- United States

- /

- Banks

- /

- NasdaqGS:CCB

What Does Coastal Financial’s (CCB) Management Change Reveal About Its Competitive Edge?

Reviewed by Sasha Jovanovic

- On October 1, 2025, Andrew Stines resigned as Executive Vice President and Chief Risk Officer of Coastal Financial Corporation, with the company clarifying there was no disagreement behind the decision.

- Coastal Financial’s financial results highlight very strong growth in net interest income and earnings per share over the past five years, well above broader banking sector averages.

- We’ll explore how Coastal Financial’s outperformance in core banking metrics shapes the investment narrative following this leadership transition.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Coastal Financial's Investment Narrative?

For Coastal Financial shareholders, the big-picture belief centers on the company’s ability to deliver rapid earnings and net interest income growth, despite competing in a sector that often battles margin pressures. That optimism has been fueled by high historic growth rates and a balance sheet geared for Banking-as-a-Service innovation. Recent leadership transitions, including the departure of Chief Risk Officer Andrew Stines, do bring some uncertainty, but there’s no public indication of internal conflict or operational distress. If the handover is managed smoothly, key short-term catalysts, such as continued fee and interest income expansion, remain intact, and last week’s market dip appears more a reaction to overvaluation concerns than to any shift in fundamental risks. However, changes in risk oversight at the top could sharpen focus on credit quality and loss trends in upcoming quarters, which investors will want to watch closely. On the other hand, evolving credit risks could weigh on future results.

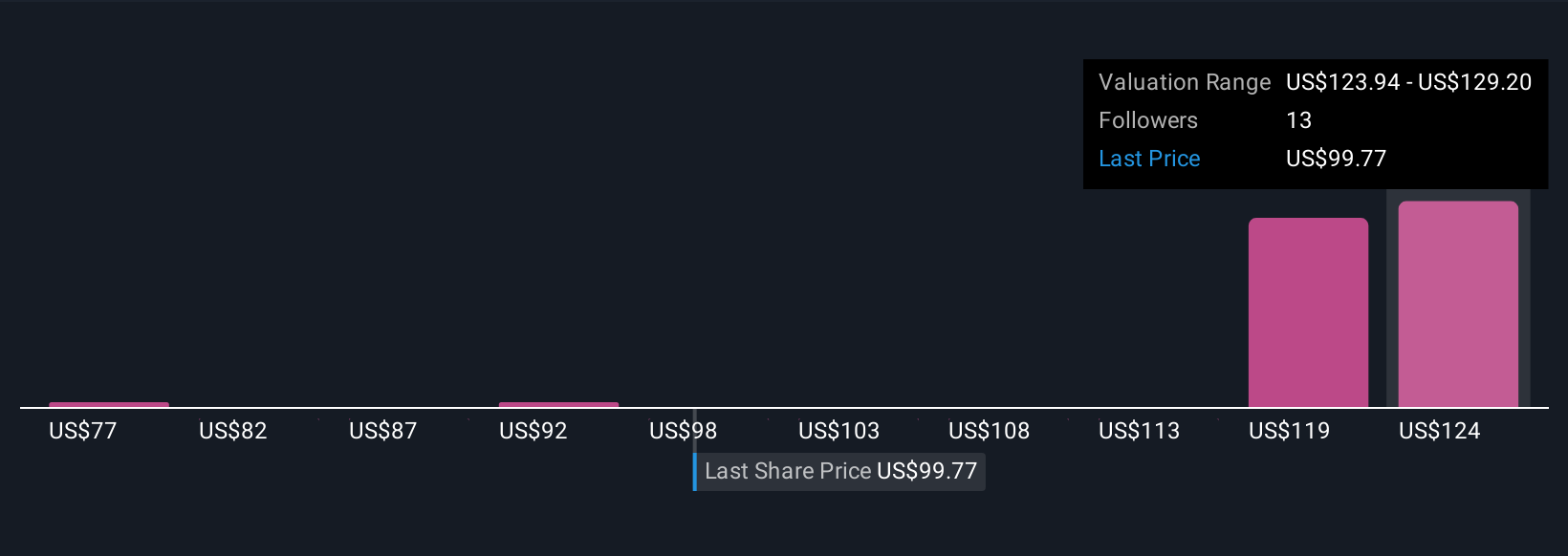

Despite retreating, Coastal Financial's shares might still be trading 17% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Coastal Financial - why the stock might be worth 26% less than the current price!

Build Your Own Coastal Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coastal Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coastal Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coastal Financial's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives