- United States

- /

- Capital Markets

- /

- NasdaqGS:TIGR

US Growth Companies With High Insider Ownership Unveiled

Reviewed by Simply Wall St

As the U.S. stock market continues to experience mixed trading with indices like the S&P 500 reaching new highs, investors are keenly observing growth trends and insider activities within companies. In this environment, high insider ownership can be a compelling indicator of confidence in a company's potential, making it an important factor for those seeking promising growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 43.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

Underneath we present a selection of stocks filtered out by our screen.

OPAL Fuels (NasdaqCM:OPAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OPAL Fuels Inc. produces and distributes renewable natural gas for heavy and medium-duty trucking fleets, with a market cap of $671.44 million.

Operations: The company's revenue segments include RNG Fuel generating $193.37 million, Renewable Power contributing $46.38 million, and Fuel Station Services bringing in $187.59 million.

Insider Ownership: 12.8%

Earnings Growth Forecast: 32.2% p.a.

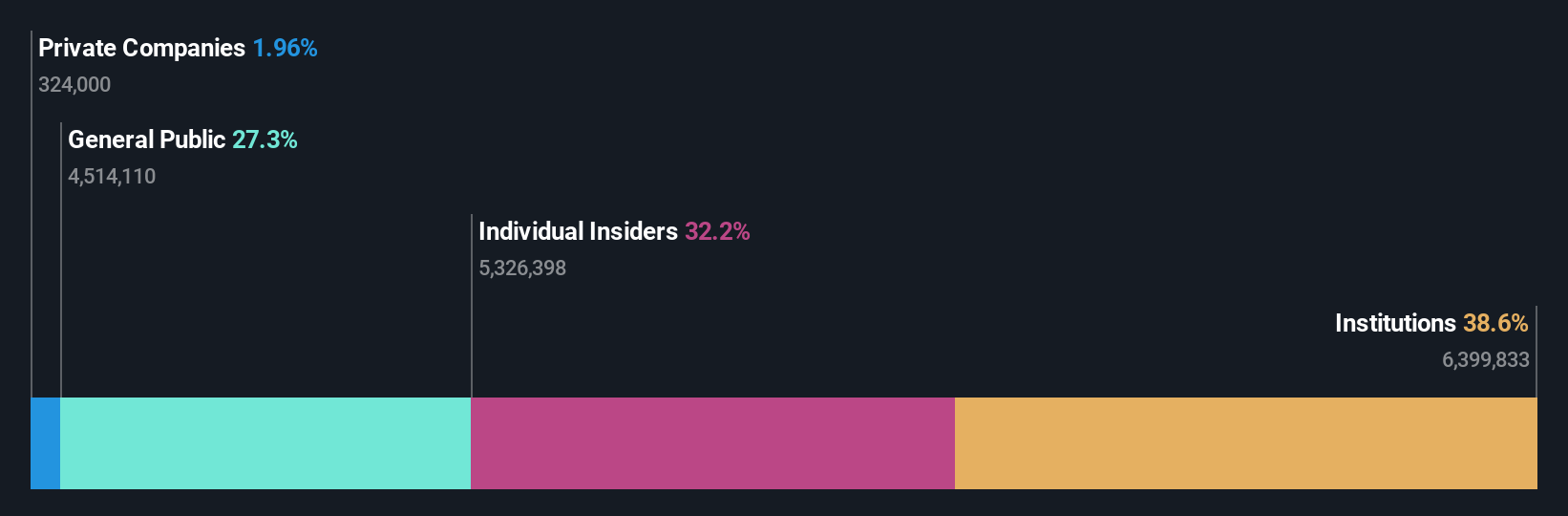

OPAL Fuels is experiencing robust growth, with earnings projected to increase significantly at 32.2% annually, outpacing the broader US market. Recent expansions include a new RNG facility in California and operational commencement at a Florida site, enhancing its renewable energy footprint. Despite revenue growth forecasts of 18.1% annually, profit margins have decreased from last year's levels. The company reported Q3 revenue of US$84.05 million and net income of US$4.98 million, showing year-over-year improvement but lower nine-month profits compared to the previous year.

- Take a closer look at OPAL Fuels' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of OPAL Fuels shares in the market.

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capital Bancorp, Inc. is the bank holding company for Capital Bank, N.A., with a market cap of $479.51 million.

Operations: The company's revenue segments include Opensky at $69.46 million, Corporate at $2.81 million, Commercial Bank at $79.24 million, and Capital Bank Home Loans (CBHL) at $6.37 million.

Insider Ownership: 31%

Earnings Growth Forecast: 29.9% p.a.

Capital Bancorp is poised for significant growth, with earnings expected to rise 29.92% annually, surpassing the US market average. Despite a slight dip in Q3 net income to US$8.67 million from US$9.79 million last year, revenue growth remains strong at 20.3% per year, outpacing the broader market's 8.9%. Insider activity shows substantial buying recently, indicating confidence in future prospects despite past shareholder dilution and low return on equity forecasts.

- Get an in-depth perspective on Capital Bancorp's performance by reading our analyst estimates report here.

- The analysis detailed in our Capital Bancorp valuation report hints at an deflated share price compared to its estimated value.

UP Fintech Holding (NasdaqGS:TIGR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UP Fintech Holding Limited offers online brokerage services primarily for Chinese investors and has a market cap of approximately $1.08 billion.

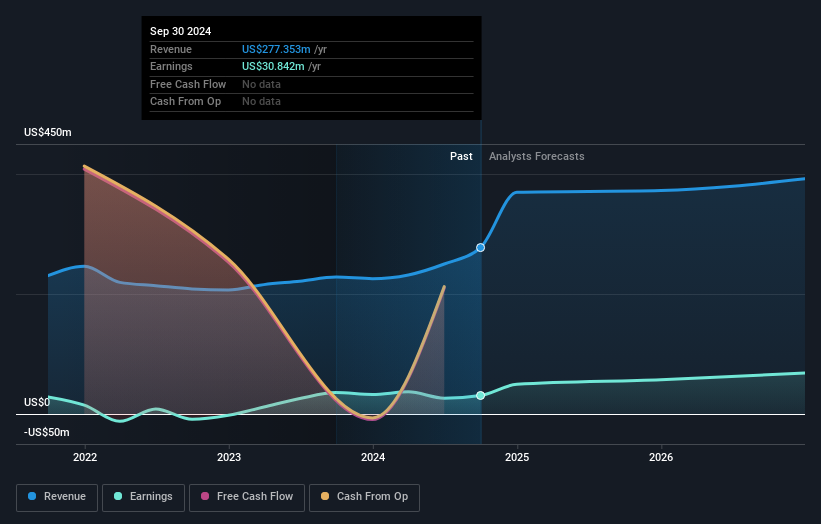

Operations: The company's revenue is primarily generated from its brokerage segment, totaling $277.35 million.

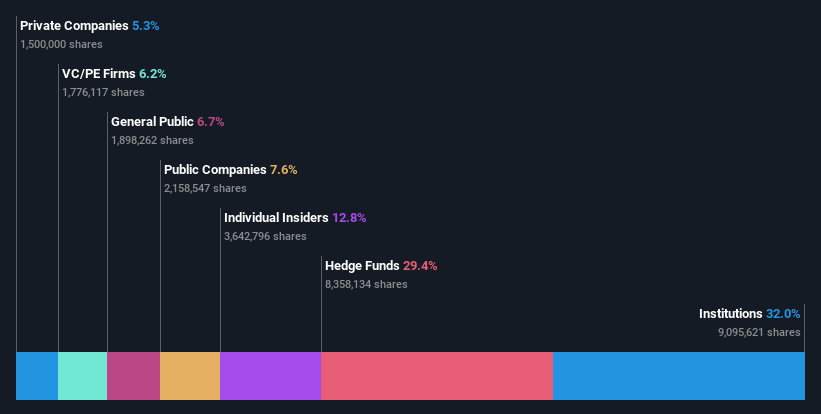

Insider Ownership: 19.2%

Earnings Growth Forecast: 28.5% p.a.

UP Fintech Holding's earnings are forecast to grow significantly at 28.5% annually, outpacing the US market average, though recent shareholder dilution may concern some investors. Despite a highly volatile share price and low return on equity projections, the company reported Q3 revenue of US$101.05 million—up from US$70.15 million last year—and net income of US$17.75 million, reflecting strong financial performance amid no recent insider trading activity.

- Click to explore a detailed breakdown of our findings in UP Fintech Holding's earnings growth report.

- The valuation report we've compiled suggests that UP Fintech Holding's current price could be inflated.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 210 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TIGR

UP Fintech Holding

Provides online brokerage services focusing on Chinese investors in New Zealand, the Cayman Island, Singapore, the United States, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives