Colony Bankcorp, Inc. (NASDAQ:CBAN) will pay a dividend of $0.1075 on the 20th of August. This means that the annual payment will be 3.0% of the current stock price, which is in line with the average for the industry.

See our latest analysis for Colony Bankcorp

Colony Bankcorp's Payment Expected To Have Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue.

Colony Bankcorp has established itself as a dividend paying company, given its 5-year history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio of 34%shows that Colony Bankcorp would be able to pay its last dividend without pressure on the balance sheet.

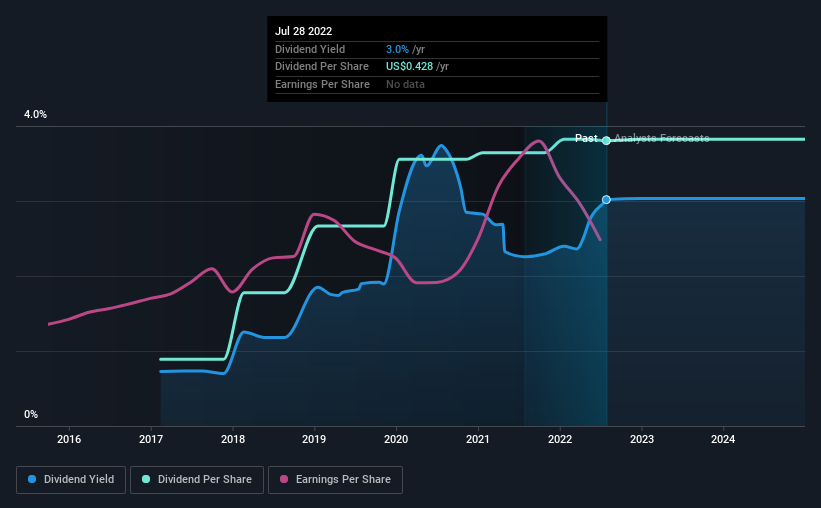

Over the next 3 years, EPS is forecast to expand by 46.4%. Analysts estimate the future payout ratio will be 25% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Colony Bankcorp Doesn't Have A Long Payment History

It is great to see that Colony Bankcorp has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The dividend has gone from an annual total of $0.10 in 2017 to the most recent total annual payment of $0.428. This implies that the company grew its distributions at a yearly rate of about 34% over that duration. Colony Bankcorp has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, Colony Bankcorp's EPS was effectively flat over the past five years, which could stop the company from paying more every year. While growth may be thin on the ground, Colony Bankcorp could always pay out a higher proportion of earnings to increase shareholder returns.

An additional note is that the company has been raising capital by issuing stock equal to 82% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

Overall, a consistent dividend is a good thing, and we think that Colony Bankcorp has the ability to continue this into the future. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for Colony Bankcorp (1 is a bit unpleasant!) that you should be aware of before investing. Is Colony Bankcorp not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CBAN

Colony Bankcorp

Operates as the bank holding company for Colony Bank that provides various banking products and services to retail and commercial customers in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives