- United States

- /

- Banks

- /

- NasdaqGS:WABC

CVB Financial And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the United States market experiences slight fluctuations amid ongoing U.S.-China tariff discussions and Federal Reserve interest rate decisions, investors are keenly observing potential impacts on major indices like the Dow Jones and S&P 500. In such a dynamic environment, dividend stocks can offer stability and reliable income streams, making them an appealing option for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.99% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.18% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.90% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.22% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.99% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.41% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 4.98% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.98% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.07% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.29% | ★★★★★☆ |

Click here to see the full list of 148 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

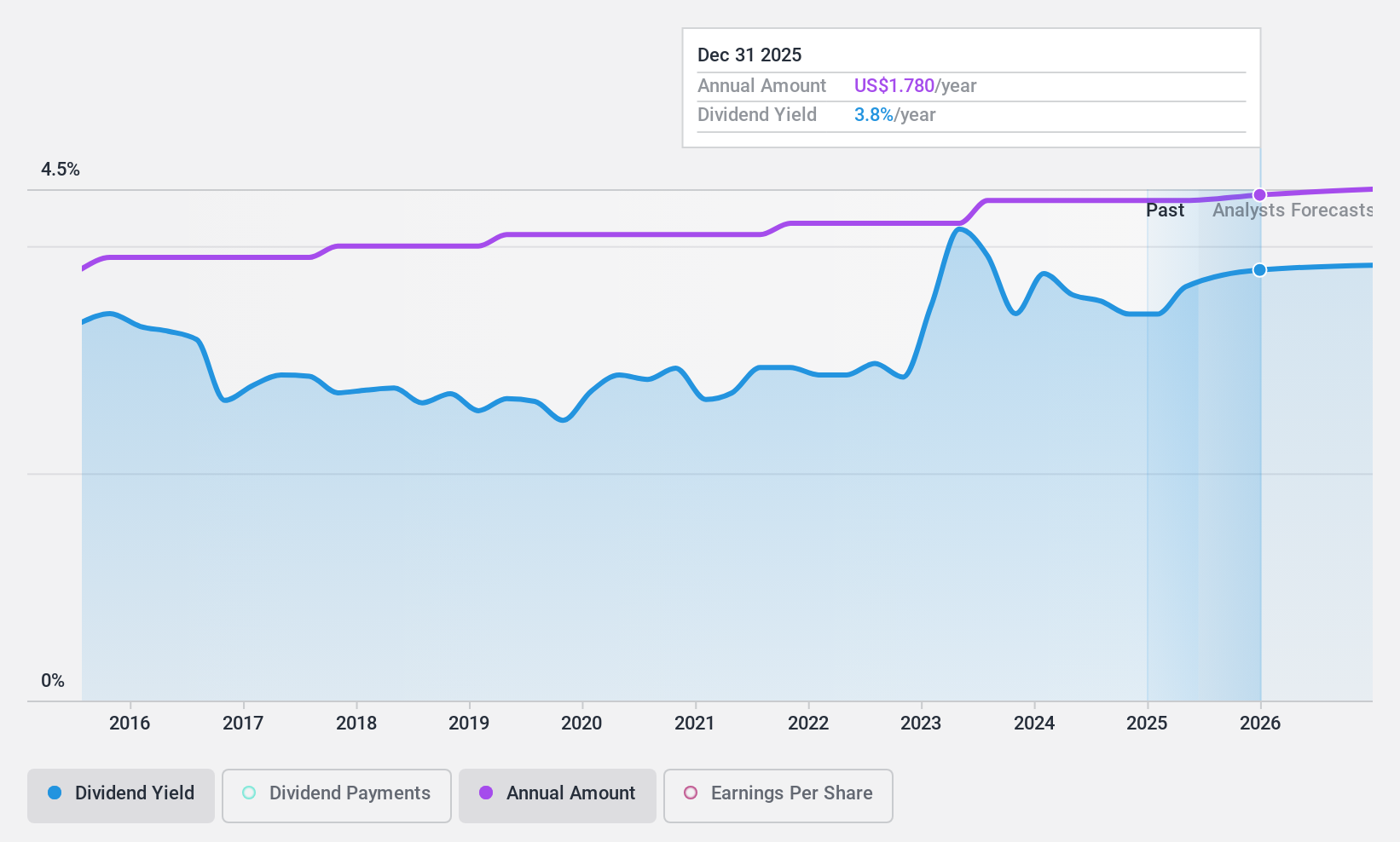

CVB Financial (NasdaqGS:CVBF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CVB Financial Corp. is a bank holding company for Citizens Business Bank, offering banking and financial services to small to mid-sized businesses and individuals, with a market cap of approximately $2.62 billion.

Operations: CVB Financial Corp.'s revenue is primarily derived from its banking segment, which generated $506.92 million.

Dividend Yield: 4.2%

CVB Financial offers a stable dividend history with consistent increases over the past decade, supported by a reasonable payout ratio of 54.9%. Despite trading at 37.7% below estimated fair value, its dividend yield of 4.15% is lower than the top US market payers. Recent earnings show slight growth in net income and EPS compared to last year. The company also completed a $15.3 million share buyback, enhancing shareholder value alongside its regular dividends.

- Get an in-depth perspective on CVB Financial's performance by reading our dividend report here.

- Our valuation report here indicates CVB Financial may be undervalued.

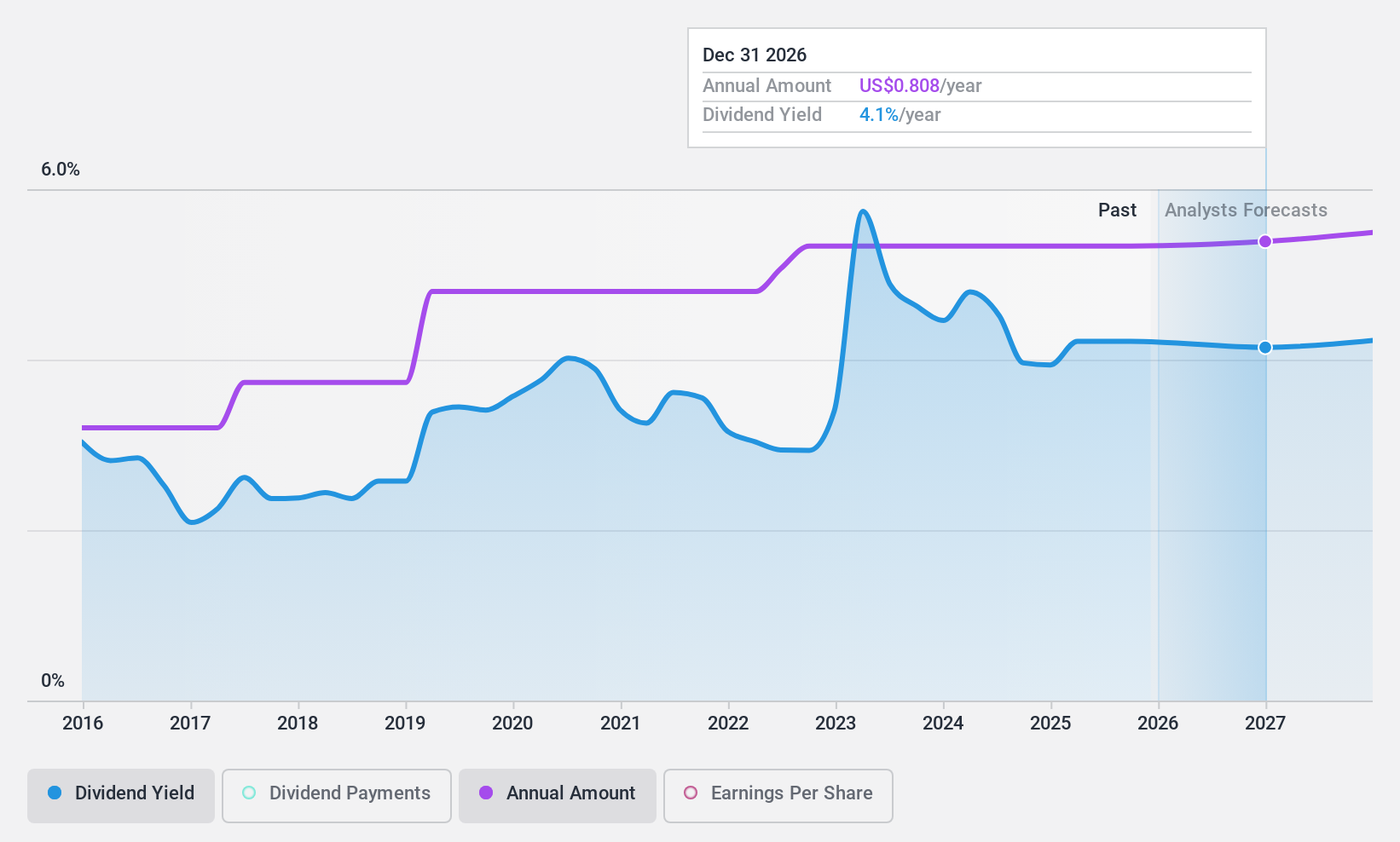

Westamerica Bancorporation (NasdaqGS:WABC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Westamerica Bancorporation is a bank holding company for Westamerica Bank, offering a range of banking products and services to both individual and commercial customers in the United States, with a market capitalization of approximately $1.31 billion.

Operations: Westamerica Bancorporation generates its revenue primarily from its banking segment, which accounted for $284.57 million.

Dividend Yield: 3.5%

Westamerica Bancorporation recently increased its quarterly dividend to $0.46 per share, reflecting a stable and growing dividend history over the past decade, supported by a low payout ratio of 35.2%. Despite trading significantly below estimated fair value, its 3.52% yield is lower than top-tier US dividend payers. Recent earnings showed declines in net interest income and net income compared to the previous year, yet it maintains shareholder value through an active buyback program for up to 2 million shares.

- Dive into the specifics of Westamerica Bancorporation here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Westamerica Bancorporation is priced lower than what may be justified by its financials.

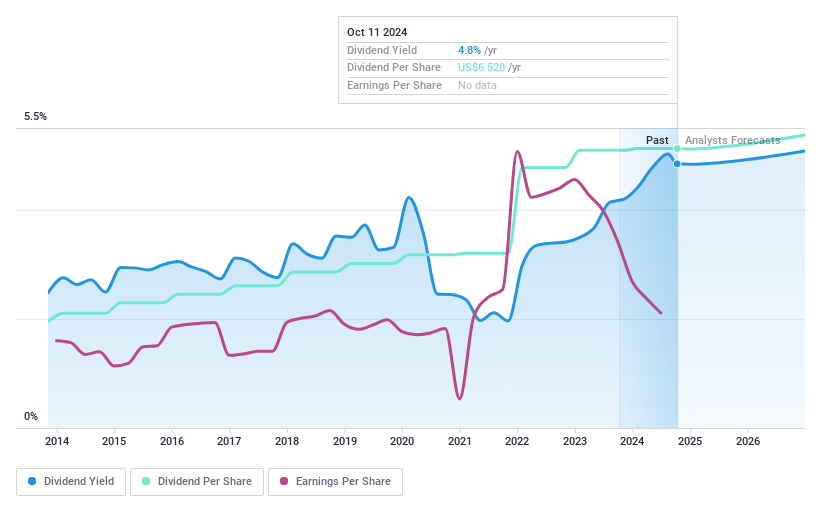

United Parcel Service (NYSE:UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery and logistics provider that offers transportation and delivery services, with a market cap of approximately $79.57 billion.

Operations: United Parcel Service, Inc. generates revenue through its three main segments: U.S. Domestic at $60.57 billion, International at $18.08 billion, and Supply Chain Solutions at $12.26 billion.

Dividend Yield: 6.8%

United Parcel Service's dividend yield of 6.77% ranks in the top 25% among US dividend payers, yet it is not well covered by earnings, with a high payout ratio of 95.2%. Recent quarterly earnings showed modest growth in net income to US$1.19 billion despite a slight decline in revenue to US$21.55 billion. UPS continues to innovate with new shipping solutions like UPS Ground Saver and Global Checkout, enhancing its service offerings globally amidst evolving market demands.

- Delve into the full analysis dividend report here for a deeper understanding of United Parcel Service.

- Upon reviewing our latest valuation report, United Parcel Service's share price might be too pessimistic.

Make It Happen

- Explore the 148 names from our Top US Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Westamerica Bancorporation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives