- United States

- /

- Banks

- /

- NasdaqCM:COFS

US Growth Stocks With High Insider Ownership That Could Boost Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market attempts to rebound from a recent downturn, with major indexes like the Dow Jones and S&P 500 inching higher after last week's sell-off, investors are keenly watching for opportunities that align with current economic conditions. In this environment, growth companies with high insider ownership could offer potential advantages, as insiders' vested interests may signal confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 25.4% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Enovix (NasdaqGS:ENVX) | 12.6% | 56.0% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.6% |

Let's explore several standout options from the results in the screener.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of approximately $933.62 million.

Operations: The company generates revenue primarily from its community banking segment, which amounts to $237.73 million.

Insider Ownership: 12.9%

Burke & Herbert Financial Services shows strong growth potential with substantial insider buying over the past three months and no significant insider selling. The company's revenue is expected to grow at 19.6% annually, surpassing the US market's average, while earnings are forecasted to increase significantly at 47% per year. Despite recent shareholder dilution, BHRB trades below its estimated fair value and maintains a reliable dividend yield of 3.53%. Recent executive changes include Jason A. Kitzmiller not standing for re-election in 2025.

- Navigate through the intricacies of Burke & Herbert Financial Services with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Burke & Herbert Financial Services' current price could be inflated.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ChoiceOne Financial Services, Inc. is the bank holding company for ChoiceOne Bank, offering banking services to corporations, partnerships, and individuals in Michigan with a market cap of $286.09 million.

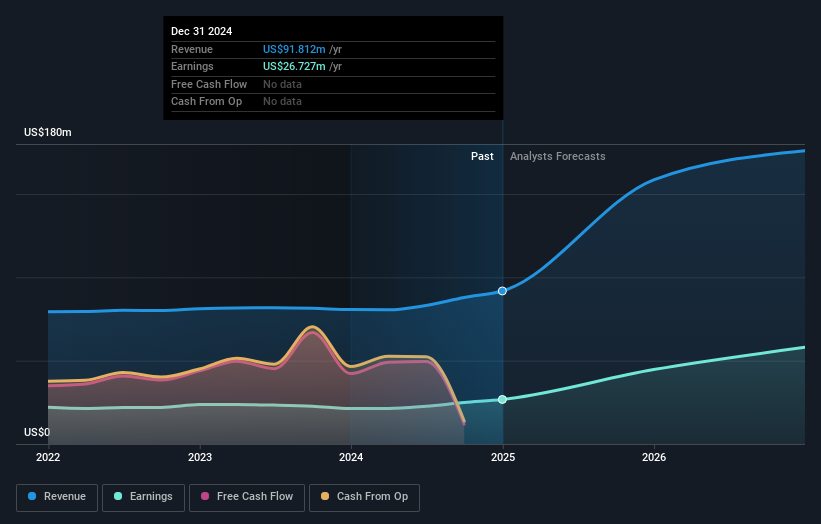

Operations: The company generates revenue primarily through its banking segment, which accounts for $91.81 million.

Insider Ownership: 10.5%

ChoiceOne Financial Services demonstrates growth potential with earnings and revenue forecasted to grow significantly, outpacing the broader US market. Despite past shareholder dilution, the company trades below its estimated fair value and offers a reliable dividend yield. Recent financials show net income rising to US$26.73 million for 2024. Insider activity indicates more buying than selling recently, though not in substantial volumes. The company also plans to increase authorized shares from 15 million to 30 million.

- Click here to discover the nuances of ChoiceOne Financial Services with our detailed analytical future growth report.

- According our valuation report, there's an indication that ChoiceOne Financial Services' share price might be on the cheaper side.

Westrock Coffee (NasdaqGM:WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC operates as an integrated provider of coffee, tea, flavors, extracts, and ingredients solutions both in the United States and internationally with a market cap of approximately $598.09 million.

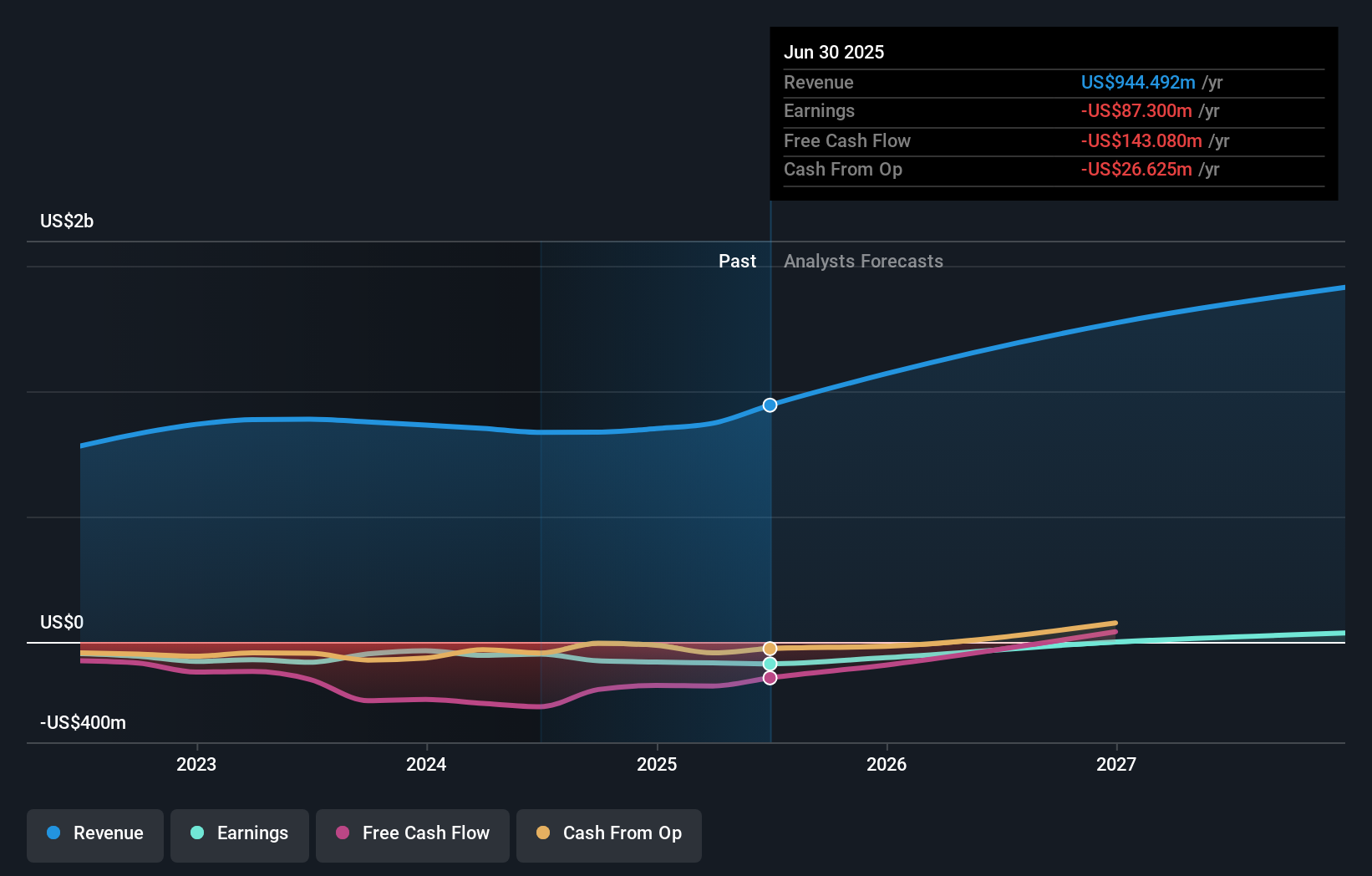

Operations: The company's revenue segments consist of Beverage Solutions, contributing $660.44 million, and Sustainable Sourcing & Traceability, generating $184.58 million.

Insider Ownership: 13.3%

Westrock Coffee is positioned for strong growth with earnings expected to increase by 98.03% annually and revenue projected to outpace the US market at 15.9% per year. Analysts agree the stock trades below target prices, suggesting potential upside of 79.5%. Insider activity is positive, with more shares bought than sold in recent months, indicating confidence in future performance. The company anticipates becoming profitable within three years, surpassing average market growth expectations.

- Take a closer look at Westrock Coffee's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Westrock Coffee is trading behind its estimated value.

Taking Advantage

- Investigate our full lineup of 198 Fast Growing US Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COFS

ChoiceOne Financial Services

Operates as the bank holding company for ChoiceOne Bank that provides banking services in Michigan.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives