- United States

- /

- Banks

- /

- NasdaqGM:UNTY

Uncovering January 2025's Undiscovered Gems in the United States

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has experienced a 25% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover opportunities that may not yet be widely recognized by investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Unity Bancorp (NasdaqGM:UNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Unity Bancorp, Inc. is a bank holding company for Unity Bank, offering commercial and retail banking services to individuals and businesses, with a market cap of $455.18 million.

Operations: Unity Bancorp generates revenue primarily through commercial and retail banking services. The company's net profit margin is a key financial metric, reflecting the profitability of its operations.

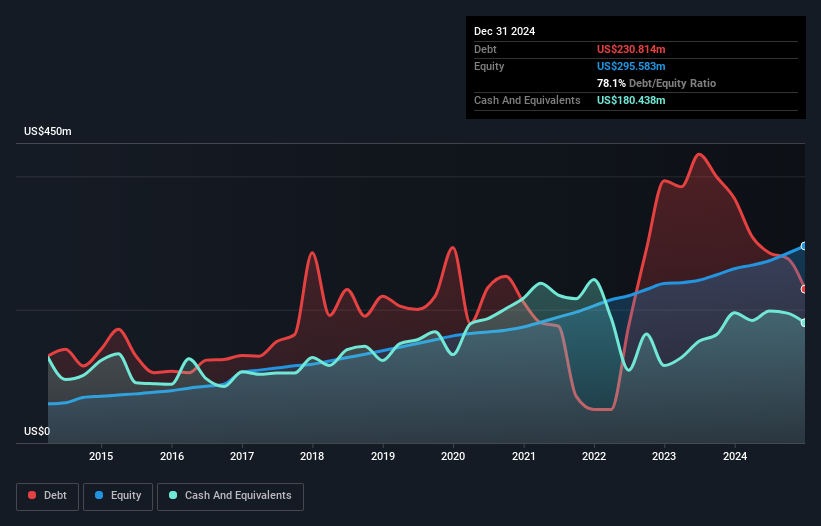

Unity Bancorp, a nimble player in the financial sector with total assets of $2.7 billion and equity of $295.6 million, stands out for its robust financial health. The bank's total deposits reach $2.1 billion while loans are at $2.2 billion, supported by an impressive net interest margin of 4.2%. Unity has a commendable bad loan allowance at 205% and maintains low-risk funding sources comprising 89% customer deposits, highlighting its prudent risk management practices. Despite significant insider selling recently, Unity trades at an attractive valuation—66% below estimated fair value—offering potential for future growth as earnings have been growing faster than industry averages.

- Click to explore a detailed breakdown of our findings in Unity Bancorp's health report.

Gain insights into Unity Bancorp's past trends and performance with our Past report.

Community Trust Bancorp (NasdaqGS:CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. is a bank holding company for Community Trust Bank, Inc., with a market cap of $974.95 million.

Operations: Community Trust Bancorp generates revenue primarily through interest income from loans and investment securities. The company's net profit margin is a key financial metric to consider, reflecting its profitability after all expenses.

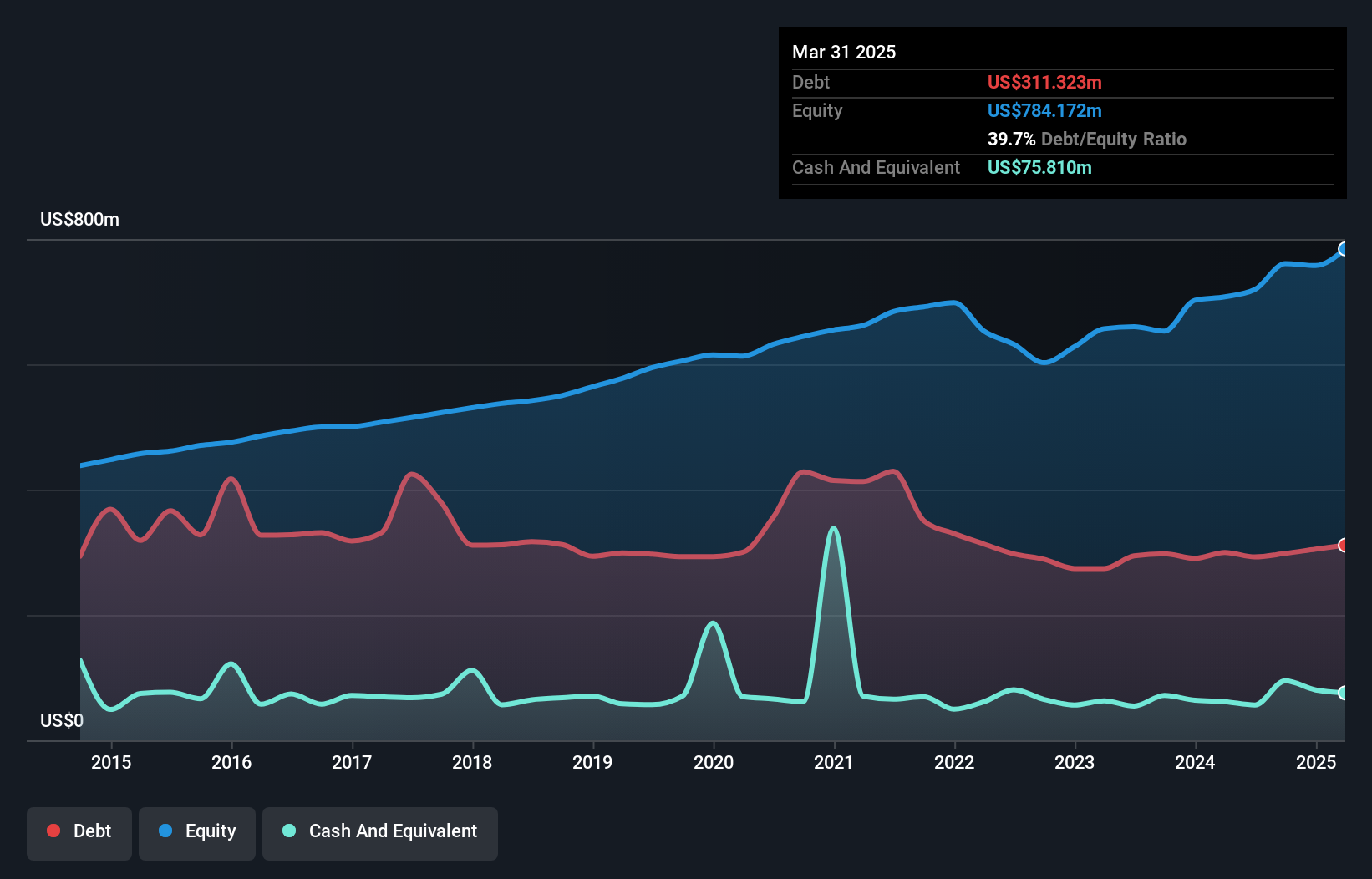

Community Trust Bancorp, with assets totaling $6.2 billion and equity of $757.6 million, appears to be an intriguing prospect in the financial sector. It boasts total deposits of $5.1 billion and loans amounting to $4.4 billion, indicating a solid balance between its liabilities and assets. The company has a commendable net interest margin of 3.4%, reflecting efficient use of its resources for income generation without relying heavily on external borrowing; 93% of its funding comes from customer deposits, which is considered low risk. With bad loans at just 0.6% and a strong allowance ratio at 206%, CTBI demonstrates prudent risk management practices that enhance its stability in uncertain times while trading significantly below estimated fair value suggests potential upside for investors seeking undervalued opportunities within the banking industry context.

- Click here to discover the nuances of Community Trust Bancorp with our detailed analytical health report.

Evaluate Community Trust Bancorp's historical performance by accessing our past performance report.

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products, with a market capitalization of approximately $655.10 million.

Operations: Ituran Location and Control Ltd. generates revenue primarily from telematics services, contributing $240.37 million, and telematics products, adding $90.81 million. The company's financial performance is characterized by its focus on these two key revenue streams.

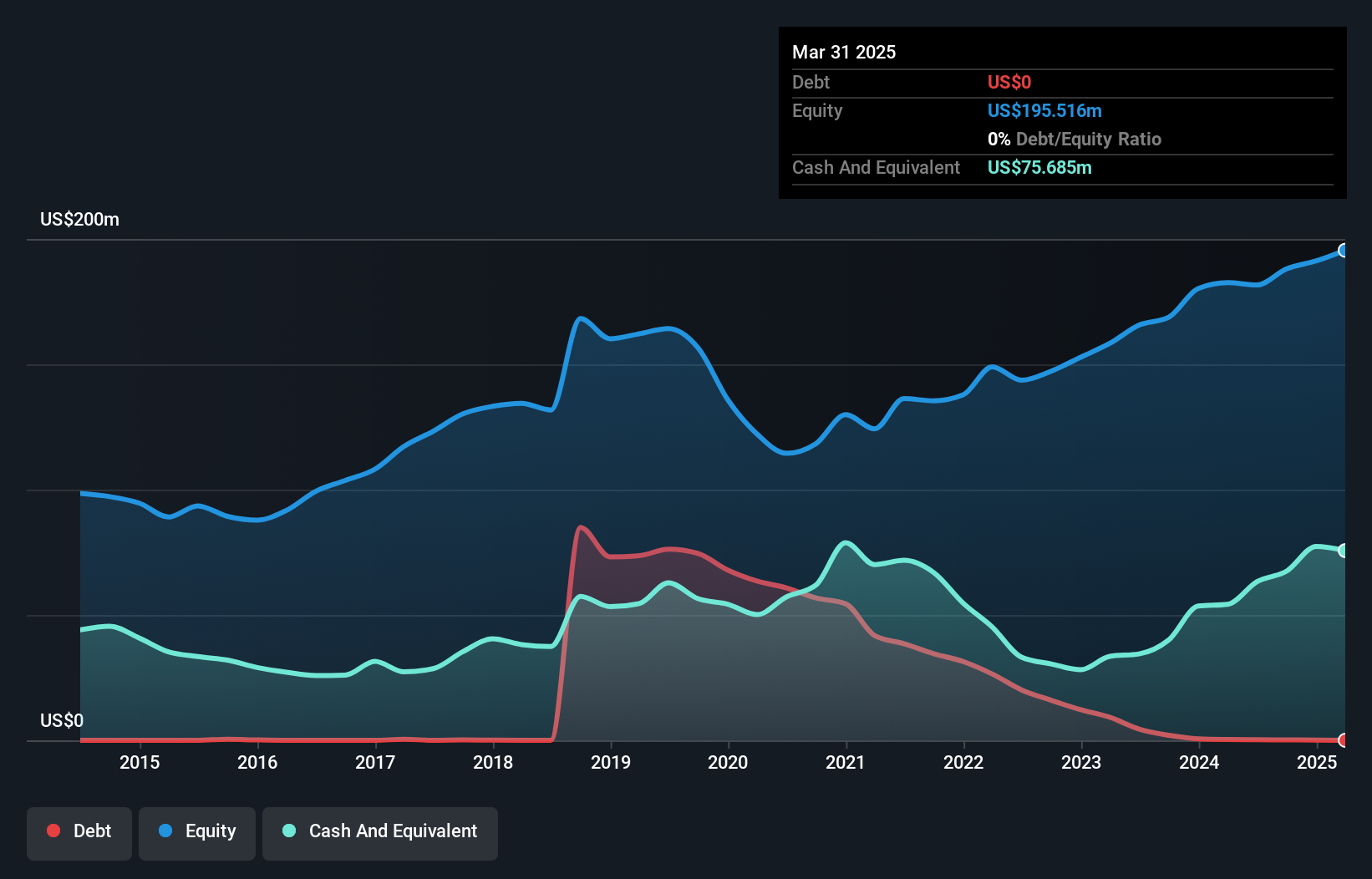

Ituran Location and Control, a smaller player in the telematics sector, shows promising potential with its strategic partnerships and financial health. Recently securing a five-year deal with Nissan Chile, Ituran is set to expand its footprint in Latin America. The company's debt-to-equity ratio impressively dropped from 47.6% to 0.09% over five years, indicating strong financial management. Earnings have grown by 13%, outpacing the industry's 1.6%. Trading at a significant discount of about 41% below estimated fair value enhances its appeal for investors seeking growth opportunities amidst currency fluctuation challenges and emerging market risks.

Turning Ideas Into Actions

- Navigate through the entire inventory of 250 US Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:UNTY

Unity Bancorp

Operates as a bank holding company for Unity Bank that provides range of commercial and retail banking services to individuals, small and medium sized businesses, and professional communities.

Flawless balance sheet, undervalued and pays a dividend.