- United States

- /

- Banks

- /

- NasdaqGS:EBTC

Undiscovered Gems in the US for January 2025

Reviewed by Simply Wall St

The United States market has shown impressive growth, rising 24% over the past year despite remaining flat over the last week, with earnings anticipated to increase by 15% annually in the coming years. In this dynamic environment, identifying stocks that have yet to capture widespread attention can offer unique opportunities for investors seeking to capitalize on potential future growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 30.23% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Health In Tech (NasdaqCM:HIT)

Simply Wall St Value Rating: ★★★★★★

Overview: Health In Tech, Inc. operates as an insurance technology platform company with a market cap of $314.68 million.

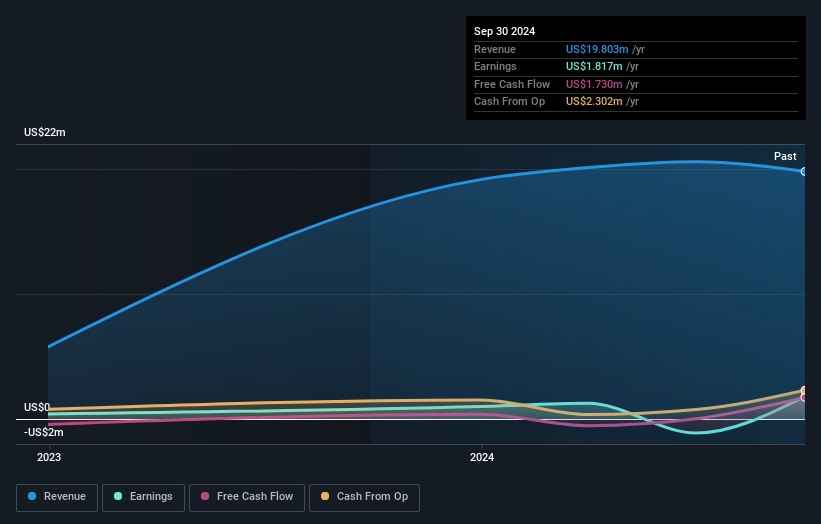

Operations: Health In Tech generates revenue primarily from its Insurance Brokers segment, which recorded $19.80 million. The company's financial performance is influenced by its ability to manage costs associated with this revenue stream.

Health In Tech, a nimble player in the insurance sector, has showcased remarkable earnings growth of 114.8% over the past year, significantly outpacing the industry average of 29.9%. The company remains debt-free, which eliminates concerns about interest coverage and enhances its financial stability. Recently added to the NASDAQ Composite Index following a $9.2 million IPO at $4 per share, Health In Tech is leveraging strategic collaborations to introduce competitively priced health plans through its eDIYBS platform. This initiative aims to enhance affordability and accessibility in healthcare for underserved populations starting January 2025.

- Click to explore a detailed breakdown of our findings in Health In Tech's health report.

Explore historical data to track Health In Tech's performance over time in our Past section.

Karooooo (NasdaqCM:KARO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Karooooo Ltd. offers a mobility software-as-a-service platform for connected vehicles across multiple regions including South Africa, Europe, and the United States, with a market cap of approximately $1.41 billion.

Operations: Karooooo Ltd. generates revenue primarily through its Cartrack segment, contributing ZAR 3.99 billion, and Karooooo Logistics, adding ZAR 403.12 million. The company's financial structure includes a segment adjustment of ZAR 38.09 million.

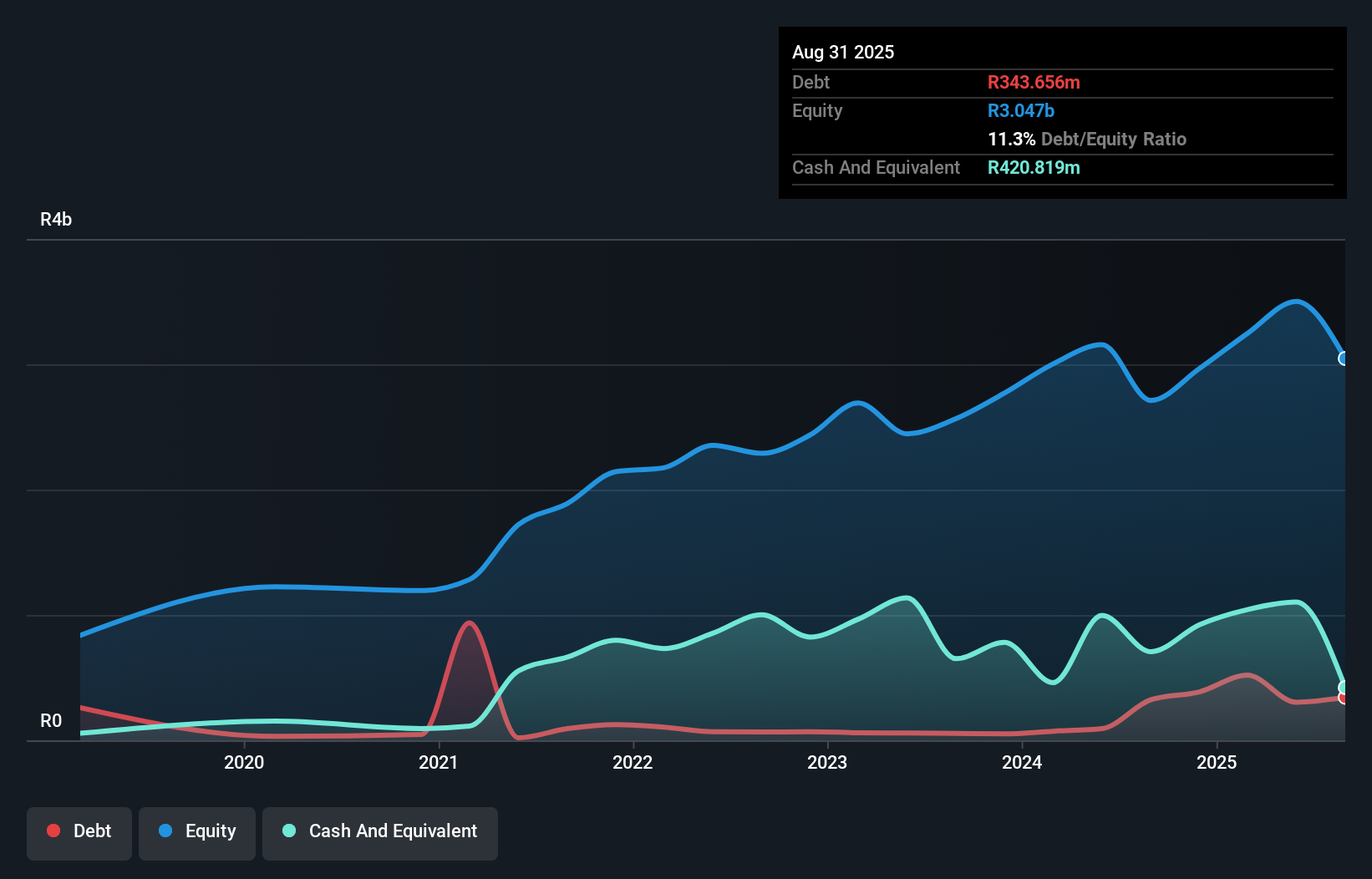

Karooooo is making strategic moves, focusing on Southeast Asia and Europe to boost its market presence with AI-driven SaaS for fleet management. Over the past year, earnings grew by 30.9%, outpacing the Software industry’s 24.6%. The company holds more cash than its total debt, indicating a strong financial position despite a rising debt-to-equity ratio from 7.8% to 13% over five years. With a price-to-earnings ratio of 30.5x below the industry average of 44.5x, Karooooo appears undervalued relative to peers while aiming for further growth through expansion efforts that could face execution risks and currency impacts.

Enterprise Bancorp (NasdaqGS:EBTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Enterprise Bancorp, Inc. is the holding company for Enterprise Bank and Trust Company, offering commercial banking products and services with a market cap of $517.08 million.

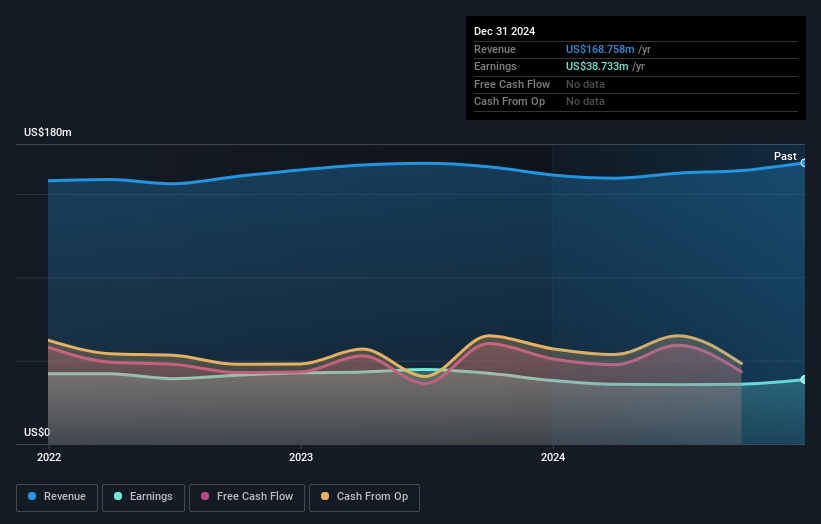

Operations: The company's primary revenue stream is derived from its banking segment, generating $168.76 million. The financial performance is reflected in a market cap of $517.08 million.

Enterprise Bancorp, with assets totaling US$4.8 billion and equity of US$360.7 million, has been demonstrating solid financial health. Total deposits stand at US$4.2 billion, while loans are valued at US$3.9 billion, supported by a net interest margin of 3.5%. The company benefits from low-risk funding sources as 94% of liabilities are customer deposits and maintains an appropriate bad loan ratio at 0.7%, backed by a sufficient allowance for bad loans at 238%. Recently announced merger plans with Independent Bank Corp., valued around $562 million, could potentially enhance its strategic positioning in the market upon completion in late 2025.

- Delve into the full analysis health report here for a deeper understanding of Enterprise Bancorp.

Evaluate Enterprise Bancorp's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 276 US Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBTC

Enterprise Bancorp

Operates as the holding company for Enterprise Bank and Trust Company that engages in the provision of commercial banking products and services.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives