- United States

- /

- Banks

- /

- NasdaqGS:NFBK

Three High-Yield Dividend Stocks Offering Up To 5.4%

Reviewed by Simply Wall St

As the U.S. stock market navigates through a mix of artificial intelligence-driven gains and anticipations of interest rate adjustments, investors continue to seek stable returns amid fluctuating indices. In this context, high-yield dividend stocks emerge as appealing options for those looking to generate consistent income in a landscape marked by economic uncertainties and sector-specific challenges.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Interpublic Group of Companies (NYSE:IPG) | 4.70% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 7.26% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.25% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.17% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.98% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.91% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.82% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.92% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 6.32% | ★★★★★☆ |

| First Bancorp (NasdaqGS:FNLC) | 5.67% | ★★★★★☆ |

Click here to see the full list of 204 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

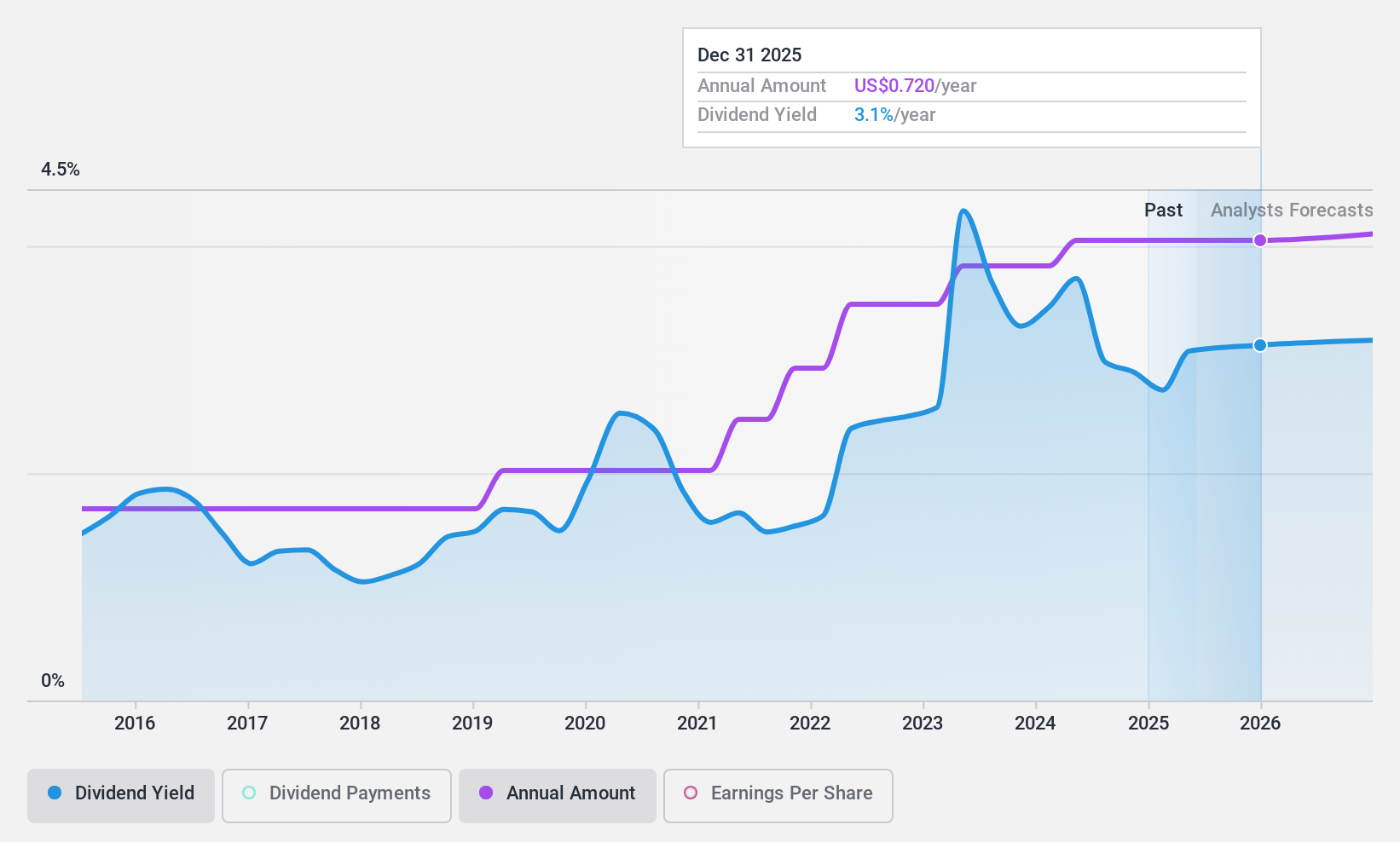

ConnectOne Bancorp (NasdaqGS:CNOB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConnectOne Bancorp, Inc. serves as the bank holding company for ConnectOne Bank, offering commercial banking products and services to small and mid-sized businesses, local professionals, and individuals in the New York Metropolitan area and South Florida, with a market capitalization of approximately $721.83 million.

Operations: ConnectOne Bancorp, Inc. generates its revenue primarily through its community banking segment, which amounted to $252.18 million.

Dividend Yield: 3.8%

ConnectOne Bancorp has demonstrated a consistent dividend track record, with dividends per share remaining stable and growing over the past decade. Recently, they announced an increase in their quarterly cash dividend to US$0.18 per share, marking a 5.9% rise from the previous quarter. Despite a recent downturn in net income and net interest income as reported for Q1 2024, the company maintains a low payout ratio of 36.5%, suggesting that its dividends are well-covered by earnings. However, its dividend yield of 3.77% is below the top quartile of U.S dividend payers at 4.7%.

- Unlock comprehensive insights into our analysis of ConnectOne Bancorp stock in this dividend report.

- In light of our recent valuation report, it seems possible that ConnectOne Bancorp is trading behind its estimated value.

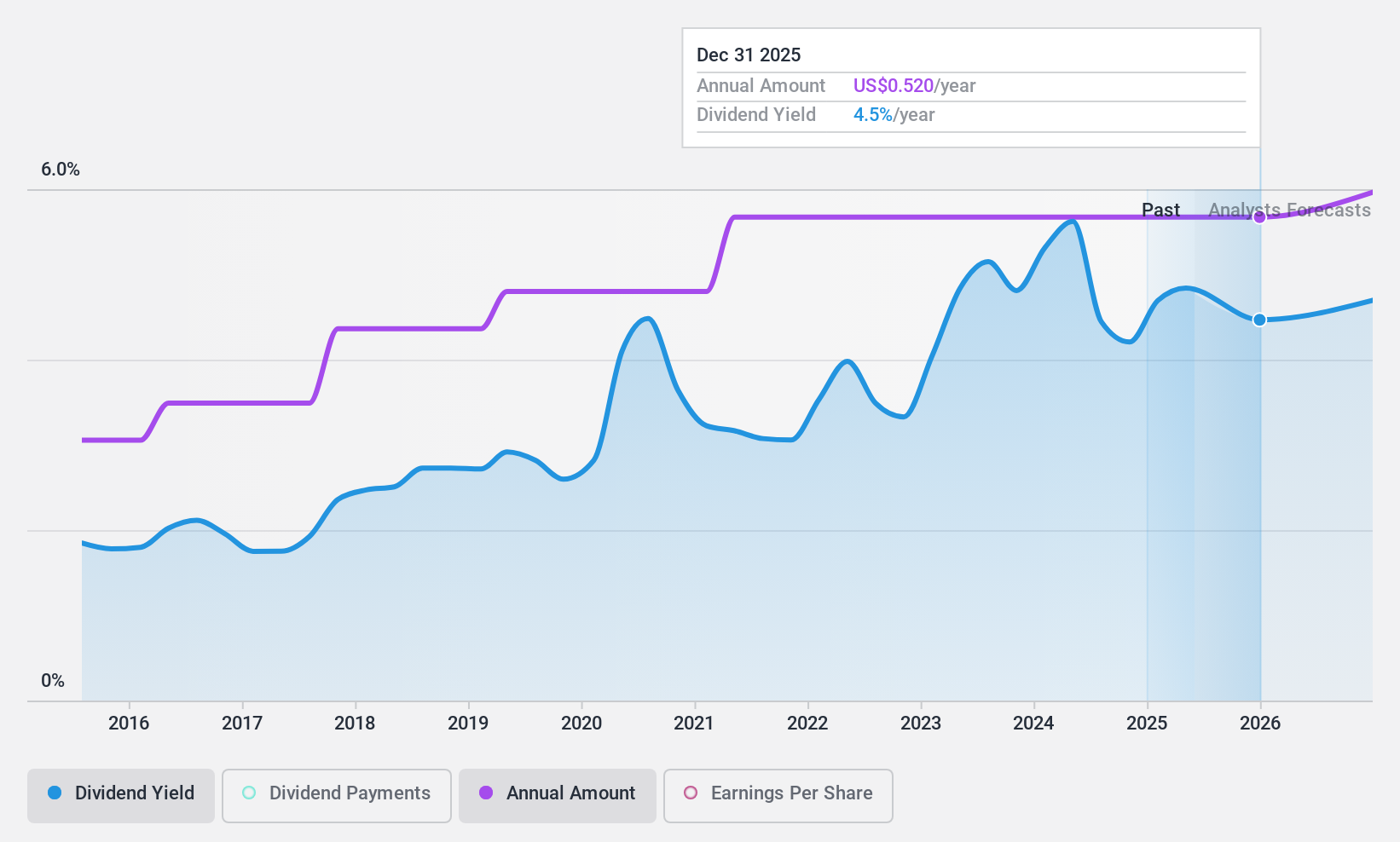

Northfield Bancorp (Staten Island NY) (NasdaqGS:NFBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northfield Bancorp, Inc. (Staten Island, NY), with a market cap of approximately $420.38 million, serves as the holding company for Northfield Bank, offering a range of banking products and services to individual and corporate customers.

Operations: Northfield Bancorp generates its revenue primarily through its community banking segment, which accounted for $128.70 million.

Dividend Yield: 5.5%

Northfield Bancorp recently announced a $10 million share buyback and declared a $0.13 per share dividend, showcasing ongoing shareholder returns despite dropping from several S&P indices earlier this month. The company's net income and interest income have decreased year-over-year as of Q1 2024, but it maintains a high dividend yield of 5.46%, which is competitive in the U.S market. Although dividends have been reliable over the past decade, recent financial performance raises questions about future sustainability without further data on earnings coverage or cash flows.

- Click to explore a detailed breakdown of our findings in Northfield Bancorp (Staten Island NY)'s dividend report.

- Our comprehensive valuation report raises the possibility that Northfield Bancorp (Staten Island NY) is priced higher than what may be justified by its financials.

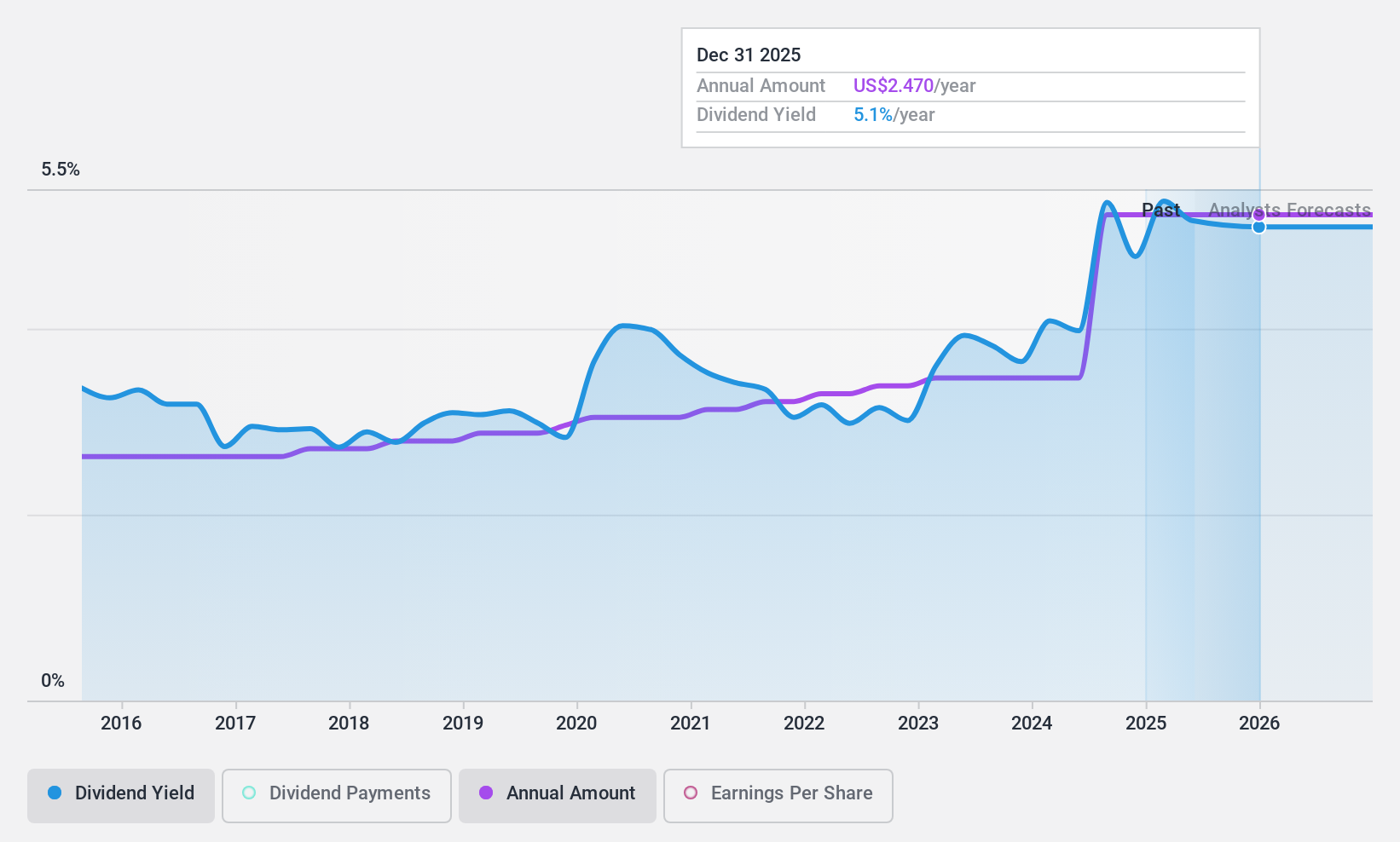

Peoples Financial Services (NasdaqGS:PFIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peoples Financial Services Corp., serving as the bank holding company for Peoples Security Bank and Trust Company, offers a range of commercial and retail banking services, with a market capitalization of approximately $321.39 million.

Operations: Peoples Financial Services Corp. generates its revenue primarily from banking services, totaling $96.88 million.

Dividend Yield: 3.6%

Peoples Financial Services Corp. maintains a consistent dividend of US$0.41 per share, reflecting stability in its quarterly payouts, unchanged from previous quarters in 2023 and 2024. Despite this regularity, the company's recent financial performance shows a decline, with net interest income dropping to US$19.32 million and net income falling to US$3.47 million in Q1 2024 compared to the previous year. While the dividend yield stands at 3.6%, below the top tier of U.S market dividend payers at 4.7%, PFIS trades at a significant discount—57.9% below estimated fair value—and has a sustainable payout ratio of 49.9%.

- Navigate through the intricacies of Peoples Financial Services with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Peoples Financial Services shares in the market.

Turning Ideas Into Actions

- Access the full spectrum of 204 Top Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Northfield Bancorp (Staten Island NY) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFBK

Northfield Bancorp (Staten Island NY)

Operates as the bank holding company for Northfield Bank that provides a range of banking services primarily to individuals and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion