- United States

- /

- Banks

- /

- NasdaqCM:BHRB

Top Dividend Stocks In US Markets To Consider

Reviewed by Simply Wall St

As the U.S. markets navigate a period of mixed performance, with the S&P 500 inching higher despite tech stocks lagging, investors are closely watching economic indicators like the Producer Price Index for signs of inflationary trends. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.71% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.84% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.16% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.15% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.96% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.92% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.80% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.06% | ★★★★★★ |

Click here to see the full list of 152 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $906.30 million.

Operations: Burke & Herbert Financial Services Corp. generates revenue primarily through its Community Banking segment, which accounted for $181.38 million.

Dividend Yield: 3.6%

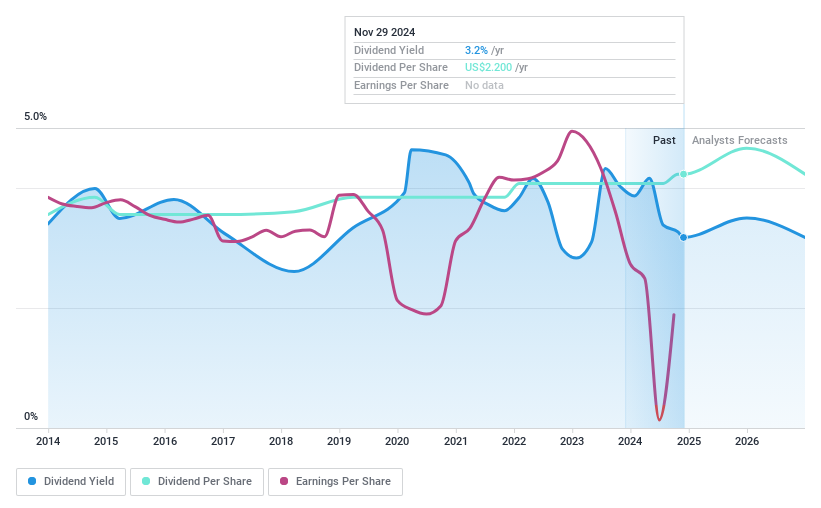

Burke & Herbert Financial Services has demonstrated consistent dividend growth over the past decade, though its current payout ratio of 109.4% suggests dividends aren't well covered by earnings. Despite a recent 3.8% dividend increase, the yield of 3.63% is below top-tier US dividend payers. Earnings have shown significant improvement with net interest income rising to US$73.18 million in Q3 2024 from US$22.89 million a year ago, yet shareholders experienced dilution last year and profit margins have decreased significantly from the previous year’s figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Burke & Herbert Financial Services.

- Our valuation report here indicates Burke & Herbert Financial Services may be overvalued.

ESSA Bancorp (NasdaqGS:ESSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ESSA Bancorp, Inc. is a bank holding company for ESSA Bank & Trust, offering a variety of financial services to individuals, families, and businesses in Pennsylvania, with a market cap of $186.57 million.

Operations: ESSA Bancorp, Inc. generates revenue primarily from its Thrift/Savings and Loan Institutions segment, which accounts for $67.84 million.

Dividend Yield: 3.1%

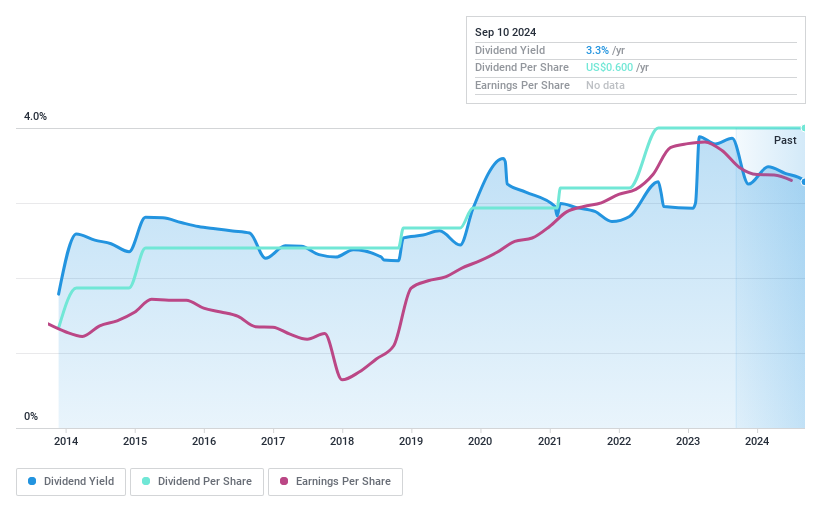

ESSA Bancorp's dividend reliability is underscored by stable and growing payouts over the past decade, with a low payout ratio of 33.7% indicating good coverage by earnings. However, its yield of 3.08% falls short compared to top US dividend payers. Recent developments include an acquisition agreement with CNB Financial Corporation valued at approximately $210 million, potentially impacting future dividend strategies post-merger completion expected in Q3 2025.

- Navigate through the intricacies of ESSA Bancorp with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that ESSA Bancorp is trading behind its estimated value.

Magic Software Enterprises (NasdaqGS:MGIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Magic Software Enterprises Ltd. is a company that offers proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services both in Israel and internationally with a market cap of approximately $599.01 million.

Operations: Magic Software Enterprises Ltd. generates revenue through its proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based offerings across various international markets.

Dividend Yield: 3.6%

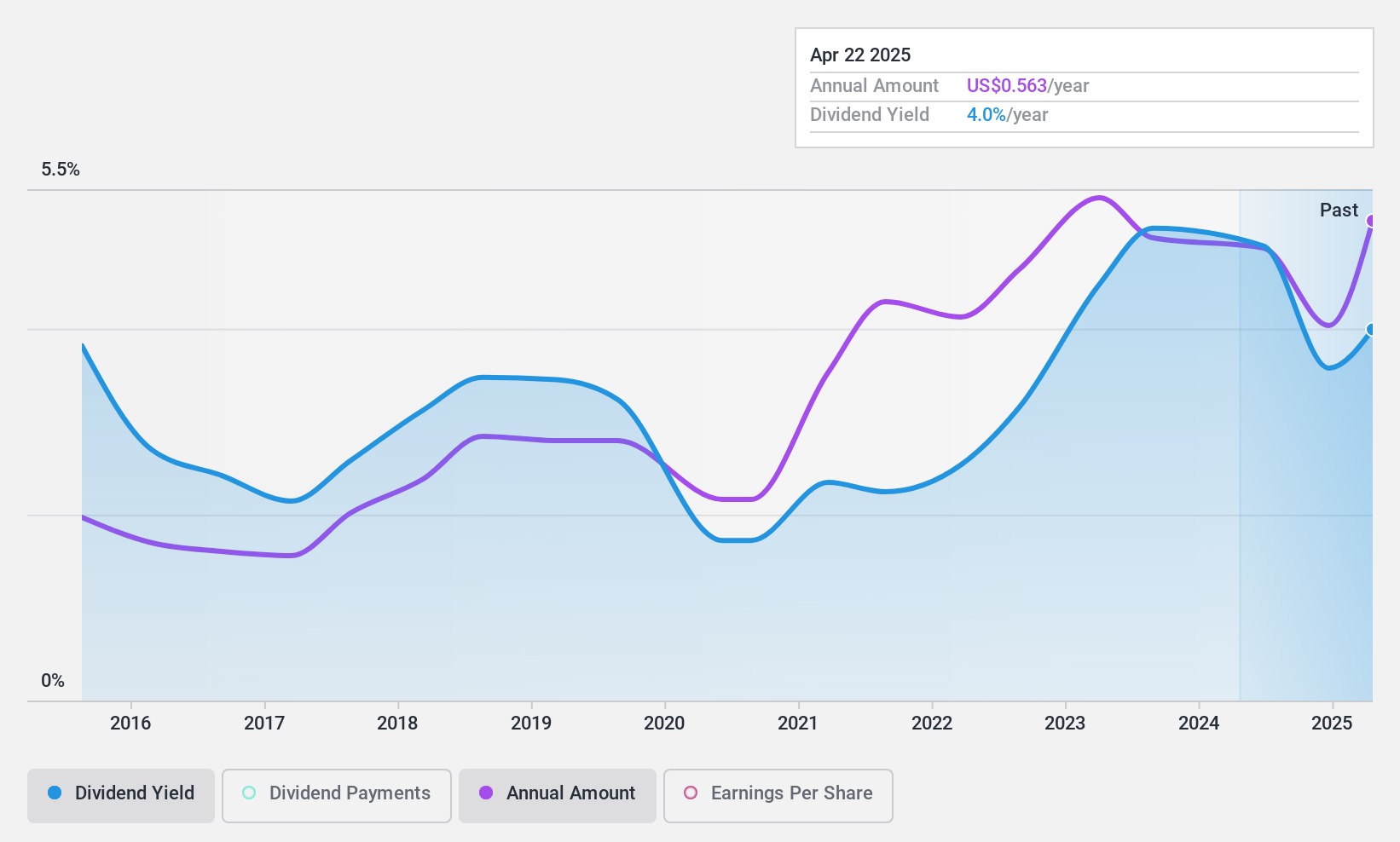

Magic Software Enterprises has shown volatility in its dividend payments over the past decade, despite recent growth. The current dividend yield of 3.61% is below top US payers, but dividends are well-covered by earnings and cash flows with a payout ratio of 62.2%. Recent guidance raised revenue expectations to $544 million-$550 million for 2024, indicating positive business momentum. However, the dividend track record remains unstable despite reasonable valuation metrics such as a P/E ratio of 17.2x.

- Click to explore a detailed breakdown of our findings in Magic Software Enterprises' dividend report.

- Upon reviewing our latest valuation report, Magic Software Enterprises' share price might be too pessimistic.

Next Steps

- Click here to access our complete index of 152 Top US Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burke & Herbert Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BHRB

Burke & Herbert Financial Services

Operates as the bank holding company for Burke & Herbert Bank & Trust Company that provides various community banking products and services in Virginia and Maryland.

Flawless balance sheet with high growth potential and pays a dividend.