- United States

- /

- Consumer Finance

- /

- NasdaqGS:WRLD

3 US Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

The United States market has shown robust performance recently, with a 2.9% increase over the past week and a 14% climb over the last year, while earnings are projected to grow by 15% annually. In such an environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering undiscovered gems that may benefit from these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

XPEL (XPEL)

Simply Wall St Value Rating: ★★★★★★

Overview: XPEL, Inc. is a company that focuses on manufacturing, installing, selling, and distributing protective films and coatings with a market capitalization of $993.17 million.

Operations: XPEL generates revenue primarily from its Auto Parts & Accessories segment, contributing $434.10 million. The company's financial performance can be evaluated through its net profit margin, which reflects the efficiency of its operations and profitability after all expenses are accounted for.

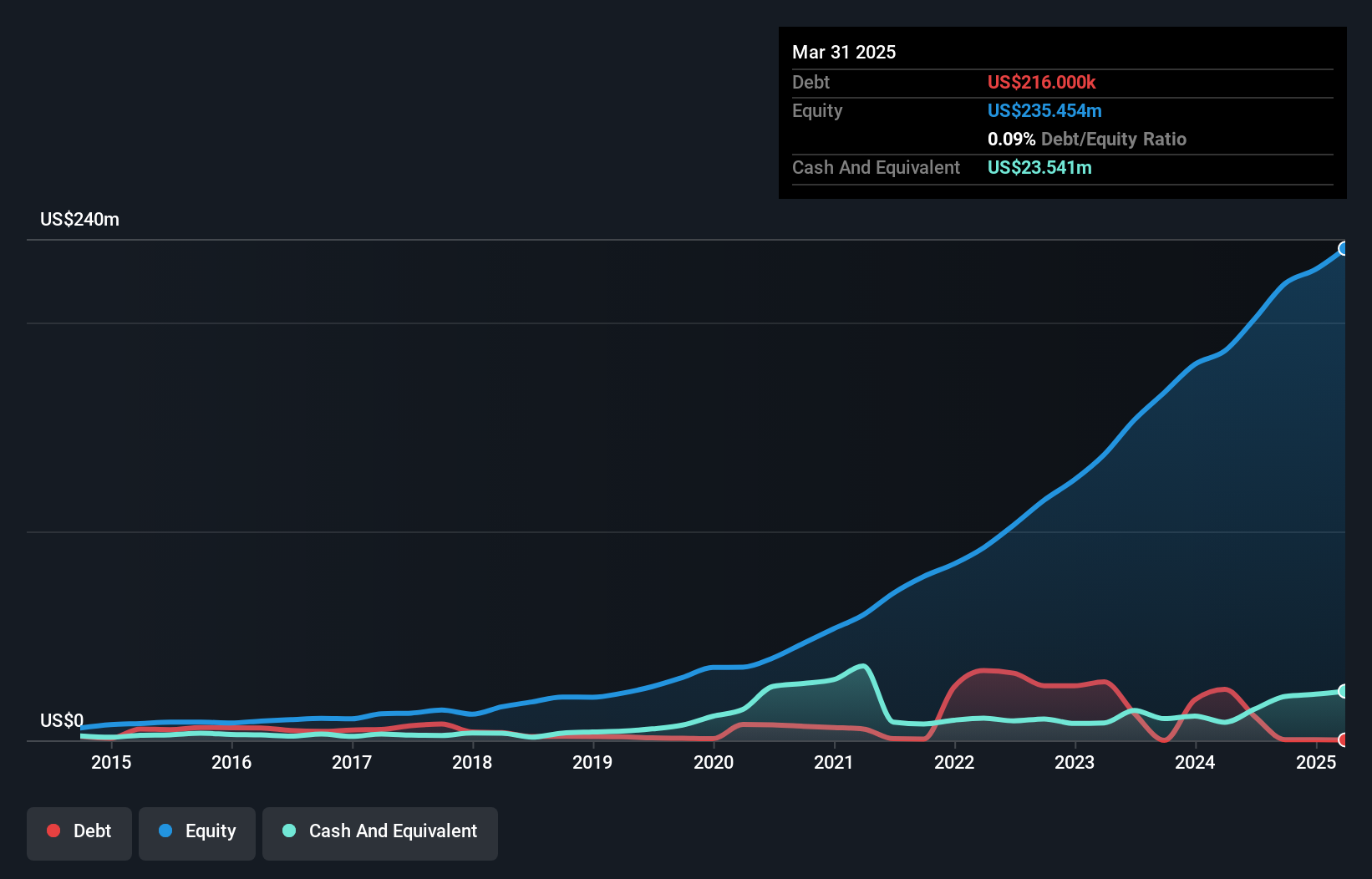

XPEL, a company in the protective films and coatings industry, has shown resilience with its recent earnings report revealing a net income of US$8.59 million for Q1 2025, up from US$6.67 million the previous year. The firm’s debt to equity ratio impressively dropped from 21.6% to just 0.09% over five years, highlighting strong financial management. Additionally, XPEL's EBIT covers interest payments by an impressive 102 times, indicating robust profitability despite macroeconomic challenges like tariffs and rising SG&A expenses. With strategic expansion into China and new product launches such as windshield protection films, XPEL aims to capture more market share while maintaining high-quality earnings performance.

Bank7 (BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. is a bank holding company for Bank7, offering banking and financial services to individual and corporate clients, with a market capitalization of $395.26 million.

Operations: Bank7 Corp. generates revenue primarily from its banking segment, which accounts for $96.03 million.

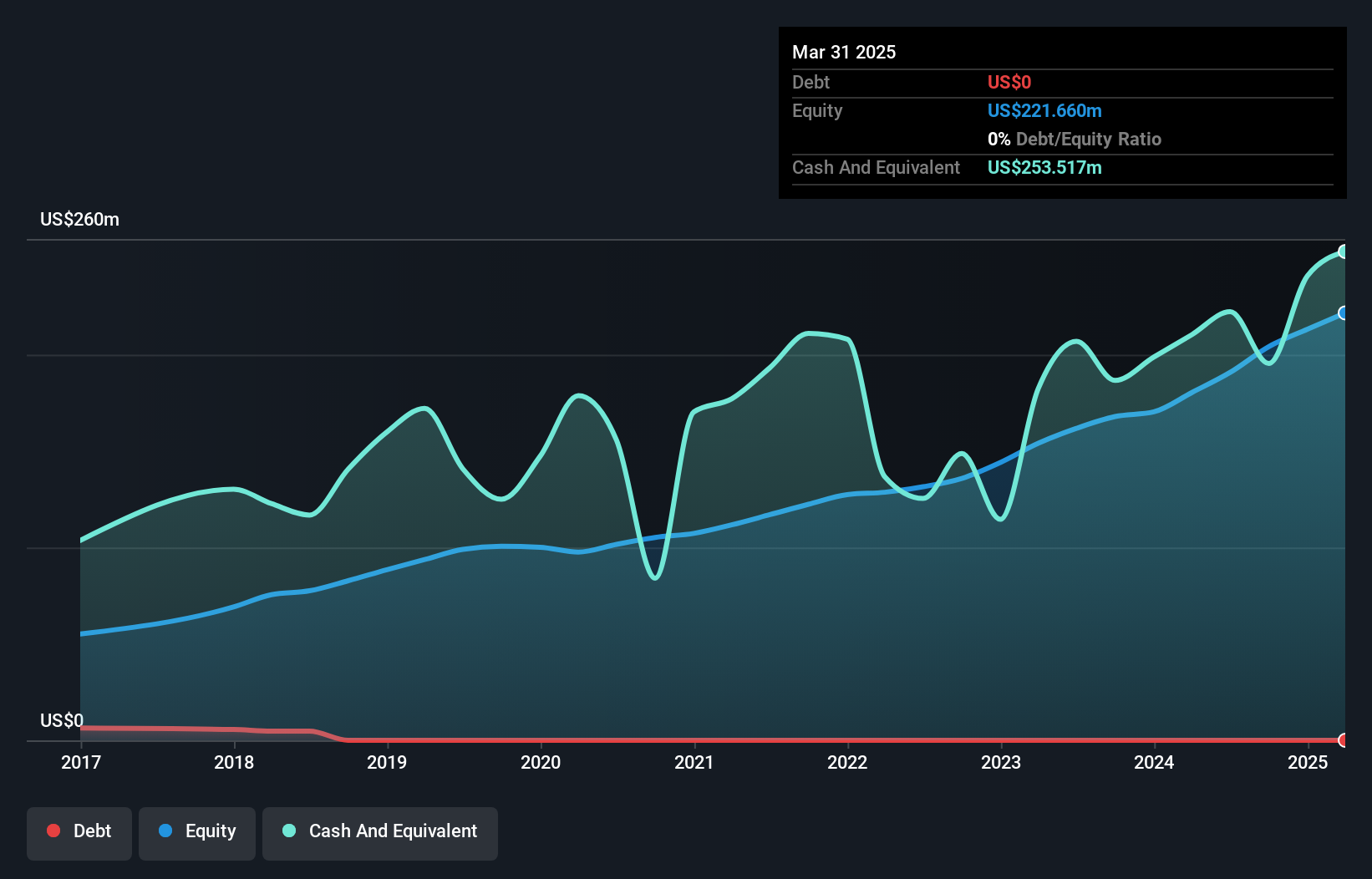

Bank7, with assets totaling US$1.8 billion and equity of US$221.7 million, is a bank holding company focused on financial services in high-growth markets like Oklahoma City and Texas. The bank's total deposits are US$1.6 billion against loans of US$1.4 billion, ensuring a solid net interest margin of 5.1%. Its allowance for bad loans stands at 0.4% of total loans, reflecting prudent risk management practices that align with its primarily low-risk funding structure reliant on customer deposits. Despite projected earnings declines averaging 7% annually over the next three years, Bank7 trades significantly below its estimated fair value by about 65%, indicating potential undervaluation amidst economic uncertainties impacting sectors such as hospitality and commercial lending where it operates actively.

World Acceptance (WRLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States, with a market capitalization of $849.98 million.

Operations: World Acceptance generates revenue primarily from its consumer finance segment, which reported $564.78 million. The company's financial performance is influenced by its net profit margin, which has shown variability over recent periods.

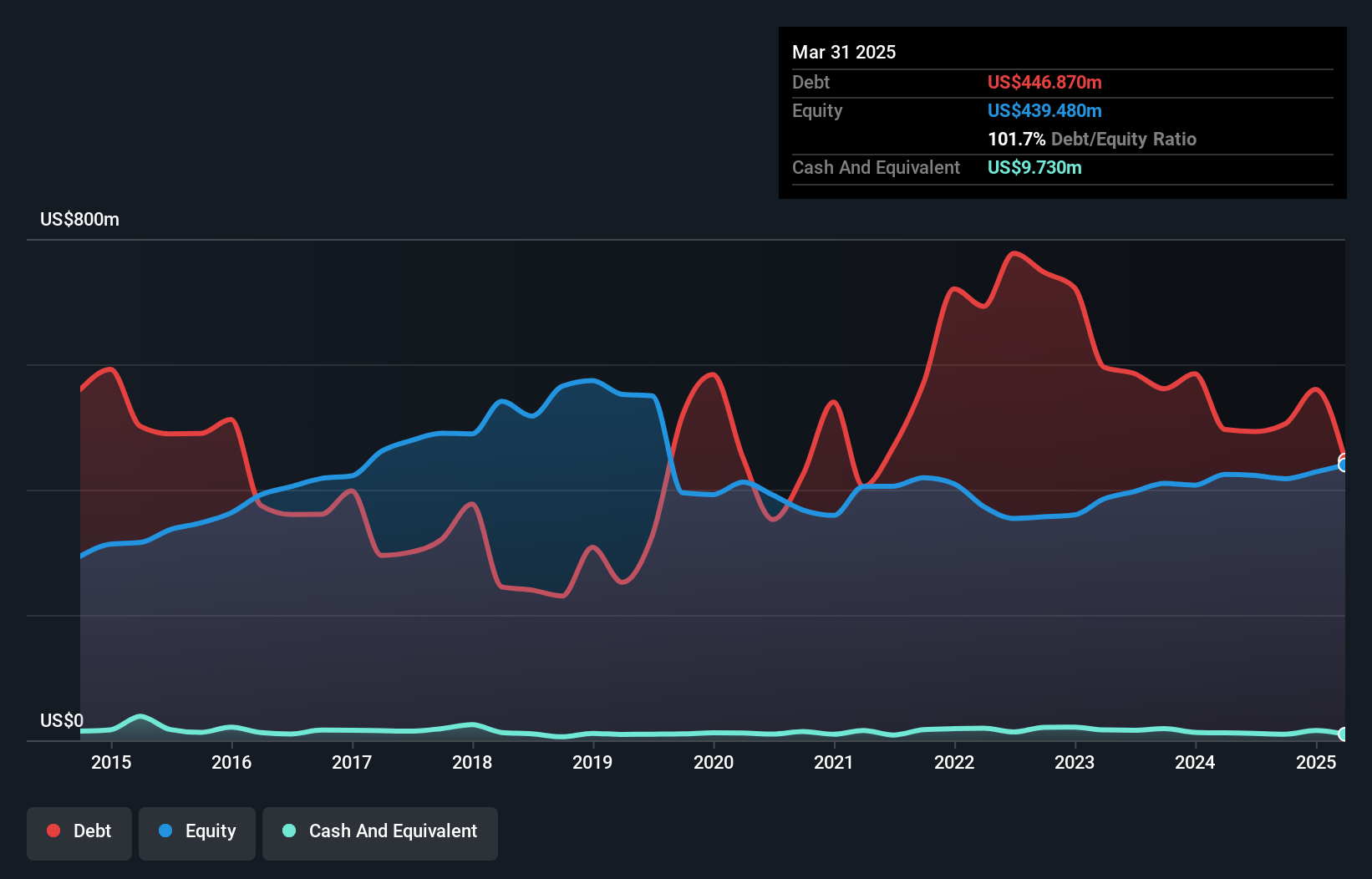

World Acceptance, a smaller player in the consumer finance sector, is navigating through strategic shifts with a focus on high-yield loans and credit card pilots to boost earnings. Their price-to-earnings ratio of 9.7x suggests undervaluation compared to the broader US market at 18.2x, while their EBIT covers interest payments comfortably at 3.6x coverage. Despite solid earnings growth of 8% annually over five years, challenges remain with a high net debt to equity ratio of 99.5%. Recent index reclassifications and share repurchases reflect ongoing efforts to optimize financial performance amidst forecasted revenue pressures.

Seize The Opportunity

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 279 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if World Acceptance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WRLD

World Acceptance

Engages in consumer finance business in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives