- United States

- /

- Construction

- /

- NasdaqGM:BWMN

3 US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the United States market navigates through a period of uncertainty with stock futures slipping ahead of the Federal Reserve's interest rate meeting, investors are keenly observing how major indices like the Dow Jones and Nasdaq are responding to these economic signals. In such a climate, growth companies with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Myomo (NYSEAM:MYO) | 13.7% | 69.1% |

Let's uncover some gems from our specialized screener.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp. is a bank holding company for Burke & Herbert Bank & Trust Company, offering community banking products and services in Virginia and Maryland, with a market cap of $1.04 billion.

Operations: The company generates revenue of $181.38 million from its community banking products and services in Virginia and Maryland.

Insider Ownership: 12.5%

Revenue Growth Forecast: 27.4% p.a.

Burke & Herbert Financial Services is experiencing rapid growth, with forecasted revenue and earnings growth rates of 27.4% and 72.5% per year, respectively, surpassing the US market averages. Despite this growth potential, profit margins have declined from last year, and shareholders faced substantial dilution recently. Insider buying has been significant over the past three months, indicating confidence among insiders. The company trades at a discount to its estimated fair value but faces challenges in dividend sustainability and return on equity projections.

- Unlock comprehensive insights into our analysis of Burke & Herbert Financial Services stock in this growth report.

- In light of our recent valuation report, it seems possible that Burke & Herbert Financial Services is trading beyond its estimated value.

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers real estate, energy, infrastructure, and environmental management solutions in the United States with a market cap of $482.95 million.

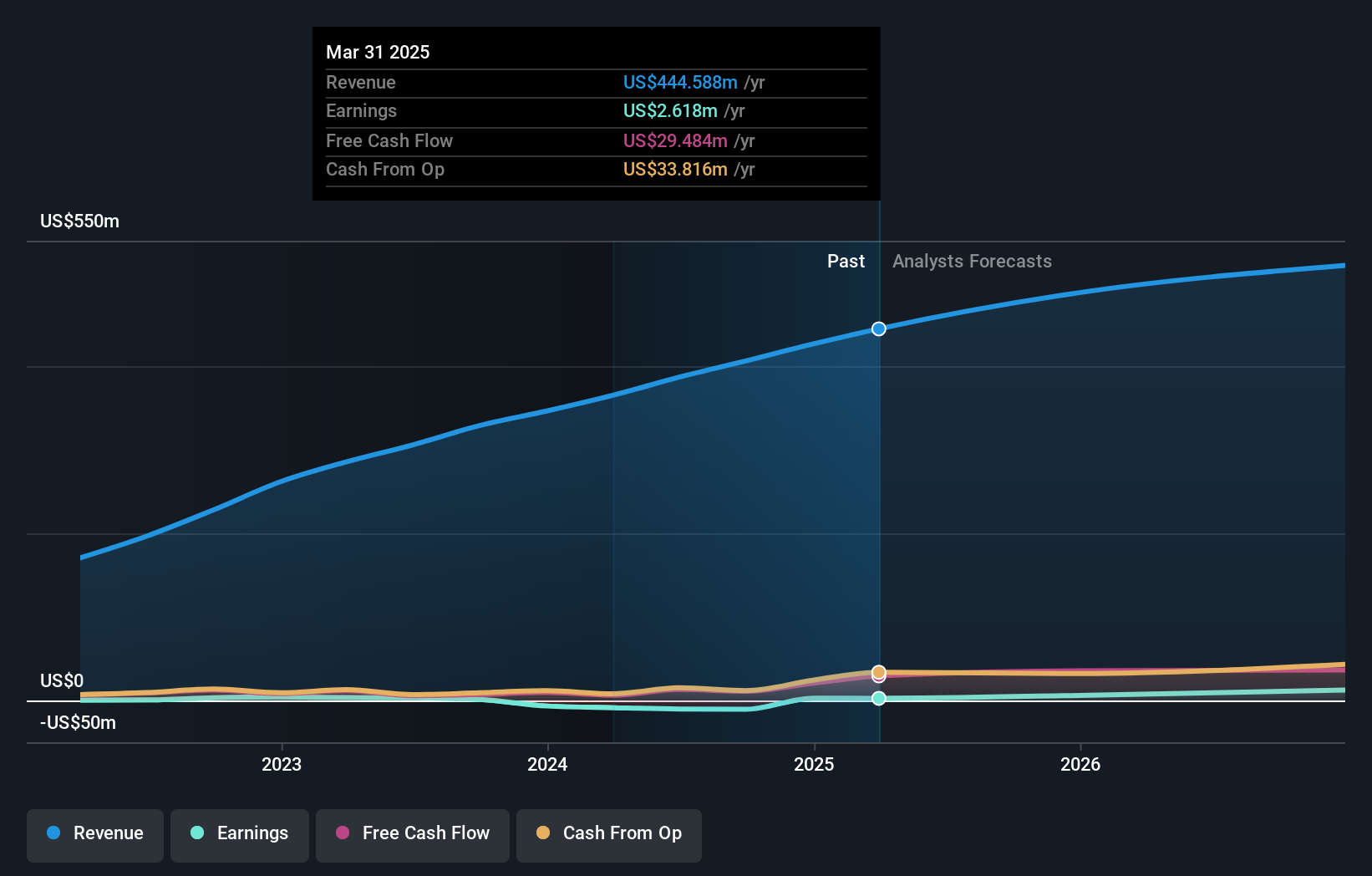

Operations: The company generates revenue of $406.31 million from delivering engineering and related professional services to its clients.

Insider Ownership: 19.1%

Revenue Growth Forecast: 11.6% p.a.

Bowman Consulting Group is poised for growth, with revenue expected to increase by 11.6% annually, outpacing the broader US market. Despite past shareholder dilution, the company is trading significantly below its estimated fair value and anticipates becoming profitable within three years. Recent projects in Boston and Michigan highlight Bowman's strategic expansion in transportation and renewable energy sectors. Additionally, a $19 million share buyback underscores management's confidence in the company's future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Bowman Consulting Group.

- According our valuation report, there's an indication that Bowman Consulting Group's share price might be on the cheaper side.

Princeton Bancorp (NasdaqGS:BPRN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Princeton Bancorp, Inc., with a market cap of $253.34 million, operates as the bank holding company for The Bank of Princeton, offering a range of banking products and services.

Operations: The company generates revenue of $67.21 million from its Community Banking Operations segment.

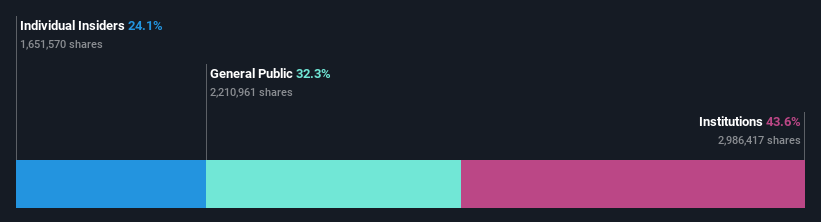

Insider Ownership: 24.1%

Revenue Growth Forecast: 12.8% p.a.

Princeton Bancorp's revenue is projected to grow at 12.8% annually, outpacing the US market, with earnings expected to increase significantly by 44.7%. Despite a recent net loss of US$3.61 million in Q3 2024, insider ownership remains high. The company trades well below its estimated fair value but has experienced shareholder dilution over the past year. A recent dividend declaration of US$0.30 per share reflects ongoing shareholder returns amidst financial challenges.

- Navigate through the intricacies of Princeton Bancorp with our comprehensive analyst estimates report here.

- The analysis detailed in our Princeton Bancorp valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Embark on your investment journey to our 204 Fast Growing US Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bowman Consulting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BWMN

Bowman Consulting Group

Provides a range of real estate, energy, infrastructure, and environmental management solutions in the United States.

Undervalued with excellent balance sheet.