- United States

- /

- Banks

- /

- NasdaqGS:CTBI

Top Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a volatile period, with the S&P 500 and Nasdaq on track for their fourth consecutive week of losses amid concerns over tariffs and economic uncertainty, investors are increasingly looking toward dividend stocks as a potential source of stability and income. In this environment, selecting dividend stocks with strong fundamentals can be an effective strategy to weather market fluctuations while benefiting from regular income streams.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.89% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.01% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.06% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.17% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.84% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.48% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.99% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.69% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.66% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.83% | ★★★★★★ |

Click here to see the full list of 164 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Banner (NasdaqGS:BANR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banner Corporation is a bank holding company for Banner Bank, offering commercial banking and financial services to individuals, businesses, and public sector entities in the United States, with a market cap of approximately $2.16 billion.

Operations: Banner Corporation's revenue primarily comes from its traditional banking operations, which involve gathering deposits and originating loans, generating approximately $601.02 million.

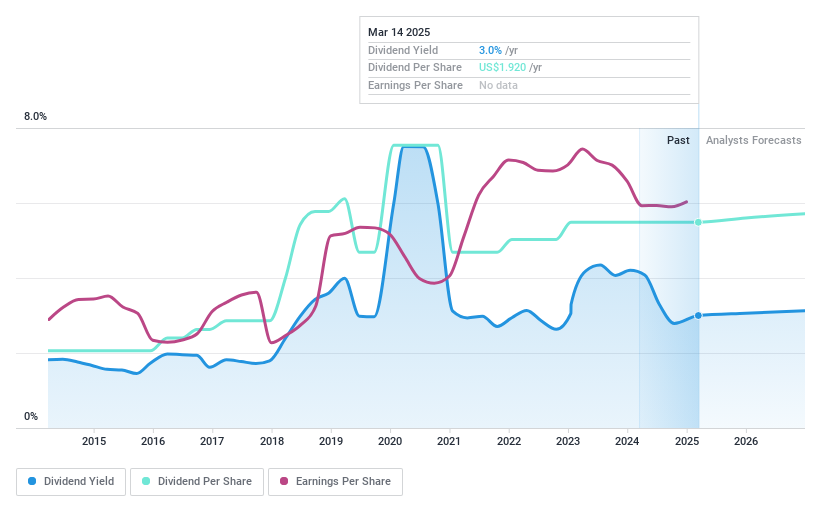

Dividend Yield: 3.1%

Banner Corporation's dividend profile highlights a mixed picture for investors. The company declared a regular quarterly cash dividend of US$0.48 per share, indicating its commitment to returning value to shareholders. However, dividends have been volatile over the past decade, with significant annual drops at times. Despite this instability, the current payout ratio of 39.2% suggests dividends are well-covered by earnings and forecasted to remain sustainable in three years with a 35.5% payout ratio forecasted by analysts.

- Click here and access our complete dividend analysis report to understand the dynamics of Banner.

- Insights from our recent valuation report point to the potential undervaluation of Banner shares in the market.

Community Trust Bancorp (NasdaqGS:CTBI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc., with a market cap of $922.83 million.

Operations: Community Trust Bancorp, Inc.'s revenue primarily stems from its Community Banking Services segment, which contributes $242.74 million.

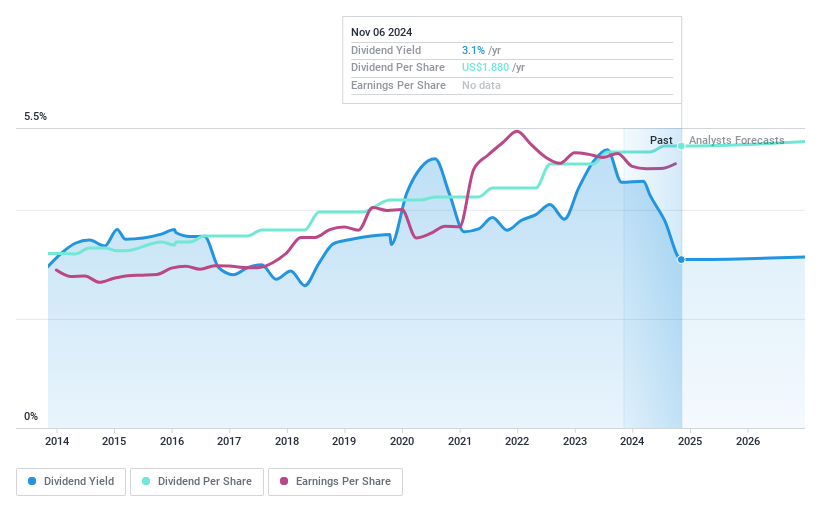

Dividend Yield: 3.7%

Community Trust Bancorp offers a stable dividend profile with recent affirmations of its quarterly cash dividend at US$0.47 per share, payable in April 2025. The company's dividends have been steadily increasing over the past decade and are well-covered by earnings, evidenced by a current payout ratio of 40.3%. Despite being below top-tier yields in the US market, CTBI's reliable 3.7% yield is supported by consistent profit growth and sound financial health.

- Navigate through the intricacies of Community Trust Bancorp with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Community Trust Bancorp's share price might be too pessimistic.

Preferred Bank (NasdaqGS:PFBC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Preferred Bank offers a range of commercial banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, investors, professionals, and high net worth individuals with a market cap of approximately $1.07 billion.

Operations: Preferred Bank generates its revenue primarily from its commercial banking segment, which accounted for $274.09 million.

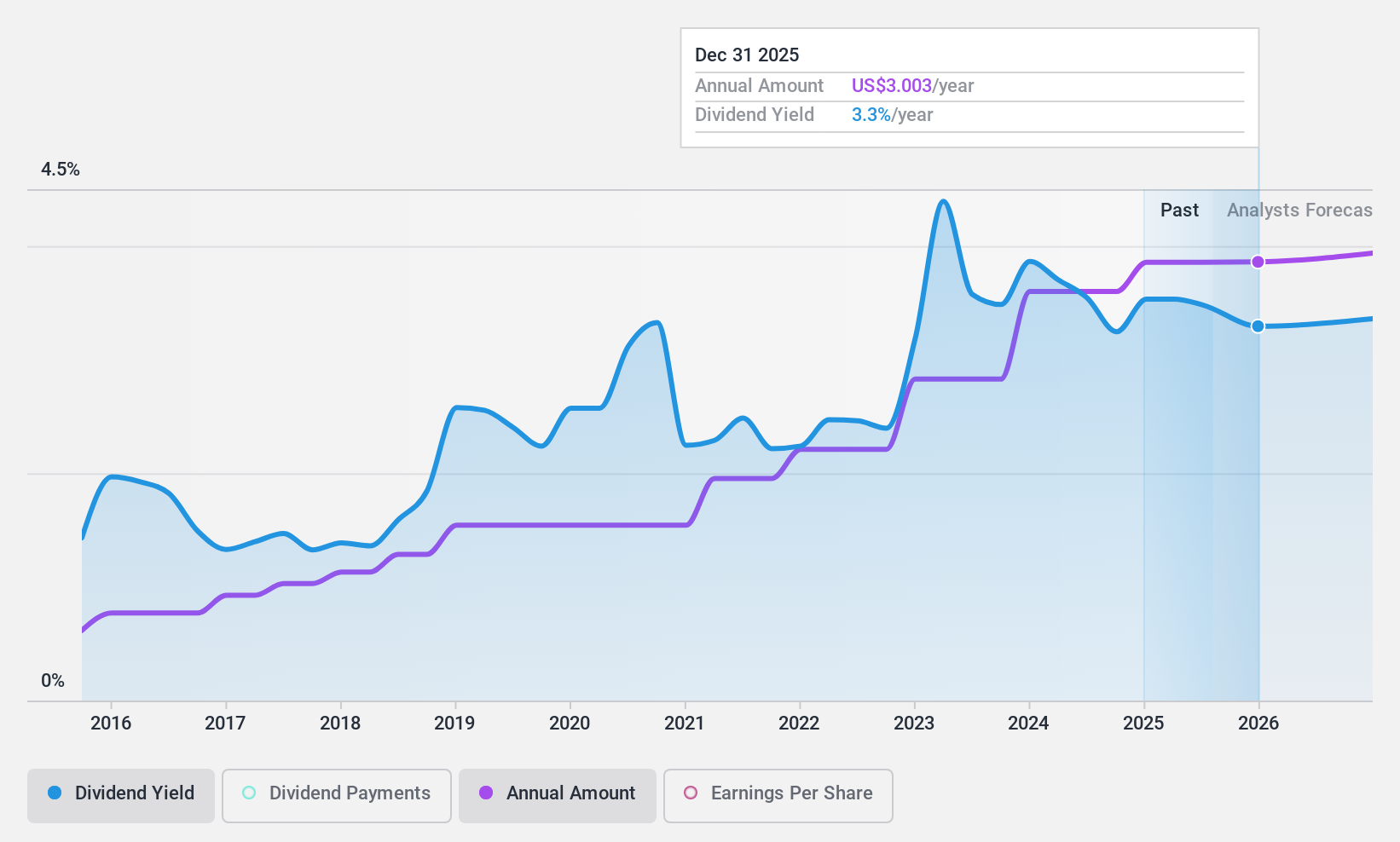

Dividend Yield: 3.7%

Preferred Bank maintains a stable dividend profile with a recent increase to US$0.75 per share, reflecting consistent growth over the past decade. Its dividends are well-covered by earnings, with a low payout ratio of 29.1%, forecasted at 30.6% in three years. Despite recent net income declines and charge-offs of US$6.6 million, the bank trades below fair value and peers, offering potential for capital appreciation alongside its reliable 3.7% yield.

- Click to explore a detailed breakdown of our findings in Preferred Bank's dividend report.

- Our valuation report unveils the possibility Preferred Bank's shares may be trading at a discount.

Next Steps

- Embark on your investment journey to our 164 Top US Dividend Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Community Trust Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTBI

Community Trust Bancorp

Operates as the bank holding company for Community Trust Bank, Inc.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives