- United States

- /

- Insurance

- /

- NYSE:EIG

Exploring Undiscovered Gems in the United States January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust 24% rise over the past 12 months with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks that are undervalued or overlooked can present unique opportunities for investors seeking to capitalize on potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 30.23% | 231.46% | 41.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Esquire Financial Holdings (NasdaqCM:ESQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services primarily to the legal industry, small businesses, and retail customers in the United States with a market cap of approximately $670.25 million.

Operations: Esquire Financial Holdings generates revenue primarily through its community banking segment, which amounts to $120.12 million. The company focuses on serving the legal industry, small businesses, and retail customers across the United States.

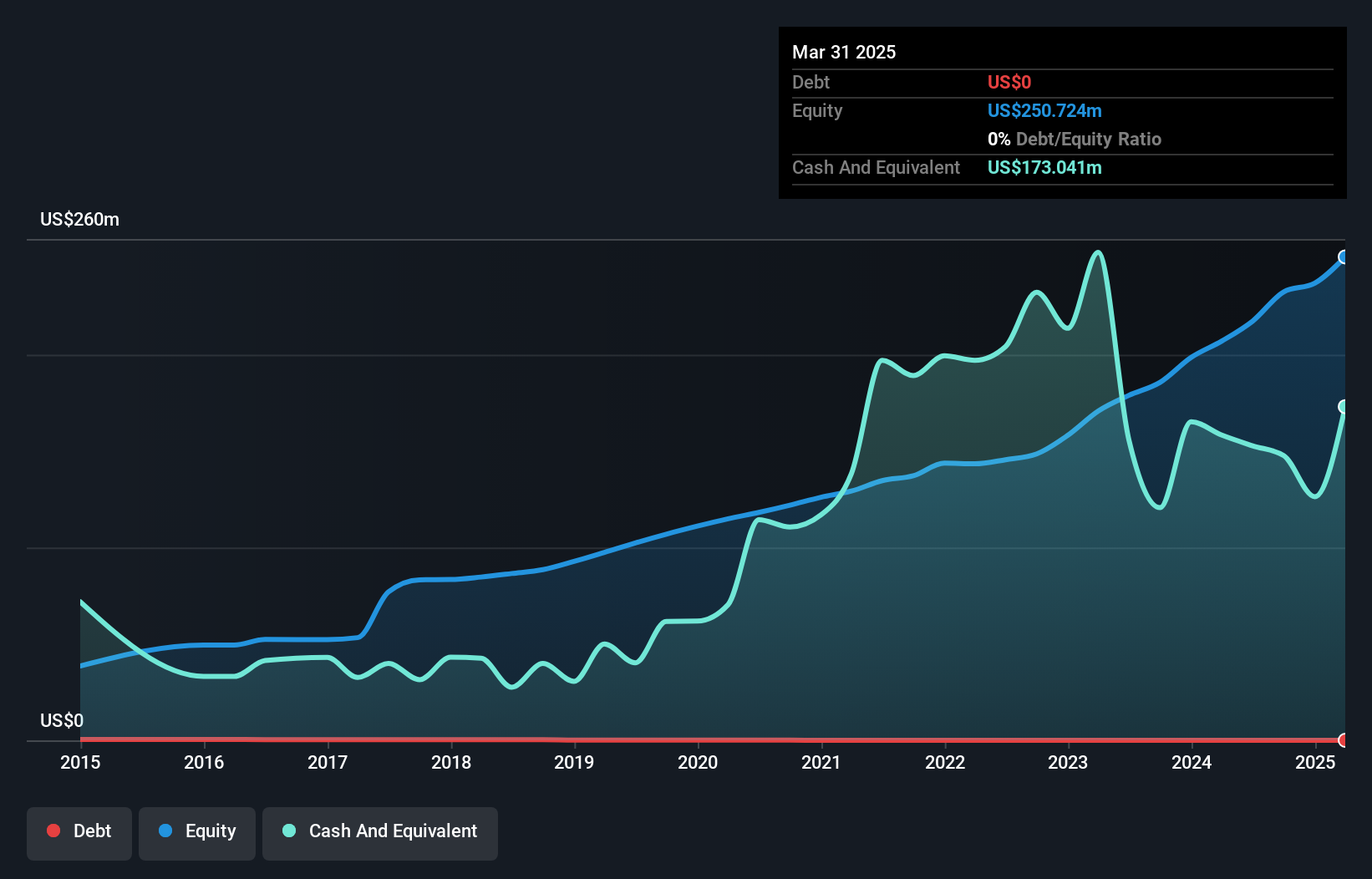

Esquire Financial Holdings, with total assets of US$1.9 billion and equity of US$237.1 million, stands out for its robust financial health and growth potential. The bank's net interest margin is 6.1%, supported by low-risk funding sources—99% from customer deposits—and a sufficient bad loan allowance at 0.8% of total loans. Earnings grew by 6.5% last year, surpassing the industry average of -4.3%. Recently, Esquire increased its quarterly dividend by 17% to US$0.175 per share, reflecting confidence in future earnings growth projected at 9.76% annually.

Greene County Bancorp (NasdaqCM:GCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Greene County Bancorp, Inc. is a holding company for The Bank of Greene County, offering a range of financial services in the United States, with a market cap of $466.54 million.

Operations: Greene County Bancorp generates revenue primarily from its thrift and savings loan institutions, amounting to $65.85 million.

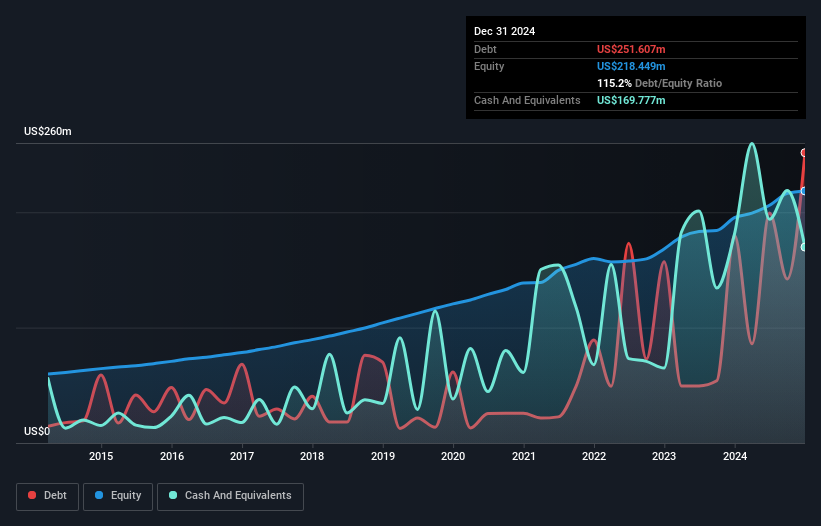

Greene County Bancorp, with assets totaling US$3 billion and equity of US$218.4 million, presents a robust financial profile. The bank's liabilities are largely low-risk, primarily funded by customer deposits. It maintains a sufficient allowance for bad loans at 492% and has an appropriate level of non-performing loans at 0.3%. Trading at 29% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Despite a slight negative earnings growth of -1.4%, it outperformed the industry average decline of -4.3%, indicating resilience in challenging conditions within the banking sector.

- Delve into the full analysis health report here for a deeper understanding of Greene County Bancorp.

Employers Holdings (NYSE:EIG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Employers Holdings, Inc. operates in the commercial property and casualty insurance industry primarily in the United States, with a market capitalization of approximately $1.23 billion.

Operations: Employers Holdings generates revenue primarily from its insurance operations, which amounted to $889.80 million. The company's net profit margin is a key financial indicator to consider when assessing its profitability in the commercial property and casualty insurance sector.

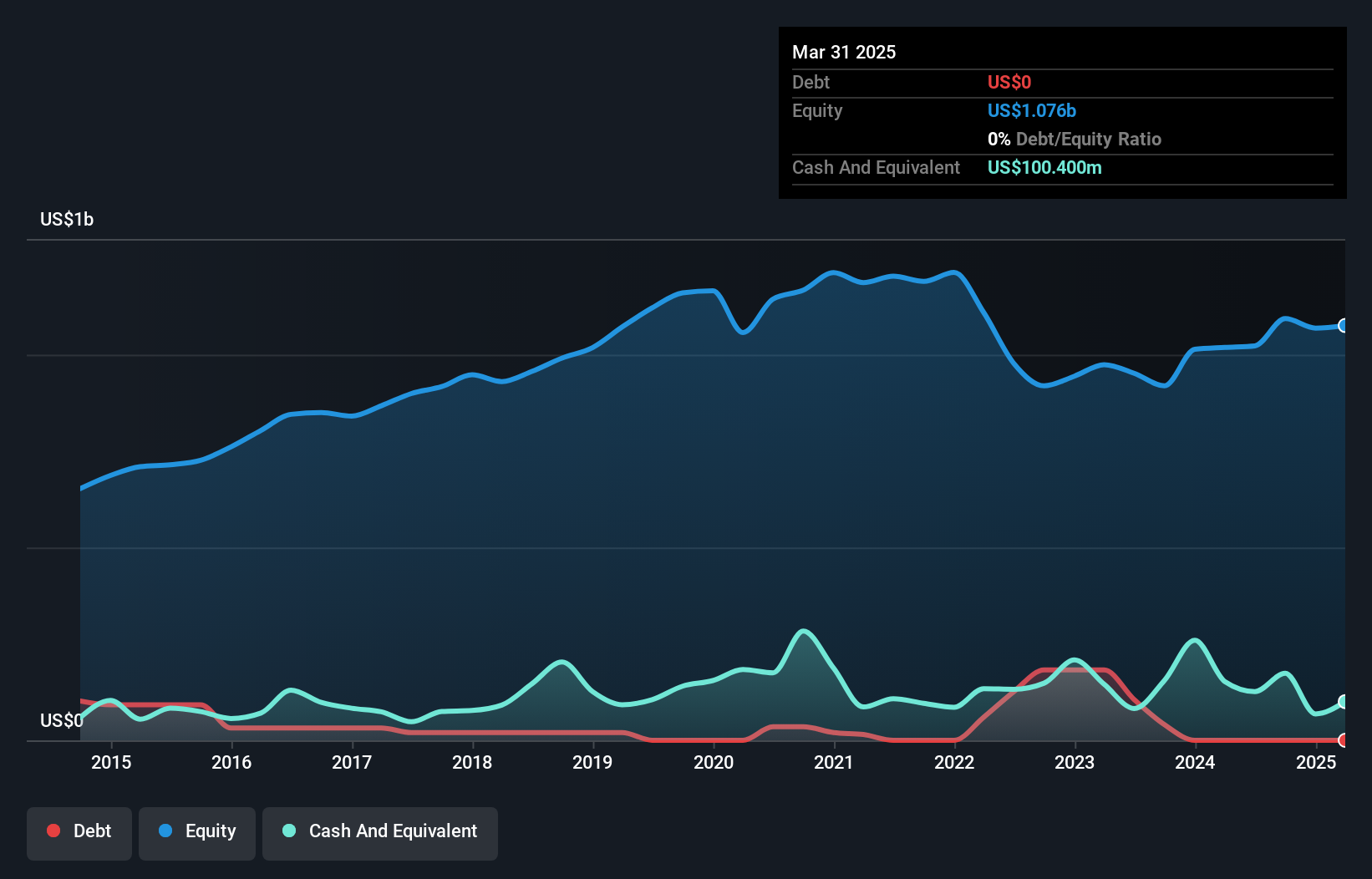

Employers Holdings, a player in the U.S. commercial property and casualty insurance market, is navigating some hurdles that might impact its financial health. The company has seen an 8% dip in gross premiums written, which could affect income stability. Analysts foresee a modest annual revenue growth of 1.4% over the next three years but expect profit margins to shrink from 15% to 8%. Despite these challenges, Employers Holdings maintains strong earnings quality and cost management strategies while exploring new market opportunities. With shares currently priced at US$51.23, there's an estimated upside potential to US$56 based on future earnings projections.

Key Takeaways

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 276 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Employers Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EIG

Employers Holdings

Through its subsidiaries, provides workers' compensation insurance and services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives