- United States

- /

- Banks

- /

- NasdaqGS:WABC

3 US Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with major indices like the Dow Jones and S&P 500 facing potential weekly losses, investors are keenly observing how these shifts might impact their portfolios. In such a climate, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to enhance their investment strategy amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.33% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.79% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.57% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.16% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.27% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.84% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.94% | ★★★★★★ |

Click here to see the full list of 139 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

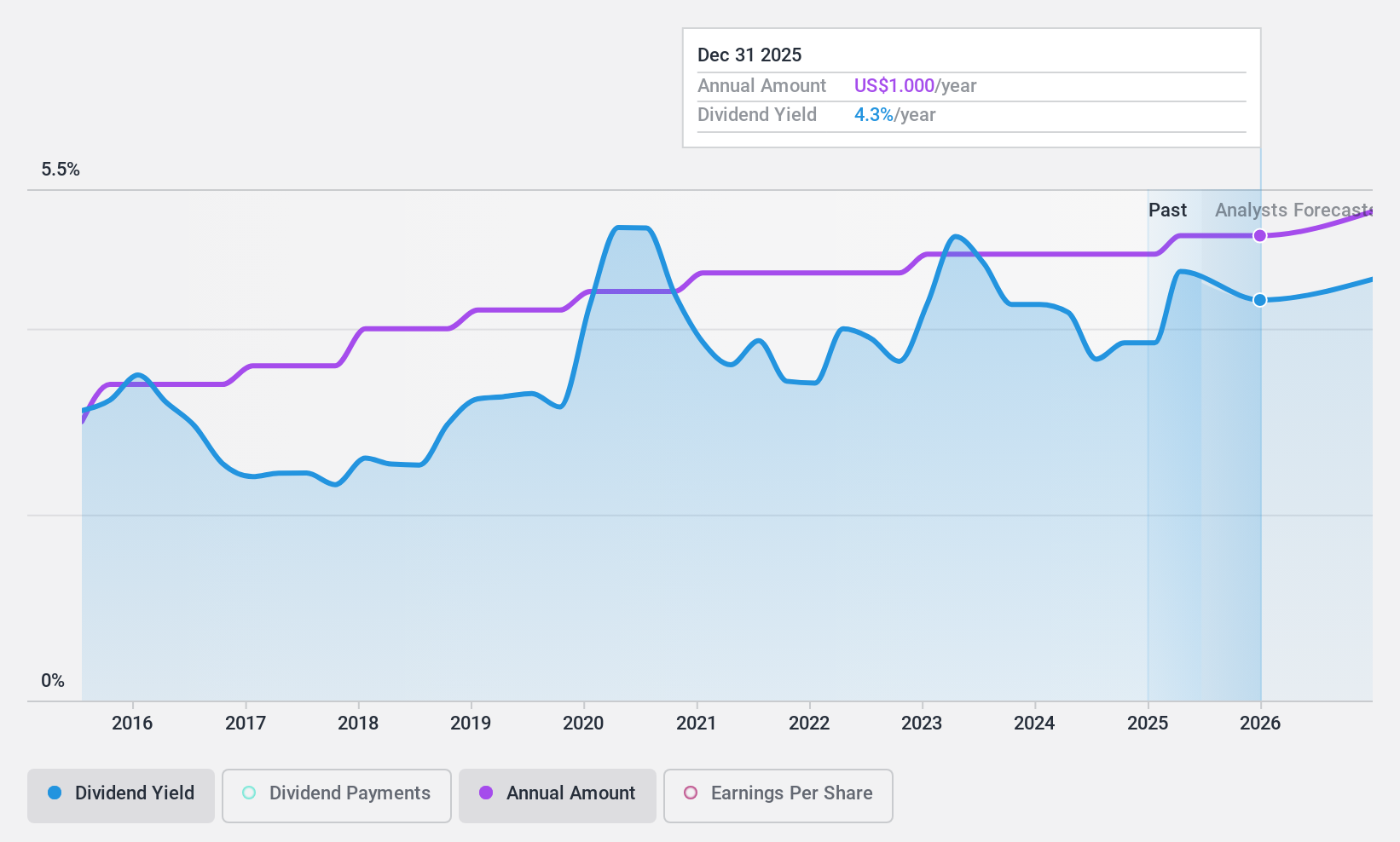

First Busey (NasdaqGS:BUSE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Busey Corporation, with a market cap of approximately $1.42 billion, operates as the bank holding company for Busey Bank, providing retail and commercial banking products and services to a diverse range of customers in the United States.

Operations: First Busey Corporation generates revenue through its retail and commercial banking operations, offering a wide array of financial products and services to individual, corporate, institutional, and governmental clients across the United States.

Dividend Yield: 4%

First Busey Corporation recently increased its quarterly dividend to US$0.25 per share, marking a 4.2% rise from the previous payout, and maintains a reliable dividend history with stable growth over the past decade. Despite net charge-offs rising to US$2.85 million in Q4 2024, earnings per share remained strong at US$0.49 for the quarter. The company's dividends are well-covered by earnings with a current payout ratio of 47.8%, indicating sustainability and potential for future coverage improvements.

- Get an in-depth perspective on First Busey's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, First Busey's share price might be too pessimistic.

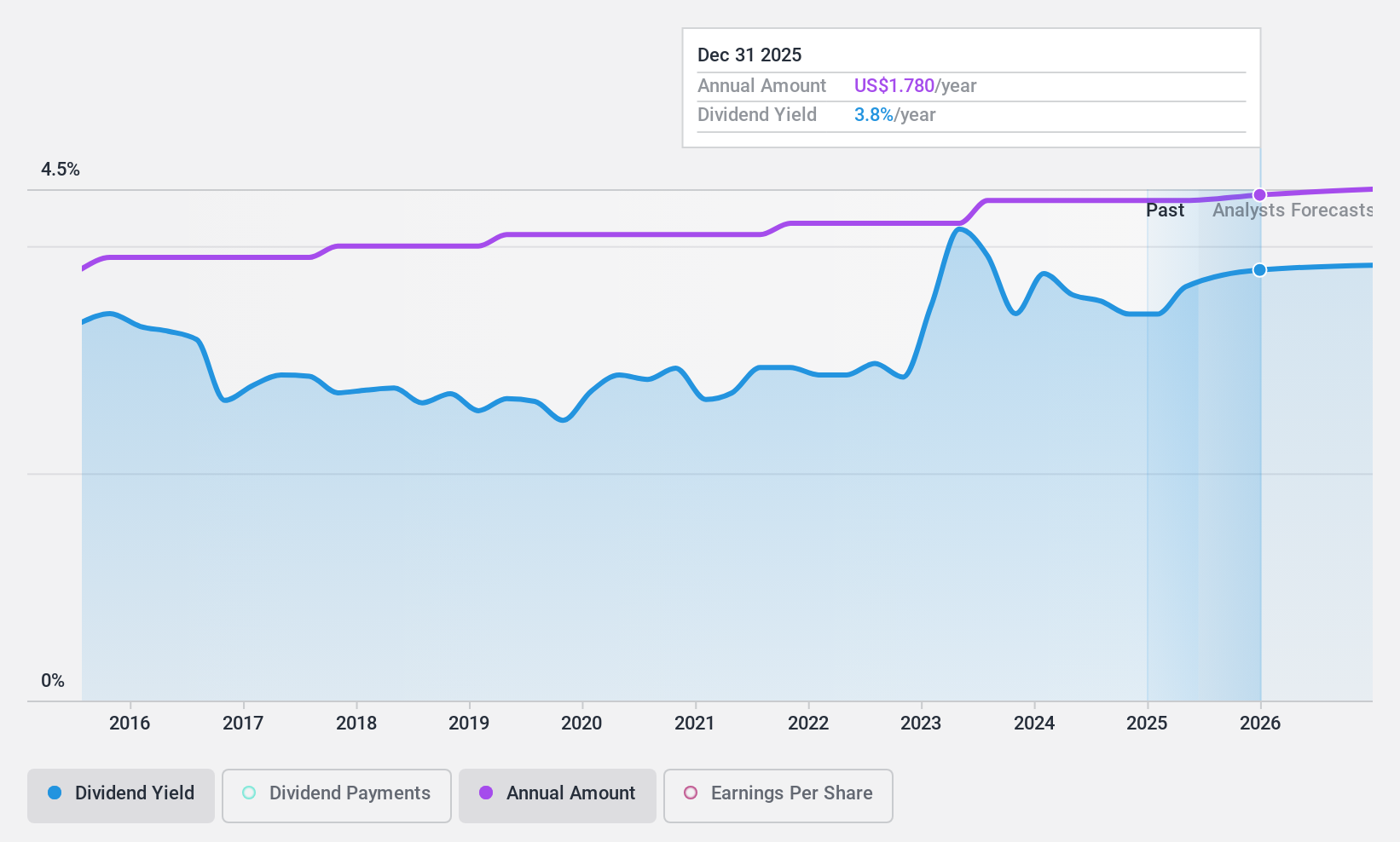

Westamerica Bancorporation (NasdaqGS:WABC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Westamerica Bancorporation, with a market cap of $1.33 billion, operates as a bank holding company for Westamerica Bank, offering a range of banking products and services to individual and commercial customers.

Operations: Westamerica Bancorporation generates its revenue primarily from its banking segment, which accounted for $293.25 million.

Dividend Yield: 3.5%

Westamerica Bancorporation declared a quarterly dividend of US$0.44 per share, maintaining its stable and reliable dividend history over the past decade. Despite a decline in net interest income to US$250.6 million and net income to US$138.64 million for 2024, the company's dividends remain well-covered by earnings with a low payout ratio of 33.9%. Recent leadership changes include John Sousa's appointment as Senior Vice President and Treasurer, potentially impacting financial strategy moving forward.

- Click here to discover the nuances of Westamerica Bancorporation with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Westamerica Bancorporation is priced lower than what may be justified by its financials.

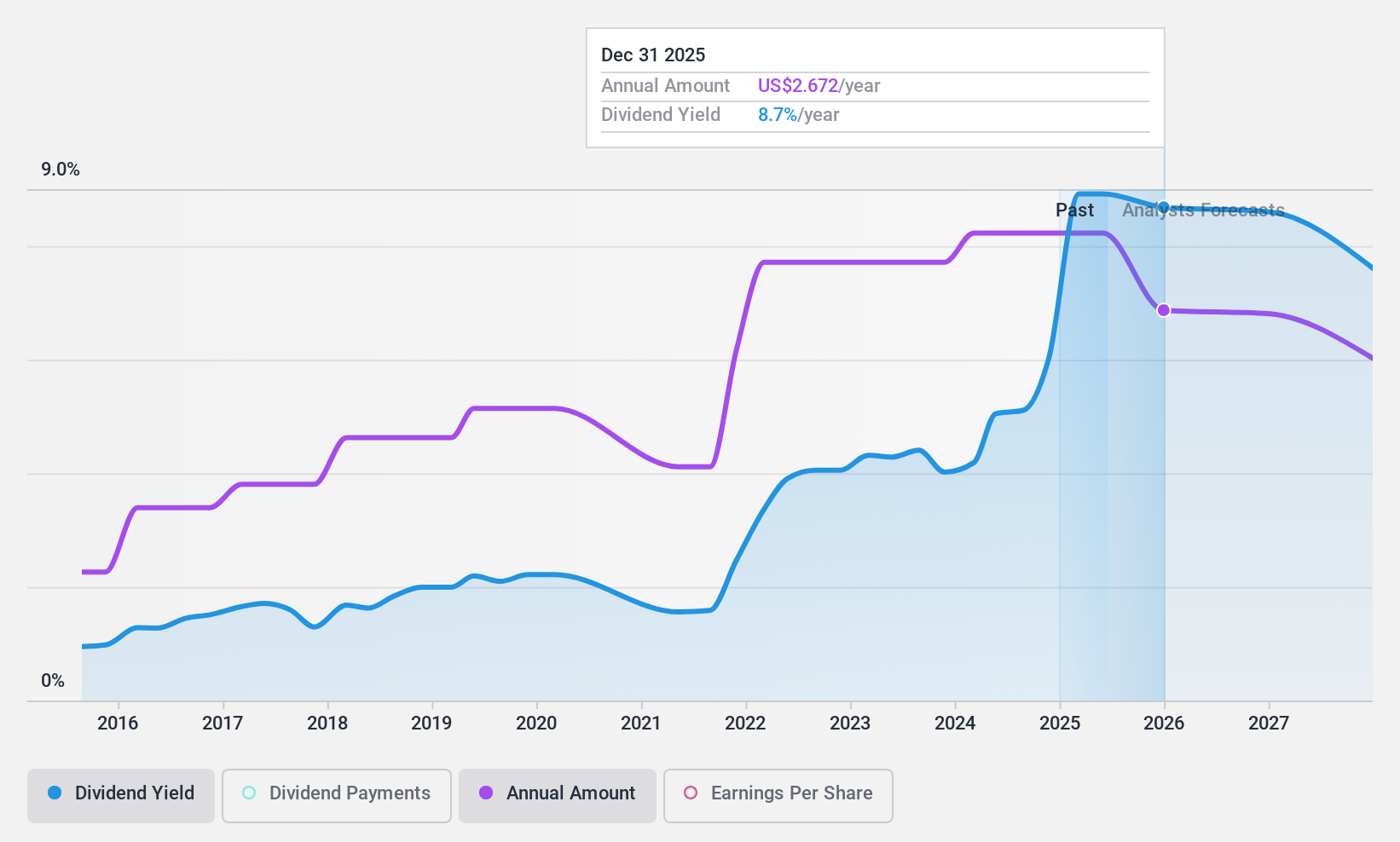

Carter's (NYSE:CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets branded childrenswear under various brands such as Carter's and OshKosh in the United States and internationally, with a market cap of approximately $1.87 billion.

Operations: Carter's, Inc. generates its revenue through three primary segments: U.S. Retail ($1.43 billion), International ($408.17 million), and U.S. Wholesale ($1 billion).

Dividend Yield: 6.2%

Carter's, Inc. offers a high dividend yield of 6.17%, placing it among the top 25% of US dividend payers, although its track record has been volatile with past annual drops over 20%. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 49.8% and 41.5%, respectively. Recent leadership changes include the retirement of CEO Michael D. Casey and Carter's addition to the S&P 600 Index following its removal from the S&P 400 Index.

- Unlock comprehensive insights into our analysis of Carter's stock in this dividend report.

- Our valuation report here indicates Carter's may be undervalued.

Summing It All Up

- Get an in-depth perspective on all 139 Top US Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives