- United States

- /

- Banks

- /

- NasdaqGS:CBSH

How Improved Net Interest Margins and Buybacks at Commerce Bancshares (CBSH) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

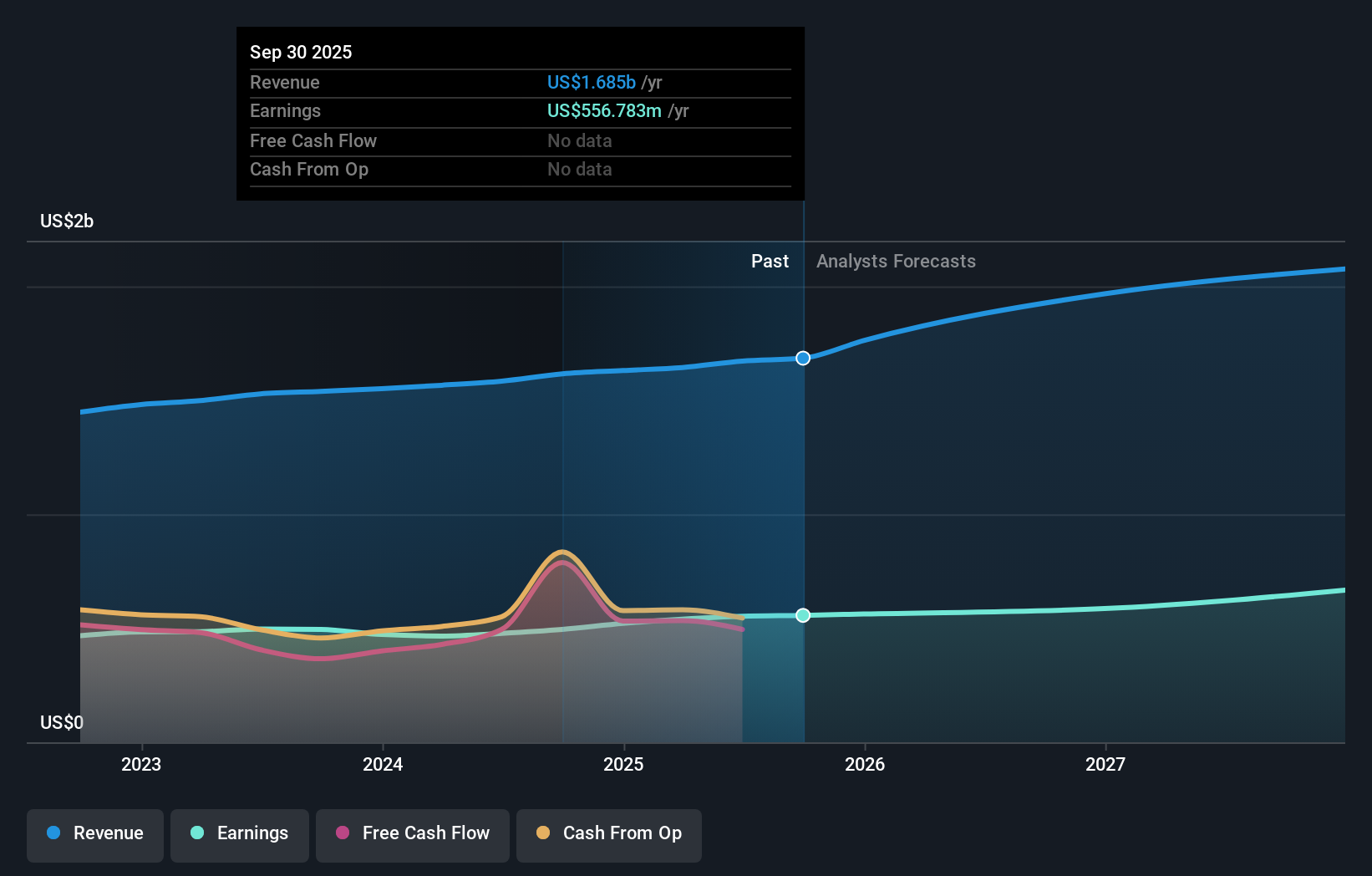

- In recent news, Commerce Bancshares has benefited from a higher net interest margin and share buybacks, both of which have driven earnings per share growth.

- A unique aspect of this development is how the combination of stronger core banking performance and capital management actions has helped enhance shareholder value.

- To better understand the implications for Commerce Bancshares, we will explore how the improved net interest margin shapes the investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Commerce Bancshares' Investment Narrative?

To make sense of Commerce Bancshares as an investment today, it’s key to believe in the resilience and adaptability of its core banking business, especially in light of a fast-changing financial environment. The latest news of higher net interest margin and ongoing share buybacks clearly fueled recent EPS growth, reinforcing shareholder value and setting up a stronger case for near-term optimism. These gains may make the upcoming Q3 earnings a more important focus for the direction of price moves, while also softening previous concerns around earnings momentum. However, with the company trading at a premium compared to peers and set against a recent record of underperforming industry returns, investor focus is shifting to whether these positive catalysts will persist. Risks such as modest loan growth or increased industry competition may gain more relevance if the margin gains prove short lived.

In contrast, competing banks are growing faster and sometimes offer a better value based on earnings multiples.

Exploring Other Perspectives

Explore 2 other fair value estimates on Commerce Bancshares - why the stock might be worth as much as 79% more than the current price!

Build Your Own Commerce Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commerce Bancshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Commerce Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commerce Bancshares' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBSH

Commerce Bancshares

Operates as the bank holding company for Commerce Bank that provides retail, mortgage banking, corporate, investment, trust, and asset management products and services to individuals and businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives