- United States

- /

- Banks

- /

- NasdaqCM:CZNC

3 Dividend Stocks With Up To 5.7% Yield For Steady Income

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced an 11% increase over the past year with earnings forecasted to grow by 14% annually. In this environment, selecting dividend stocks that offer a steady income can be a prudent strategy for investors seeking stability and potential growth in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.82% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.84% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.20% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.17% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.98% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.79% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.90% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.87% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.89% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.70% | ★★★★★☆ |

Click here to see the full list of 139 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

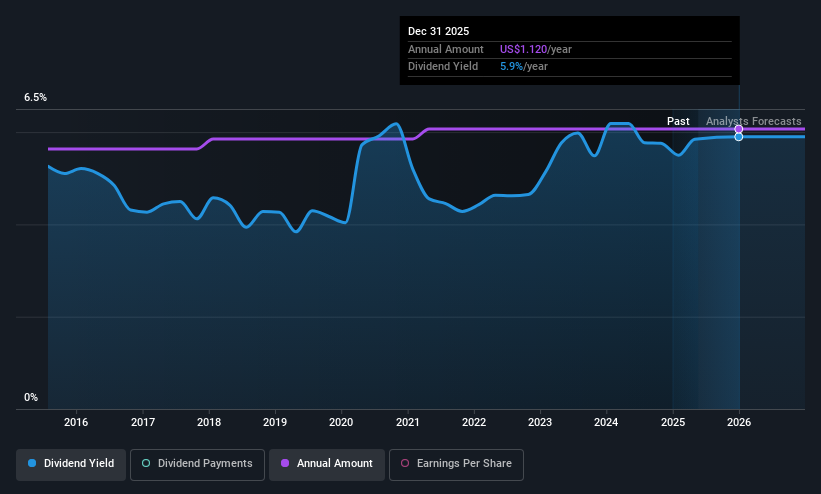

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens & Northern Corporation, with a market cap of $300.90 million, operates as the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate customers.

Operations: Citizens & Northern Corporation generates revenue primarily through its Community Banking segment, which accounted for $108.11 million.

Dividend Yield: 5.7%

Citizens & Northern offers a stable and reliable dividend history, with payments increasing over the past decade. Its dividend yield of 5.75% places it in the top 25% of US payers, supported by a reasonable payout ratio of 64.1%. Recent earnings growth and a merger agreement with Susquehanna Community Financial Inc. may enhance future prospects. However, there's insufficient data to confirm long-term sustainability or coverage by future earnings or cash flows.

- Delve into the full analysis dividend report here for a deeper understanding of Citizens & Northern.

- The analysis detailed in our Citizens & Northern valuation report hints at an deflated share price compared to its estimated value.

CB Financial Services (NasdaqGM:CBFV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CB Financial Services, Inc. is a bank holding company for Community Bank, offering a range of banking products and services to individuals and businesses in southwestern Pennsylvania and West Virginia, with a market cap of $150.78 million.

Operations: CB Financial Services, Inc. generates revenue through its provision of diverse banking products and services targeted at both individual and business clients in southwestern Pennsylvania and West Virginia.

Dividend Yield: 3.4%

CB Financial Services maintains a stable dividend history, with consistent payments over the past decade. Its current yield of 3.38% is below top-tier US dividend payers, but dividends are well-covered by earnings due to a low payout ratio of 49.8%. Recent financials show decreased net income and profit margins, yet the company affirmed its quarterly dividend amid ongoing share buybacks totaling $2.99 million, reflecting shareholder value focus despite recent earnings challenges.

- Unlock comprehensive insights into our analysis of CB Financial Services stock in this dividend report.

- Our valuation report unveils the possibility CB Financial Services' shares may be trading at a premium.

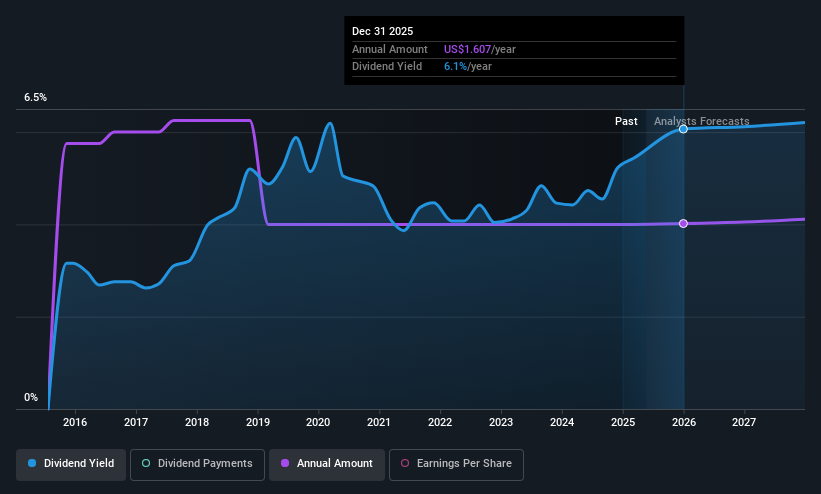

Kraft Heinz (NasdaqGS:KHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Kraft Heinz Company, along with its subsidiaries, manufactures and markets food and beverage products both in North America and internationally, with a market cap of approximately $32.99 billion.

Operations: Kraft Heinz generates revenue from three main segments: North America ($19.20 billion), Emerging Markets ($2.73 billion), and International Developed Markets ($3.50 billion).

Dividend Yield: 5.7%

Kraft Heinz's dividend yield ranks in the top 25% of US payers, supported by a reasonable payout ratio with earnings and cash flow coverage. However, dividends have been volatile over the past decade. The company trades significantly below its estimated fair value, though recent financials show declining sales and net income. Despite this, Kraft Heinz affirmed its quarterly dividend and completed a substantial share buyback program worth $1.30 billion, indicating commitment to returning value to shareholders amidst fluctuating earnings.

- Navigate through the intricacies of Kraft Heinz with our comprehensive dividend report here.

- Our expertly prepared valuation report Kraft Heinz implies its share price may be lower than expected.

Where To Now?

- Click through to start exploring the rest of the 136 Top US Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives