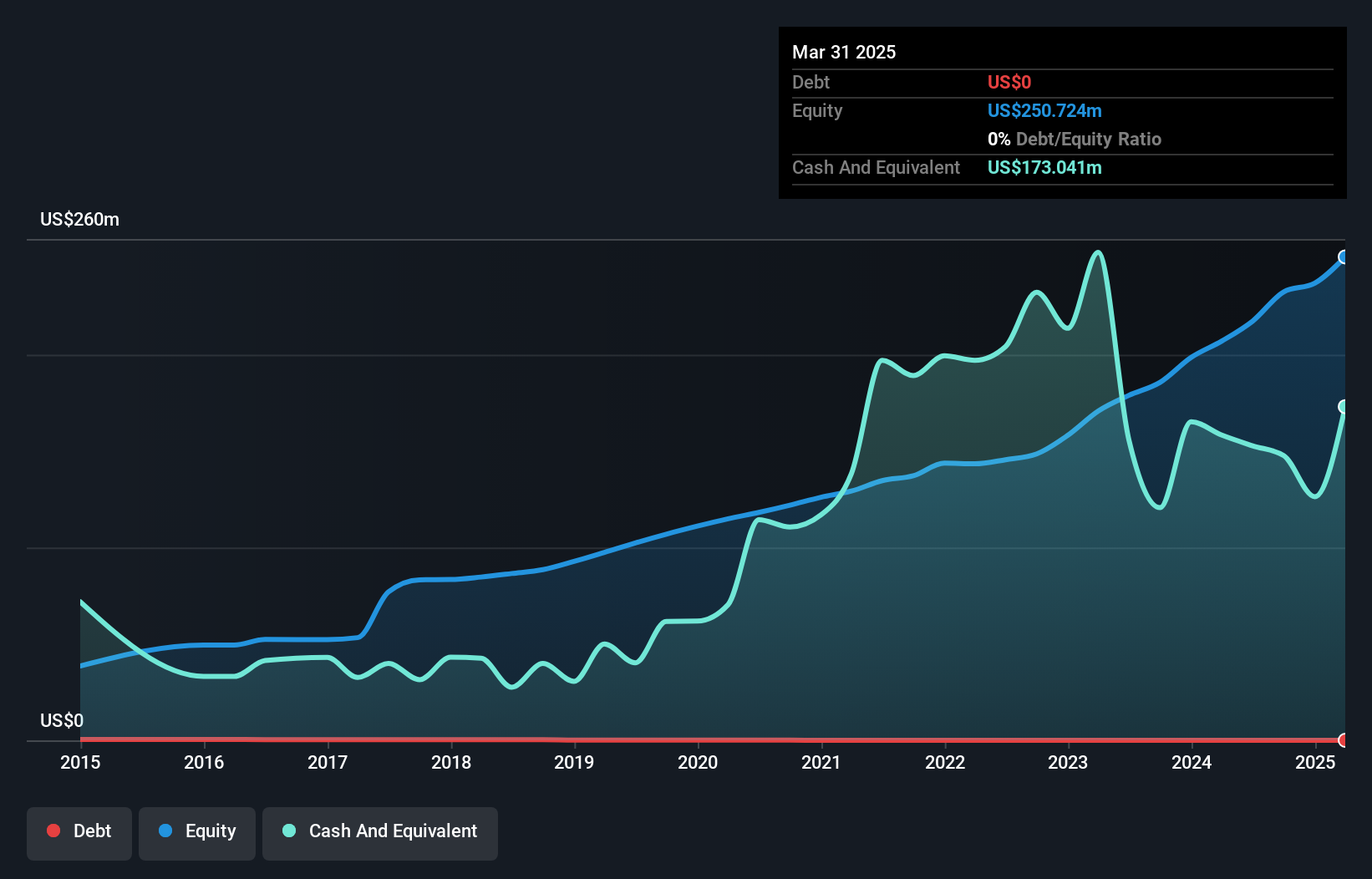

Esquire Financial Holdings, with total assets of US$2 billion and equity of US$250.7 million, stands out for its robust financial health. Its total deposits amount to US$1.7 billion, while loans reach US$1.4 billion, supported by a sufficient bad loan allowance at 0.6%. Despite being dropped from several Russell indices recently, Esquire's earnings growth over the past year hit 15.7%, outpacing the industry average of 7.2%. The company trades at an attractive valuation, approximately 44% below estimated fair value, and maintains high-quality earnings with primarily low-risk funding sources comprising 99% customer deposits.

PrimeEnergy Resources (PNRG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PrimeEnergy Resources Corporation, with a market cap of $269.37 million, operates in the United States focusing on the acquisition, development, and production of oil and natural gas properties through its subsidiaries.

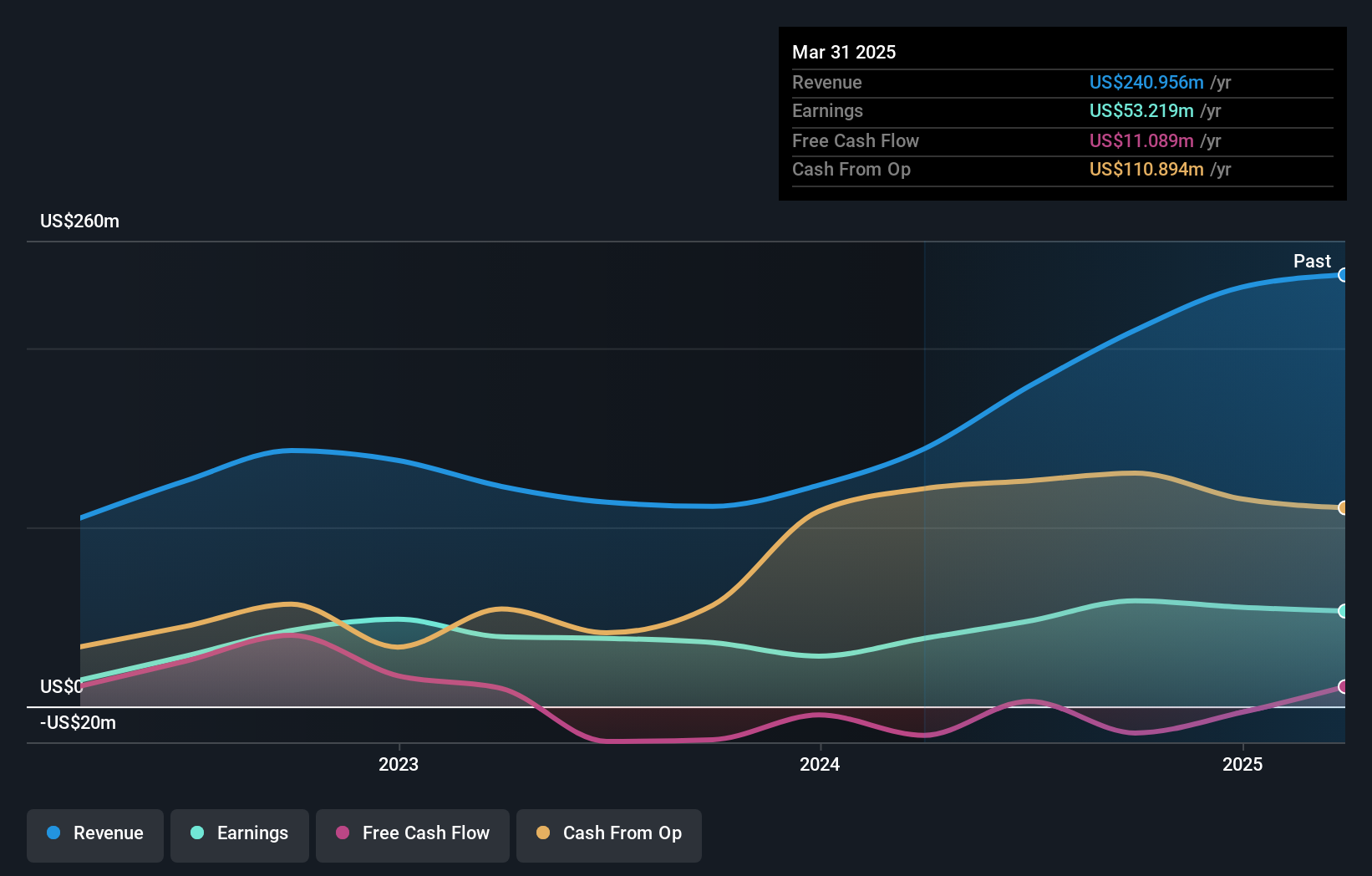

Operations: PrimeEnergy Resources generates revenue primarily from its oil and gas exploration, development, operation, and servicing activities, totaling $240.96 million.

PrimeEnergy Resources, a nimble player in the energy sector, has demonstrated notable financial resilience. Over the past five years, its debt to equity ratio impressively decreased from 52.2% to 3.2%, indicating prudent financial management. The company also boasts a strong interest coverage ratio of 34.5x through EBIT, ensuring its debt obligations are well managed. Recent earnings growth of 40% outpaced the industry average and reflects robust operational performance despite broader market challenges. Additionally, PrimeEnergy's inclusion in multiple Russell indices highlights growing recognition within investment circles, potentially enhancing visibility and investor confidence moving forward.

- Take a closer look at PrimeEnergy Resources' potential here in our health report.

Assess PrimeEnergy Resources' past performance with our detailed historical performance reports.

Power Solutions International (PSIX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of $1.92 billion.

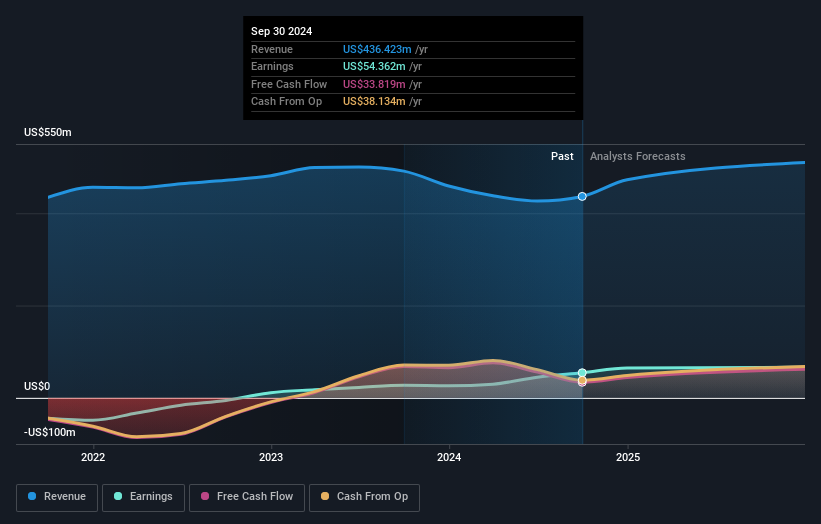

Operations: Power Solutions International generates revenue primarily from its Engineered Integrated Electrical Power Generation Systems segment, which contributes $516.17 million.

Power Solutions International has been making waves, recently joining multiple Russell indexes, highlighting its growing recognition. The company reported a significant rise in sales for the first quarter of 2025 at US$135 million, up from US$95 million the previous year. Net income also saw an impressive jump to US$19 million from US$7 million. Despite a high net debt to equity ratio of 72%, interest payments are well-covered with EBIT at 9.2 times coverage. Its earnings growth of 173% outpaces the industry average, though future earnings are forecasted to decline by an average of 4% annually over three years.

- Delve into the full analysis health report here for a deeper understanding of Power Solutions International.

Understand Power Solutions International's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 284 US Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PNRG

PrimeEnergy Resources

Through its subsidiaries, engages in acquisition, development, and production of oil and natural gas properties in the United States.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives