- United States

- /

- Auto Components

- /

- NYSE:SMP

3 Undervalued Small Caps With Recent Insider Activity To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.6%, contributing to a 12% increase over the past year, with earnings forecasted to grow by 14% annually. In this context of steady market performance, identifying small-cap stocks with recent insider activity can provide valuable insights into potential opportunities for investors seeking growth in undervalued segments.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | NA | 0.5x | 39.05% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.5x | 46.57% | ★★★★★☆ |

| Citizens & Northern | 10.9x | 2.7x | 48.30% | ★★★★☆☆ |

| Barrett Business Services | 20.7x | 0.9x | 47.02% | ★★★★☆☆ |

| S&T Bancorp | 10.7x | 3.7x | 43.42% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 27.73% | ★★★★☆☆ |

| Vital Energy | NA | 0.4x | 8.54% | ★★★★☆☆ |

| MVB Financial | 13.9x | 1.8x | 35.00% | ★★★☆☆☆ |

| Cracker Barrel Old Country Store | 21.2x | 0.3x | -637.46% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -365.97% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

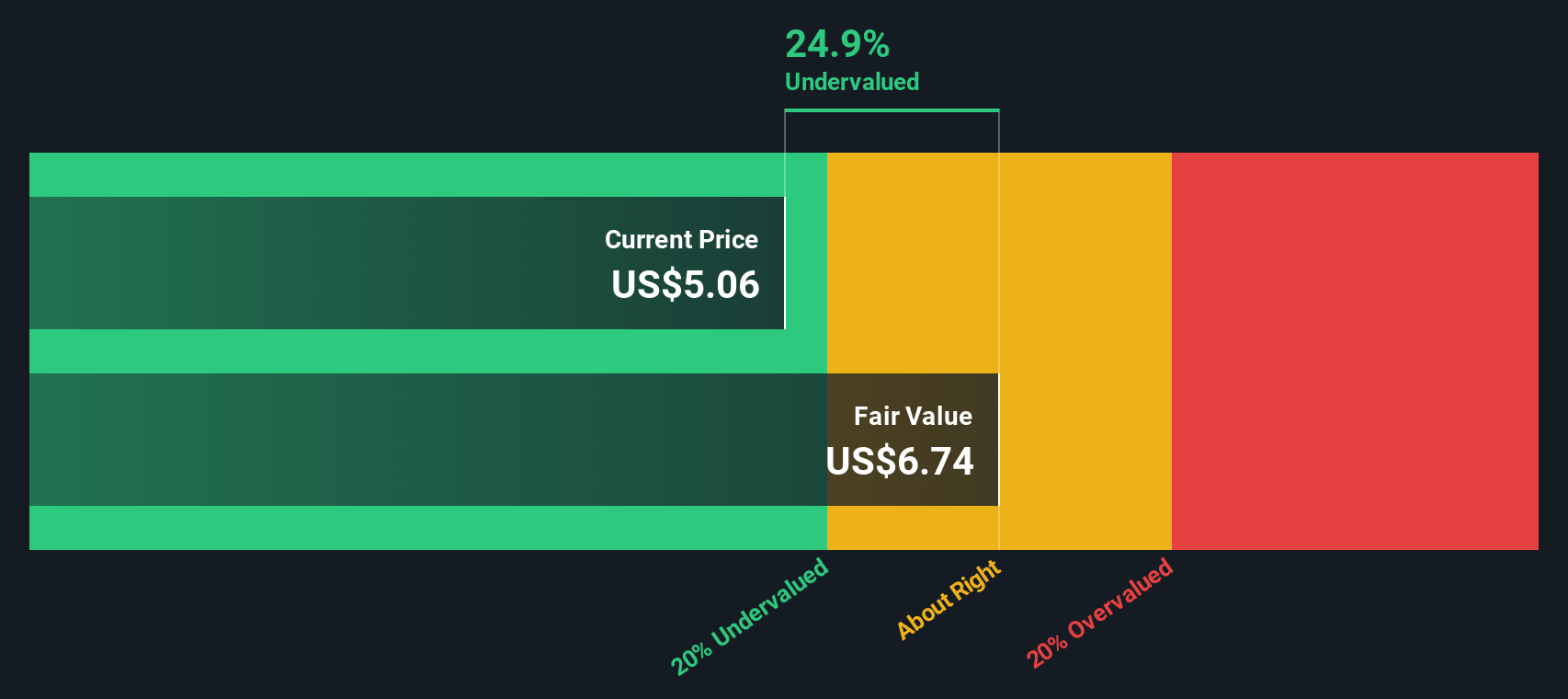

AirSculpt Technologies (AIRS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: AirSculpt Technologies is a company that specializes in providing direct medical procedure services, with a market capitalization of approximately $0.39 billion.

Operations: The primary revenue stream is from Direct Medical Procedure Services. The company has experienced fluctuations in its gross profit margin, which was 65.54% as of March 31, 2024, and decreased to 63.81% by June 12, 2025. Operating expenses have consistently been a significant portion of costs, with General & Administrative Expenses being the largest component among them.

PE: -19.1x

AirSculpt Technologies, a smaller player in the U.S. market, recently completed a follow-on equity offering of US$12 million at US$3.8 per share on June 9, 2025. Despite reporting a net loss of US$2.85 million for Q1 2025 compared to last year's profit, they project annual revenue between US$160 million and US$170 million for 2025. The company's reliance on external borrowing highlights funding risks; however, insider confidence is shown through recent share purchases within the same period.

- Dive into the specifics of AirSculpt Technologies here with our thorough valuation report.

Assess AirSculpt Technologies' past performance with our detailed historical performance reports.

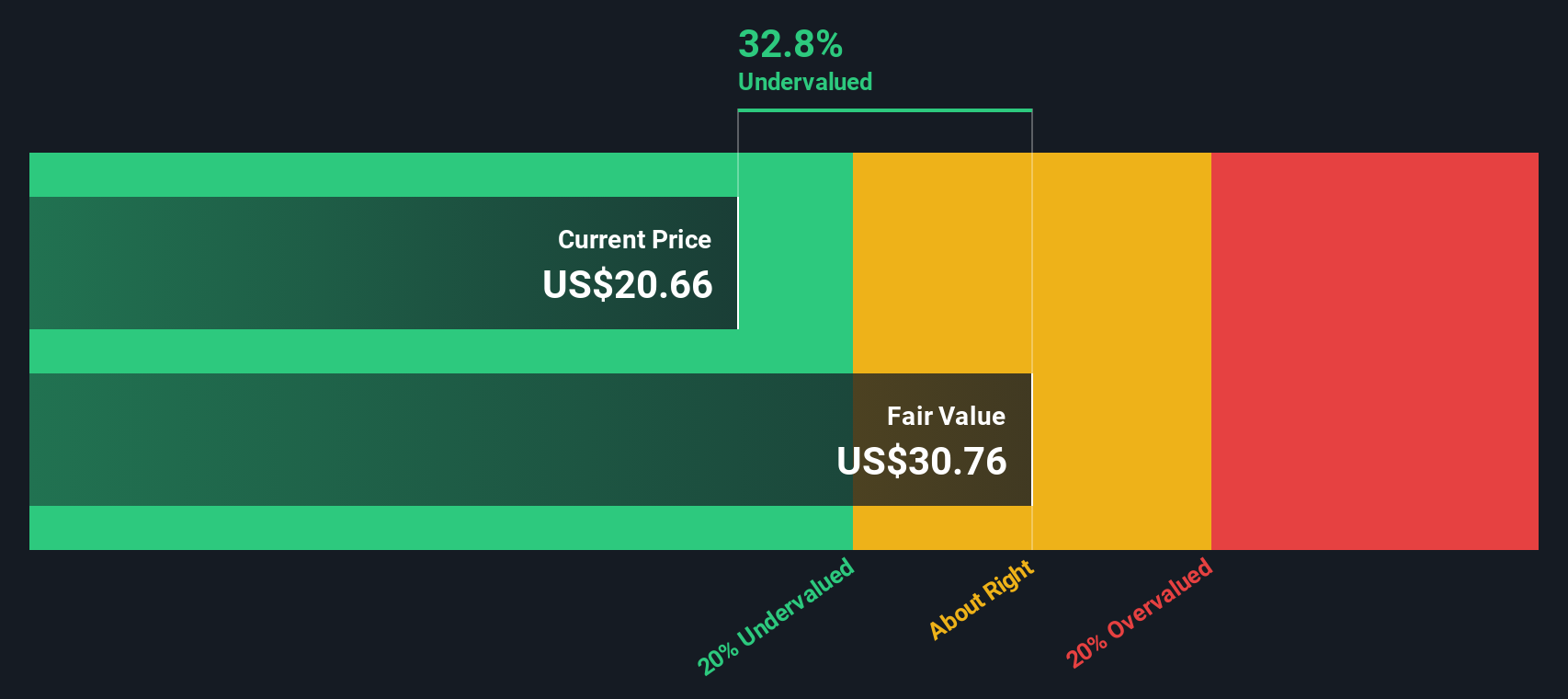

Capital Southwest (CSWC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Capital Southwest is a business development company that focuses on providing financing solutions to middle-market companies and has a market cap of approximately $0.64 billion.

Operations: The company generates revenue primarily from its investment activities, with the latest reported figure being $204.44 million. Operating expenses for the most recent period were $29.03 million, while non-operating expenses amounted to $105.55 million. The net income margin has shown variability over time, with a recent figure of 34.17%.

PE: 16.9x

Capital Southwest, a smaller U.S. company, has shown resilience in its financial strategy despite facing challenges. The firm's revenue increased to US$204.44 million for the year ending March 31, 2025, up from US$178.14 million previously, although net income declined to US$70.55 million from US$83.39 million. Insider confidence is evident with recent share purchases by executives over the past few months, signaling belief in potential growth despite earnings pressures and reliance on external borrowing for funding needs.

- Click here and access our complete valuation analysis report to understand the dynamics of Capital Southwest.

Understand Capital Southwest's track record by examining our Past report.

Standard Motor Products (SMP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Standard Motor Products is a manufacturer and distributor of replacement parts for motor vehicles in the automotive aftermarket industry, with a market capitalization of approximately $1.02 billion.

Operations: Standard Motor Products generates revenue primarily from Vehicle Control, Temperature Control, and Engineered Solutions segments. The company's gross profit margin has shown fluctuations over the years, with recent figures around 29.62%. Operating expenses are a significant part of their cost structure, often exceeding $200 million annually.

PE: 11.9x

Standard Motor Products, a player in the automotive aftermarket, shows promising potential with its recent product expansions. Their EVAP program now covers over seven million vehicles, enhancing their market reach. Despite relying on external borrowing for funding, earnings are projected to grow 28% annually. The company reported first-quarter sales of US$413 million and net income of US$12.57 million, up from last year. Insider confidence is evident with recent stock purchases by executives this year, indicating belief in future growth prospects.

Key Takeaways

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 92 more companies for you to explore.Click here to unveil our expertly curated list of 95 Undervalued US Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMP

Standard Motor Products

Manufactures and distributes replacement automotive parts in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)