- United States

- /

- Auto

- /

- NYSE:NIO

NIO (NYSE:NIO) Reports 62 Percent Year-Over-Year Jump In February Deliveries

Reviewed by Simply Wall St

NIO (NYSE:NIO) recently announced robust delivery figures, echoing a 62% year-over-year increase in February, alongside a 49% jump in year-to-date deliveries, which likely influenced the company's 10% share price rise over the past month. This performance showcases NIO’s growing market presence in the electric vehicle sector, amidst broader market turbulence marked by general losses in major indexes. While the Nasdaq faced a tough month, down 4%, NIO's impressive delivery numbers provided a counterbalance amidst this volatility. The benign inflation data and end-of-month tech stock recovery might have further impacted investor sentiment, contributing to NIO's uptick as other large-cap tech stocks like Tesla gained momentum. Despite market concerns of tariffs and economic uncertainty, NIO’s notable delivery growth could bolster investor confidence in the company's expansion strategy, setting it apart from broader market dynamics throughout February.

Click here to discover the nuances of NIO with our detailed analytical report.

The last five years have seen NIO achieve a total return of 30.42%, despite challenges and an industry performance that outpaced it over the past year. Although NIO's recent underperformance relative to the US auto industry and market highlights some areas of concern, several key developments provide context for its longer-term trajectory. The addition of NIO to the S&P Global BMI Index in October 2024 underscored its strengthening market position. Product innovation continued with the December 2024 launch of the ET9 and Firefly brands, reflecting the company's commitment to expanding its vehicle portfolio.

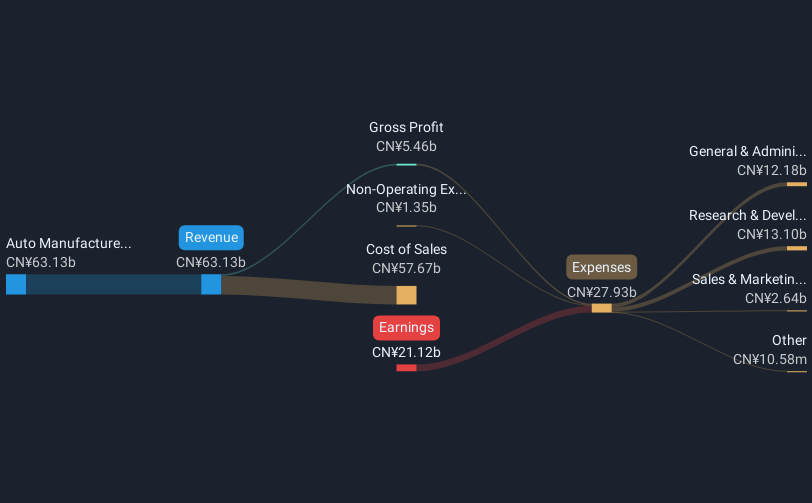

However, NIO's financial performance over this period has been complex. The Q3 2024 earnings report showed sales growth but also a widening net loss of CNY 5.14 billion. The company also underwent significant corporate changes, like the CFO transition in July 2024, which might have influenced investor sentiment. Despite being deemed expensive compared to industry averages based on its Price-To-Sales Ratio, NIO remains focused on revenue growth, with forecasts exceeding the market average, potentially supporting its long-term growth ambitions.

- Understand the fair market value of NIO with insights from our valuation analysis—click here to learn more.

- Gain insight into the risks facing NIO and how they might influence its performance—click here to read more.

- Is NIO part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives