- United States

- /

- Auto

- /

- NYSE:NIO

NIO (NYSE:NIO) Valuation in Focus After Record-Breaking Vehicle Deliveries and Renewed Analyst Optimism

Reviewed by Kshitija Bhandaru

NIO (NYSE:NIO) just reported its highest-ever monthly and quarterly vehicle delivery numbers. This showcases clear momentum in both its premium and mass-market brands and is putting the stock back in the spotlight.

See our latest analysis for NIO.

Despite an intense week, NIO’s share price tumbled 12.9% over the last 7 days after a sharp rally. However, momentum for the stock remains clear, with a 30-day share price return of 17.3% and an impressive 47.5% gain year-to-date. Buoyed by record-setting delivery numbers, upbeat earnings signals, and shifting sentiment around China’s EV sector, NIO’s long-term returns have struggled (with a three-year total shareholder return of -42.9%), yet the recent surge hints at renewed optimism and potential for further growth if execution remains strong.

If NIO’s run has you curious about what else is happening in the electric vehicle space, now is a great opportunity to explore See the full list for free.

With shares rebounding sharply this year but long-term returns still deep in the red, the big question now is whether NIO remains undervalued or if the recent rally means all the good news is already priced in. Is there a real buying opportunity here, or are markets looking ahead to growth that is yet to materialize?

Most Popular Narrative: 20% Undervalued

With NIO's last close at $6.71 and the most followed narrative estimating fair value at $6.72, the stock sits practically in line with consensus, yet subtle upside remains if the big assumptions play out. This view is based on a carefully blended mix of projected growth, margin recovery, and risk, using a 12.74% discount rate as the lens for future outcomes.

Strong delivery growth driven by the launch of new high-demand models (ONVO L90, all-new ES8, FIREFLY) and a multi-brand strategy positions NIO to capture a broader user base and higher market share in premium and mainstream EV segments. This supports robust top-line revenue growth and volume leverage. Expansion and densification of NIO's proprietary Power Swap network and charging infrastructure across China's largest cities and highways removes range anxiety and further differentiates NIO from competitors. These factors accelerate EV adoption and increase recurring services revenue and margin stability.

What is the secret behind this slender 20% upside? It all comes down to bold volume targets, aggressive new model launches, and a transformation of the company’s recurring revenue engine. Are Wall Street projections banking on a pivot in profitability, or is it the scale narrative that tips the balance? Only a deep dive will reveal how the numbers add up.

Result: Fair Value of $6.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and intensifying competition could quickly challenge this optimistic outlook. As a result, NIO's path to sustainable profitability is less certain.

Find out about the key risks to this NIO narrative.

Another View: Comparing Multiples for Perspective

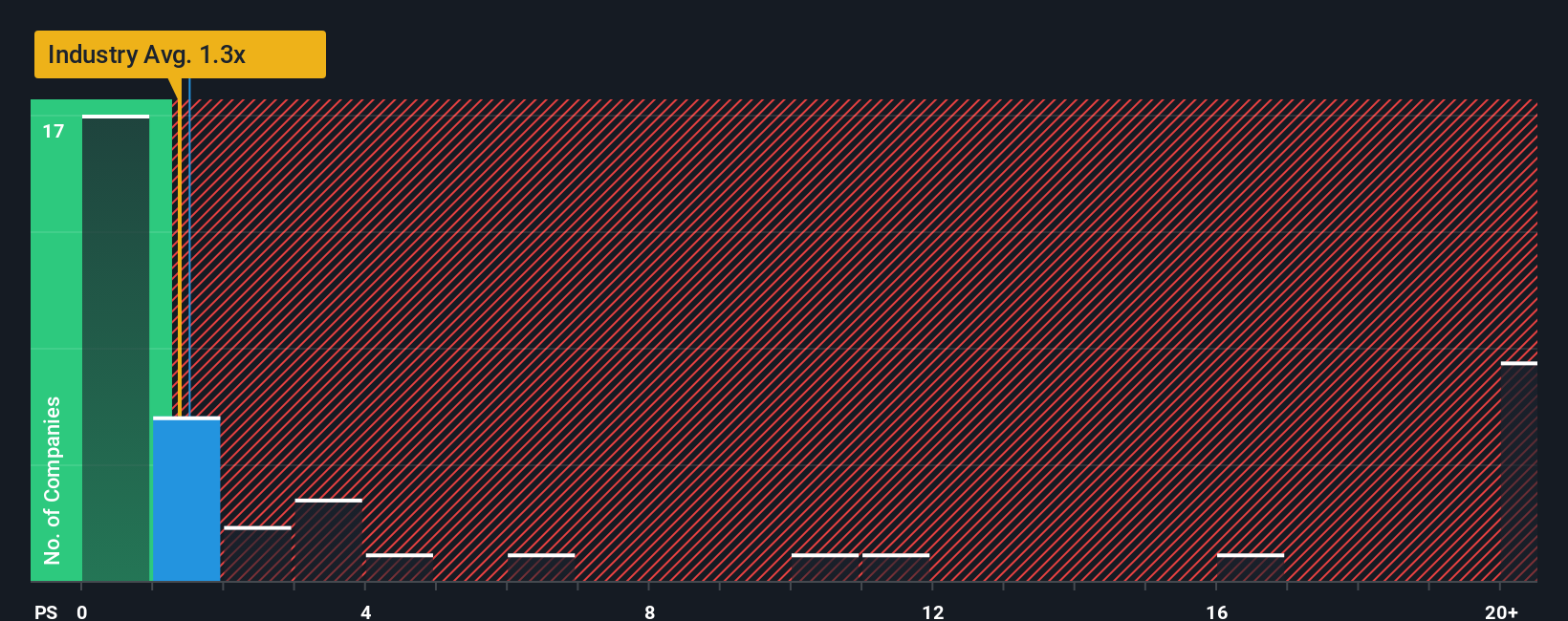

Looking from another angle, NIO’s price-to-sales ratio stands at 1.7x. This is higher than the US Auto industry average of 1.3x and also above its fair ratio of 1.5x. This signals that the stock may carry valuation risk if market trends or sentiment shift unexpectedly. Could this premium really be justified, or does it set up investors for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NIO Narrative

If you prefer digging into the numbers yourself or have a different take on NIO’s story, it’s quick and easy to create a tailored view of your own. Do it your way.

A great starting point for your NIO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let opportunity pass you by. The right stock could be just one search away, and Simply Wall Street makes it simple to zero in on the best prospects fast.

- Uncover potential bargains by scanning for companies trading below their cash-flow valuations with these 898 undervalued stocks based on cash flows.

- Target future disruptors and capitalize on tech momentum by checking out these 24 AI penny stocks, which are set to benefit from rapid advancements in artificial intelligence.

- Secure steady passive income and stability with these 19 dividend stocks with yields > 3%, offering yields above 3% and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives