- United States

- /

- Banks

- /

- NasdaqCM:ESQ

Discovering Undiscovered Gems 3 Promising US Stocks

Reviewed by Simply Wall St

As the U.S. stock market grapples with renewed trade tensions and fluctuating indices, investors are increasingly looking towards smaller companies for potential opportunities amidst the volatility. In this environment, identifying promising stocks often involves seeking out those with strong fundamentals and unique value propositions that can withstand broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation, with a market cap of $290.37 million, operates as the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients.

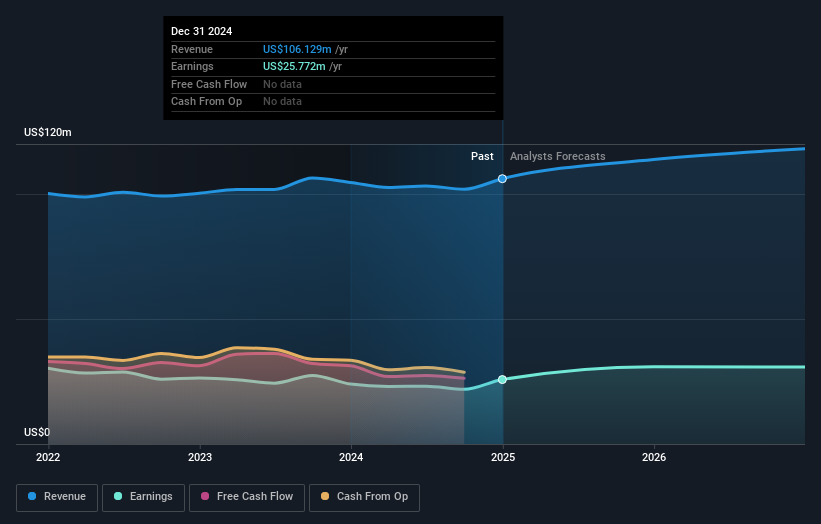

Operations: Citizens & Northern Corporation generates revenue primarily through its Community Banking segment, which reported $108.11 million in revenue. The company's net profit margin reflects the efficiency of its operations and financial management strategies.

Citizens & Northern, with assets totaling $2.6 billion and equity of $281.8 million, stands out in its sector for several reasons. Its earnings grew by 16% last year, surpassing the industry average of 5.2%. The bank's loans are $1.9 billion with a net interest margin of 3.3%. Despite having a low allowance for bad loans at 84%, it maintains an appropriate level of non-performing loans at 1.3% of total loans, reflecting solid risk management practices. Trading at nearly half its estimated fair value and backed by primarily low-risk funding sources, it shows potential as an undervalued opportunity in the financial landscape.

- Take a closer look at Citizens & Northern's potential here in our health report.

Assess Citizens & Northern's past performance with our detailed historical performance reports.

Esquire Financial Holdings (NasdaqCM:ESQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services to legal and small businesses as well as commercial and retail customers in the United States, with a market cap of $711.59 million.

Operations: Esquire Financial Holdings generates revenue primarily from its community banking segment, which reported $124.13 million.

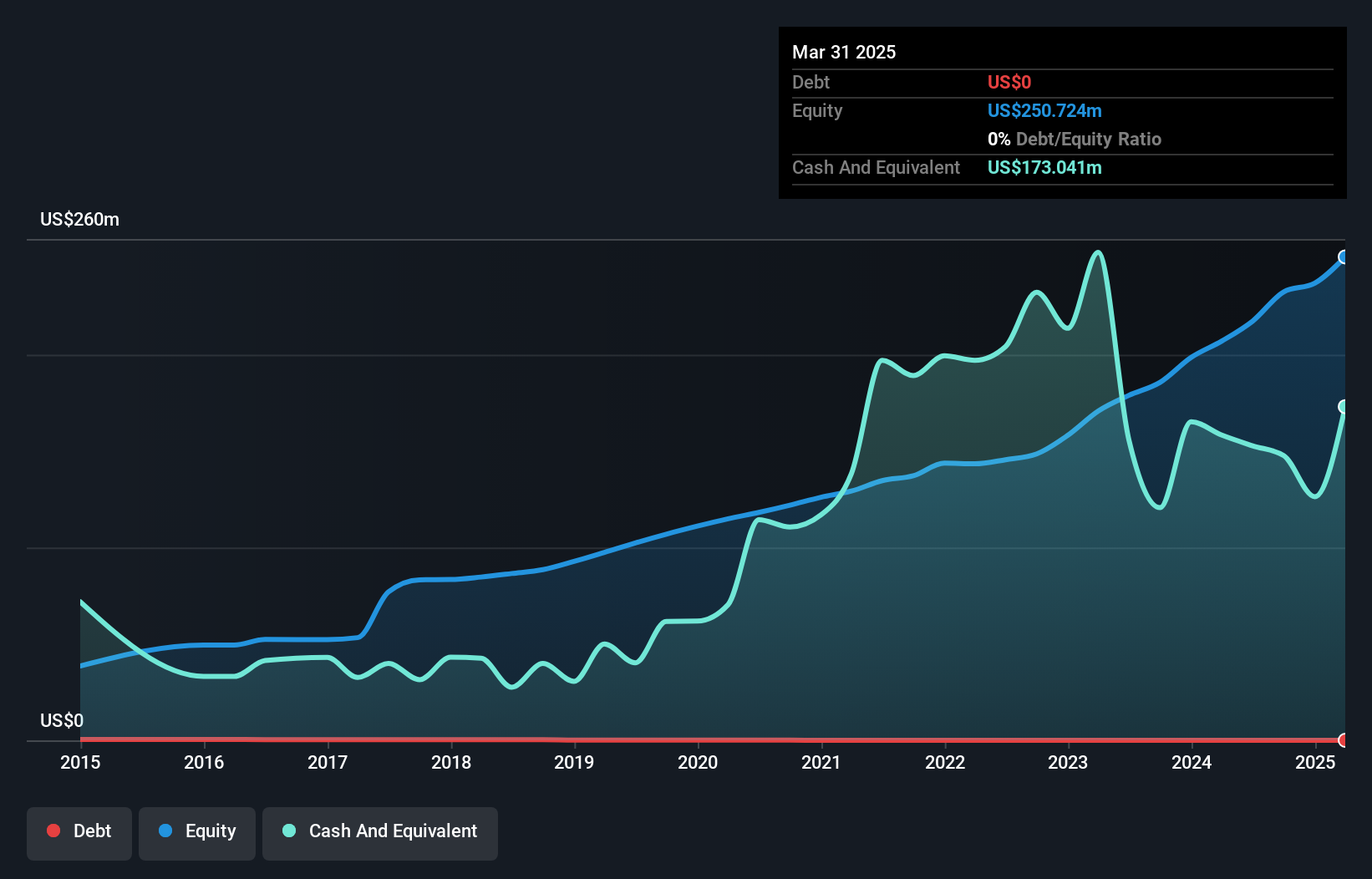

Esquire Financial Holdings, with assets totaling US$2.0 billion and equity of US$250.7 million, presents a compelling opportunity in the financial sector. The company boasts total deposits of US$1.7 billion and loans amounting to US$1.4 billion, while maintaining a net interest margin of 6.1%. Its allowance for bad loans is robust at 243%, covering non-performing loans which are just 0.6% of total loans, indicating sound risk management practices. Recently added to the S&P Regional Banks Select Industry Index, Esquire's strategic alliance with Fortress Investment Group aims to enhance lending solutions for law firms, potentially driving further growth in earnings already up 15.7% from last year.

- Unlock comprehensive insights into our analysis of Esquire Financial Holdings stock in this health report.

Gain insights into Esquire Financial Holdings' past trends and performance with our Past report.

Colony Bankcorp (NYSE:CBAN)

Simply Wall St Value Rating: ★★★★★★

Overview: Colony Bankcorp, Inc. is the bank holding company for Colony Bank, offering a range of banking products and services to retail and commercial clients in the U.S., with a market cap of approximately $268.45 million.

Operations: Colony Bankcorp generates revenue primarily through its Banking Division, which contributes $93.03 million, followed by the Small Business Specialty Lending Division at $14.11 million and the Mortgage Banking Division at $6.62 million.

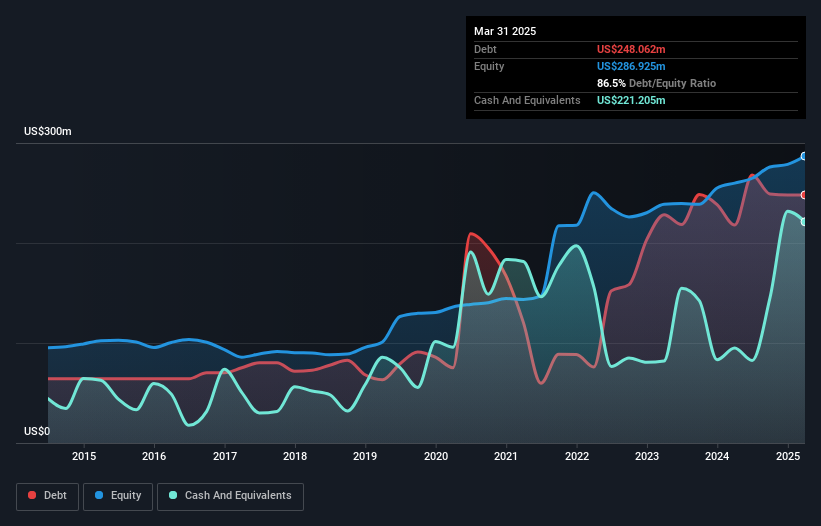

Colony Bankcorp, with total assets of US$3.2 billion and equity of US$286.9 million, stands out for its robust financial health. The company boasts a sufficient allowance for bad loans at 160% and keeps non-performing loans low at 0.6%. Trading at 42.5% below its estimated fair value, it offers good relative value compared to peers in the industry. Earnings grew by 14.1%, surpassing the industry average of 5.1%, while maintaining primarily low-risk funding sources with customer deposits making up 91% of liabilities, reflecting strong operational stability and growth potential in a competitive market landscape.

Turning Ideas Into Actions

- Get an in-depth perspective on all 284 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Esquire Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESQ

Esquire Financial Holdings

Operates as the bank holding company for Esquire Bank, National Association that provides commercial banking products and services to legal and small businesses, and commercial and retail customers in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives